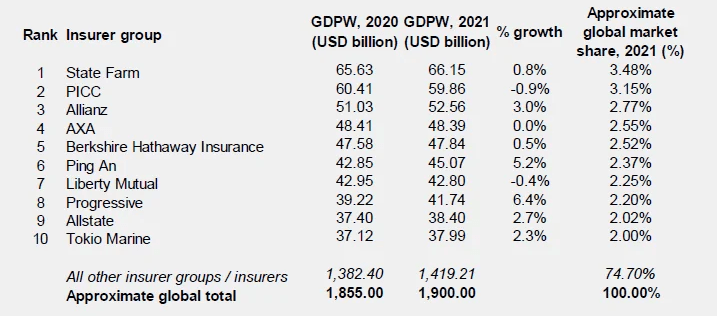

According to Insuramore`s global rankings, the TOP-10 P&C (non-life) insurer groups accounted for 25.3% of total P&C gross direct premiums written worldwide (down marginally from 25.5%).

In respect of the binary split between commercial and private P&C lines, only one insurer group – PICC – was ranked among the top five insurer groups globally for both activities.

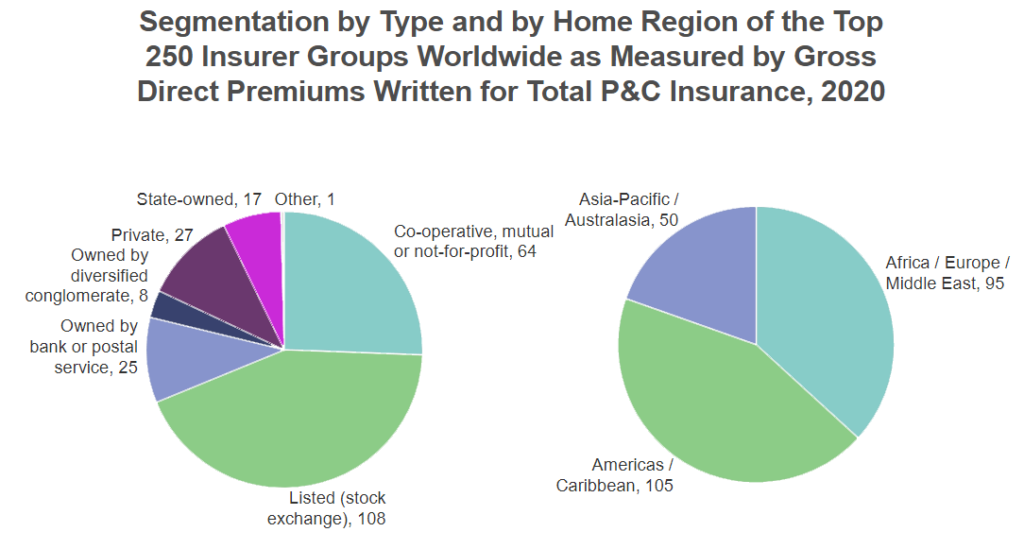

Main segments of P&C insurance market?

In descending order, the leading five were State Farm, PICC, Allianz, AXA and Berkshire Hathaway Insurance, and these were followed from sixth to tenth position by Ping An, Liberty Mutual, Progressive, Allstate and Tokio Marine. In total, their combined gross direct premiums written came to around USD 480.8 billion within a worldwide market for P&C lines worth in the region of USD 1.9 trillion.

Ranked second by gross direct premiums written for commercial lines and fifth for private lines, it was joined in the top five in the former segment by AXA (the sector leader) plus AIG, Allianz and Chubb, and in the latter, in descending order, by four US-based groups, namely State Farm, Allstate, Progressive and Berkshire Hathaway Insurance.

Overall, the top five insurer groups for commercial P&C insurance accounted for around 15.3% of worldwide business while the corresponding figure for private P&C lines was 19.8%.

TOP 10 Insurer Groups Worldwide

The slightly more fragmented nature of commercial P&C insurance relative to private P&C business at the global level is also apparent when analyzing the top 200 insurer groups in each segment. These were responsible for 82.3% of gross direct premiums written globally for private P&C insurance, falling to 80.5% for commercial P&C insurance.

Total P&C insurance

Total P&C insurance is defined as property and casualty (non-life) insurance acquired by any type of customer including accident insurance but not health insurance.

This difference is due to private P&C insurance being composed primarily of personal auto (motor) and home insurance, while the market for commercial P&C business is more fragmented across diverse lines.

Note that syndicates at Lloyd’s of London had gross direct premiums written for commercial P&C insurance of over USD 28.5 billion. However, because these syndicates belong mainly to major insurer groups already in the ranking, Lloyd’s as a whole is not itself counted within it as a separate entity.

Focus on auto insurance

With a specific focus on auto insurance, including both private and commercial business, the world’s leading insurer groups, again as measured by gross direct premiums written and again in descending order, were State Farm, PICC, Progressive, Berkshire Hathaway Insurance and Ping An (see U.S. Auto Insurance Performance & Underwriting Results).

Counted together, their share of the global market value for this line was in the region of 21.9%. In contrast, the largest five insurer groups in home insurance accounted for around 19.4% of the worldwide market for this product.

In descending order and reflecting the considerable size of the US market for home insurance, these were four US-based groups (State Farm, Allstate, Liberty Mutual and USAA) plus one group headquartered in Europe (Allianz).

Global market for P&C insurance

While the value of the global market for P&C insurance rose by 2.4% (before adjusting for inflation), there was a significant variance in the performance of different insurer groups.

With growth in P&C gross direct premiums written of 11.8%, China Life Insurance Group was the largest to achieve a double-digit growth rate in the year.

In contrast, with premiums falling by 14.2%, and with exposure to some of the territories hit hardest by the pandemic, MAPFRE was the largest group to experience a double-digit rate of decline.

Overall, the most rapid growth rate of any group featuring in Insuramore’s rankings for P&C insurance was that of Bermuda-based Convex Group which achieved a more than ten-fold rise in its direct business.

Edited & Fact checked by