World’s largest insurers and brokers is crucial for grasping the dynamics of the global insurance market. These entities not only shape industry trends and standards but also influence regulatory practices, product innovation, and market strategies.

The value of global gross premiums in 2024 generated by the global insurance industry amounted to more than $5 trillion

The United States is the leading country on the insurance market in terms of value of life and non-life direct premiums written, with premiums estimated at $2.8 trillion.

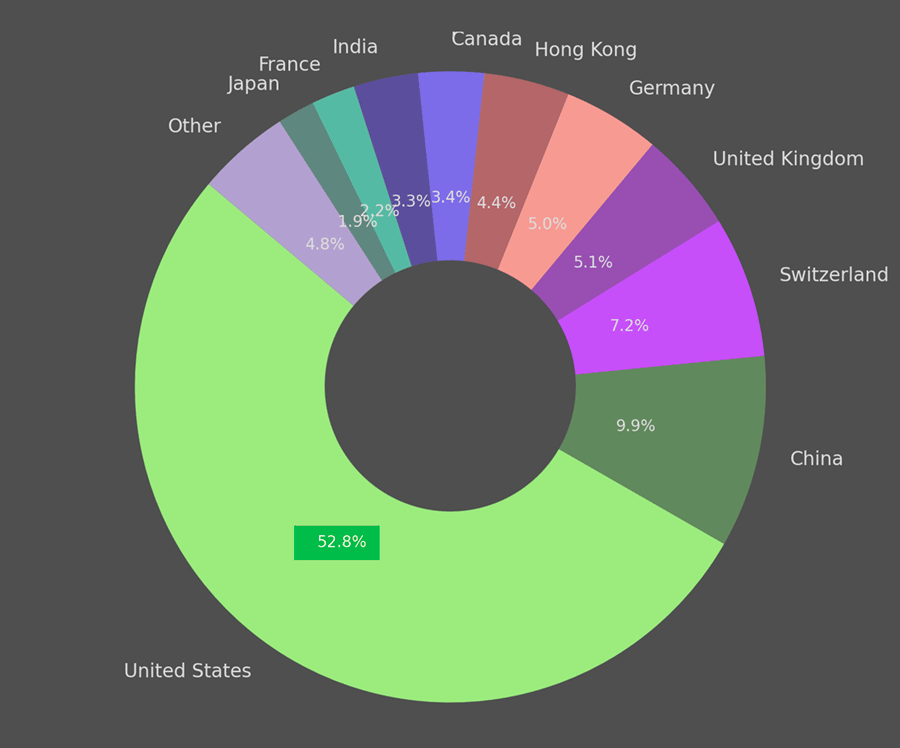

Total value of Insurers & Brokers capitalization by country for the TOP 10 countries & other

The diagram illustrating the total value by country for the top 10 countries and grouping the rest as “Other”.

UnitedHealth was to be the largest insurer globally, with market capitalization amounting to approximately $480 bn. When ranking global insurers by their total assets, the Chinese insurance company Ping An Insurance placed first, with assets worth approximately $1.25 trillion. Ping An Insurance was also the company with the strongest brand value among insurance companies in 2024.

TOP 50 Re/Insurers & Brokers Worldwide by market capitalization, $ bn

| № | Company | Country | Value, $ bn |

|---|---|---|---|

| 1 | UnitedHealth | United States | 480.4 |

| 2 | Elevance Health | United States | 108.9 |

| 3 | AIA | Hong Kong | 103.5 |

| 4 | Ping An Insurance | China | 103.3 |

| 5 | China Life Insurance | China | 102.5 |

| 6 | Cigna | United States | 84.7 |

| 7 | Marsh & McLennan Companies | United States | 75.5 |

| 8 | Chubb | Switzerland | 75.3 |

| 9 | Progressive | United States | 71.1 |

| 10 | Allianz | Germany | 66.1 |

| 11 | Humana | United States | 61.6 |

| 12 | Zurich Insurance Group | Switzerland | 60.4 |

| 13 | Aon | United Kingdom | 57.7 |

| 14 | AXA | France | 52.9 |

| 15 | MetLife | United States | 49.3 |

| 16 | Life Insurance Corporation of India (LIC) | India | 48.9 |

| 17 | Centene | Norway | 44.9 |

| 18 | American International Group | United States | 37.8 |

| 19 | The Travelers Companies | United States | 36.8 |

| 20 | Arthur J. Gallagher & Co. | United States | 36.1 |

| 21 | Tokio Marine | United States | 35.7 |

| 22 | Munich Re | Germany | 33.5 |

| 23 | Prudential Financial | United States | 32.9 |

| 24 | Manulife Financial | Canada | 30.2 |

| 25 | Prudential | United Kingdom | 28.9 |

| 26 | People's Insurance Company of China | China | 27.3 |

| 27 | Intact Financial | Canada | 25.4 |

| 28 | Sun Life Financial | Canada | 24.0 |

| 29 | Sampo | United States | 22.3 |

| 30 | Generali | Italy | 22.2 |

| 31 | Willis Towers Watson | United Kingdom | 22.0 |

| 32 | Swiss Re | Switzerland | 21.9 |

| 33 | The Hartford | United States | 20.0 |

| 34 | Molina Healthcare | United States | 19.0 |

| 35 | Principal | United States | 18.0 |

| 36 | Hannover R?ck | Germany | 17.9 |

| 37 | Cathay Financial Holding | Taiwan | 17.1 |

| 38 | W. R. Berkley | United States | 16.9 |

| 39 | Dai-ichi Life Holdings | Japan | 16.7 |

| 40 | Arch Capital | Bermuda | 15.9 |

| 41 | SBI Life Insurance | India | 15.5 |

| 42 | Markel | United States | 14.8 |

| 43 | MS&AD Insurance | Japan | 14.8 |

| 44 | Cincinnati Financial | United States | 14.6 |

| 45 | HDFC Life | India | 13.8 |

| 46 | Sompo Holdings | Japan | 13.6 |

| 47 | Swiss Life | Switzerland | 13.6 |

| 48 | Tryg | Denmark | 13.2 |

| 49 | Corebridge Financial | United States | 13.0 |

| 50 | Aviva | United Kingdom | 12.6 |

Source: Statista

World’s Largest Insurers

The world’s largest insurers are typically categorized by their core business lines: life and health (L&H) insurance, and property and casualty (P&C) insurance. These companies often have a global footprint, serving millions of customers across various jurisdictions.

- UnitedHealth Group (U.S.): Primarily focused on health insurance, it’s one of the largest health insurers globally, known for its extensive network and diverse range of health insurance products and services.

- Ping An Insurance (China): A conglomerate that operates in both the L&H and P&C sectors, offering a wide array of financial and insurance products. It’s recognized for its innovation and use of technology in insurance.

- AXA (France): With a strong presence in Europe, North America, and Asia, AXA is a leading global insurer in the P&C segment, as well as life and savings products.

- Allianz (Germany): A global leader in both insurance and asset management, Allianz offers a comprehensive range of services, including P&C insurance, L&H insurance, and investment products.

- China Life Insurance (China): One of the world’s largest life insurance companies, it provides a broad spectrum of life insurance and investment services.

The presence of companies from various regions highlights the global nature of the insurance industry, reflecting not only regional market strengths but also the internationalization of insurance products and services. The varied mix of life and health insurers alongside P&C insurers and brokers points to the multifaceted aspects of the industry, from individual and corporate health insurance to risk management and reinsurance services.

Notably, the list includes insurers with a broad range of specializations, including those focused on specific niches such as Progressive known for auto insurance in the United States, and Life Insurance Corporation of India (LIC), which is one of the largest life insurers globally by volume of policies.

World’s Largest Insurance Brokers

Insurance brokers play a pivotal role in the industry by acting as intermediaries between insurers and policyholders, providing advice, and facilitating the placement of insurance coverages.

- Marsh & McLennan Companies (U.S.): A global professional services firm offering clients advice and solutions in risk, strategy, and people. Marsh, its insurance broking and risk management arm, is the world’s leading insurance broker.

- Aon plc (U.K.): Specializing in risk management, insurance brokerage, and human resources solutions, Aon operates globally, serving clients with complex needs.

- Willis Towers Watson (U.K.): A leading global advisory, broking, and solutions company that helps clients around the world turn risk into a path for growth.

- Arthur J. Gallagher & Co. (U.S.): Known for its risk management services and insurance brokerage, Gallagher has a strong focus on commercial P&C insurance and employee benefits.

- Hub International (U.S.): A leading North American insurance brokerage that provides a wide range of products and services, including P&C, life and health, and employee benefits.

These companies are at the forefront of addressing the complex and evolving needs of global insurance markets, driving innovation, and setting standards for excellence in the industry. Their strategies, market performance, and adaptation to regulatory changes and technological advancements are closely watched by professionals across the insurance sector.

Looking ahead, core inflation is projected to start cooling in 2024. That acceleration will result from weaker global activity, a housing market correction in various regions, easing supply chain strains, further tightening of monetary policy around the world and the deflationary effects of a likely global recession.

In this environment, insurers will need to carefully monitor consumer and business purchasing trends, as well as financial conditions.

Year-on-year percentage point change in policy interest rate

Inflation will have varying impacts across the industry. Inflation-driven increases in claims costs (e.g., repairs, replacement parts, labor) will be a particular problem for property and casualty (P&C) insurers in the US, where regulators have been turning down rate increases.

Commercial carriers have been able to pass along rate increases more consistently. Life insurers are cautiously optimistic as higher interest rates today fuel future profitability and seem to outweigh the impact of inflation.

……………

Fact checked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media