Global Reinsurance market conditions since 1/1 have continued to move in favor of reinsurance buyers. At the start of last year, property catastrophe capacity was constrained.

According to Aon’s Reinsurance Market Dynamics report, April 1 is a key renewal for Asia with about 60 percent of Asia treaty business renewing at April 1. It is also of global significance, with some of the world’s largest catastrophe programs renewing in Japan, as well as large portfolios of business renewing in other regions, including South Korea, China and India.

Following challenging reinsurance renewals in 2023, which resulted in a global reset in property catastrophe pricing and retention levels, the 4/1 renewal was more predictable and generally favorable to reinsurance buyers.

Property catastrophe renewals in Japan reinforced the positive trends seen in the U.S. at 1/1, with pricing flat to slightly reducing, while South Korea, China and India also saw increased competition for catastrophe business, to varying degrees (see Global Reinsurance Rate for Property Catastrophe Forecasts).

While pricing renewed flat to down modestly for property catastrophe reinsurance across the region, certain Asia Pacific markets and product lines remain challenged and subject to a tightening of terms and conditions, including property per-risk reinsurance, industrial fire accounts, certain natural catastrophe loss-affected regions, and U.S. exposed casualty treaties.

Reinsurance Supply-Demand Dynamic

Since January 1, reinsurance market conditions have increasingly favored buyers. Last year began with limited capacity for property catastrophe coverage. However, by 2024, a significant increase in supply led to abundant capacity, driven by appealing risk-adjusted returns for property catastrophe reinsurance.

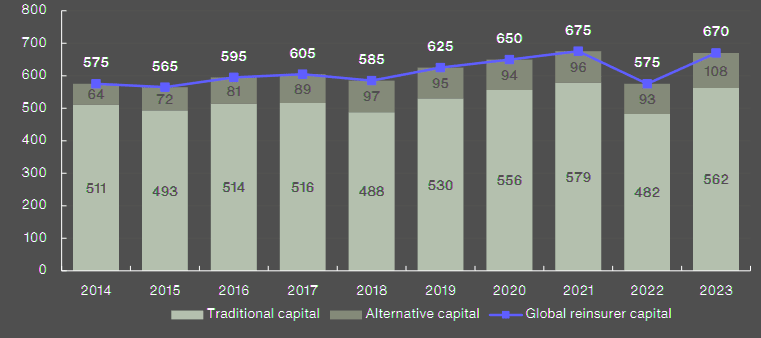

At the end of 2023, the total capital in the reinsurance industry reached $670 bn, nearly matching the peak levels of 2021. This growth was fueled by robust performance, a recovery in asset values, and a record year in the catastrophe bond markets.

The substantial reset in the property catastrophe reinsurance market on January 1, 2023, markedly improved the position of reinsurers. Despite global natural catastrophe insured losses totaling $118 bn in 2023—the fourth consecutive year losses surpassed $100 bn—many reinsurers reported strong financial outcomes.

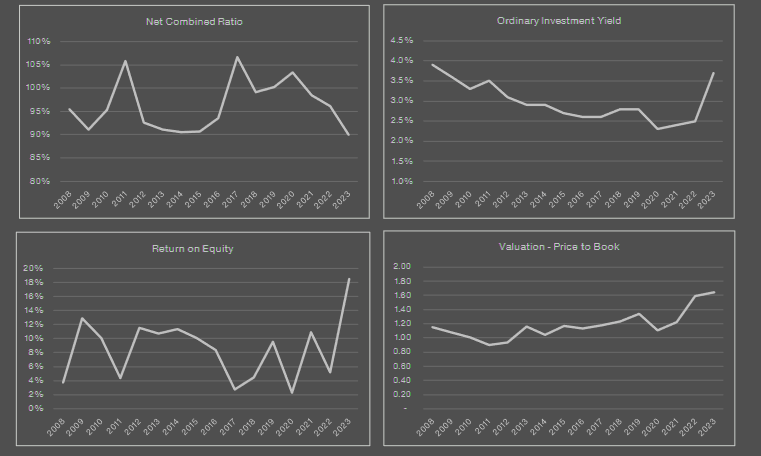

This reflects a market shift where cedants took on higher retentions. Early analyses indicate that global reinsurers achieved an average combined ratio of around 90 percent and an average return on equity of about 18% in 2023, marking one of the sector’s best performances to date.

Catastrophe market transitioning

The global property catastrophe market is in a period of transition, although various markets are at different stages of the cycle. With attractive returns, reinsurers have turned their attention to growth, increasing competition for higher catastrophe layers, according to Global Reinsurance Market Report.

Underlying ROEs were materially higher due to a further reduction in underlying combined ratios and higher recurring investment income. Whether viewed on a headline or underlying basis, reinsurers’ ROEs now comfortably exceed the industry’s cost of capital.

Given recent rate increases and reinvestment rates, it is likely that reinsurers’ underlying ROEs will continue to trend upwards and remain meaningfully above the cost of capital.

Global reinsurance dedicated capital totalled USD729 billion at full-year 2023, a rise of 12% versus the restated full year 2022 base. Growth was driven by both the INDEX3 companies and non-life alternative capital.

All things being equal, increased supply will continue to put downwards pressure on pricing and support broader coverage terms and conditions in property catastrophe reinsurance. However, reinsurers are maintaining a tight grip on retention levels, and show little sign of giving way.

In 2024, the ability of reinsurers to maintain their earnings will be crucial for attracting capital and enhancing investor support, particularly in the context of catastrophe losses.

The estimated global catastrophe losses for the first quarter of 2024 amount to at least $11 bn, a significant decrease from the $30 bn recorded in the same period in 2023.

This reduction is due to the lesser impact of severe convective storms (SCS) and winter storms in the United States, compared to the previous year that included a major earthquake in Turkey in February and two consecutive billion-dollar disasters in New Zealand.

As the mid-year renewals commence in catastrophe-prone markets such as Florida, Australia, and New Zealand, the trend of positive renewal conditions observed at the start of the year is expected to persist. These conditions include sufficient capacity for traditional occurrence property catastrophe risks and increased pricing competition.

The reinsurance market currently presents opportunities for reinsurers to deploy excess capital in attractively priced lower layer covers, and to accommodate the growing demand for higher limits.

This demand, potentially increasing by as much as $7 billion from U.S. insurers, is driven by adjustments for inflation and evolving risk perceptions, alongside a revitalized market in Florida.

Forward-looking reinsurance renewals

With the challenges of 2023 behind us, the insurance and reinsurance market is now entering its next phase. There is still significant unmet insurer need, including solutions that address earnings volatility such as structured solutions and aggregate covers (see about Underwriting Margins for Reinsurers).

At 4/1 reinsurance renewals, reinsurers have been more flexible in this regard, with growing opportunities for insurers to leverage competition among reinsurers for the attractive higher catastrophe layers to secure protection across their program.

For regional insurers that renew at 1/1, the remainder of this year will be critical. Faced with heightened frequency of natural catastrophes and increased net retentions, regional insurers are making considerable progress in terms of underlying rate and structural adjustments to portfolios.

Global Reinsurer Capital and Catastrophe Bonds

Aon estimates that global reinsurer capital rose by $95 billion to $670 billion over the year to December 31, 2023, representing recovery close to the level seen at the end of 2021.

The increase was principally driven by retained earnings, recovering asset values and new inflows to the catastrophe bond market.

Global Reinsurer Capital Dynamics ($ bn)

Traditional reinsurance capital: Rebound nearly complete

Aon estimates that shareholders’ equity reported by global reinsurers increased by $80 billion to $562 billion over the year to December 31, 2023, representing a substantial recovery from the $97 billion decline seen over the course of 2022

It should be noted that the reduction in reported equity in 2022 was largely linked to the sharp increase in global interest rates, which had the effect of reducing the market value of existing lower yielding bond portfolios on (re)insurance company balance sheets.

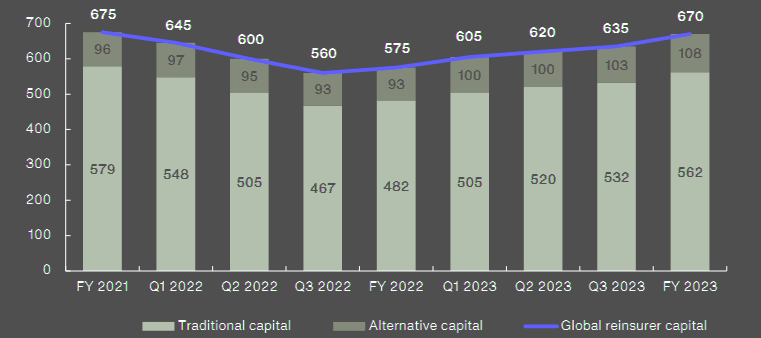

Global Reinsurer Capital – Quarterly Progression

Reported equity fell by $112 billion over the nine months to September 30, 2022, but has since recovered by $95 billion. The main drivers have been strong underwriting results, higher ordinary investment yields and the aforementioned pull to par effect.

Reinsurance Sector Performance

Strong performance by reinsurers has caught investors’ interest, evident from high attendance at several industry conferences early in 2024. This growing interest is promising, though it hasn’t yet led to the formation of new companies, mainly due to ongoing concerns about the effects of climate change and social inflation on future losses.

Capital is accumulating rapidly, with expectations that established reinsurers will continue to perform well in 2024, assuming minimal significant primary peril losses occur.

Additionally, the pull-to-par effect is likely to provide extra support. If this new capital enters the reinsurance market, it may lead to lower prices and more favorable terms and conditions during future renewals.

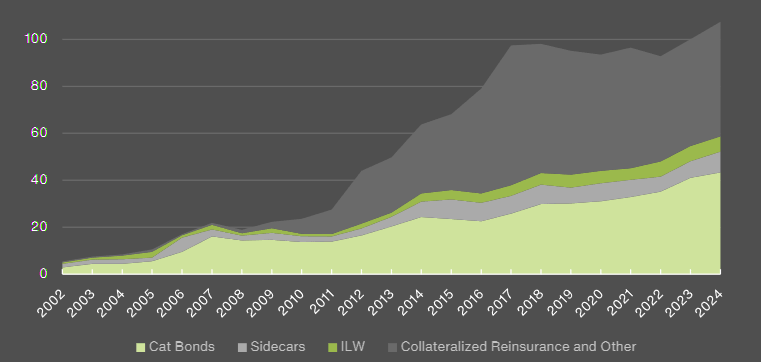

Alternative capital: Catastrophe bond market

2024 began much the same as 2023 ended—with robust issuance of insurance-linked securities (ILS). Aon Securities estimates that overall ILS capital has grown to $108 billion, which marks a 16% increase since the beginning of 2023 and a new all-time high.

Of significance to the broader insurance and reinsurance markets, alternative capital has continued to grow at a time when Aon’s clients have targeted diversified sources of capital to help alleviate upward pricing pressure sustained in the reinsurance and retrocession markets.

Alternative Capital Deployment (Limit in $ bn)

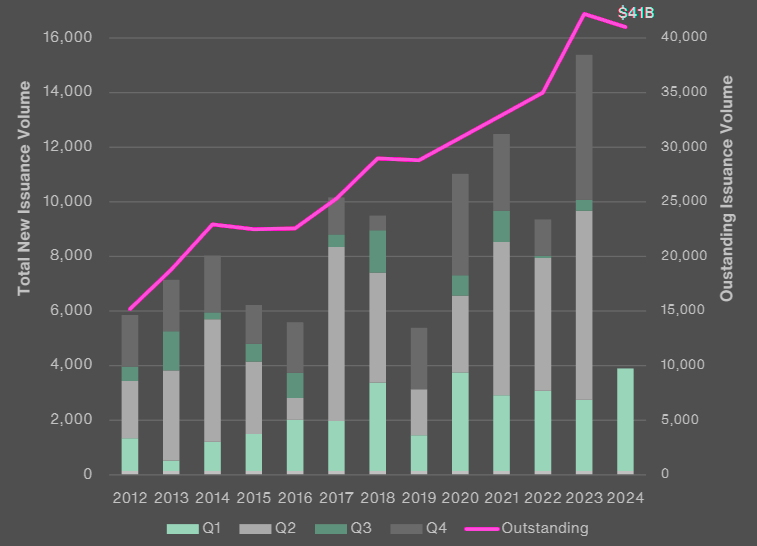

Throughout the first quarter in 2024, Aon Securities noted robust new issuance of $3.87 billion, surpassing the first quarter in 2023 ($2.75 billion) and the previous Q1 record set in 2020 at $3.76 billion.

While issuance volume has remained high, it’s worth noting that investors benefited from a very healthy supply of catastrophe bond maturities throughout the first quarter.

In early January, investors received $3.14 billion from maturities, accumulating to $4.65 billion over the entire quarter.

Alongside these maturities, strong coupon payments contributed to their earnings, with returns on collateral proceeds exceeding 5% for USD denominated catastrophe bonds. Combined, maturities and coupons yielded over $6.15 billion for investors in the first quarter. Assuming no principal losses, the expectation is to generate over $17.61 billion throughout 2024.

Investors typically use coupon payments and maturities as primary sources of capital for new issuances. Although the catastrophe bond market has attracted new capital due to favorable margin views, some investors have withdrawn funds to rebalance their investments in Insurance-Linked Securities (ILS), aiming to maintain a diversified portfolio of alternative assets, which have performed well relative to other asset classes over the past 15 months.

Property Catastrophe Bonds Issued and Outstanding by Quarter ($ mn)

During the first quarter of 2024, as capital accumulated from coupon earnings and the maturation of catastrophe bonds (cat bonds), the spreads on these bonds tightened. This tightening was evident in new issuance spreads as well, notably in Aon Securities’ initial 2024 transaction for Fidelis.

Fidelis sought $150 million in annual aggregate protection against U.S. named storms and earthquakes, securing this coverage at pricing approximately 20% lower than similar year-end 2023 transactions.

This highlighted the ample capital available to investors at the start of the year and a strong demand for industry index-triggered cat bonds.

Secondary market spreads also tightened by around 10% since January 1, 2024. This tightening was favorable to sponsors, who launched 17 deals during this period.

Although the number of catastrophe bonds reaching the market reached a record high for the first quarter, the average deal size has not increased significantly; it stood at $228 million in 2024, slightly up from $223 million in 2023.

These figures indicate a growing interest from clients in the Insurance-Linked Securities (ILS) market to diversify risk transfer options amid a more competitive reinsurance landscape. Additionally, the cat bond market saw an increase in diversity among its participants, with nearly a quarter of the issuers in the first quarter of 2024 being first-time sponsors.

…………………..

AUTHORS: Mike Van Slooten – Head of AON Business Intelligence, Richard Pennay – CEO of AON Insurance-Linked Securities