The global reinsurance market has endured a complex and in many cases frustrating renewal process which has gone down to the wire, according to the 1st View January reinsurance renewals report by Gallagher Re.

As anticipated before negotiations began, the two areas of most constraint were peak-zone US property catastrophe capacity and coverage for strikes, riots & civil commotion and war (see Reinsurance Rates for Property Catastrophe Forecast 2023).

According to Gallagher Re, in most other lines and regions, buyers have largely been able to source capacity, albeit at a higher cost and in many cases changed structures with an increase in attachment points and the raising of the ‘floor’ on minimum rates on line, a key focus for many reinsurers.

Key Findings for the Reinsurance Market

- The two areas of most constraint were peak-zone US property catastrophe capacity and coverage for Strikes, Riots & Civil Commotion and War. In most other lines and regions, buyers have largely been able to source capacity, albeit at a higher cost

- A divergence between reinsurers prepared to provide clear lead terms and capacity and others who waited for firm orders in an effort to adjust terms at the last minute

- Clients with broad trading relationships facilitated negotiations with some reinsurers to be ‘packaged’, helping generate preferred pricing and/or increased capacity

- European property renewals generally being completed earlier than those for US clients albeit much later than the previous norm, in some instances by as much as a month or two

- Casualty treaty market viewed as calmer and more rational than other parts of the business, and with renewals completed at terms seen as tough but fair by most buyers

- Improvements in pricing and conditions particularly for property cat-related lines led to some new capacity coming into the market

- ILS and collateralized markets have seen little signs of new capital entering but lower estimates from certain clients on Hurricane Ian losses eased trapped capital concerns and helped to provide much needed additional liquidity for retrocession buyers

Reinsurance Market Turns

The renewal process has been gruelling for participants, many of whom have not faced such a rapid change in market conditions across a single renewal season. Only a limited number of reinsurers were prepared to offer quotes in a timely fashion leading to difficulties for clients and their brokers to find market clearing prices, terms, and conditions (see TOP 50 Largest Global Reinsurance Groups in the World).

This final point perhaps best illustrates the challenge facing many clients. The primary liability market has seen improved trading conditions for insurers for the last four to five years and did not require a hardening reinsurance market to provoke its own ‘turn’.

Reinsurers, while wary of prior year development in some instances, saw the benefit of improved original pricing and consequently reinsurance capacity and pricing has remained relatively constant. In addition, the significant increase in interest rates over the last 12 months is providing additional support for reinsurers, a benefit they have not enjoyed for many years (see about Latest Reinsurance Renewal).

Conversely for short-tail lines, insurance pricing in recent years has not seen the same degree of price increases as witnessed in the longer tail lines.

This competitiveness has been facilitated by a reinsurance market willing to provide attractive terms with plentiful occurrence and aggregate capacity.

For 2023, the property treaty market has hardened considerably, and now many clients face the challenge of increased reinsurance costs, increased retentions and more restricted coverage knowing that the original market pricing environment will take time to move upwards, particularly for personal lines business and the US admitted market (see Reinsurance Sector Outlook Improving).

The current economic climate makes this predicament even more challenging. It is for this reason that buyers were inclined to favour reinsurance partners taking a longer-term view on adjusting pricing, terms and conditions.

For property Risk renewals there has been less regional differentiation and a more uniform approach adopted by reinsurers seeking to improve their returns on a globally under performing class of business.

Capacity has been restricted with reinsurers wanting to see the impact of original underwriting changes some buyers were starting to introduce in their portfolios before committing additional capacity.

There are, however, reasons for cautious optimism. The improvement in pricing and conditions, most notably in property treaty business, has led to some new capacity coming into the market from a combination of modest capital raising by existing reinsurers, a reallocation of internal capital from some reinsurers, and notably some primary carriers with existing reinsurance operations (see how War in Ukraine Slows Growth of Global Reinsurance Market).

Grueling renewal period

The renewal process has been grueling for participants, many of whom have not faced such a rapid change in market conditions across a single renewal season. Political violence renewals have been especially demanding in terms of finding a market consensus.

The differences in opinion between buyers and sellers were aggravated by the perception that there was time to reach agreement on the complex issue of the Ukraine/Russia conflict well in advance of renewals.

Times of significant market change are always challenging to navigate but we have seen a significant difference in the ways that individual reinsurers have reacted despite a widespread stated ambition to grow premium volumes in what is being viewed as the best treaty underwriting terms and conditions for a generation.

Some have reached the end of the renewal season with reputations enhanced, exercising a firm, fair, transparent approach based on a commitment to their own view of pricing adequacy.

Others who have acted less deftly may find sustaining long term client relationships more challenging, especially once capital and competition rebuild in the global reinsurance market.

Capital relief on the horizon

Whilst in a changing market frustration is easily felt by all participants, several buyers perceived that their efforts to approach markets early with more detailed renewal presentations addressing reinsurers’ concerns over inflation and coverage were not recognized. Only a limited number of reinsurers were prepared to offer quotes in a timely fashion leading to difficulties for clients and their brokers to find market clearing prices, terms, and conditions.

Political violence renewals have been especially demanding in terms of finding a market consensus. The differences in opinion between buyers and sellers were aggravated by the perception that there was time to reach agreement on the complex issue of the Ukraine/ Russia conflict well in advance of renewals.

Key factors prevalent throughout the renewal process included:

- A divergence between reinsurers prepared to provide clear lead terms and capacity and others who waited for firm orders in an effort to adjust terms at the last minute

- Clients with broad trading relationships facilitated negotiations with some reinsurers to be ‘packaged’, helping generate preferred pricing and/or increased capacity

- European property renewals generally being completed earlier than those for US clients albeit much later than the previous norm, in some instances by as much as a month or two

- A casualty treaty market viewed as calmer and more rational than other parts of the business, and with renewals completed at terms seen as tough but fair by most buyers

ILS and collateralised markets have seen little signs of new capital entering but lower estimates from certain clients on Hurricane Ian losses has eased some concerns over trapped capital and helped to provide much needed additional liquidity for retrocession buyers in the last few weeks of the renewal.

In the stressed US natural catastrophe market, more positive signs of regulatory reform are tentatively emerging and while not impacting the 1/1/2023 capacity challenge may provide some tangible relief further into 2023.

Property: Commentary by Territory

Europe

The traditional European January 1 renewal kick-off at the annual market gathering in Monte Carlo had already indicated a hardening property market and subjects such as secondary perils losses (again being responsible for an above-average Cat load at mid-year), high inflation and growing demand for Cat capacity – that was perceived at that time to be beyond the then available Cat capacity – dominated the meeting agendas.

Whilst these challenges were recognised by buyers, reinsurers and brokers, they didn’t nearly address the fundamental European Property Market pressures that then played out post Hurricane Ian in the 4th quarter of 2022.

A very late renewal market evolved, which turned through November and December from a hardening market closer to a hard market, driven by discipline rather that shortage of capacity. This was described by many as a very tense renewal with little flexibility shown by reinsurers and some hard fought “wins” at the expense of damaged client relationships and reduced confidence from some buyers in the reinsurance product. During those two months, European clients ended up mostly stepping up to reinsurers requests, issuing market led firm order terms FOTs, and aiming at full syndication. Arguably the European property market re-set in two months some ten years of downwards cycle.

Key outcomes of the European Property Renewals were:

- European Cat and associated placements came together in a late rush during December but only after a renewal process that was delayed by weeks. Clients felt that this was driven by a combination of tactical delays by some reinsurers to force change as well as an inability to commit to renewals by others. Overall, this approach shifted the European market shares of the different global reinsurance markets (Bermuda, Europe, Lloyd’s/London and Asia) to a much greater degree than during previous renewals with many traditional European markets gaining from this move.

- Driven by a once-in-a-generation CPI development, inflation became a key renewal subject. Most renewal portfolio data was adjusted for 2022 inflation and prospectively inflated into 2023 which represented a new approach for European buyers.

- Low attachment levels were challenged by reinsurers, moving on an event basis closer towards the 1 in 10 years for key perils – slightly lower attachments for combined perils layers were sometimes achieved. However, there was little or no flexibility shown by reinsurers towards these benchmarks with markets holding firm their positions to the end and often “forcing” programme restructurings.

- Despite the inflation driven cash increases on programmes that often already represented a double-digit percentage increase, most Cat firm order terms – even for loss free covers – were up by at least a further mid +20%s to low +40%s risk-adjusted uplift for contracts covering key perils – slightly lower for EQ – only covers and significantly higher (some up to +100%) for loss affected and Aggregate covers. Accepting to lose existing relationships, reinsurers were determined to force through these changes motivated by their own internal pressures of poor past results and restricted capacity for Euro wind often influenced by limited availability of Retro coverage – other reinsurers were willing to step up but only at a price.

- Reinsurers aimed to limit the number of reinstatements (partly successful) and to move away from pre-paid (mostly successful).

- Early fears of limited key perils capacity (Euro wind) and inability of reinsurers to satisfy additional capacity requests didn’t materialise as numerous reinsurers were willing to expand their deployed capacity, but only at the right price for new top layer capacity and often with restricted coverage. The expected increase in demand for Cat limit didn’t materialise in line with inflation as overall more modest additional capacity was sought.

- The market was less aligned on conditions with reinsurers pushing for coverage limitations on Strikes Riots and Civil Commotion, Non-Damage Business Interruption, Russia Ukraine and Belarus and limits on hours clauses which represented a significant challenge to align overall placements.

- An early renewal push by some reinsurers – some European but mainly Bermudian markets – to limit Cat coverage to named perils didn’t ultimately materialise. However, it was a significant “road block” in the early weeks of the renewal and one of the contributors to the delayed renewal.

- Earning protections and bottom end aggregate Cat covers were in a true hard market situation, several of them either not being completed or even renewed

Despite all of the above challenges, the vast majority of Cat excess of loss programmes have achieved their target placement levels and there have been many fewer “shortfall covers” transacted than certain reinsurers expected and sometimes seem to have been waiting for.

United States

- In addition to Hurricane Ian, other recent Cat and Risk losses, the return of inflation and increasing interest rates are all causing disruption in the market.

- While reinsurers were citing difficulty in raising new capital; there have recently been a number of capital raises which helped alleviate some capacity constraints late in the season.

- Overall, the renewal season ran late; many reinsurers were refusing to quote before Thanksgiving which had a knock-on effect with FOTs not being issued until the middle of December. Reinsurers were also not authorizing rapidly, waiting for revised firm orders. Some cedants who issued firm orders prior to the market crystalizing in late December needed to provide revised FOTs.

- On Pro Rata structures, ceding commission reductions were generally seen across the board with larger reductions on less profitable contracts. Gross quota share capacity was largely unavailable, and many programmes shifted to a net basis.

- Reinsurers were seeking to exclude natural perils from Risk excess programmes; however, this position was moderated with many programmes completed on an all-perils basis and others excluding critical Cat only.

- Reinsurers aimed to tighten occurrence definitions on Cat programmes, and in some cases sought to exclude secondary perils and restrict coverage to critical Earthquake and Hurricane perils only. On firm order terms natural perils were generally accepted, however, cedants looking to complete large capacity programmes had to accept some restriction of perils covered.

- A wide range of price changes was observed as reinsurers looked to differentiate between geographical scope, peril specific coverages, cedants and loss impacted accounts.

- First layers of Risk excess of loss and Cat programmes were particularly challenging to place as reinsurers looked to move up programmes. Accordingly, many cedants increased net positions via co-participations, annual aggregate deductibles, or fixed retention increases.

- While many cedants looked to buy more capacity in response to exposure increases, inflation and perceived loss trend, top layer pricing came under pressure as reinsurers substantially increased their minimum premium requirements in response to their own cost of capital.

- Cyber, Communicable Disease, Terrorism, Strike and Riot (SRCC) became a frequent point of discussion with reinsurers seeking to restrict coverage.

- Non-concurrent terms have become much more prevalent with some cedants being encouraged to bind authorizations as they come in rather than waiting for programme completion.

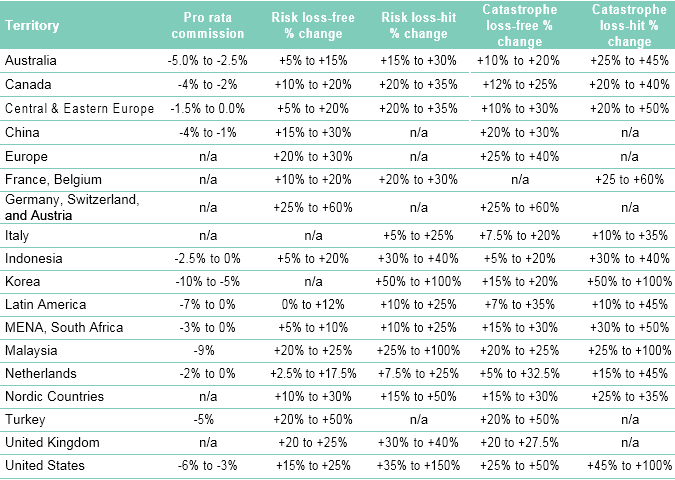

Property Rate Movements

Casualty: Commentary by Territory

The casualty treaty market, was overshadowed by its noisier Catastrophe and Specialty siblings. The market was calmer and more rational with renewals completed at terms seen as tough but fair by most buyers.

Concerns over prior-year deterioration coupled with the real uncertainty of economic and non-economic loss inflationary dynamics are shared jointly by primary market participants and their reinsurers.

Quota Share ceding commissions adjusted moderately to reflect rate and loss experience but for context, that follows two years of upward movement for the same reasons.

The primary liability market has seen improved trading conditions for the last four to five years led by insurers resolve to address underperformance. It did not nor does not require a hardening reinsurance market to provoke its own ‘turn’. Furthermore, the economics of longer-tail classes have benefitted from the major improvement in reinvestment rates over the last 12 months providing additional support for reinsurers, a benefit they have not enjoyed for many years.

Global – Motor Liability

- The renewal season for Motor was, as with other lines of business, very late but seemed to be slightly more measured than short-tail lines. Reinsurers often cited a need to understand the broad client relationship before committing their capacity.

- Recent performance was relatively stable in most territories and not needing any major corrections; however, reinsurers have been taking the opportunity of a harder market to improve terms wherever possible. This action was countered to some extent by the desire of some reinsurers to diversify away from Property Cat and Risk and broaden client relationships. On the same basis buyers have been using long-tail lines as a sweetener to maintain support in more challenging areas.

- Pricing corrections averaged around +10% risk adjusted, with reinsurers often citing concerns about social inflation in addition to economic inflation. Of course, with long-tail lines, the potential improvement in investment returns and increases in discount rates in some markets, will have enhanced reinsurers margin further.

- There was some pressure on retention levels, but many programmes found an acceptable price in order to maintain existing levels.

- Initial discussions regarding Index Clauses and a desire to move towards full indexation were short lived.

- In most placements, clarity around Russian, Ukrainian and Belarussian exposures was secured.

International Casualty

- International Casualty is a predominately excess of loss market with consequently little evidence of commission discussions across International compared with North America.

- It was an exceptionally slow renewal with a significant delay in the provision of quotations and in turn firm orders. Most placements finalised on or before inception.

- Reinsurer response times were slow – in some instances this appeared to be a deliberate tactic with reinsurers waiting to take advantage of the challenges in the property market.

- The range of quotations was broad. In almost all cases pricing was up with loss impacted reinsurance placements facing larger increases.

- Reinsurers sought additional clarification across all exposures, noting inflation and cyber exposures as a key focus.

- There was real reluctance from most reinsurers to accept changes in coverage without detailed explanation or additional premium.

- Other issues at the front of mind for reinsurers included:

- Limit utilisation (i.e. how are buyers selling their limits after a period of limit compression).

- Rate change within the business – reinsurers are increasingly interested in statements about movements in original rates, seeking to dissect rate changes driven by inflation compared with rate change driven by growth in exposure.

- Buyers continued to seek solutions for systemic and accumulative risks. Although reinsurers underwriting appetite and process was significantly more discerning, adequate capacity for Clash and casualty Catastrophe was still available for quality buyers that presented well and showed sufficient pricing adequacy. There was however, a clear trend of reinsurers seeking to remove or limit exposure to the more volatile risks.

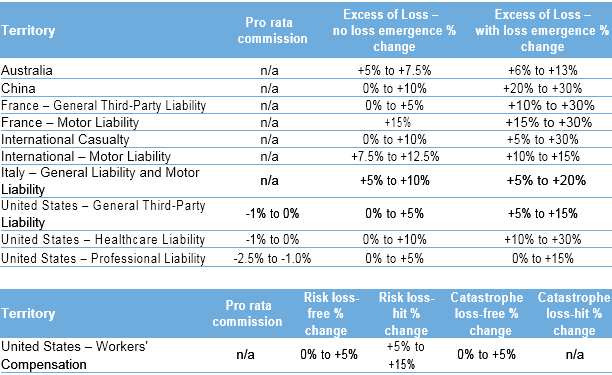

Casualty Rate Movements

Specialty: Commentary by Line of Business

Global – Aerospace

- The aviation reinsurance market is going through a period of seismic change which has had an impact on all sub-lines within the class including Aviation All Risk, Major Risk placements, General Aviation and most notably Aviation Hull War renewals.

- The severity of the market’s reaction to renewals was driven by significant back year claims deterioration and the ongoing spectre of sizable Contingent Leasing losses being formally presented in the coming months.

- Reinsurer’s focus was towards both coverage and pricing. Coverage was subject to much tighter restrictions and limitations and reinsurers were seeking to significantly re-inflate the premium volume flowing into the aviation reinsurance market. This was markedly evident on non-proportional placements with increases in prices being applied to both clean and loss impacted programmes.

- The quantum of rate increase varied by attachment point, with middle to top layers of general excess of loss placements severely impacted with increases being evident in the region of +150% to +200% of expiring levels.

- Beginning to see a distinct tightening in the availability of retrocessional capacity which will stimulate a further hardening within excess of loss pricing. Capacity for Hull War placements was also in short supply with demand for capacity much increased as reinsurers have looked to remove coverage from composite placements.

Global – Cyber

- Proportional

- Continued appetite for existing pro rata treaties as Cyber premium and exposures grow both on a standalone basis and where Cyber forms parts of composite treaties.

- Reinsurers looked more closely at exposure growth across their portfolios with pressure on Loss Ratio caps to decrease, especially in light of underlying exposure reductions and rate increases.

- Reinsurers supportive of following clients’ original war exclusions where strategies for this have been communicated following the Lloyd’s bulletin communicated earlier this year on this subject.

- Aggregate Excess of Loss / Stop Loss

- Significant risk-adjusted rate increases driven by increasing attachment points, treaty limit compression and higher rates on line.

- Despite significant rate hardening in underlying portfolios, ‘market performance deterioration’ on prior years of account meant that reinsurer loss picks remained stable, rather than reducing. Capacity demand and supply dynamic also contributed to hardening environment, although new entrants and growth in appetite of some markets helping to offset increase in demand.

- Cat/Event/Occurrence

- Increased interest in occurrence structures from buyers and reinsurers with a few new purchases being considered and more interest going into 2023.

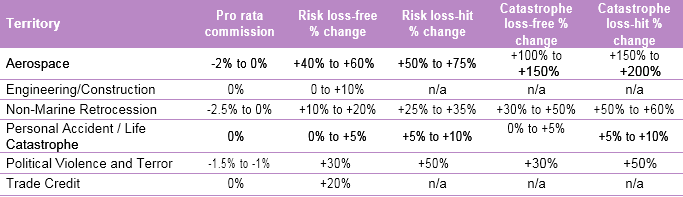

Specialty Rate Movements

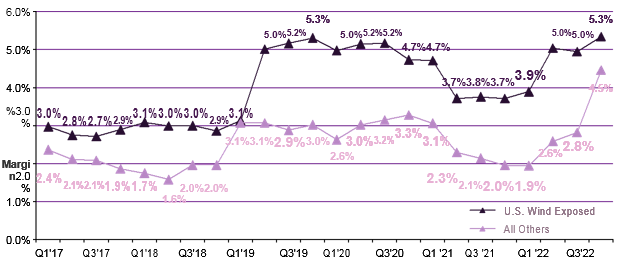

Quarterly Weighted Average Margins for New Issue Cat Bonds on an LTM Basis

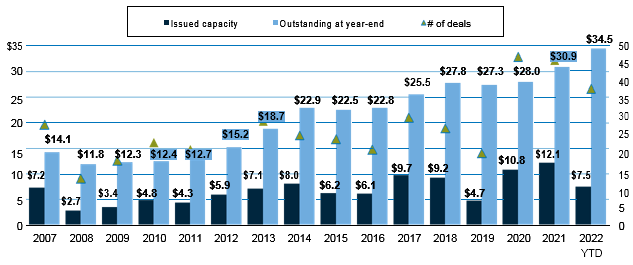

Non-life Catastrophe Bond Capacity Issued and Outstanding by Year

The current economic climate makes this predicament even more challenging. It is for this reason that buyers were inclined to favour reinsurance partners taking a longer-term view on adjusting pricing, terms and conditions.

……………….

AUTHOR: James Kent – Global CEO, Gallagher Re