Reinsurance rates for property catastrophe business should increase by well over 10% when contracts are renewed in January 2023, Fitch Ratings says, supporting underwriting margins against rising claims due to high inflation and climate change.

Typically, two-thirds of non-facultative reinsurance business is renewed in January, with a regional focus on Europe.

Increasing prices and higher reinvestment yields

Increasing prices and higher reinvestment yields will help to offset the effects of rising claims inflation and lower asset values.

Fitch therefore forecasts broadly stable underlying profitability for the global reinsurance sector in 2023, and is maintaining its neutral fundamental sector outlook.

Fitch expect double-digit percentage premium rate rises for property catastrophe cover in 2023 driven by insured losses of about USD120 billion in 2022 and the increasing frequency and severity of natural catastrophe claims.

Price rises will be most pronounced in the regions

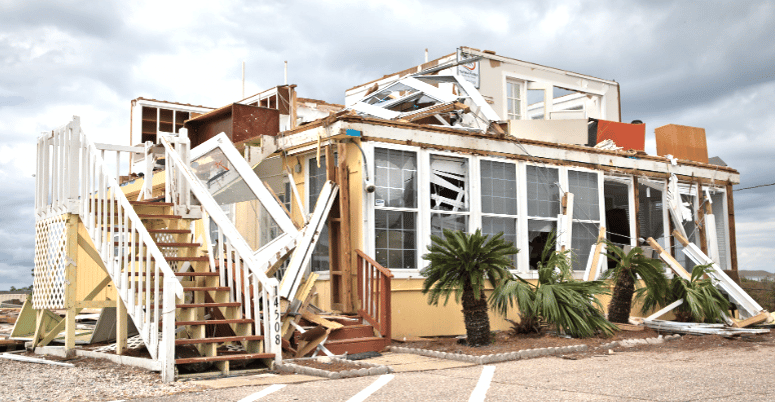

Price rises will be most pronounced in the regions worst affected by natural catastrophe events in 2022, including Australia, Florida and France. Hurricane Ian is likely to have caused between USD35 billion and USD55 billion of insured claims, making it one of the costliest natural catastrophe events ever.

Fitch expects reinsurance capacity for property catastrophes risks to be pressured in 2023, with selective capital inflows from existing or new risk carriers more than offset by partial or total withdrawals by other reinsurance providers.

Furthermore, limited retrocession capacity will put additional upward pressure on property cat premium rates.

Fitch has updated its global reinsurance forecasts and now expects the calendar-year combined ratio to improve by about 4pp in 2023, assuming a more normal level of natural catastrophe losses and given the withdrawal of cover related to the war in Ukraine. However, underwriting margins excluding natural catastrophe and war-related losses are likely to only marginally improve.

Fitch Ratings’ Global Reinsurance Forecast 2023

| $ mn | 2022F | 2023F |

| Net premiums written, $ mn | 173,975 | 189,6 |

| Catastrophe losses | 20,175 | 18,65 |

| Net prior-year favourable reserve development, $ mn | 3,18 | 3,57 |

| Calendar-year combined ratio, % | 98.1 | 94.0 |

| Accident-year combined ratio, % | 100.0 | 96.0 |

| Accident-year combined ratio excl. catastrophes, % | 86.4 | 85.6 |

Tighter terms and conditions in 2023, including a movement to named perils coverage from all perils, higher insurer retentions and reduced limits provided. Nevertheless, we believe demand for property catastrophe reinsurance during the 2023 renewals season will be broadly met, except for Florida.

Significant premium rate increases for specialty lines of business, such as marine and aviation, that have been most affected by the war in Ukraine.

Motor hull premium rates will also increase in response to high spare-parts price inflation, but increases for liability lines should be more muted as more reinsurance capacity will be directed to this part of the market.

Claims inflation has yet to be pushed up by social inflation or general inflation but we expect this to change in 2023, with negative implications for underwriting margins and reserves. Underestimating claims inflation for liability lines is one of the most significant risks for reinsurers.

The steep rise in interest rates in 2022 has led to write-downs on large parts of reinsurers’ investment portfolios. This has caused accounting capital to shrink significantly due to the accounting mismatch between assets and liabilities.

However, the impact on economic and regulatory capital has been neutral to positive, and we do not consider the industry’s capitalisation to have suffered. The write-downs have also depressed investment income, leading to lower reported earnings for 2022, but rising reinvestment yields should gradually boost investment income over time.

Securitizing Property Catastrophe Risk

The trading of property catastrophe risk using standard financial instruments such as options and bonds enables insurance companies to hedge their exposure by transferring risk to investors, who take positions on the occurrence and cost of catastrophes. Although these property catastrophe risk instruments are relatively new products, they have already established an important link between the insurance industry and the U.S. capital market.

The enormous costs of property catastrophes have underscored the risks borne by insurance companies.

To minimize their aggregate risk, insurance companies spread insurance risk over a large number of policy-holders and purchase reinsurance (insurance for insur-ance companies).

Until recently, these have been the only mechanisms available for transferring insurance risk. However, increased catastrophe risk, coupled with limitations on insurers’use of traditional risk-reduction alternatives, has led to the development of another method of transferring insurance risk: securitization.

Since 1992, financial market innovations have enabled property catastrophe risk to be securitized— that is, traded by using standard financial instruments such as options and bonds. These instruments have cre-ated, for the first time, a direct link between the insurance industry and the capital market.

Individuals and businesses can take positions on the occurrence and cost of property catastrophes, just as they can hedge or speculate on the movement of interest rates or crop prices. Insurance companies, in turn, can hedge their exposure by transferring property catastrophe risk to a wide pool of willing investors.

Insurers can respond to increased insurance exposure in a number of ways. They can reduce aggregate risk by diversifying across different types of exposures. Writing policies in several states reduces the proportion of policies in high-catastrophe-risk areas.

To offset the additional risk assumed, they can also raise high-risk policyholders’ premiums. Alternatively, insurers may attempt to reduce the supply of insurance in high-risk areas, either by lowering the amount of coverage or by decreasing the number of policies. They may also use reinsurance to pass on additional risk.

Insurers also have few opportunities to manage addi-tional catastrophe risk through premium rate increases and withdrawal from certain insurance markets.

Although premium rate regulation varies by state and type of insurance, rate changes in California, Florida, and Texas require approval by the state insurance regulator. The timing and size of premium increases are significantly restricted in these high-risk states.

In addition, insurance companies’ attempts to exit high-catastrophe-risk insurance markets have been con-strained by legislation in several states. For example, Florida has limited the number of policies an insurance company can drop upon policy expiration and California requires insurance companies to offer earth-quake insurance with homeowners insurance policies.

Property Catastrophe Risk Instruments

Faced with increased catastrophe risk and limited means of transferring it, insurance companies sought an alternative to traditional methods of managing their risk load. That alternative emerged in the form of insurance-based financial instruments such as options, bonds, and swaps. The instruments, which securitize property catastrophe risk, enable insurers to reduce that risk by passing it on to investors, who take positions on the occurrence and cost of catastrophes.

Property catastro-phe options are standardized financial instruments traded through the Chicago Board of Trade.

Buyers and sellers of these call and put options either hedge or speculate on the occurrence of a catastrophe and the resulting amount of claim payments.

Typically, an option provides the right to buy or sell an underlying asset at a fixed price (called the strike price), and the option’s value depends on the asset’s price relative to the strike price. But with catastrophe options, an under-lying asset does not exist, so an index is used in lieu of an asset price.

The index is an estimate of the industry’s total claim payments for catastrophes occurring within the contract period and specified region. The difference between the strike price and the index at the option’s expiration determines the option’s value.

By establishing a direct link between the insurance industry and the capital market, catastrophe risk instru-ments introduce the strategic advantages of the finan-cial markets to the insurance industry. Not only do these instruments provide insurers with more hedging alternatives, they also enable investors to participate in the property catastrophe risk market. Consequently, property catastrophe risk can be spread across a broader pool of individuals and businesses, reducing the impact of catastrophes on individual insurance companies and the insurance industry as a whole.

Since catastrophe risk instruments are relatively new financial products, their low trading volume currently exposes market participants to high liquidity risk.

However, trading volume should rise as exchanges, underwriters, and insurers make these instruments more accessible and investors and other market partici-pants become more familiar with them. Increased vol-ume should then reduce liquidity risk and promote more competitive pricing.

………………………..