Average costs for U.S. employers that pay for their employees’ health care will increase 8.5% to more than $15,000 per employee in 2024, according to AON.

The projection increase, which assumes employers do not implement employee cost sharing increases and other cost saving strategies, is nearly double the 4.5% increase to health care budgets that employers experienced from 2022 to 2023 and Healthcare insurance premiums in U.S. increases.

An alarming number of insured Americans still can’t afford healthcare treatment, but there are approaches employers can take to reduce costs and improve outcomes for employees and their families.

As healthcare costs continue to surge for both individuals and employers across the U.S., many organizations are pursuing value-led strategies. These strategies are known to lower costs while also improving the quality of care and patient outcomes (see How Artificial Intelligence AI is Modernizing the HealthCare Industry?).

This is particularly important, as high-deductible plans and health savings accounts are commonplace, offering few additional cost savings opportunities.

Many employees are not seeking the care they need because they can’t afford it even with health insurance.

This results in less healthy and less productive employees and more costly healthcare outcomes in the long run.

Research finds 32% of individuals with health insurance program still have difficulty accessing care due to costs. This increases to 6% for those considered “functionally underinsured,” meaning they don’t have funds to cover basic out-of-pocket costs like deductibles, copays and coinsurance.

Medical claims & insurance experience return to typical levels of growth

The analysis uses the firm’s Health Value Initiative database, which captures information for more than 800 U.S. employers representing approximately 5.6 million employees.

On average, the budgeted health care plan cost for clients is $13,906 per employee in 2023.

Since the COVID-19 pandemic, employers are seeing medical claims experience return to typical levels of growth and should anticipate more inflationary cost pressures in the coming year.

While economy-wide inflation spiked during the past two years, employer-sponsored health care costs did not see dramatic increases during the same time period due to the multi-year nature of typical medical provider contracts

Debbie Ashford, the North America chief actuary for Health Solutions at Aon

Even though inflation is subsiding, health care trend is growing as medical providers push insurers for larger cost increases to cover the higher costs of wages and supplies that they endured during the last couple years but were unable to pass on to payers.

Other contributing factors adding pressure on health care cost trends are the proliferation of newly indicated weight loss drugs, new technologies, severity of catastrophic claims and increasing share of specialty drugs.

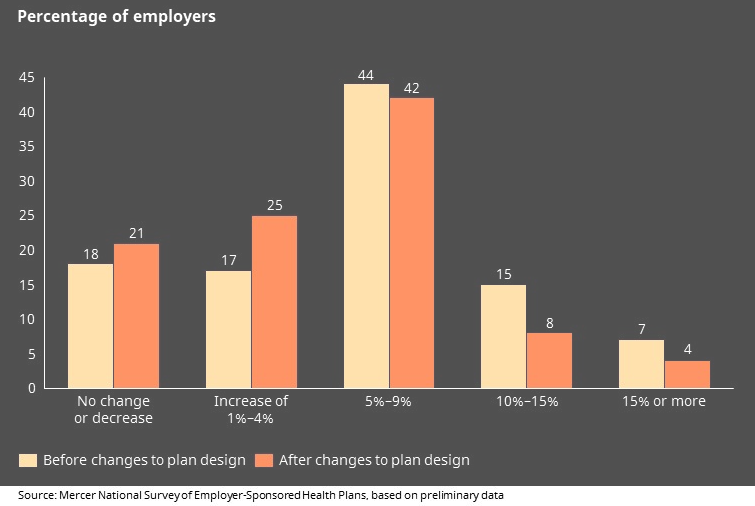

Distribution of projected increases in Health Plan Cost

In terms of 2023 health plans, employer costs increased 4.5%, while employee premiums from pay checks were slated to be a more modest 1.7% increase from 2022.

Plan costs represent the employer’s and employee’s combined premiums for medical and prescription drug costs but exclude employee out-of-pocket payments such as deductibles, co-pays and co-insurance.

On average, employers subsidize about 81 percent of the plan cost, while employees pay the remainder.

Increase to U.S. Health Care Plan Costs from 2022 to 2023

| Plan Cost | 2022 | 2023 | Change from 2022 to 2023 |

| Employer cost | $10,736 | $11,224 | +4.5 % |

| Employee premiums from pay checks | $2,638 | $2,682 | +1.7 % |

| Total plan cost | $13,374 | $13,906 | +4.0 % |

We see employers continuing to absorb most of the health care cost increases. In a tight labor market, plan sponsors are hesitant to shift significant cost to plan participants and make benefits less affordable.

Farheen Dam – North American Health Solutions leader at Aon

Employees in 2023 are contributing about $4,675 for health care coverage, of which $2,682 is paid in the form of premiums from pay checks and $1,993 is paid through plan design features such as deductibles, co-pays and co-insurance.

Co-pays and co-insurance Health Care Plan Employee Costs

| Employee Costs | 2022 | 2023 | Change from 2022 to 2023 |

| Employee premiums from pay checks | $2,638 | $2,682 | +1.7 % |

| Employee out-of-pocket costs | $1,886 | $1,993 | +5.7 % |

| Total employee costs | $4,524 | $4,675 | +3.3 % |

The rate of health care cost increases vary by industry, as does the proportion of cost shared by the plan, employer plan sponsor and employee.

The professional services industry has the highest average employer cost increase at 7.5%, while the manufacturing industry has the highest average employee cost increase at 2.9%.

The retail and wholesale industry has the lowest average change in employee contributions: a half percent decrease from 2022 to 2023.

Increase by Industry to U.S. Health Care Plan Costs

| Industry | Employer Cost | Employee Pay Check Contributions | Total Plan Cost |

| Health care | 3.2 % | 1.2 % | 2.8 % |

| Manufacturing | 3.1 % | 2.9 % | 3.1 % |

| Professional services | 7.5 % | 0.0 % | 5.7 % |

| Public sector | 4.7 % | 1.7 % | 4.2 % |

| Retail and wholesale trade | 3.5 % | -0.5 % | 2.5 % |

| Technology and communications | 5.0 % | 2.6 % | 4.5 % |

Improving Outcomes and Health Care Costs by Predicting and Addressing Complex Conditions

High-cost claimants are one of the largest drivers of health care expenses for employers, and this group of members is growing.

This growth is caused by several factors, including new high-cost injectable drugs, increasing cancer rates and longer hospital stays resulting from multiple conditions, complications and complex procedures.

On the other hand, reinsurance premiums are climbing, making it harder for employers to hedge the elevated claim risk.

To help employers manage their health care spend and build a more resilient workforce, Aon developed its Health Risk Navigator, which provides predictive insights to anticipate and protect against the elevated risk employers face.

The tool helps plan sponsors make better decisions to optimize reinsurance coverage, improve budget planning and implement targeted care management programs by using machine learning and risk simulation to analyze historical claims and demographic data for each individual employee, accurately predicting high-cost claim risks.

4 Ways for Employers to Lower Healthcare Costs

Here are four ways for employers to lower costs and improve care as they try to make healthcare more affordable for employees.

1. Lower Costs by Steering Toward Optimal Providers

It’s no secret that there is a wide variation in cost and quality across physicians, hospitals and other healthcare providers in the U.S. But most plan designs and network structures don’t make the choice of higher quality and more cost-effective care an easy one.

This can result in plan members unintentionally making healthcare decisions that lead to higher cost and poorer health outcomes.

One of the most important things to do to lower cost and improve quality of care is to make choosing the right provider simple. This can be done through a guidance service or health plans that make that decision clear, such as variable copay plan designs that offer a range of copays for a service based on the cost and quality of the healthcare provider.

The employer funded a Health Reimbursement Account (HRA) for employees to use to pay for out-of-pocket expenses when receiving healthcare services from recommended providers.

Once the program was rolled out, the client saw healthcare costs fall 12%, even after paying up to $2,000 in individual HRA contributions.

Employees experienced an average savings of 11% in out-of-pocket expenses. Even more important to the employer, however, is the improvement in the quality of care employees and their families are receiving that the company continues to track closely.

2. Lower Costs with Reference-Based Pricing

Another strategy is to implement reference-based pricing (RBP), where the health plan pays for services based on a specific reference price, such as a percentage of Medicare, rather than on a provider’s billed charge.

One of clients who implemented RBP achieved a 34% reduction in medical claims, driven by significant price reductions for costly services like emergency room visits, dialysis, high-cost imaging and surgical admissions.

The employer then reinvested some of these savings into other areas of total rewards such as wages, subsidized childcare and expanding their employee assistance program. The client also added a concierge navigation service alongside the reference-based pricing plan. This steered employees to high-quality providers whose prices fall within the allowed price limit.

3. Reduce Cost Uncertainty with Predictive Analytics

The continued increase in the number of insured employees with chronic and complex conditions — coupled with new expensive drugs and therapies — is driving up the number of high-cost claimants for many employers.

It’s more important than ever for employers to understand this emerging risk so they can better predict and budget claim volatility and make the best decisions on claims mitigation and reinsurance strategies.

For example, Aon’s Health Risk Navigator uses machine learning to analyze historical claims and demographic data, which then allows the tool to accurately predict future high-cost claim risks.

This type of predictive modeling helps employers take control of healthcare spending, integrate support and management for their high-cost claimant risks and ensure long-term sustainability of healthcare benefit programs.

4. Integrate Support by Bringing Vendors Together

Individuals with chronic conditions and complex healthcare situations often have co-morbid conditions and a variety of needs that call for holistic support.

Integrating support can improve the engagement, savings, clinical outcomes and return on investment that employers might not experience through stand-alone solutions targeted at individual chronic conditions or care needs.

The vendors refer and treat people based on their spectrum of clinical need — ranging from primary care and physical therapy to health coaching, nutrition and surgery.

This type of integrated solution gives employees and their families access to convenient (mostly virtual care except for surgery), around-the-clock, high-quality care with low or no out-of-pocket costs — reducing costs for employees and employers alike.

Here are some other ideas for reducing healthcare costs and making the most of the dollars spent:

- Shift to Plans With Higher Deductibles and Health Savings Accounts (HSAs)

- Improve Employee Education About Healthcare

- Telehealth

- Wellness Programs

- Work/Life Balance

- Healthcare Assistance Programs

- Deductibles and Co-pays

But many employers don’t realize that employees who are enrolled in health plans with very low affordability often have higher healthcare expenditures.

……………………

AUTHORS: Debbie Ashford – the North America chief actuary for Health Solutions at Aon, Farheen Dam – North American Health Solutions leader at Aon