The year 2023 marks the tenth year of operation for the US health insurance exchanges since they launched as part of the Affordable Care Act in 2014. The individual market has remained fluid during this time, with insurer participation, pricing, and plans changing from year to year.

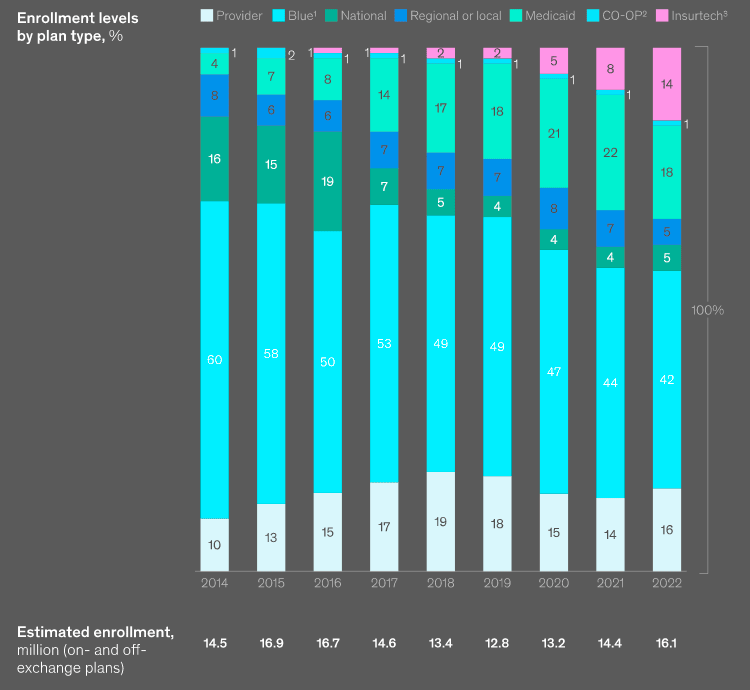

According to McKinsey Insights, consumer participation increased 25% to approximately 16 mn from 2020 to 2022, coincident with extended enrollment periods and enhanced subsidies implemented under the American Rescue Plan Act of 2021 and extended through 2025 by the Inflation Reduction Act of 2022.

Average annual health insurance premiums in 2023 are $8,435 for single coverage and $23,968 for family coverage. These average premiums each increased 7% in 2023. The average family premium has increased 22% since 2018 and 47% since 2013.

More than 3.6 mn new consumers entering the health insurance market are choosing among an average of 88 plans.

McKinsey collected and analyzed data from every health insurance exchange in the country across the 33 marketplaces on the federal platform and the 18 state-based marketplaces at the county level (see 2024 Global Medical Trend Rates Outlook).

This review includes several insights into the individual market for 2023 that are relevant to stakeholders, including insurers, providers, private equity firms, policy analysts, and consumers.

Consumers continue to have increased choice in product offerings in 2023, given increased insurer participation and an increase in the number of plans offered by participating insurers:

- Beyond 2023, this trend could be affected by regulations recently proposed by the Centers for Medicare & Medicaid Services (CMS) for federally facilitated marketplaces (FFM), which would limit the number of plans each insurer can offer starting in 2024.

- Plan premiums have increased modestly in 2023 (a median increase of 4 percent for the lowest-price silver plan) following four consecutive years of almost no premium changes.

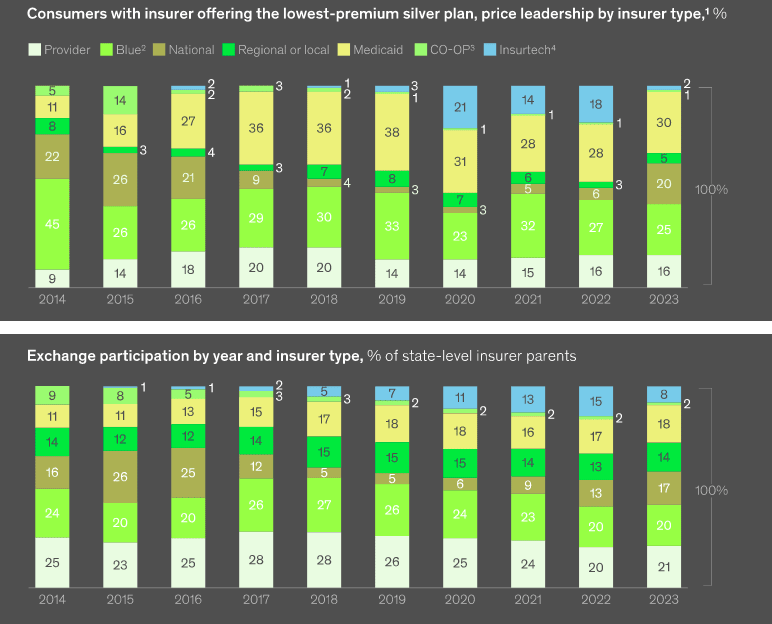

- National insurers are offering more competitively priced silver-level plans compared with last year. They currently offer the lowest-price silver option available to 20% of consumers, up from 6% in 2022.

The upcoming resumption of Medicaid redeterminations, which states may begin as early as April 2023, could result in an estimated additional 2.7 million individuals becoming disenrolled from Medicaid coverage and eligible for individual market premium subsidies.

The individual insurance marketplace grew

Heading into the 2023 open enrollment period, consumer participation increased to more than 16 mn in 2022. Approximately 42% of members were enrolled with Blues in 2022, down 18 percentage points from their high in 2014. Insurtechs enrolled 14% of members, a 12-percentage-point increase since 2019.

Insurer participation continued to grow

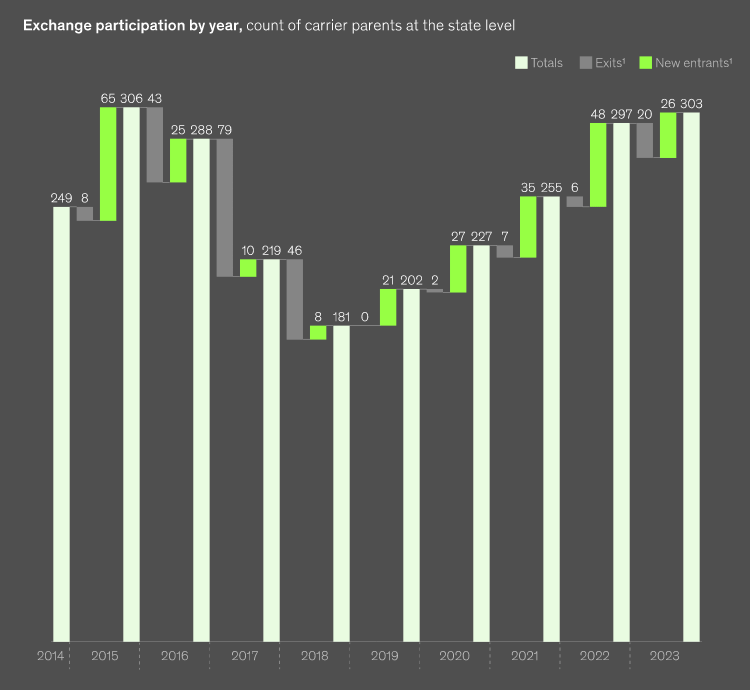

Insurer participation increased in 2023 for the fifth consecutive year to 303 insurer participants at the state level, nearly matching the all-time high of 306 in 2015 (see How to Reduce Health Insurance Price?).

27 new insurers entered at the state level in 2023 (+9% in participation), compared with 48 and 35 new entrants in 2022 and 2021, respectively. This increase was offset by the exit of 20 insurers (-7%) at the state level. The overall net increase of six insurers (+2%) in 2023 is lower than the increases observed in the previous four years, which ranged from 11 to 16%.

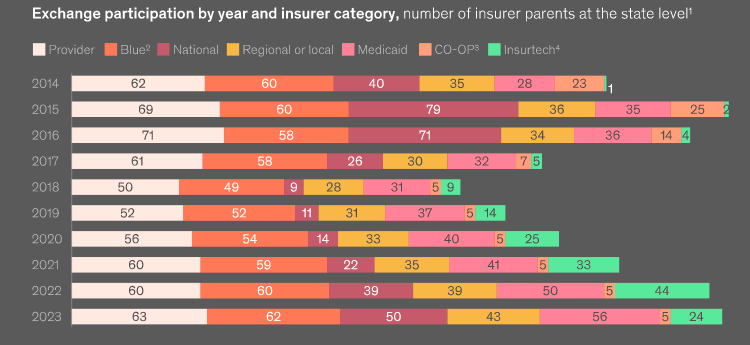

National insurers and insurtechs participation

Although insurtechs have been a major contributor to participation growth in recent years, they experienced a retrenchment in 2023, with Bright Health exiting the market and Friday Health Plan pausing operations in some states.

As of 2023, 59% of consumers have access to a plan from a national insurer, up from 47% in 2022. Blues (98%) and Medicaid (76%) insurers still provide access to the most consumers nationwide.

All other insurer categories were stagnant or grew in 2023, with national insurers driving the largest increase in participation.

Large health insurers expanded participation in individual insurance

Despite the strong overall earnings through first-half 2022, sizeable unrealized losses negatively impacted capital and surplus, which counterbalanced approximately a third of underwriting gains. Given the direction of interest rates, unrealized losses are likely to grow into 2023. In addition, the anticipated end of the PHE and Medicaid redetermination will dampen Medicaid results next year.

The expiration will pressure revenues for insurers with greater proportional exposure to the Medicaid market, with a corresponding reduction in claims costs, according to Fitch.

Most large health insurers have significantly expanded participation in the individual market in recent years, which should partially offset the effect of the redetermination process on the operating performance of the health insurance sector.

Under the Families First Coronavirus Response Act enacted by Congress at the onset of the pandemic, state Medicaid programs were required to maintain continuous enrollment for beneficiaries during the designated COVID-19 public health emergency in exchange for enhanced federal funding.

Consumer choice of health insurers and products

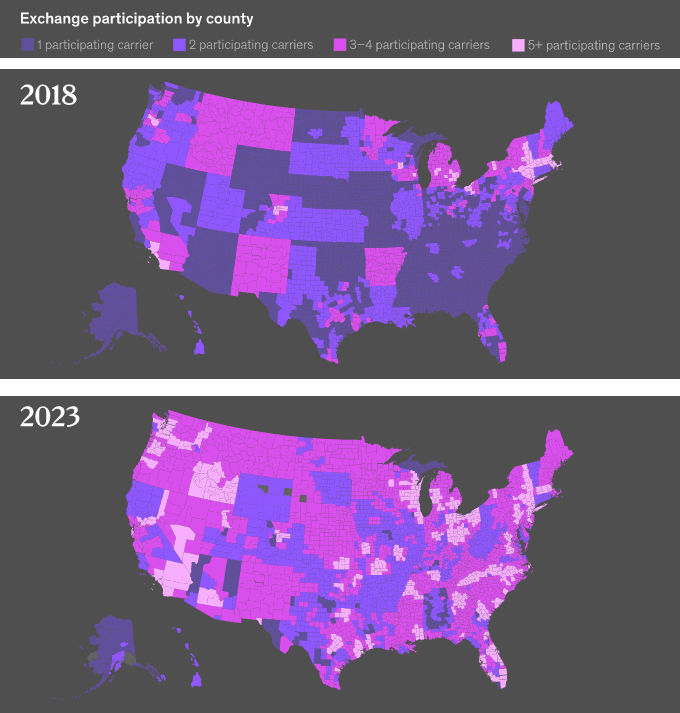

Consumer access to multiple insurer options has increased along with insurer participation over the past five years, with 87% of consumers having access to three or more insurers in 2023 (see why Health Insurance Premium Rate in New York Increased).

This is unchanged from 2022 but up from 49% (an increase of 38%age points) since 2018. Just 4% of counties had access to only a single insurer in 2023, down from 52% in 2018.

Consumers continue to have more choices, with insurers offering 17% more plan options in 2023 than in 2022 and more than three times the number of offerings in 2018.

On average, a consumer can choose among five insurers and 88 plans in 2023, compared with three insurers and 27 plans in 2018.

The proportion of countries with a single health insurer

With the goal of simplifying the shopping experience for consumers, CMS included regulations as part of the HHS Notice of Benefit and Payment Parameters for 2024 proposed rule that would limit insurers in FFM states to offering two nonstandardized plans per product network type and metal tier.

McKinsey estimate that if this rule had been in effect for plan year 2023, the average number of plan options available to FFM consumers would be 34% lower overall, with a 45% reduction in nonstandardized plan options.

Premiums for single and family health insurance coverage

According to KFF report, average annual health insurance premiums in 2023 are $8,435 for single coverage and $23,968 for family coverage. These average premiums each increased 7% in 2023.

- The average premium for single coverage in 2023 is $8,435 per year. The average premium for family coverage is $23,968 per year.

- The average annual premium for single coverage for covered workers at small firms ($8,722) is higher than the average premium for covered workers at large firms ($8,321). The average annual premium for family coverage for covered workers at small firms ($23,621) is similar to the average premium for covered workers at large firms ($24,104).

- The average annual premiums for covered workers in HDHP/SOs are lower than the average premiums for coverage overall for both single coverage ($7,753 vs. $8,435) and family coverage ($22,344 vs. $23,968). The average premiums for covered workers in PPOs are higher than the overall average premiums for both single coverage ($8,906 vs. $8,435) and family coverage ($25,228 vs. $23,968).

- The average premium for covered workers with single coverage is relatively higher in the Northeast and relatively lower in the South. The average premium for covered workers with family coverage is relatively higher in the Northeast and relatively lower in the West.

- The average family premium for covered workers at firms with a relatively large share of lower-wage workers (firms where at least 35% of the workers earn $31,000 annually or less) is lower than the average premium for covered workers at firms with smaller shares of lower-wage workers for family coverage ($21,902 vs. $24,151).

- The average premiums for covered workers at firms with a relatively large share of older workers (firms where at least 35% of the workers are age 50 or older) are higher than the average premium for covered workers at firms with smaller shares of older workers for single coverage ($8,790 vs. $8,112) and for family coverage ($24,700 vs. $23,304).

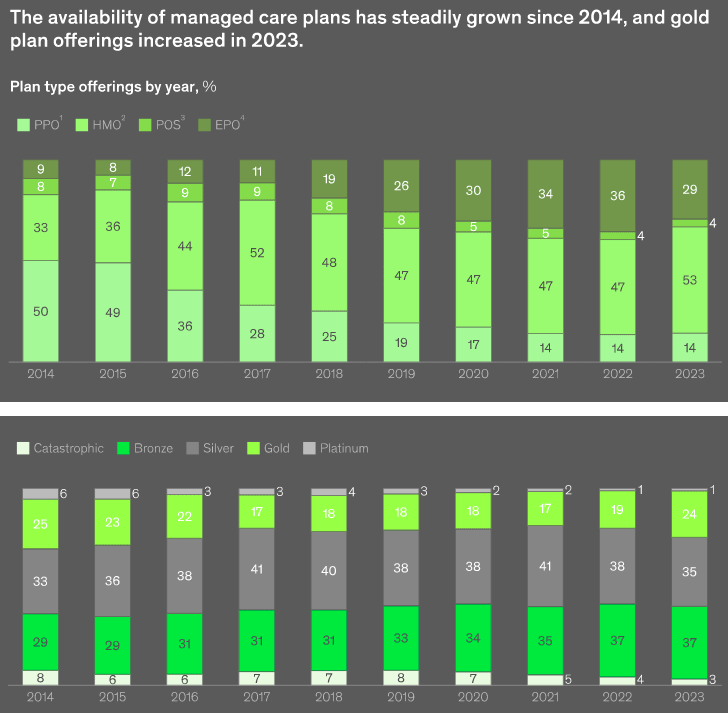

Growth in health insurance product availability

Although overall product offerings have increased substantially, this growth has not been consistent. In 2023, 82% of plans available to consumers are HMO or EPO plans that generally do not provide out-of-network coverage, with the proportion of HMOs relative to EPOs increasing in 2023.

In 2014, HMOs and EPOs represented a combined 42% of offerings, with the increase coming at the cost of PPO and POS offerings, which have declined from 58% in 2014 to 18% in 2023.

A higher proportion of plans available to consumers in 2023 are gold plans (24%, compared with 19% of total product offerings in 2022).

Proportions across other tiers in 2023 are largely consistent with recent years, including a six-percentage-point increase in availability of bronze plans since 2018, with proportional decreases in platinum and catastrophic plans.

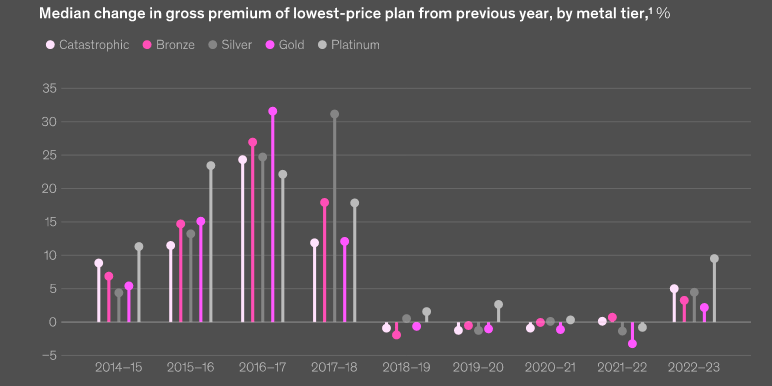

Insurance rates for healthcare plans increased

Gross premiums in 2023 increased across all metal tiers after four years of relative premium stability or declines.

Platinum and catastrophic plans saw the highest rate increases in 2023, at 10% and 5%, respectively. Increases for gold plans were relatively modest at 2%.

Premiums for the lowest-price silver plan also increased across all plan categories, with the highest increases coming from insurtechs.

Insurance premium changes varied by insurer type

From 2022 to 2023, 83% of all consumers enrolled across all insurer categories saw at least some increase in lowest-price silver premiums. The insurtech category had the largest increases in 2023, with a median increase of 8%, compared with 4 or 5% for Blues, nationals, Medicaid, and regional insurers, and 2% for provider plans.

A greater share of national insurers had declines in silver premiums from 2022 to 2023, compared with other insurers; but on average, the provider and CO-OP categories had the most stable premiums.

National insurers improved their price position

National insurers now offer the lowest premiums for silver plans for 20% of consumers in the individual market, an increase of 14 percentage points from 2022. This increase is offset by a similar decrease in price leadership for insurtechs from 2022 (price leader in silver for 18% of consumers) to 2023 (price leader in silver for 2% of consumers).

………………….

AUTHORS: Edith Chan – associate partner in McKinsey’s New York office; Brandon Flowers – partner in the Washington, DC, office; Himani Kohli – consultant in the Delhi office; Isaac Swaiman – senior expert in the Minneapolis office.

The authors wish to thank: Stephanie Carlton, Ankit Jain, Mike Lee, Amy Li, Avantika Mishra, Zoe Williams for their contributions to this article.