Fitch Ratings does not expect rating implications for U.S. health insurers from the expiration of Medicaid continuous enrollment, which was established as a result of the pandemic.

AM Best is maintaining a stable market segment outlook on the U.S. health insurance industry for 2023, citing reduced pressure from COVID-19-related medical costs, as well as diversified revenues and earnings and strong levels of risk-adjusted capitalization among health insurers.

Earnings from government business particularly remained very strong, supported by elevated margins in the Medicaid segment due to the continued public health emergency (PHE) declaration and lack of eligibility checks.

Despite the strong overall earnings through first-half 2022, sizeable unrealized losses negatively impacted capital and surplus, which counterbalanced approximately a third of underwriting gains. Given the direction of interest rates, unrealized losses are likely to grow into 2023. In addition, the anticipated end of the PHE and Medicaid redetermination will dampen Medicaid results next year.

The pressure for health insurers revenues

The expiration will pressure revenues for insurers with greater proportional exposure to the Medicaid market, with a corresponding reduction in claims costs, according to Fitch.

Positively, most large health insurers have significantly expanded participation in the individual market in recent years, which should partially offset the effect of the redetermination process on the operating performance of the health insurance sector.

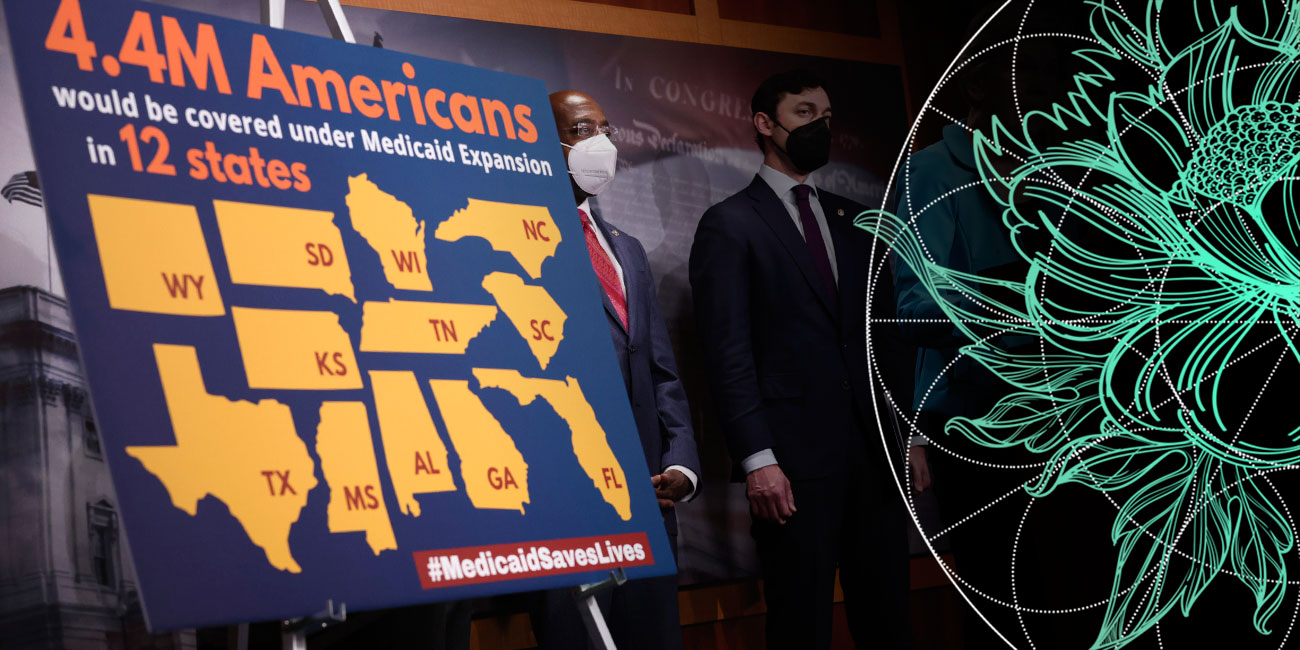

Under the Families First Coronavirus Response Act enacted by Congress at the onset of the pandemic, state Medicaid programs were required to maintain continuous enrollment for beneficiaries during the designated COVID-19 public health emergency in exchange for enhanced federal funding.

Recession is a negative factor for the health insurance industry since job losses lead to membership declines in the commercial segment (see about Life & Health Inclusive Insurance).

Group membership declines can become an issue for carriers in 2023 should a recession materialize and unemployment rise.

At the same time, Medicare Advantage and Medicaid are generally less affected by a recession and can even gain membership during an economic downturn.

The Consolidated Appropriations Act passed by Congress at the end of 2022 set a March 31, 2023 sunset of the Medicaid continuous enrollment provision, phasing out the enhanced federal Medicaid matching funds by YE2023.

The Consolidated Appropriations Act, 2023 is a $1.7 trillion omnibus spending bill funding the U.S. federal government for the 2023 fiscal year.

It includes funding for a range of domestic and foreign policy priorities, including support for Ukraine, defense spending, and aid for regions affected by natural disasters.

States were permitted to resume disenrollments beginning in April 2023 but must meet certain reporting and other requirements during the unwinding process. States will have 12 months to determine current eligibility and two months to complete outstanding actions.

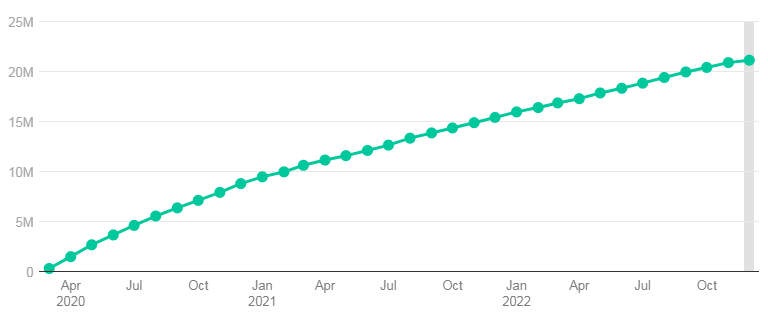

Medicaid Enrollment Grew

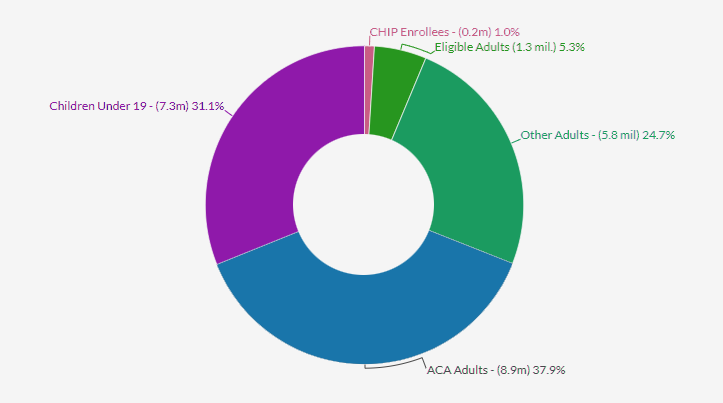

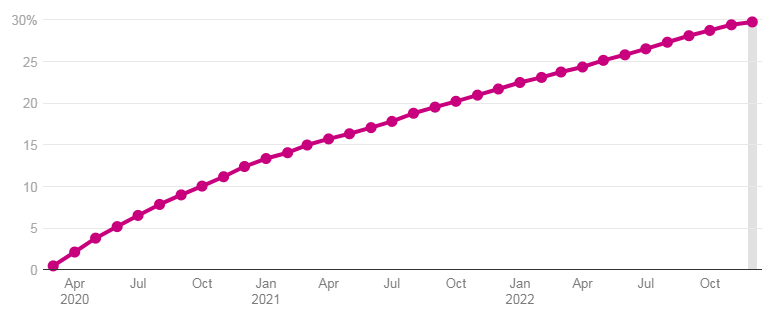

Medicaid Enrollment Grew by 23.3 Mil. From Feb. 2020 – March 2023. Medicaid/CHIP enrollment is increasing amid the coronavirus pandemic, total grew to 92.3 million as of YE2022, a 21.2 million (30%) increase from enrollment levels in February 2020 at the onset of the pandemic, and is estimated to have reached 95 million by March 31, 2023.

The U.S. Department of Health and Human Services (DHHS) estimates that up to 15 million individuals currently covered by Medicaid and the Children’s Health Insurance Program will lose coverage as a result of the redetermination process.

Medicaid/CHIP Enrollment to Reach ~95 mn. Enrollees in March 2023

Source: Fitch Ratings, Kaiser Foundation, Centers for Medicare and Medicaid Services

The number of beneficiaries that lose insurance coverage

The number of beneficiaries that lose coverage will vary by state and depend upon Medicaid policies, enrollment outreach and individual healthcare options.

However, a significant number of disenrolled individuals are expected to obtain replacement coverage on the state exchanges, due in part to the extension of ACA subsidies as provided in the Inflation Reduction Act passed in August 2022.

Others may earn too much to qualify for Medicaid but not enough to afford even subsidized individual coverage, contributing to an expected increase in the uninsured population.

Over the past decade the enrollment composition of many health insurers has become more balanced, with improved diversification between commercial and recession-resistant government-funded business, such as Medicare Advantage and Medicaid.

Commercial enrollment remains the largest segment for most large health insurers. This enrollment diversification could have a stabilizing effect on overall earnings over time. Fitch sees a growing risk of a mild recession in the U.S. in the second and third quarters of 2023.

Medicaid/CHIP Enrollment Has Increased Since The Start Of The Pandemic

Following the implementation of the ACA Medicaid expansion to low-income adults in 2014, there were large increases in Medicaid and CHIP enrollment across states that followed steady growth in coverage of children over the past decade.

These increases reflected enrollment among newly eligible adults in states that implemented the expansion as well as enrollment among previously eligible adults and children due to enhanced outreach and enrollment efforts and updated enrollment procedures tied to the ACA.

This trend began reversing when enrollment started to decline in 2018 and continued to decline in 2019.

Cumulative Percent Change In Medicaid/CHIP Enrollment Since February 2020, $M

Cumulative Percent Change In Medicaid/CHIP Enrollment Since February 2020, %

Total enrollment fell from 73.3 million in December 2017 to 71.0 million in December 2019, a decline of 2.3 million people or 3.1%. Month-to-month enrollment declines slowed but continued until February 2020.

The declines in enrollment, in part, reflected a robust economy, but experiences in some states suggested that they may have also reflected enrollment losses among people who were still eligible for coverage due to challenges completing enrollment or renewal processes.

The rise in unemployment that typically accompanies a recession is likely to result in slower growth or modest declines in reported enrollment within the commercial segments of health insurers.

Although health insurers do not typically release margin-level information on specific business lines, Fitch estimates that commercial insurance has the most attractive profit margins, followed by Medicare Advantage and Medicaid.

Medicare Advantage business has the strongest absolute gross margin per member, as seniors generate high medical costs that necessitate higher premium payments to cover the costs.

Despite a more modest average Medicare Advantage rate increase in 2024, MA growth is expected to partially offset reduced earnings from Medicaid.

Downside risk from the redetermination process to margins for insurers with outsized Medicaid exposure, including Centene and Molina, may also be mitigated by shifting individuals who lose Medicaid coverage to exchange products, increased enrollment from expanding state contracts, and efforts to reduce administrative expenses related to Medicaid.

………………………

AUTHORS: Bradley Ellis, CFA – Senior Director, North American Insurance at Fitch Ratings, Laura Kaster, CFA – Senior Director, Fitch Wire