No Life & Health (L&H) insurance market is fully inclusive. This is supported by the findings of Swiss Re Institute L&H Insurance Inclusion Radar, which provides a measure of the degree of inclusivity of L&H insurance markets in a sample of advanced and emerging economies.

Factors that promote and/or hinder inclusivity provide insights to help insurers extend their reach across a broader spectrum of society in the countries in which they operate.

By making L&H insurance more affordable, available, and accessible, individuals and households will be better equipped to withstand the financial challenges that occur when a primary breadwinner passes away, and/or when they incur high costs of healthcare treatments.

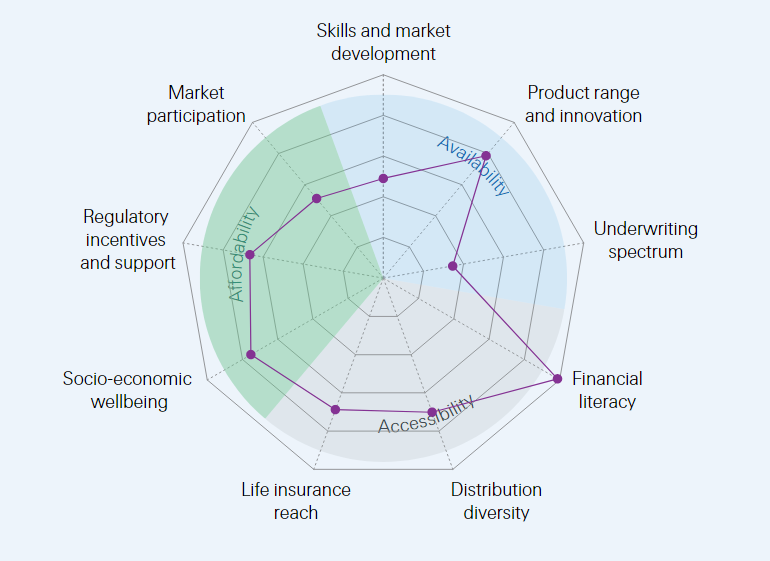

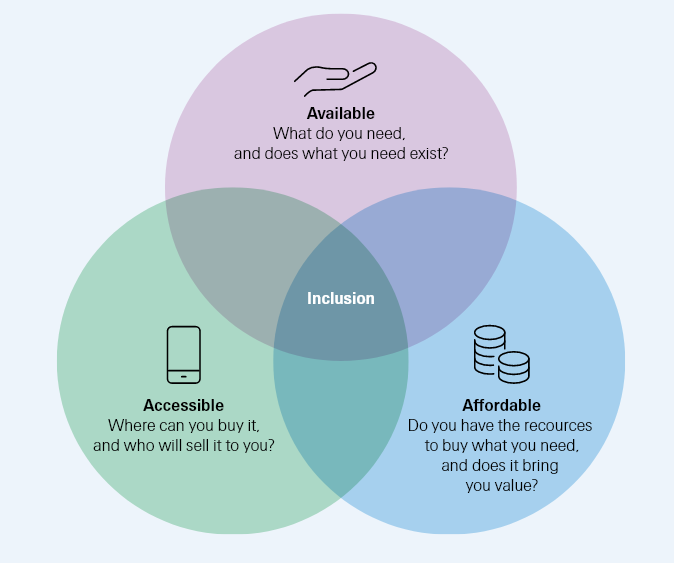

Swiss Re consider “inclusive insurance” to be the provision of relevant risk protection covers to all people in society. In the context of L&H insurance, analitycs explore three drivers of inclusion: the availability of and accessibility to relevant insurance services, and the affordability of insurance.

The three dimensions – Availability, Accessibility and Affordability (the 3As) – make up the framework of the Inclusion Radar.

In advanced markets, inclusion is boosted by a wide range of L&H product types and greater skills development for industry professionals.

Some common drivers explain the variance in Inclusion Radar scores. For instance, we find that the Availability of a wide range of L&H product types and options to suit consumer needs is one reasons why this dimension carries more weight in terms of fostering inclusion in advanced markets, more so than in emerging economies.

The advanced markets also score higher with respect to offering skills development and training opportunities for industry professionals, another indicator of the Inclusion Radar’s Availability dimension.

Advanced markets example

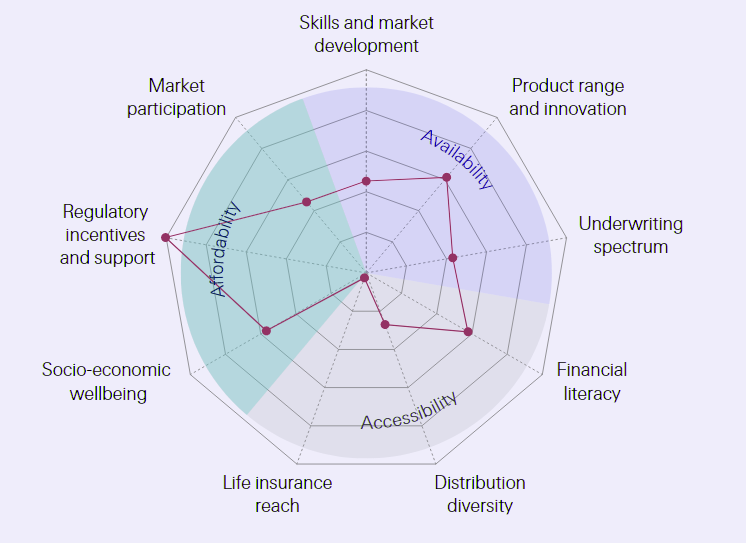

In emerging markets, diversity in distribution models and simple products with low minimum face values support inclusion

On average, consumers in advanced markets face fewer barriers to the 3As, but the typically higher income levels in advanced economies do not necessarily translate to higher levels of Affordability.

With the exception of Japan, in advanced markets the smallest policy sizes on offer often are too expensive and not relevant for lower-income consumers with modest needs.

Emerging markets example

The opposite is the case in emerging markets, where products with low minimum face values boost participation for low-income communities, and where there is regulatory support for mass distribution of small covers. In emerging markets, Accessibility hampers consumers most.

Persistent insurance protection gaps

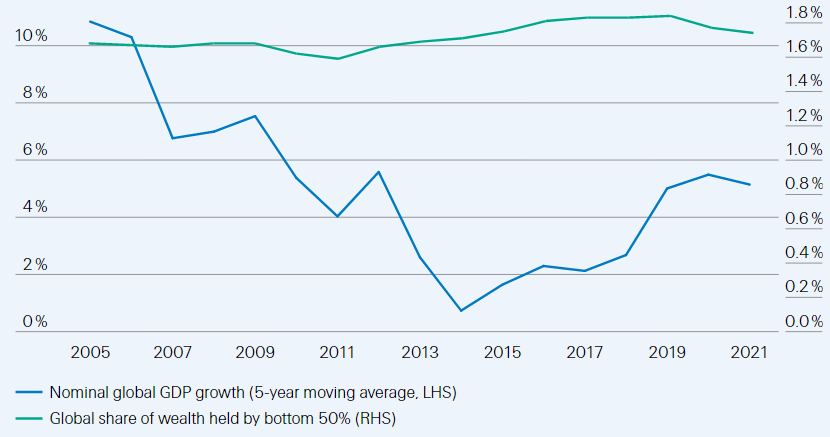

Global economic growth is slowing and social inequalities within and between countries remain high. Figure shows little progress on these twin challenges over the past two decades. Insurance has a role to play in fostering economic and social progress (see Insurance Economics Perspective).

Non-life insurance like Property and Casualty (P&C) covers help support financial resilience and promote economic growth.

Life and Health (L&H) insurance, meanwhile, provides a family with financial relief in the event of existential threats such as death and disability, and also financial support for healthcare costs. Both can play an important role in redressing social inequalities.

Global GDP and share of wealth held by bottom 50% of world population

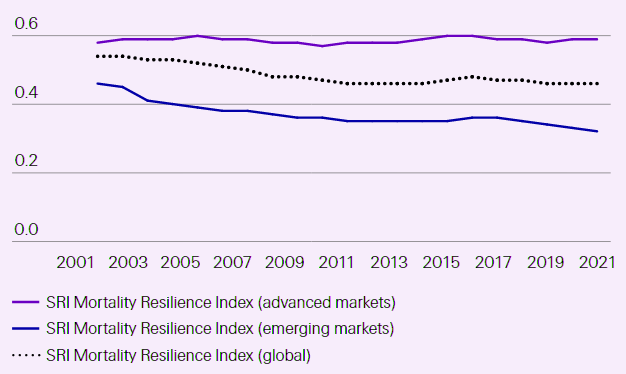

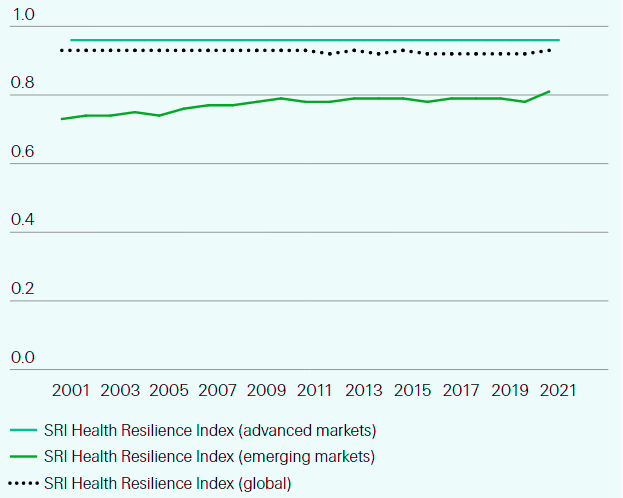

Global Mortality and Health Resilience Index

In spite of the well-recognised utility of insurance, large protection gaps persist across different lines of business in both the advanced and emerging markets. In 2021, the SRI

Mortality Resilience Index stood at 45.7%, the inference being that 54.3% of the estimated global need for financial support after the death of a household breadwinner was not covered by either asset wealth or insurance protection.

Global mortality resilience, a two-decade decline of 9 percentage points (ppt), with advanced markets stagnating, and emerging declining somewhat. Mortality resilience varies widely across countries, with India (SRI Mortality Resilience Index of 8.9%), Vietnam (9.2%) and Indonesia (18.6%) at the lower end of the range, and others such as Canada (89.4%), Japan (67.6%) and Brazil (56.1%) at the upper.

Swiss Re Institute Mortality Resilience Indices

Swiss Re Institute Health Resilience Indices

Insurance Focus on Inclusion

We consider “inclusive insurance” to be the provision of appropriate risk protection cover to all people in society. The underlying assumption of this study is that when L&H insurance is more inclusive, the industry will be better positioned to help narrow mortality and health protection gaps.

In an attempt to assess how inclusive the private L&H markets in different countries are, we develop a framework based on three drivers of inclusivity.

That protection gaps will shrink if private-sector L&H insurance is made more Available, Accessible and Affordable to society at large, including hitherto underserved communities (typically low-income households).

- Availability = the existence of protection products/plans that adequately meet the range of mortality and morbidity protection needs of society.

- Accessibility = the places, people and processes deployed to connect available insurance products with the potential buyers.

- Affordability = whether insurance product premium price-points are reasonable/ within the financial resources of intended buyers and convey fair value.

From hereforth, these dimensions are referred to as the “3As”. A deficit in any one of the three limits the extent to which L&H insurance can reach both served and underserved customers.

Analysis considers and contrasts the drivers of inclusion within and between advanced and emerging market countries.

The 3A dimensions

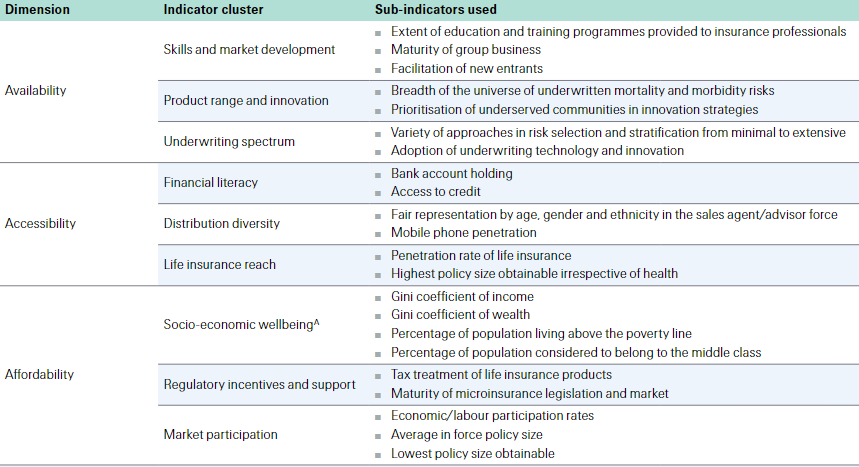

The Inclusion Radar framework

We have developed a framework we call the based on the 3As to measure the degree of inclusivity of different markets. For each of the three dimensions, we have selected several sub-indicators that we seek to quantify using primary and secondary-sourced data, and analysed these for a sample of 16 countries (five advanced and 11 emerging markets).

The scores for the respective sub-indicators are aggregated using weighted averages to reflect the quality of data and, in terms of influence, our assessment of each sub-indicator’s contribution to inclusion.

The separate dimension Radar scores are further aggregated using an arithmetic mean to determine an overall Inclusion Radar score for each market. These overall scores are also aggregated using the population of each country as weights.

Due to a lack of secondary-source data, the primary-source data for the sub-indicators of Availability are the responses given by 35 Swiss Re experts from the 16 sample markets to a set of interview questions covering various aspects of the three dimensions.

The secondary data used, such as statistics on bank account holdings and mobile phone penetration rates, are predominantly from the World Bank’s World Development Indicators.

The L&H Insurance Inclusion Radar framework: indicators and sub-indicators for each of the 3A dimensions

Measuring inclusion: key findings

Re/Insurers use Inclusion Radar to measure the degree of inclusivity in L&H insurance across our sample markets, which represent all advanced and emerging regions (in alphabetical order Australia, Canada, Japan, the UK and the US (advanced markets); and Brazil, Colombia, Egypt, Kenya, India, Indonesia, Mexico, Nigeria, South Africa, Turkey and Vietnam (emerging markets)).

The measure of inclusivity is based on the 3A dimensions: the Availability and Accessibility of insurance, and the Affordability of insurance products/services in each market.

The Inclusion Radar has been developed as a model to simulate reality. The sub-indicator and dimension Radar scores are used as a tool to appraise, in relative terms, market differences in inclusion and the drivers of those differences. A Radar score closer to 1 represents a high level of inclusion, whereas a score closer to 0 infers a lack of inclusion.

L&H Insurance Inclusion Radar scores for markets, overall and for each 3A

| Country | Aggregate inclusion score | Availability score | Accessibility score | Affordability score |

| US | 0.67 | 0.73 | 0.62 | 0.67 |

| Japan | 0.66 | 0.55 | 0.79 | 0.64 |

| Canada | 0.64 | 0.66 | 0.64 | 0.62 |

| South Africa | 0.62 | 0.73 | 0.74 | 0.38 |

| UK | 0.61 | 0.72 | 0.59 | 0.53 |

| India | 0.52 | 0.55 | 0.53 | 0.48 |

| Australia | 0.52 | 0.47 | 0.48 | 0.59 |

| Indonesia | 0.51 | 0.56 | 0.39 | 0.57 |

| Mexico | 0.49 | 0.50 | 0.45 | 0.52 |

| Turkey | 0.49 | 0.50 | 0.30 | 0.66 |

| Brazil | 0.48 | 0.53 | 0.50 | 0.42 |

| Egypt | 0.48 | 0.52 | 0.31 | 0.61 |

| Kenya | 0.47 | 0.59 | 0.32 | 0.50 |

| Nigeria | 0.44 | 0.44 | 0.30 | 0.58 |

| Vietnam | 0.43 | 0.44 | 0.40 | 0.46 |

| Colombia | 0.36 | 0.38 | 0.33 | 0.37 |

| Advanced markets | 0.65 | 0.67 | 0.65 | 0.64 |

| Emerging markets | 0.50 | 0.53 | 0.47 | 0.50 |

| Global | 0.53 | 0.56 | 0.50 | 0.53 |

Advanced insurance market 3As

Availability

Radar findings show that in advanced markets, a key driver ofAvailability is the provision of a wide range of cover types and innovative product options to suit consumer needs. All advanced markets in our sample, except Australia, perform similarly on this indicator.

SRI Mortality Resilience Index for Australia strengthened from 2000-2015, approaching the advanced markets average.

However, from 2017 it has declined while at the same time, the mortality protection gap widens. A potential explanation could be related to regulatory reforms to prevent high-pressure selling, misrepresentation and unfair contract terms in the country’s financial services sector, which began at the end of the last decade.

Increased disclosure requirements from those reforms led to a Quality of Advice review by the Australian Treasury starting in 2022, proposing further reforms to make it easier for customers to obtain sound financial advice.

The review has attracted over a hundred industry submissions and is ongoing, with the intention to restore better levels of inclusion for consumers

Accessibility

Consumers in advanced markets experience fewer difficulties in accessing insurance services than their peers in emerging markets. This is primarily driven by systemic factors like their financial markets being more established, leading to high levels of financial institution account-holding and credit usage.

In sample of advanced markets, the share of population with bank accounts averages 97%, compared with 54% in the emerging markets. This suggests higher levels of financial literacy and trust in financial institutions.

Advanced market consumers are generally more aware of insurance products. Physical access to banks is also greater: there are often no banks in remote regions in emerging markets.

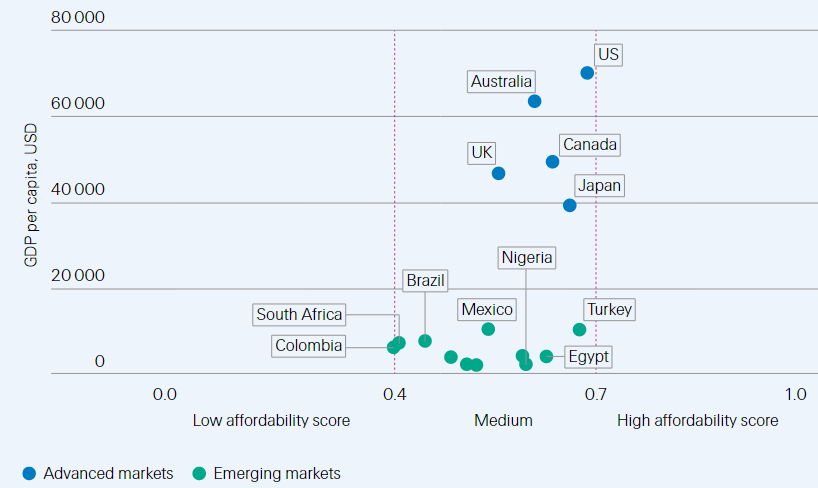

Affordability

Acts as a hinderance to insurance inclusion in advanced markets. Thisreflects the situation that, with the exception of Japan, the smallest policy sizes on offer are generally too expensive and not relevant for advanced market low-income consumers with modest needs.

Affordability scores plotted against advanced and emerging markets’ levels of GDP per capita

Another driver for low Affordability Radar scores in advanced markets relative to the other two 3A dimensions is how average in-force policy sizes compare to per capita GDP.

Lower relative levels of protection suggest that consumers are not willing or able to allocate funds to the premiums required for the level of cover that would adequately meet their needs, leading to lower market participation. Japan has the lowest ratio of policy size to GDP per capita of all advanced markets.

Emerging insurance market 3As

Some emerging markets exhibit positive outliers on some scores and for certain indicator clusters. For instance, the availability of microinsurance and associated regulatory support to keep policy premiums within the means of low-income communities boost the Radar scores.

Availability

There is a fair range of products and innovation effort in emergingmarkets, but Availability Radar scores in all regions are weakened by fewer opportunities for skills development and training. This is more marked in Latin America (particularly Colombia) and in emerging Asia (Vietnam).

In South Africa and to a lesser extent India, Nigeria and Kenya, insurance sector professionals benefit from more opportunities to upskill and apply their knowledge to benefit market development.

Accessibility

On aggregate, the Accessibility Radar scores for the emerging marketsin our sample are the lowest of all the 3As, and also lag the advanced market scores most.

Weighing on scores to different degrees are lower levels of financial literacy, and less usage of and trust in the financial services sector.

For instance, in Brazil, India, South Africa and Turkey, consumers make more use of financial services than in the other emerging market sample countries. Another factor hampering Accessibility is low insurance penetration. With the exception of South Africa and to a lesser extent India, penetration in the other markets is low.

Affordability

Emerging markets tend to have more providers of insurance productswith very low minimum face amounts than the sample advanced markets. These providers support market participation for low-income communities and significantly raise Affordability Radar scores relative to the advanced markets.

Insurers and insureds in emerging markets benefit from regulations to promote the growth and mass distribution of small policy coverages, more so than the advanced markets.

In Brazil for example, specific regulatory support in recent years includes giving parties more freedom and flexibility to determine terms of the contract, allowing on-demand insurance products, launching a regulatory sandbox, and establishing more flexible rules for personal insurance.

The overall Inclusion Radar score for South Africa is the highest of all the emerging markets in our sample. This is based on strong Radar scores for Availability and Accessibility, where performance is similar to that of the advanced markets.

Conversely, however, South Africa is the second-worst performing of all markets on Affordability, just slightly behind Colombia. This is largely driven by high unemployment and deep social inequalities. In South Africa, the L&H insurance market has high penetration and high levels of product innovation, and consumer awareness and familiarity with insurance and other financial services is also high relative to other emerging markets.

Paths to more inclusive insurance

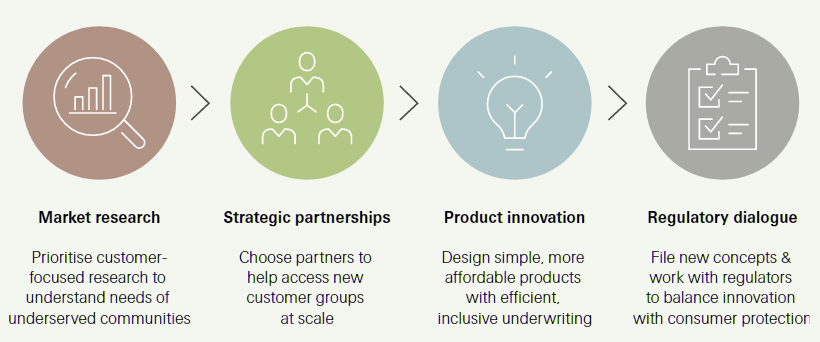

In Swiss Re view, there are four key areas of opportunity where the industry could progress the inclusivity of L&H insurance markets:

- consumer-focused market research across all segments to better understand the needs of underserved customer groups;

- strategic partnerships to increase accessibility for consumers to insurance products;

- innovation in product development and underwriting processes to better meet consumer needs in more affordable and efficient ways;

- dialogue with regulators to ensure consumer protection and an environment in which innovation can flourish.

The path to more Inclusive insurance

Conclusion

- More inclusive insurance can help narrow mortality and health protection gaps.

- The Inclusion Radar provides insights for insurers globally…

- …to inform actions to extend the reach of L&H covers to all segments of society.

L&H insurance can play an important role in reducing social inequalities but for maximum impact, the industry must prioritise inclusion for all.

The L&H Insurance Inclusion Radar framework allows us to move beyond measuring the size of mortality and health protection gaps to consider the drivers of those gaps.

The insights derived from the Radar scores can serve as a call to action for insurers globally to make L&H insurance more inclusive for both existing and underserved consumers.

We see four main areas for positive action. First, insurers should undertake consumer-based market research that prioritises underserved communities.

Second they should engage in strategic partnerships to foster diversity in distribution and use digital technology to achieve scale. Third, they should continue to innovate in product design alongside more efficient, inclusive underwriting practices and fourth, foster dialogue with regulators to strike the right balance between innovation and consumer protection.

Inclusive Insurance FAQs

What is insurance inclusion?

Inclusive insurance is a broader term denoting all insurance products aimed at the excluded or underserved market; rather than just those aimed at the poor or a narrow conception of the low-income market.

What is inclusive insurance mean?

“Inclusive insurance” allows insurers to achieve social impact as well as business objectives. Different markets have different needs; by understanding the nature of each market and designing appropriate products and distribution networks, insurers can positively contribute to societal resilience. Inclusive Society.

What is the importance of insurance in financial inclusion?

Financial inclusion is important for the insurance industry to gain access to a wider range of customers. Therefore, the insured are people with jobs, incomes, and their own homes. This is likely to include high-potential customers whose development can help the long-term development of the insurance business.

What is the difference between microinsurance and inclusive insurance?

The term “microinsurance” is used to refer to insurance for low-income populations, which may fall within a broader category called “inclusive insurance” — insurance intended for groups generally excluded or under-served by the insurance market.

What is inclusion of life insurance policy?

Life insurance plan inclusions are the benefits provided with a life insurance policy, which can include a wide range of benefits and features.

What is the inclusion of life insurance?

Life insurance, for estate tax purposes, includes not only the common forms of insurance taken out by an individual on the individual’s own life, but also the proceeds of certain other types of insurance policies.

What is an example of inclusive?

Being inclusive means that you act based on the belief that everyone has inalienable rights. For example, people have the right to: Express themselves without being penalised for certain differences. Choose an occupation and engage in work that pays a competitive wage and allows them to use their abilities.

…………………..

AUTHORS: Roopali Aggarwal – Insurance Research & Data Associate, Swiss Re Institute, Shelly Habecker – L&H Sustainability Lead Americas, Life & Health Products Swiss Re Institute, Melissa Leitner – Head Sustainable L&H Delivery, Life & Health Products Swiss Re Institute, Ayush Uchil – Insurance Research & Data Analyst, Swiss Re Institute

Fact checked by Oleg Parashchak