Ahead of the Jan. 1, 2024 reinsurance renewals, reinsurers’ overall appetite for US regional property catastrophe coverage remains healthy, but carriers are proving less willing to provide aggregate covers for regional property Cat risk, preferring instead to deploy capital through occurrence excess of loss (XOL) programs.

Gallagher Re conducted a market survey with various reinsurance partners focusing on regional personal and small commercial business.

Jan. 1, 2024, reinsurance renewals look set to be less contentious and economically painful for cedents than last year, with ample property and property catastrophe capacity available, but coverage is still expected to come at a higher price

The survey aimed to ask questions related to pricing and portfolio appetite, capacity expectations and structure considerations for various reinsurance programs.

Property reinsurance pricing should rise but not as sharply as last year, partly due to better communications between buyers, sellers and brokers.

Property catastrophe reinsurance capacity

The poll, which surveyed 24 of the reinsurers most active in the regional market in fall 2023, found the overall dollar amount of capacity to be deployed in property Cat coverage for these insureds was likely to remain flat at January 1, 2024.

The findings are significant, as half of respondents said that from 40% to 60% of their US book renews at Jan. 1, 2024. And for 59% of reinsurer respondents, regional clients made up at least 40% of their Jan. 1, 2024 renewals.

The survey found that 58% of reinsurers planned to write the same amount of Property exposure as last year through similar levels of participation in insurers’ Cat programs, with 38% planning for modest growth.

The survey also found that property Cat capacity will more likely be deployed in excess layers than aggregates. In 2022, the same survey found 37% of reinsurers were unwilling to write aggregate covers. This year, that percentage jumped to 63%.

Challenge for re/insurance renewal

The global reinsurance market is still facing an imbalance between the rising demand for protection being seen and the fact inflows of capital to the sector remain sluggish.

The increase follows a challenging insurance renewal in January 2023, during which reinsurers made less capacity available for working layers and aggregate covers, amid fundamental shifts in pricing and increases to attachment levels.

By contrast, there are now signs that reinsurers are beginning to lean into this market in a more meaningful but selective way.

Reinsurers’ desire to shift capacity further up the programs to more remote layers will result in ample capacity at these levels, which could result in a reduction in pressure on rates.

The challenge for Jan. 1, 2024, therefore, is to balance this dynamic with reinsurers being willing to support programs across the board.

This balance may be achieved in part through more sophisticated program design. Within the almost two-thirds of carriers that said they wouldn’t write aggregate policies, a quarter said they would consider providing subsequent-event XOL reinsurance coverage instead. This number was a slight uptick in appetite compared to last year when just 17% of respondents said the same.

Insured Losses from Hurricanes

The survey was conducted against the backdrop of another significant year of losses from adverse weather events in the US (see TOP 20 Costliest U.S. Hurricanes).

Natural catastrophe losses are on the rise globally, and hurricanes account for a significant proportion of them. While it’s tempting to ascribe the increased losses to climate change, the available data doesn’t support that conclusion.

9M2023 saw insured losses crossing the $50 bn threshold for the first time on record, according to Gallagher Re analysis.

The North Atlantic hurricane season still has a few weeks to run, and if another big loss event happens, reinsurers’ positioning might change.

Moody’s RMS has published an overview of North Atlantic seasonal activity forecasts and summarized the key oceanic and meteorological drivers behind the predictions. Expanded in 2021 to cover seasonal forecasts in the Asia-Pacific region, the report again includes the latest forecasts of 2023 Western North Pacific typhoon activity.

Munich Re estimated that, following the North Atlantic hurricane season, overall losses from all storms amounted to around $110 bn, with insured losses in the magnitude of $65 bn. Hurricane Ian alone is expected to generate losses of $100 bn, Munich Re said, with $60 bn of these losses to be passed on to private re/insurers.

Insured losses from hurricanes have risen over the past 15 years as hurricane activity has intensified. When adjusted for inflation, nine of the 10 costliest hurricanes in U.S. history have struck since 2005.

In addition to increased storm activity, coastal construction has continued, and property values risen, resulting in higher loss exposure (see how Insurers Poorly Prepared for the Increased Losses by Catastrophe & Flooding).

- $80 bn in new industry loss data, including Hurricane Ida (2021) and Hurricane Ian (2022)

- $6.5 bn in new detailed claims data, including more than $3 bn in new residential claims data outside of Florida, more than $2 bn in new U.S. commercial claims, and more than $1 bn in data from Puerto Rico

Reinsurance pricing seen flat

Analysts at JMP Securities say they are expecting reinsurance pricing will be flat to slightly up at the January 2024 renewal season, with reinsurers expected to push for rate to keep pace with inflationary costs, but a chance that some appetite returns for lower-layers if the price is right.

This year-end renewal season should be less tumultuous. Over the past year, each successive reinsurance renewal at April 1, June 1 and July 1 was “incrementally more orderly than the prior,” and there was a “relatively stable supply” of capacity.

Flat pricing at the reinsurance renewal could be viewed as a victory, is the sentiment the analysts are hearing from brokers, while on the reinsurer side, they will be quick to note they care more about terms and conditions than pricing, within reason.

Cedents and brokers are acknowledging that it will be a challenge to get rates down, with flat seen as the best target.

“We expect particular focus around increased top-layer protection as cedants react to inflation, as well as an upcoming new RMS Atlantic hurricane model,” the analysts state, which could have some bearing on the insurance-linked securities (ILS) community, especially catastrophe bonds, where the ILS market would be ready to help absorb any additional top-layer demand that emerges.

As the year went on, people understood the expectations and budgeted properly. In April, May, June, July, while we were still getting rate increases that were needed and restructuring as needed, they were able to get it done, because they understood how to budget.

Reinsurance rate for property catastrophe

For the time being, there are some early signs of rate expectations being moderated for stronger performing portfolios, when compared with the prior year.

Secondary perils are set to remain in strong focus at the January 2024 reinsurance renewals, the analysts believe, with reinsurers buoyed by the results they are experiencing, as they avoid many of the frequency type losses thanks to higher attachments and improved terms.

Reinsurers are expected to rely less on mandated, across-the-board rate increases this year, and focus more on the client-specific underwriting experience, with an emphasis on loss experience in 2023.

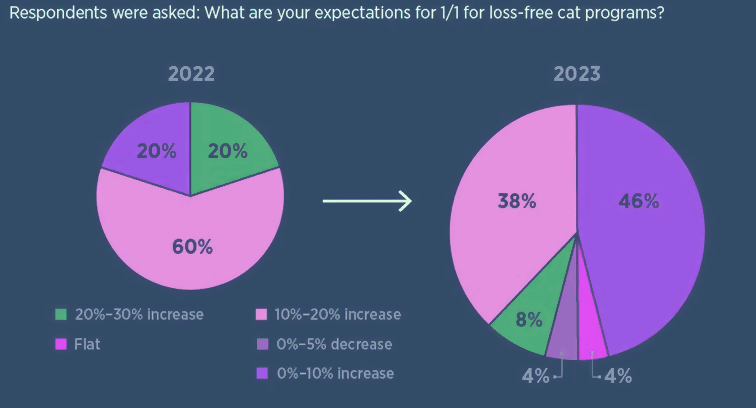

For loss-free property Cat XOL exposures, 84% of our respondents said they expected pricing to increase less than 20%, with 46% indicating less than 10% increases. A small number even reported they expected prices to drop by up to 5%.

Reinsurers’ expectations on loss-free pricing in Cat XOL

This outlook for buyers is better than last year, when a fifth of reinsurers looked for a more than 20% price lift, and no carriers expected a drop in rates.

Meanwhile, for portfolios that have been impacted by losses, 68% of respondents expected a price increase of 10% to 30%.

Moderated reinsurance rate expectations

The survey found similar moderated rate expectations for per risk coverage: loss-free accounts were expected to generate rate increases of flat to 10% in 2024, according to 49% of respondents, up from just 27% of reinsurers the year before.

Last year’s survey found the majority of reinsurers pushed for 10-20% rate hikes for loss-free accounts.

Reinsurers are expected to place significant weight on historical experience when evaluating retention levels and pricing, specifically when considering whether the retentions agreed at Jan. 1, 2023 proved adequate, or if further corrections are needed.

Carriers should expect reinsurers to push for retention increases in some cases. The survey found that 78% of respondents indicated that greater than 10% of their portfolios will require retention increases, with 39% indicating that they will be pushing for retention increases on at least 20% of their portfolio.

At a minimum, reinsurers will be looking to keep retentions on pace with exposure change and inflation.

………….

AUTHOR: Josh Knapp – Executive Vice President Gallagher Re