The COVID-19 pandemic has prompted a widespread reprioritisation of tech initiatives and will hasten the deployment of digital solutions across the world.

With the world economy entering into the deepest recession in decades on account of the COVID-19 pandemic, we see digital transformation as one of the paradigm shifts of a post-virus era.

Collaboration between insurers and digital platforms

With an increasing number of digital platforms extending their business reach into financial services, insurers need to adapt their business models and engage with digital ecosystems.

Collaboration between insurers and digital platforms can be a win-win for both. Insurers can innovate their value chain with online distribution, predictive underwriting and automatic claims management.

Digital platforms can benefit from business diversification and stronger customer loyalty by offering financial service online. The key success factor for such partnerships will be to accurately identify consumer needs with respect to online risk protection solutions.

Understand the digital behaviours and insurance needs of customers

To that end, we conducted a consumer survey study to understand the digital behaviours and insurance needs of customers. The findings shed light on how different market players can work together to deliver better digital insurance experiences to residents in these dynamic markets.

Swiss Re Institute conducted surveys in key markets to better understand how the pandemic experience has changed consumer behaviours and attitudes toward insurance.

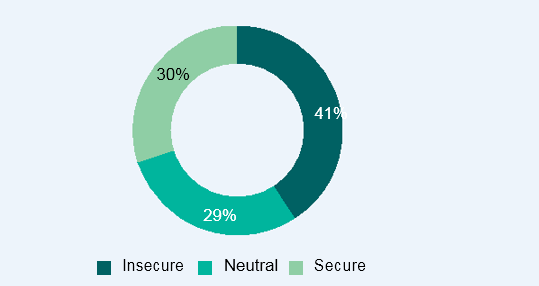

In many markets, survey respondents expressed worry about being financially insecure, and also about having inadequate coverage.

Respondents in Japan, South Africa, the UK and Brazil reportedly feel the least secure with their current level of life insurance coverage.

This was particularly the case among younger cohorts. Even among those who currently own a life insurance policy, almost two-fifths feel that their existing level of cover is inadequate, with those younger than 30 years old feeling the most vulnerable.

The pandemic has led to an increase in health concerns

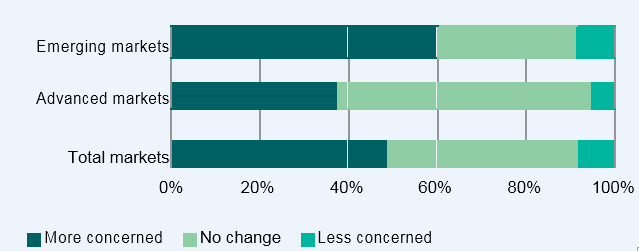

The pandemic has led to an increase in health concerns, with respect to both physical and mental well-being. Across the markets surveyed, more than half of the respondents said they have become more concerned about their overall health status due to COVID-19.

Globally, health worries are especially high among younger age groups. Around 60% of the respondents below 40 years old are more concerned about their level of health because of COVID-19.

At 60%, the concern is highest among respondents in emerging markets where insurance penetration is low and health protection gap high relative to that in advanced markets. The levels of concern expressed were the highest in Brazil, Mexico and India.

Global sentiment of financial security among policyholders

Health concerns due to COVID-19: global, advanced markets, emerging markets

Based on the survey findings, consumers most wary of tomorrow’s uncertainties are not only in the early phase of their lifecycle, but are also more digitally savvy and most likely to research insurance products online.

Younger consumers are most likely to search and purchase life and health insurance online

Survey participants younger than 40 years of age and in emerging markets are most likely to increase their level of life and health insurance coverage given concerns over their financial security and health status.

Online platforms stand out as the most preferred purchase channel globally. In particular, consumer appetite for digital touchpoints and the swift processing potential offered by digital platforms is growing.

Swiss Re published Global COVID-19 consumer survey 2022 a study based on consumer surveys conducted in 20 markets across the globe and APAC region in 2022. Markets include US, France, UK, Germany, South Africa, Brazil, Poland, Mexico, Australia, New Zealand, China, Hong Kong, South Korea, India, Indonesia, Japan, Malaysia, Thailand, Singapore, and Vietnam.