Guy Carpenter explained that the property catastrophe reinsurance market saw some “significant” price adjustments for loss-impacted programs in peak zones, whereas loss-free accounts in other geographies actually trended flat to down.

According to Artemis` Report, reinsurance broker’s index is a proprietary index of U.S. property catastrophe reinsurance rate-on-line movements, so offers a way to measure catastrophe reinsurance pricing in the U.S. market. Property catastrophe reinsurance rates-on-line in the U.S. have risen by almost 15%.

With this Index weighted towards peak zone regional perils at the January renewals, the slight rise seems to have been driven more by the loss impacted accounts, than the market as a whole and certainly does away with the idea that the market is broadly harder after this renewal.

The reinsurance renewal was shaped by deteriorating loss experience, a lack of new capital inflows and also increasingly challenged primary insurance and retrocession markets.

While reinsurance supply was seen as in the main sufficient to meet increasing demand, apart from in some of the most constrained areas of the market, Guy Carpenter said that renewal outcomes have varied significantly by geography, line of business and cedent, with their performance one of the key differentiators.

Beyond the broader measures affecting the macro dynamics of most markets, Global Reinsurance Sector Outlook report covers several factors impacting both supply and demand including Standard & Poor’s upcoming model changes, real and social inflation, new risks emerging from PFAS and other chemicals, secondary peril considerations and climate change.

Supporting risk transfer, global reinsurance capital increased 3.8% through year end 2021 to $675 billion, with traditional capital increasing 4.1% to a new peak of $579 billion and alternative capital growing to $96 billion (slightly shy of the peak levels at $97 billion in 2018). With record issuance in the catastrophe bond market in 2021, issuance pipelines continue to expand as the turmoil created by non-loss external sources is expected to be short-lived.

Reinsurance Renewals Commentary

Losses and the changing view of risk has been a particular driver for this renewal, the broker said, with reassessments of risk resulting in some drawbacks of capacity after derisking exercises or complete withdrawals of capacity.

Guy Carpenter calls the January 2020 renewal market “asymmetrical”, as certain classes whose performance remained positive and profitable often resulted in flat renewals, or in some cases a modest rate decrease.

Midyear renewals reflected one of the most challenging property markets in many years with pricing driven by inflation, escalating geopolitical risk, and loss experience.

John Doyle, President and COO

Throughout the first half of the year, we saw some reinsurers take tougher positions on specific terms and conditions and shift portfolios to limit capacity in certain lines of business or geographies.

Catastrophe activity in Q1 2022 resulted in more than $10 billion of losses to the industry. That said, this is consistent with average results for the prior 10 years and significantly less than losses experienced in 2021. While a number of events surpassed the $1 billion level, overall losses were distributed fairly evenly among the regions.

The most pronounced reinsurance rate increases were locally felt in specific regions or markets, driven mainly by successive years of losses, deterioration in performance and changing perceptions of risk.

Conversely, the areas of the market that have been more strained saw market corrections, some significant.

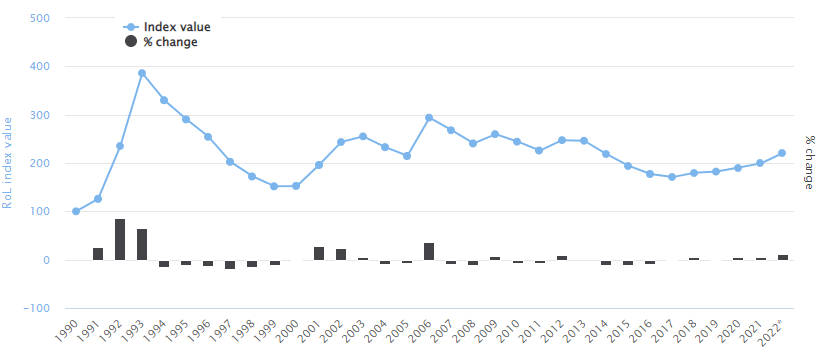

Global Property Catastrophe Rate-On-Line Index

This Index has risen by 10.8% at January 1st 2022, reflecting the price increases achieved on global property catastrophe reinsurance contracts by reinsurers at renewals.

This is more than double the increase seen a year earlier, when this Index rose by 4.5% at Jan 1 2021.

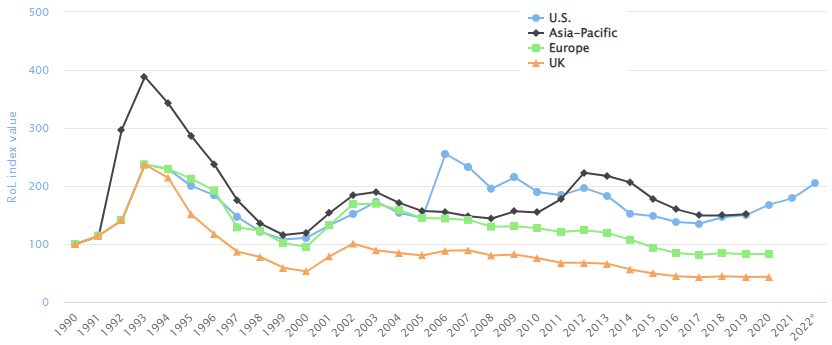

Regional Property Catastrophe Rate-On-Line Index

A steady influx of new capital in 2021 kept catastrophe bonds largely insulated from the rate hardening experienced in other parts of the reinsurance market and helped drive positive issuance momentum into 2022.

That reflects far steeper increases now achieved in Europe at the 2022 reinsurance renewal, which make up a significant contributor to this Index at the January 1st season.

It is also the biggest positive change in this Index since 2006 and takes the Index back to levels last seen prior to 2014.

Guy Carpenter explained that, where rates and pricing moved higher in property catastrophe reinsurance risks, structure adjustments, especially on retentions, were most prevalent in the heavier loss-impacted sectors.

In fact, while pricing movements spanned a wide range, on a risk-adjusted basis, non-loss-impacted property reinsurance renewals were generally flat to up 7%, while loss-impacted rose by between 10% to more than 30%.

A hard property catastrophe reinsurance market is expected to affect commercial insurance lines pricing, according to Goldman Sachs.

With the latest incremental inflation, pricing in property lines of business are likely to stop decelerating or potentially begin to accelerate again, as it began seeing some evidence of this in the latest pricing surveys from Ivans & Marketscout.

It expects commercial pricing to continue to show modest deceleration with the potential for pricing to come in flatter QoQ as inflation impacts property lines of business.

Improvements in reinsurers’ financial performances

Fitch Ratings expect significant improvements in reinsurers’ financial performances due to higher prices in a hardening market, a strong rebound in economic activity and lower pandemic-related losses.

The positive factors should outweigh the negative effects of declining investment returns, increasing natural catastrophe claims due to climate change, and a temporary pick-up in inflation.

Increased risks from rising claims inflation, financial market volatility and weakening price momentum have seen Fitch Ratings revise its sector outlooks on global reinsurance and London market to neutral from improving.

Fitch Ratings has lowered its sector outlooks for the global reinsurance and London markets to “neutral” from “improving,” citing increased risks from rising claims inflation, financial market volatility and weakening price momentum.

………………………..