The continued escalation of the conflict in Ukraine is affecting us all in many different ways. As an reinsurance industry, many firms have suspended some or all operating activity in Russia.

Beyond the broader measures affecting the macro dynamics of most markets, Aon’s Reinsurance Market Outlook report covers several factors impacting both supply and demand including Standard & Poor’s upcoming model changes, real and social inflation, new risks emerging from PFAS and other chemicals, secondary peril considerations and climate change.

We all hope for a rapid resolution with minimal impact on insurance market. Although it is too early to understand any potential coverage implications, reinsurers will continue to support insurers during this difficult time.

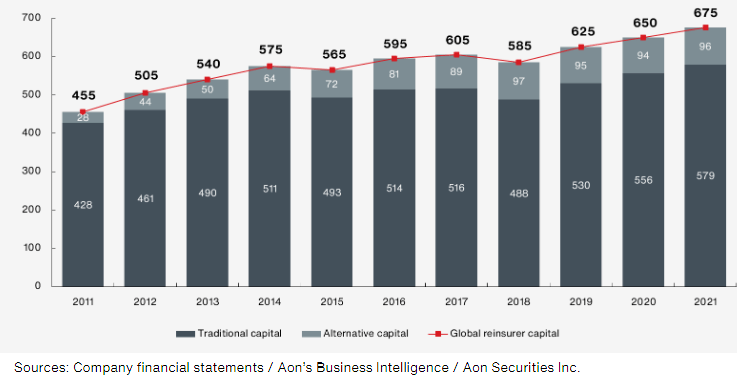

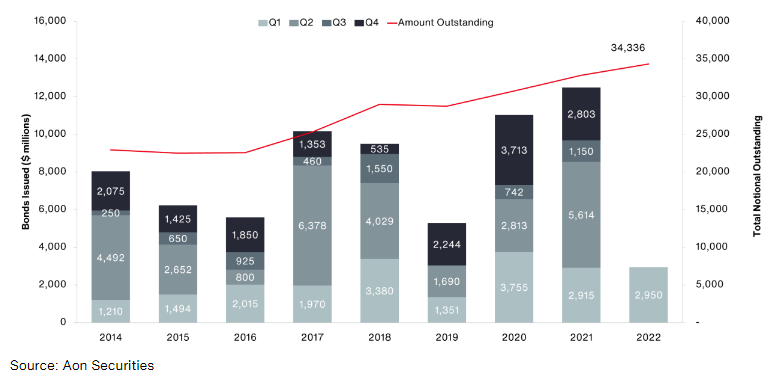

Supporting risk transfer, global reinsurance capital increased 3.8% through year end 2021 to $675 billion, with traditional capital increasing 4.1% to a new peak of $579 billion and alternative capital growing to $96 billion (slightly shy of the peak levels at $97 billion in 2018). With record issuance in the catastrophe bond market in 2021, issuance pipelines continue to expand as the turmoil created by non-loss external sources is expected to be short-lived.

Catastrophe activity in Q1 2022 resulted in more than $10 billion of losses to the industry. That said, this is consistent with average results for the prior 10 years and significantly less than losses experienced in 2021. While a number of events surpassed the $1 billion level, overall losses were distributed fairly evenly among the regions.

While April renewals saw a relatively orderly market, numerous factors continue to evolve in Florida in advance of June and July renewals including Florida Governor Ron DeSantis recently announcing a special legislative session on insurance reform planned for May. This is against a backdrop of evolving risks in the market as climate change, inflation, and emerging casualty and cyber risks prove the value of insurance and reinsurance to the broader economy.

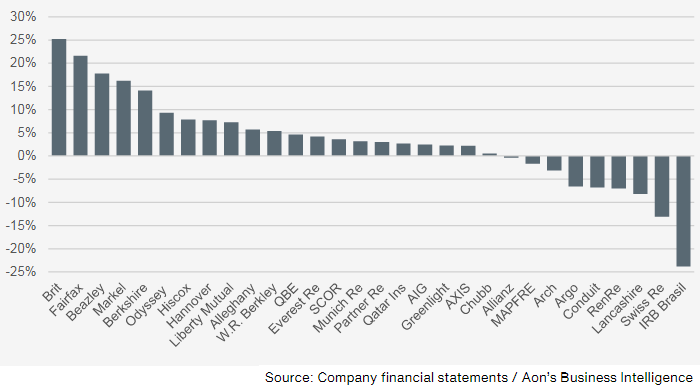

Notable Reinsurer Capital Changes

Most companies showed growth, with strong stock markets driving some sizeable increases with above average allocations to equities.

The reductions at IRB Brasil, Lancashire, RenRe and Conduit coincided with overall losses reported for the year, while net income of $1.4 billion at Swiss Re was outweighed by a combination of dividend payments, unrealized losses on bonds and adverse foreign exchange movements.

Change in Total Equity

Retained Earnings Drive Capital Growth

Aon estimates that global reinsurer capital totaled $675 billion at December 31, 2021, an increase of $25 billion relative to the end of 2020, driven principally by retained earnings. This calculation is a broad measure of the capital available for insurers to trade risk.

Global Reinsurer Capital (USD Billions)

A steady influx of new capital in 2021 kept catastrophe bonds largely insulated from the rate hardening experienced in other parts of the reinsurance market and helped drive positive issuance momentum into 2022.

Issuance pipelines continued to expand early in 2022 as cedents looked to capitalize on favorable pricing and terms.

Recently though, the geopolitical turmoil and currency volatility have reduced the ILS investors’ investable cash (currency hedging, redemptions and a need for increased liquidity have all been cited) leading to a reversal of the tightening trend, with most transactions now pricing around their wide end of spread guidance. Coupled with a robust pipeline, this has also led to increased investor selectivity in risk selection and a push for improved structural terms.

We would expect the current market uncertainty to be relatively short-lived, as the shift was not driven by losses but rather by external forces. We believe that new entrants and fresh capital will continue to return to the space once the broader capital market volatility recedes.

Growth of Catastrophe Bond Market

Inflation can present a challenging environment for (re)insurers, which need to calculate how and if they should build elevated costs into their pricing models and negotiating at policy renewals.

According tips for (Re)Insurers, claims handling, especially, is more difficult, caused by shortages of goods and labor, and volatile prices. However, insurers with appropriate inflation guard mechanisms in their policies likely reflect current inflation in their limit profiles.

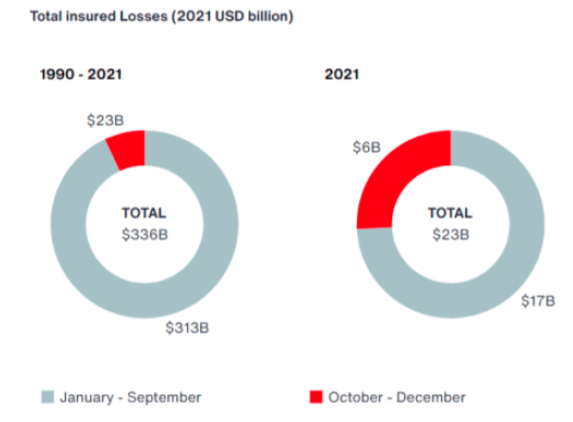

Total Insured Losses

On the modeling and pricing front, demand surge is already built into the catastrophe models. Demand surge loads of 30+% are in the models for very large events. Smaller events have smaller demand surge loads, but they are typically still more than 10% for events more than $10 billion.

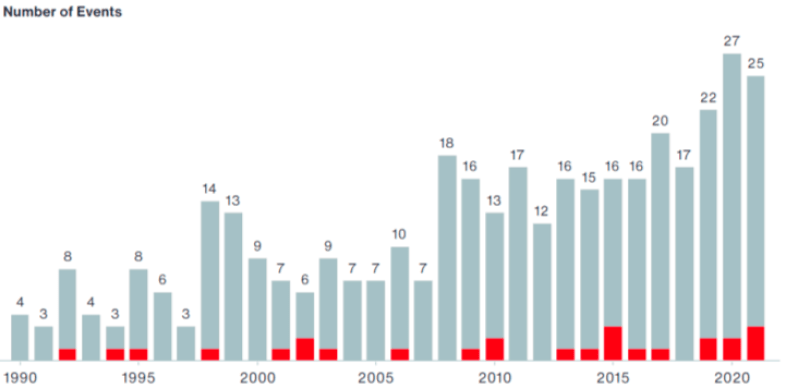

Total Insured Losses from US SCS that Caused at Least $250 Million Insured Loss (Since 1990)

If insured values are being properly captured, premium will naturally rise with inflation as compensation for the increased insured value. Further protection is provided if percentage deductibles are in place since they will float with inflation. It’s important to consider which inflation metric is being used when adjusting insured values though, as some of the broader metrics like CPI could undercount the true rise in costs such as that seen with building materials and CPI over the past year. There are numerous sources of this type of cost indexing that could be consulted.

2021 was yet another year of above average reinsurers losses coming in at the seventh costliest year on record with $343 billion of global economic loss (27% above the 21st century average). Even more notable is an insured loss of $130 billion (76% above the 21st Century average), with contributions from 20 billion-dollar insured loss events (4th highest on record).

Eight of the top 10 insured loss events in 2021 are from perils traditionally considered ‘secondary’ perils, such as winter weather, flood, severe convective storm, and wildfire, which is resulting in a shift in how we view potential loss severity and volatility from these types of events, according to Aon’s Catastrophe Insight. These changes in perception are occurring alongside questions of how climate change is influencing natural catastrophe loss experience.

………………………..