The Insurance-Linked Securities (ILS) market ended another year on a high note as the annual new issuance record was broken once again.

This milestone was achieved in spite of a challenging year of catastrophe losses and with most market participants working from home.

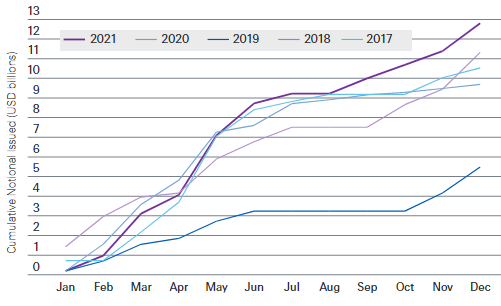

The ILS market continues to demonstrate its resilience with bonds issued in every month of last year and almost USD 13 billion of total new issuance for the calendar year.

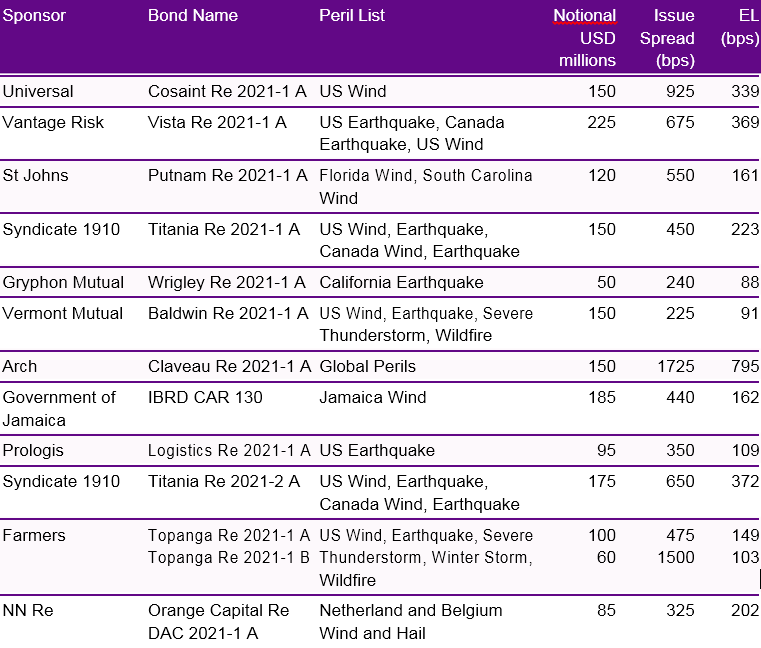

According to Swiss Re ILS Market Insights, most encouraging was the number of new sponsors and ESG developments in the asset class. Notable new sponsors this past year included the Government of Jamaica, California insurer Farmers and Dutch insurer NN.

Primary ILS market

ILS New Issuance: Cumulative Notional Issued

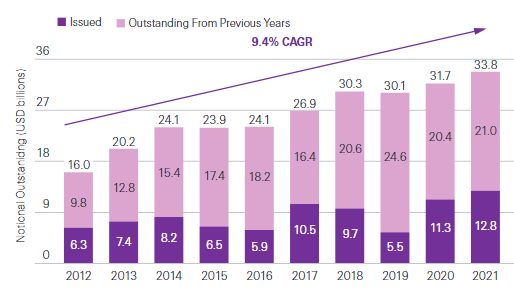

The higher volume of new issuance in the year also contributed to the growth of the market as a whole. The notional outstanding at the end of 2021 stood at USD 33.8 billion and for the second straight year, 2021 new issuance outpaced scheduled maturities. Since the end of 2012, the catastrophe bond market has achieved a Compound Annual Growth Rate (CAGR) of 9.4%

ILS market issued vs. outstanding notional

Along with record-breaking issuance, 2021 presented a host of new sponsors coming to market for their inaugural catastrophe bond in the 144A market. One new sponsor even came to market twice, once in the first half and again in the second half of the year.

This demonstrates how the catastrophe bond market is an attractive and effective source of alternative capital to insurers, reinsurers, and other sponsors alike.

Catastrophe Bond Sponsors

Transaction spotlight

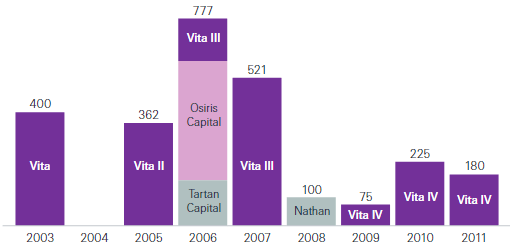

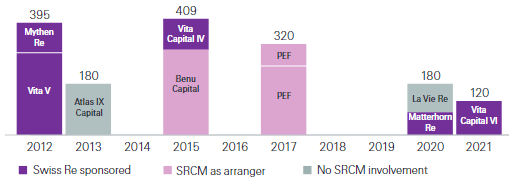

Mortality risk was first securitized in 2003, when Swiss Re sponsored the first “Vita” cat bond, and since then, the company has been developing the nascent market as a regular and prominent sponsor.

As an active structurer in the mortality segment, Capital Markets has arranged USD 3.7 billion of mortality bonds, accounting for almost 90% of mortality issuances since 2003, and USD 2.4 billion through the “Vita” program alone.

Despite new sponsors entering the field, the life and health ILS market remains relatively small with less than 5% of outstanding cat bonds today covering mortality or morbidity perils. Looking ahead, Capital Markets is optimistic that offering pandemic risks will be an area of growth for the ILS market driven by increased risk awareness.

Historical Extreme Mortality Bond Issuances 2003 – 2011 (notional in USD millions)

Historical Extreme Mortality Bond Issuances 2012 – 2021 (notional in USD millions)

The Vita Capital VI Series 2021-1 Class B issuance forms the latest addition to Swiss Re’s “Vita” program and provides protection to Swiss Re against extreme mortality events in four countries – Australia, Canada, the UK and the US – across five calendar years.

The Class B was issued in July 2021, showing the demand for mortality risk during an ongoing pandemic. The bond was positively received by investors, evidenced by an upsizing of the deal from the initially announced USD 75 million to USD 120 million.

Typically, the trigger of a mortality bond works through an age and gender weighted Mortality Index compiled based on pre-defined national reporting sources such as the USCenters for Disease Control and Prevention (CDC) or the Office for National Statistics (ONS) in the UK.

This index is calculated for the calendar year in question and compared to the calculation for a prior reference year to derive the Mortality Index Value (MIV) per country.

Structure ILS

The structure of the 2021 Series was adjusted in two main aspects to reflect a market environment influenced by the ongoing pandemic:

- For the purpose of establishing the MIV, COVID-19 mortality was specifically excluded for the 2021 calendar year, but not for following years.

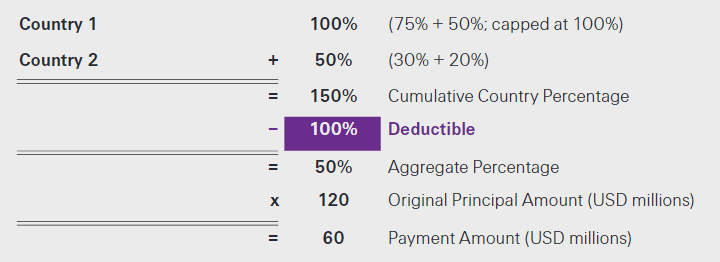

- A deductible, set at 100%, was introduced to the computation of the Aggregate Percentage (see Figure 9 for a calculation example). This newly added deductible means that an isolated instance of extreme mortality in one country alone, like a devastating local earthquake or terrorism event, or perhaps an epidemic or pandemic affecting one country in a more material way, cannot trigger a payout under the terms of the bond. Instead, excess mortality, i.e., the MIV reaching a country’s Attachment Point, needs to be observed in at least two countries to cause a principal reduction, thereby underlining the pandemic nature of the event.

Illustrative calculation example for the application of the deductible

Albeit not directly related to extreme mortality bonds, a further innovation introduced in the Vita Capital VI Limited Series 2021-1 Class B Notes relates to the permitted investments.

Collateralized by a puttable EBRD Note, it was the first cat bond with an interest rate referenced to the Secured Overnight Financing Rate (“SOFR”) following the transition away from LIBOR.

To conclude, the successful issuance of the Vita transaction shows that despite difficult market conditions caused by the global pandemic and especially for mortality bonds, a carefully structured extreme mortality bond could nonetheless be placed. It also received investor demand to the extent that the deal was upsized by 60% to USD 120 million – the largest extreme mortality bond in the last four years.

Secondary ILS market

The ILS secondary market once again evidenced its liquidity throughout the year for both buyers and sellers. As noted in our 2020 year-end Insights report, the ILS secondary market revealed how reliable it can be when faced with a liquidity event, like COVID-19 in March 2020. However, investors looked to the secondary market for other reasons also in 2021.

A slower start to the new issuance pipeline left investors with an opportunistic secondary market to turn to as newly raised capital was allocated to catastrophe bond strategies.

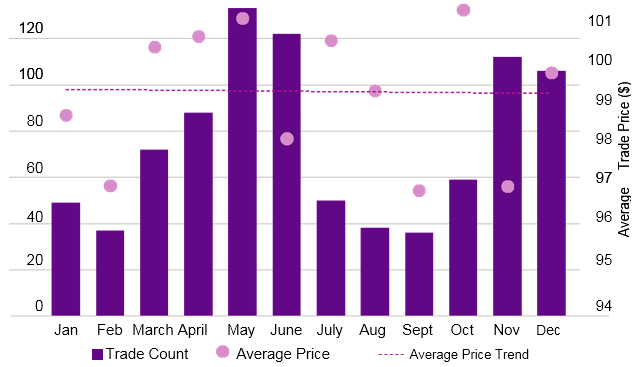

The highest volume of secondary trading occurred in May and June, with the last two months of the year also showing heightened activity, according to FINRA’s Trade Reporting and Compliance Engine (TRACE).

Historic TRACE Trade Volume by Month

Overall, the average trading price for 144A catastrophe bonds during the period has trended downward, according to TRACE.

Unlike earlier in the year, the fourth quarter saw some distressed trading from loss-impacted bonds after events like Hurricane Ida. Impacts from key events during 2021 will be explored in more detail later in this report, but the losses were bearable by a robust market that has continued to grow and actively trade.

ILS Market composition

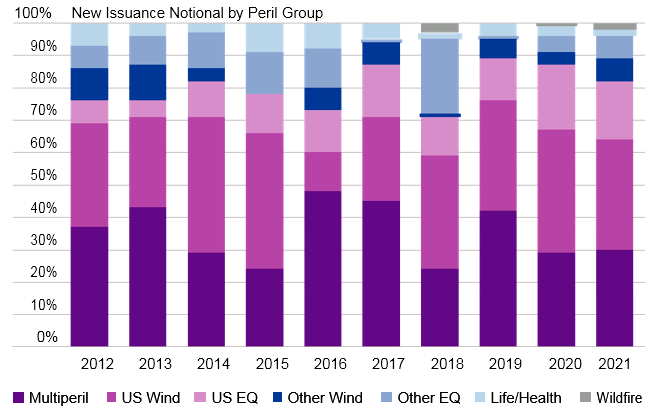

During the two-year period starting in 2020 to present, the catastrophe bond market has maintained a relatively consistent diversified mix of perils for investors to source. As seen in Figure 11, the percentage of pure US Wind offerings in the market averages 35% of the issued notional since 2018.

New issuance composition

Diversifying earthquake offerings have been considerably lower after a blockbuster USD 1.36 billion, multi-country offering of earthquake protection in 2018.

Since then, the market has benefited from other diversified perils to help investors construct a well-balanced portfolio. During 2021, the new issue market saw its fair share of large diversifying peril offerings with USD 925 million coming from pure Japan earthquake risk alone.

Yearly New Issuance by Peril Group (in USD billions)

Multi-peril aggregate bonds

Catastrophe events over the past five years have placed aggregate structures in the spotlight, especially for those providing US multi-peril coverage on an indemnity basis. Over the years, pricing for aggregate structures has increased, diverging from that of risk-comparable occurrence structures.

Investors have grown weary of higher-frequency, lower-severity events accumulating and causing losses to aggregate layers. In recent years, a large number of events that contributed to losses have been wildfires, severe thunderstorms, convective storms, and other secondary perils.

These types of perils are generally considered harder to model accurately and are believed to be more impacted by climate change than primary perils.

Historically, most aggregate structures in the cat bond market have utilized a Franchise Deductible mechanism, which acts as a binary filter to determine which event qualify for coverage under the catastrophe bond. Losses greater than a defined level are included in full, whereas losses just below the defined level are not included at all. This creates additional volatility, as many of these smaller events have estimated ultimate losses that hover around the same level as that franchise deductible.

This means that very small changes to an individual event’s estimated ultimate loss can change whether it qualifies for coverage.

That can lead to very large swings in the aggregate loss and losses to a bond. It was clear that changes had to be made to aggregate structures to address investors’ concerns and mitigate the volatility seen in existing structures.

USAA was the first of several nationwide insurers to make the switch from a Franchise Deductible to an Event Deductible for their aggregate catastrophe bond program in 2021. The introduction of the Event Deductible greatly reduced the volatility created by those high-frequency, low-severity events and was appreciated by investors.

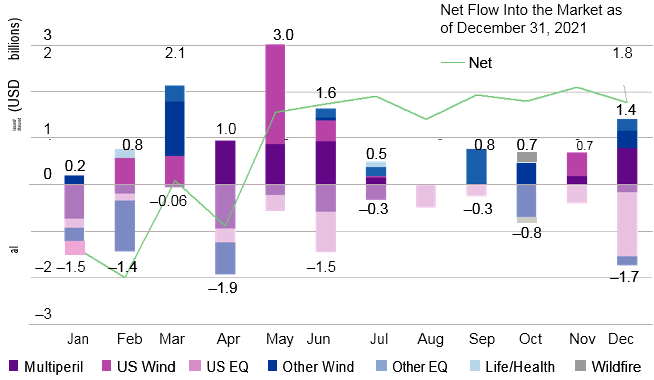

ILS Capital flows

As mentioned earlier in the report, 2021 saw record-setting new issuance. While there was also a high amount of maturing notional this year, issuance was sufficient to more than make up for those maturities. As a result, the market saw a net inflow of nearly USD 1.8 billion over the year.

Issued and Matured Notional by Peril (in USD billions)

In 2021, bond payouts from loss events declined by almost 39% compared with the prior year. The catastrophe bond market had roughly USD 400 million in payouts to sponsors with the large majority coming from losses suffered in years prior.

As 2021 presented a benign year for loss activity in the catastrophe bond market, we expect bond payouts to continue for losses suffered in the 2020 risk period, where aggregate structures are being monitored for potential loss creep.

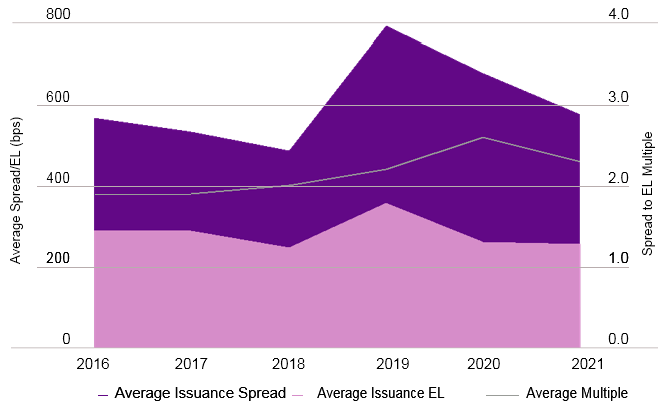

Cat bond performance

Continuing the trend from late 2020, new issue spreads saw a tightening trend throughout most of the year. The average multiple on catastrophe bond transactions in 2021 declined by about 11% year over year, which contrasts to the 16% increase from 2019 to 2020.

SRCM observed new issuance spreads for California earthquake take a sharp decline as investors looked to diversify away from a growing, peak US wind risk marketplace.

Weighted Average Nat Cat Issuance Spread, Expected Loss and Multiple

Secondary market spreads over the period also declined in tandem with new issuance. US Wind spreads during 2021 tightened to lower levels than in 2018 and this was after the market faced a heavy year of losses during 2017 and 2018 from US hurricanes and wildfires.

Spreads rose from there, but investors were nonetheless looking to put capital to work in the ILS market after its resilience following a period of price dislocation. Spreads stabilized in July 2020 and since then have drastically declined.

After events like European Storm Bernd and Hurricane Ida in the US Gulf Coast, spread widening commenced. Investors faced a competitive secondary market where ‘bidding-up’ on catastrophe bonds led most of the secondary market activity in the first nine months of the year.

Since the beginning of the fourth quarter, spreads slightly widened back to early-2020 levels for both peak and non-peak perils. SRCM is of the view that spreads hit a low in 2021 and a more disciplined secondary market will stabilize itself throughout the course of 2022.