The Bank of England proposed further reforms to capital rules for UK insurers in a step it said would cut red tape without lowering solvency standards. The Solvency II rules were inherited from the European Union and their reform is seen by the insurance industry and by lawmakers who supported Britain’s exit from the bloc as a key “Brexit dividend” to unlock billions of pounds to invest in infrastructure.

The proposed reforms are expected to alleviate capital strain and enhance Solvency II ratios for these insurers. The timeline for implementation is notably short, with new rules for a lower Risk Margin potentially in place by the end of 2023 and further updates, including a more flexible Matching Adjustment, anticipated by the end of 2024.

Changes to major elements of the rules – focused on how far to ease capital requirements – are already due to come into effect this year and in 2024, following protracted negotiations between the Bank and the finance ministry.

The proposed reform aligns with a relaxation of requirements for UK PRT and annuity writers. The UK Treasury’s draft rules, issued in June 2023, define a new Risk Margin calculation that aims to reduce the Risk Margin by around 65% for UK life insurers and 30% for UK general insurers.

The Bank set out on additional changes that it said were designed to further streamline reporting by insurers to regulators, and removing smaller insurers from the scope of the rules.

These measures will reduce bureaucracy, facilitate competition, and support UK economic growth and competitiveness without lowering prudential standards or weakening policyholder protection

Sam Woods, chief executive of the BoE’s Prudential Regulation Authority arm

The latest reforms also introduce a “mobilisation” regime to allow newly authorised insurers more flexibility as they set up in Britain, the BoE said, in a bid to increase its attractiveness as a global financial centre and helping to increase competition.

Risk Margin reduction and tapering mechanism

The introduction of a tapering mechanism is expected to lessen interest rate sensitivity, a significant concern for life insurers. The Risk Margin reduction is particularly significant for capital-intensive long-term business like annuities.

J.P. Morgan anticipates that the Solvency II ratios for insurers will see improvements in the mid single digits due to these changes.

The burden of new business strain on PRT and annuities could be reduced by up to approximately 20%, enhancing the attractiveness of these sectors.

The reforms will expand the range of assets that UK life insurers can prudently invest in, as the proposed Matching Adjustment rules are set to allow a broader scope of illiquid assets to back annuity liabilities.

S&P Global Ratings suggest that the government’s announcement of its proposed change to Solvency II is likely to be neutral for the creditworthiness of rated insurers in the UK as it expects them to broadly maintain their capital positions.

The proposed 65% reduction in the size of risk margins will materially improve the solvency ratios of UK life players, especially those with significant long-term exposure.

S&P suggests that the government’s decision to keep its existing approach to fundamental credit spreads instead of its original proposal will provide some stability for UK life insurers’ capitalisations and business positions, notably for annuity writers that may have been the most negatively affected by the original proposal.

Importantly, the EU’s intention to review Solvency II doesn’t undermine the significance of the UK’s reform efforts.

UK Government Measures

The EU’s Solvency II regime came into force in the UK on 1 January 2016, following many years of development in which the UK was deeply involved. In June 2020, post-Brexit, the government announced a wide-ranging review of the Solvency II framework in the UK.

As part of the sweeping changes which have been proposed as a result of that review, the UK government in June 2023 released draft statutory instruments that will require the PRA to:

- Reduce the required “risk margin” (an additional reserve required to be maintained by an insurer above its best estimate of liabilities (BEL)) and below its solvency capital requirement (SCR), reducing the risk margin by around 65% for long-term life business and 30% for non-life business, and enabling a modified cost-of-capital approach to its calculation.

- Liberalise rules around the “matching adjustment” (MA) (a capital benefit to insurers that hold long-term assets that match the cash flows of similarly long-term insurance liabilities), in particular to:

- Adopt a margin (referred to as the “fundamental spread’) that is more sensitive and tailored to better measure credit risk.

- Liberalise MA eligibility criteria for assets and liabilities.

- Adopt a more proportionate approach to MA breaches by carriers, moving away from the current draconian consequences of breach.

Currently 24 life insurance firms benefit from transitional measures to assist with the move from Solvency I (the precursor regime) to Solvency II (the current regime). TMTP allows the Solvency II regime to be phased in on a straight line basis over a 16-year period for liabilities that were in force when Solvency II was introduced on 1 January 2016.

Britain’s reforms to Solvency II capital rules for insurers will unlock billions of pounds

These measures will be simplified with a view to a complete transition to Solvency UK by 2032. They will also benefit any firm that is granted TMTP permission in the future after accepting business that already benefits from TMTP (e.g., by portfolio transfer or 100% reinsurance transactions).

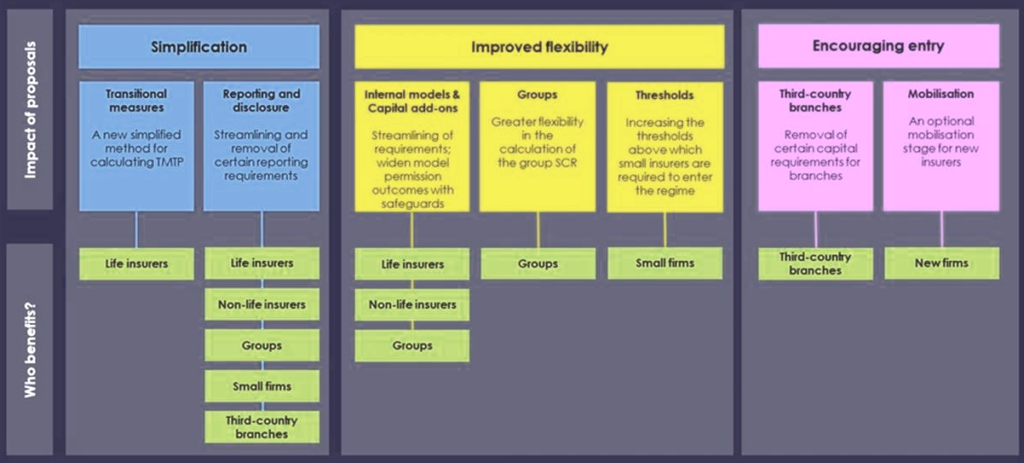

The Prudential Regulation Authority’s proposals and the key benefits

This consultation paper (CP) marks a significant milestone towards adapting the Solvency II framework to the UK insurance market. It sets out the Prudential Regulation Authority’s (PRA) proposals to deliver significant reforms for Solvency II, which the PRA considers will lead to a more competitive and dynamic insurance sector in the UK, while maintaining high standards of policyholder protection.

The proposed reforms to Solvency II included in this CP consist of the following:

- Simplifications and process improvements to the calculation of the transitional measure on technical provisions (TMTP) to reduce costs and complexity for firms, including the costs involved in retaining legacy Solvency I models, while ensuring firms plan effectively for the end of these transitional measures in 2032. These proposals would benefit the 24 life insurance firms that currently have TMTP approval and any firm that is granted TMTP permission in the future after accepting business that already benefits from TMTP.

- A new, streamlined set of rules for internal models (IM) where these are used by insurers to calculate their capital requirements, designed to maintain robust standards while reducing the number of prescriptive requirements firms have to meet under the current framework. Instead, the focus will be on the application of supervisory judgement on a smaller number of more principles-based requirements. For example, the PRA proposes to move to a much more principles-based approach to assessing modelling standards, allowing it to remove the majority of the detailed requirements that firms have previously had to meet in order to get IM approval, leading to greater flexibility for firms and a more dynamic approach to model permission and approval for firms and the PRA. Rather than having to reject IMs that have residual limitations, the PRA proposes two new safeguards to support granting of model permissions, where required, in order to maintain an appropriate level of prudential soundness: a residual capital add-on tool, and model use requirements. These proposals would benefit all insurers that already have IM approval from the PRA, and other insurers that may be considering applying for permission in future.

- Greater flexibility for insurance groups in the calculation of group solvency requirements to provide more flexibility in the development of group IMs and allow a better reflection of groups’ underlying risks. The PRA considers that these reforms will facilitate effective competition and increase the UK insurance sector’s competitiveness while maintaining high standards of policyholder protection, including by removing an inefficient temporary increase in cost when acquiring a subsidiary. These proposals could benefit any UK insurer for which the PRA is group supervisor.

- The removal of certain requirements for branches of international insurers operating in the UK, to facilitate entry/expansion and competition and the international competitiveness of the UK insurance sector. Given a branch cannot fail independently of its legal entity as a whole, the PRA judges that branch capital requirements and the risk margin for branches are not effective tools to support the safety and soundness of branches operating in the UK. The proposals would benefit the 130+ branches of international insurers that currently operate in the UK across a range of business models, including general insurance firms that operate in the wholesale London insurance market and reinsurance firms.

- The streamlining and removal of reporting requirements that the PRA considers are not needed for the UK insurance sector, to increase proportionality and reduce complexity. The proposals lead to an overall reduction in reporting requirements and cost savings for firms in the medium term, having taken into account implementation costs and some limited proposed new reporting. This builds on previous steps the PRA has already taken under its existing powers to reduce reporting requirements and get to a reporting package that ensures the PRA has the information it needs to supervise insurers operating in the UK, while lowering overall costs and reporting burdens on firms. These proposals would benefit all insurers to a certain extent, in particular the proposed deletion of the Regular Supervisory Report (RSR), with more significant reductions likely for insurance groups and UK branches of international insurers.

- A new ‘mobilisation’ regime to facilitate entry and expansion for new insurers and to facilitate competition, and the international competitiveness and growth of the UK insurance sector. Under the proposals, the PRA would offer new insurers the option of using a set period of extra time to build up systems and resources while operating with business restrictions and proportionate regulatory requirements. The proposals would enable the PRA to lower minimum capital requirements during mobilisation. These proposals could benefit firms who are contemplating applying for authorisation as an insurer in the UK now or in the future.

- An increase to the size thresholds at which small insurers are required to enter the Solvency II regime, to increase proportionality for smaller or newer insurance firms. This proposal would benefit small insurers that may be close to the current thresholds, either now or in the future.

Impact of the Solvency II proposals in consultation paper

The PRA’s reforms set out in this CP are intended to maintain a high level of prudential standards for the insurance sector, while improving the proportionality of a number of aspects of the current regime.

They are also intended to allow more scope for firms and the PRA to apply judgement to ensure appropriate prudential outcomes are achieved in a proportionate manner.

The PRA remains committed to the principles underlying the existing Solvency II regime, which have underpinned and well served the UK’s approach to insurance regulation since before that regime was developed within the EU.

These principles are also consistent with the developing international capital standards for insurers: regulating firms as going concerns; the use of market-adjusted valuation for insurance liabilities; robust standards for capital resources; a ‘1-in-200’ 1-year value at risk measure for capital requirements; and the application of judgement-based supervision.

The reforms represent priority areas where the PRA can use its new powers to tailor aspects of the regime to reflect the circumstances of the UK market where these were previously fixed in retained EU law.

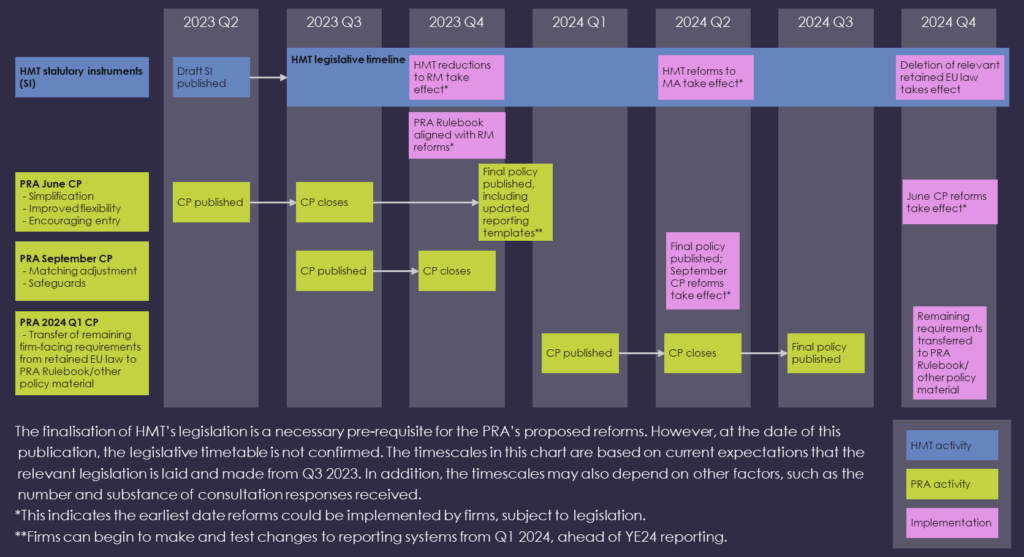

Timeline of the Solvency II reforms

Financial services regulators will generally take responsibility for setting the direct regulatory requirements that were previously contained within that retained EU law, acting within a framework set by government and Parliament.

This means that detailed regulatory requirements that currently sit within EU law, and can currently only be amended by primary or secondary legislation, can move into the regulators’ rules, in line with the UK’s model of operationally independent regulators and where they will be easier and less time-consuming to update.

Solvency II Reforms to the risk margin

The Government’s November 2022 reform package for Solvency II announced that it will legislate to reduce the risk margin, an important component of firms’ insurance liabilities, by around 65% for long-term life insurance business and 30% for non-life business, and to enable a modified cost of capital approach to its calculation.

To enable timely implementation of these changes, HMT has since confirmed its intention to effect them initially through transitional amendments to the existing onshored Commission Delegated Regulation (EU) 2015/35 (SII CDR).

To understand and prepare for these changes, firms should look to the provisions in HMT’s SIs for details of the revised formula and parameters, as well as the implementation timeline.

The PRA considers that implementation of the changes to the RM as set out by the Government is likely to be a material change to a firm’s risk profile such that firms should apply to recalculate TMTP, as per the expectations of the PRA’s Supervisory Statement 6/16.

The proposed amendments would also provide firms with legal certainty as to the interaction between HMT’s SIs and PRA rules. These proposed amendments are set out in Chapter 11 – Administrative amendments.

Cost benefit Solvency II Reforms analysis

In developing the proposals set out in this CP, the PRA has had regard to its objectives and a range of factors that contribute to the cost benefit analysis (CBA). The baseline for the CBA is the current Solvency II rules and legislation (unless stated otherwise). Each individual policy chapter contains analysis of the expected costs and benefits of the specific proposals.

Benefits

The proposals set out in this CP would lead to a reduction in both compliance costs to firms and supervision costs to the PRA, which is a benefit, through:

- offering firms greater flexibility to meet regulatory requirements (eg IM, groups);

- making regulatory requirements more appropriate for the risks posed to the PRA’s objectives (eg thresholds, mobilisation, branches);

- simplifying compliance with certain regulatory requirements (eg TMTP, reporting and disclosure, currency redenomination, IM).

In addition, the proposals could give rise to capital compliance benefits through:

- proposed removal of the FRR test for the TMTP calculation;

- allowing the group SCR calculation to recognise some of the diversification benefits between Method 2 entities.

As a result, the proposals could facilitate effective competition, international competitiveness, and growth through:

- reduced costs for insurers, together with increased flexibility, making it more attractive to locate or expand in the UK (IM, reporting, TMTP, groups);

- facilitating entry/expansion of new firms and branches (mobilisation, thresholds).

Cost

The proposals could give rise to some implementation compliance costs; however, the PRA expects that there would be an ongoing saving in costs in the longer term. In addition, in many cases (eg TMTP, thresholds, mobilisation), firms have the option to continue existing practices.

The PRA has also considered whether the use of residual model limitation capital add-ons (RML CAOs) would result in materially higher levels of capital requirements. This is not expected because the proposed reforms would not change the ‘1-in-200’ calibration standard for IM firms, but rather introduce flexibility for an IM firm to meet its requirement either directly with its model calibration, or to allow residual limitations to be addressed through the combination of model and RML CAO.

In summary, the proposals in this CP would continue to advance an appropriate level of protection for policyholders, and the safety and soundness of insurers, while facilitating effective competition, international competitiveness, and growth.

…………..

AUTHOR: Oleg Parashchak – Editor-in-Chief at Beinsure, CEO Finance Media Holding