The International Association of Insurance Supervisors published its Global Insurance Market Report, sharing the outcomes of this year’s Global Monitoring Exercise (GME), the IAIS’ risk assessment framework to monitor key risks and trends and detect the potential build-up of systemic risk in the global insurance sector. Beinsure Media selected the key points of the IAIS’ report.

The GME builds on data collected by year-end from approximately 60 of the largest international insurance groups and aggregate sector-wide data from supervisors across the globe, covering over 90% of global written premiums.

GME data indicates that global insurance sector capital adequacy remains sound but has slightly declined at year-end, primarily due to financial market developments such as lower asset valuations

Shigeru Ariizumi, IAIS Executive Committee Chair

The aggregate systemic risk footprint of the insurance sector decreased. Key drivers for the decline in system risk scores of the insurance sector are lower exposures to short-term funding, liability liquidity, intra-financial assets and minimum guarantees on variable products.

According to Harvard insurance market research, 2023 has been shaped so far by geopolitical turbulence and climate-related events, but also economic resilience in the face of persistent inflation. Humanitarian concerns are at the forefront of global priorities for society at large, but lingering concerns about financial solvency following failures in the banking sector continue for many business leaders.

A cross-sectoral comparison of insurance systemic risk scores with the banking sector shows that systemic risk stemming from insurers remains significantly below that of banks.

A complex macro environment shaped insurer confidence and strategies. Economic resilience, gradual improvements in global supply chains, and a global construction boom served to bolster insurer confidence, while geopolitical instability, persistent social and economic inflation, and climate-related concerns created uncertainty and conservatism.

The assessment of climate-related risks in the insurance sector shows that insurers globally maintained significant exposure to climate-related assets, with insurers continuing to allocate substantial portions of their investment portfolios to climate-relevant sectors, exposing themselves to transition risk.

One of the main physical risks of climate change for insurers is the expected increase in claims related to NatCat events.

An increase in extreme NatCat events may impact insurers’ profitability, challenge their capital management and may disrupt reinsurance markets.

In-depth analysis was performed on two macroprudential themes, which will also be the focus of ongoing work:

- Interest rate, liquidity and credit risks in a challenging macroeconomic environment; and

- Structural shifts in the life insurance sector, including greater allocation of capital to alternative assets and increased reliance on cross-border asset-intensive reinsurance.

IAIS collected data on the global reinsurance market through annual Global Reinsurance Market Survey covered Top reinsurers based in 9 jurisdictions: Bermuda, France, Germany, Japan, Luxembourg, Spain, Switzerland, the UK and the US. The participating reinsurers remained largely consistent throughout those years.

While rising interest rates positively affected insurers’ aggregate solvency positions, they may result in unforeseen cash outflows, such as margin calls on derivatives or policy surrenders

Jonathan Dixon, IAIS Secretary General

In the evolving digital landscape, lapse risk dynamics may have shifted. Factors such as social media can influence policyholder behaviour and the speed at which collective action is initiated.

As a result, supervisors are intensifying their monitoring efforts, employing more frequent offsite and onsite supervision.

This includes sensitivity analysis and liquidity risk stress testing. Increasing credit risk is also top of mind for supervisors, as are commercial real estate exposures and the insurance sector’s interconnectedness with banks.

The increasing use of cross-border asset-intensive reinsurance transactions has raised questions about the extent to which regulatory differences in valuation, reserving and capital requirements across jurisdictions drive this trend.

Supervisory focus on these reinsurance transactions also aims to provide clarity on who retains asset ownership (cedent or reinsurer), who manages the assets and which jurisdiction has supervisory authority over these assets.

Risk factors affecting future insurance sector solvency and profitability include sustained high levels of inflation, lapses, significant unrealised loss positions and the possibility of a reduction in demand for insurance due to strains on the purchasing power of households.

Geopolitical tensions continue to negatively influence the outlook. The IAIS will continue to actively monitor the global insurance market and refine its systemic risk assessment, including through the development of additional indicators in 2024.

Global insurance market developments

Assets and liabilities

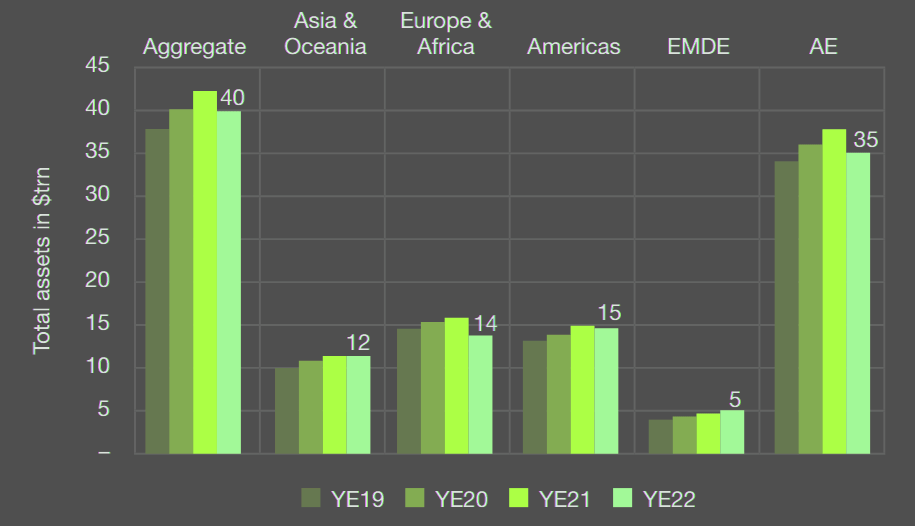

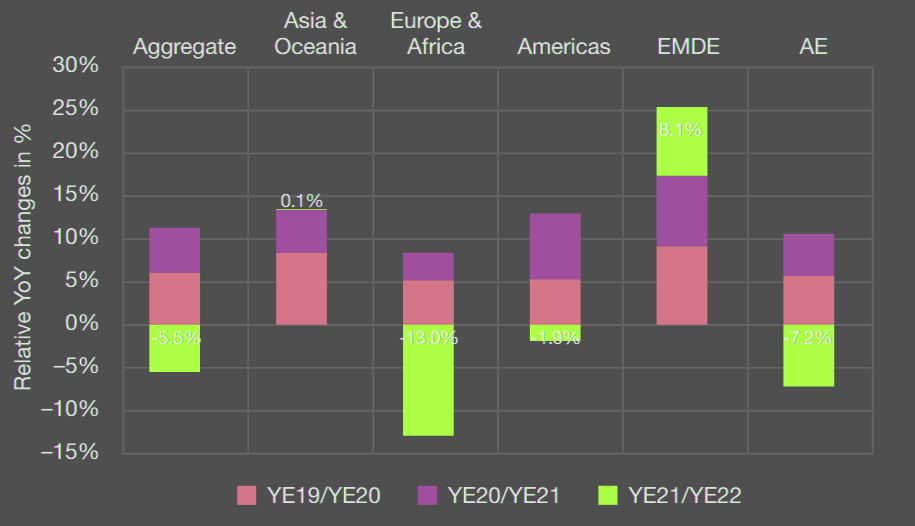

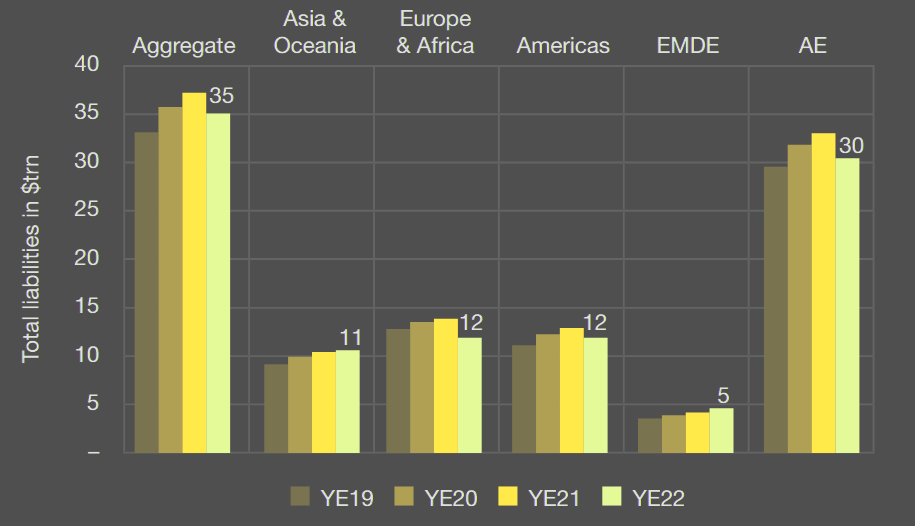

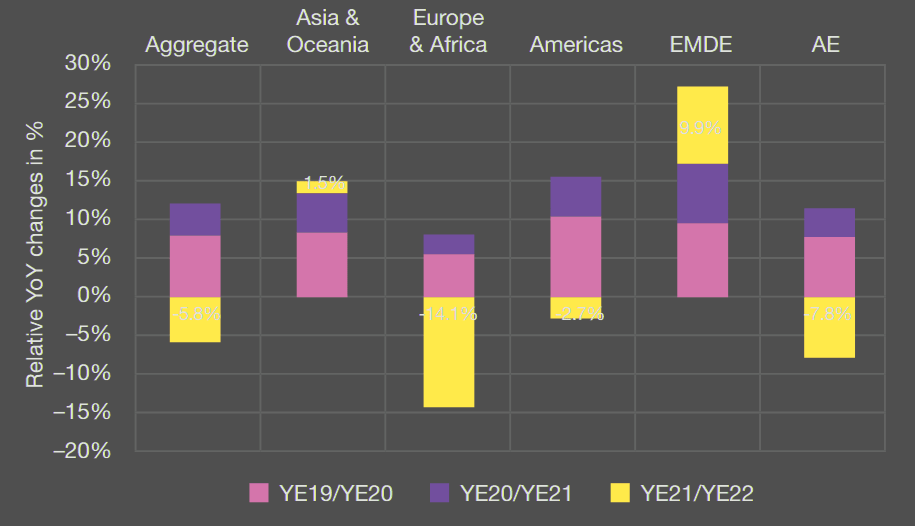

Total assets as reported in the SWM declined by 5.5% to $40 trillion and total liabilities declined by 5.8% to $35 trillion. Key drivers behind the decline in total assets are declines in equity prices and widened credit spreads on corporate and sovereign debt. Declines in liabilities were mainly driven by increased interest rates.

Comparing developments in emerging markets and developing economies (EMDEs) to advanced economies (AE), EMDEs have seen several consecutive years of growth in total assets, including from year-end 2022 to year-end 2023 (+8.1%).

In contrast, AEs have seen a decline in the last year (–7.2%) after two consecutive years of growth. A similar trend is observed for total liabilities.

Total insurers assets

Total insurers assets changes

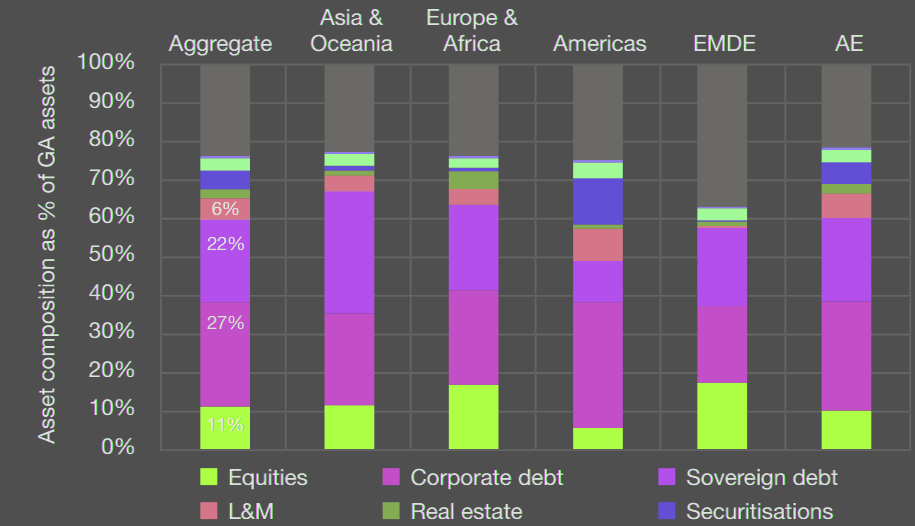

The insurers’ assets are still mostly composed of fixed-income investments, notably corporate debt (27% of total general account, or GA, assets), sovereign debt (22%) and loans and mortgages (L&M) (6%). The second largest asset class is equities (11%).

Total insurers liabilities

Total insurers liabilities changes

On aggregate, liabilities were mostly composed of gross technical provisions for life insurance (54%), gross technical provisions for non-life insurance (13%) and gross technical provisions for unit-linked insurance (9%).

The overall amount of borrowing remained limited at 3%, showing no change compared with the previous year.

Asset composition as % of GA assets

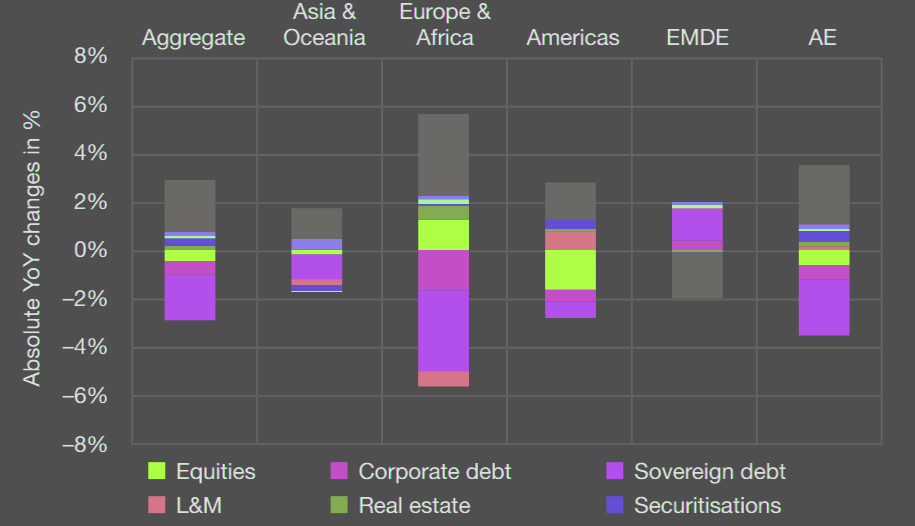

Asset composition as % of GA assets abs. changes

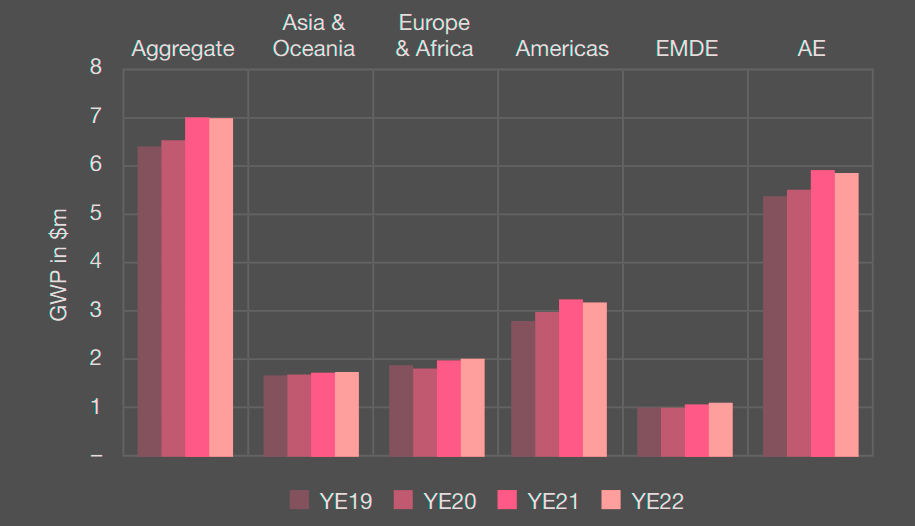

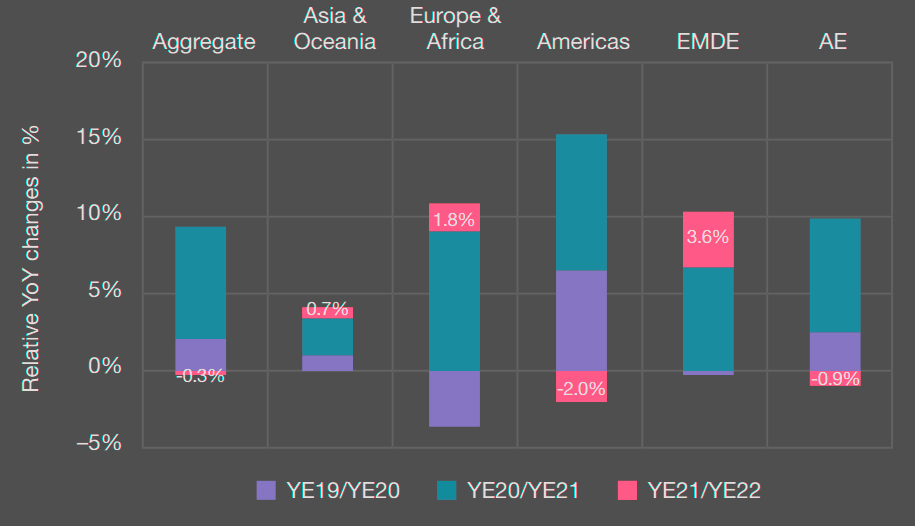

Gross written premiums (GWP) covered by the SWM decreased by 0.3% at 2023 compared to year-end 2021, which is a significant change from the 7.2% increase observed from year-end 2020 to year-end 2021.

Gross written premiums

Gross written premiums changes in %

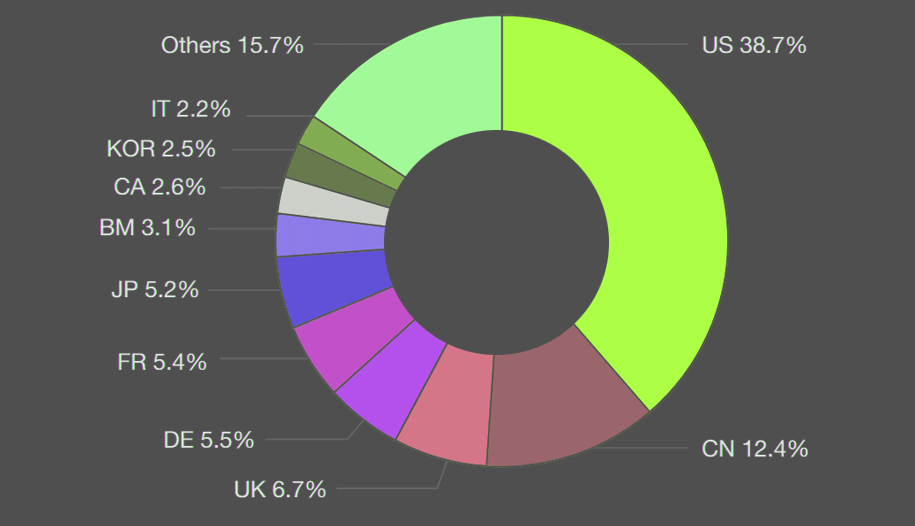

In terms of geographic distribution of GWP, according to the SWM data, most premiums were underwritten in the United States of America (US) (38.7%), followed by China (CN) (12.4%), the United Kingdom (UK) (6.7%), Germany (DE) (5.5%), France (FR) (5.4%) and Japan (JP) (5.2%).

Share of Global Gross written premiums

Solvency Developments

Jurisdictional solvency ratios decreased slightly in 2023 in all regions except Europe and Africa where a slight increase was observed.

The most significant decreases were observed in Asia and Oceania and in EMDE jurisdictions.

The key drivers of these declines were lower asset valuations – including declines in equities – widened credit spreads on corporate and sovereign debt, higher volatility of interest rates and weaker currencies in some jurisdictions.

These declines were partially offset by increases in interest rates at year-end 2023 compared to year-end 2022, which reduced the aggregate value of liabilities.

At the global level, the excess of assets over liabilities reported in the SWM slightly increased on aggregate (by 1.5%). Supervisors noted that this increase was mostly driven by the life insurance business, where liabilities were positively affected by the rise in interest rates. Discounting future cashflows at higher interest rates resulted in lower liability values.

Measures taken by supervisors

Supervisors continued to closely monitor insurers’ solvency ratios. Many supervisors conducted stress-testing exercises. In addition, some supervisors completed in-depth analyses of and closely monitored the methodologies to calculate technical provisions in order to ensure that the methodologies adequately reflect changes in the economic environment, in particular those relating to inflation. Some supervisors also reported closely monitoring dividend distributions.

In several jurisdictions, supervisors reported a change to their solvency regime or that such a change is planned for the near future. Depending on the jurisdiction, transitional measures were also put in place.

In addition, the introduction of International Financial Reporting Standards (IFRS) 9 and IFRS 17 has impacted solvency calculations in several jurisdictions.

Looking ahead, most supervisors expect a stable or slightly negative outlook for the solvency position of insurers in their jurisdictions, particularly in light of uncertainties in the economic environment.

The effects of the Covid-19 pandemic are largely considered to have been overcome, however geopolitical tensions, including the war in Ukraine, and the overall volatility of financial markets continue to negatively influence supervisors’ outlook for the insurance sector.

Second-round effects from higher interest rates in many jurisdictions are also being closely monitored.

Supervisors noted concerns that a possible decline in real estate markets would negatively affect insurers’ assets. Key risks for non-life insurance relate to the inflationary environment, while lapses and surrenders resulting from higher interest rates and a rise in the cost of living could negatively affect life insurers.

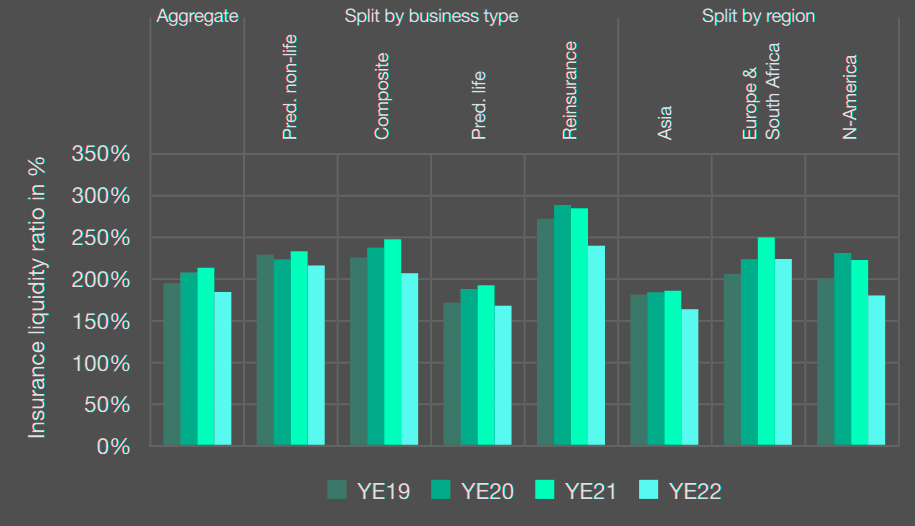

Insurance Liquidity

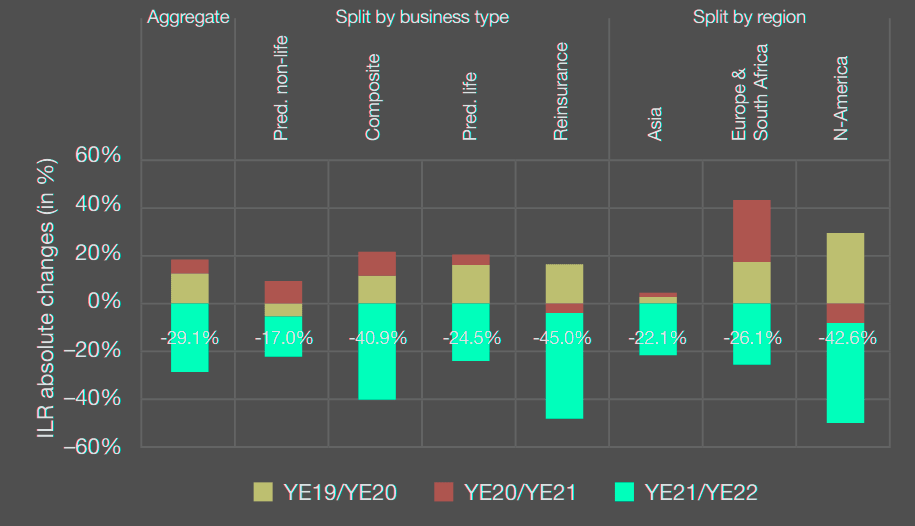

On aggregate, the insurance liquidity ratio (ILR) has decreased, while remaining well above 100%. Key liquidity sources are liquid investments such as highly-rated sovereign and non-financial corporate debt, as well as premium income.

Key liquidity needs mainly consist of surrender values. Supervisors reported that, on aggregate, insurers hold large amounts of highly liquid assets to be prepared for potential liquidity needs, for instance stemming from policy surrenders or margin calls on derivative exposures.

The SWM results indicate an increase in the cash held by insurers in most jurisdictions. By increasing cash positions, insurers build buffers against potential increases in liquidity needs and also shorten their asset duration, thereby reducing their exposure to potential further rises in interest rates.

Insurance liquidity ratio

Insurance liquidity ratio abs. changes

Several supervisors reported that insurers in their jurisdictions had strengthened their liquidity positions in order to cope with potential increases in surrenders. Some supervisors also reported an increase in observed liquidity needs relating to margin calls on derivatives.

Supervisors anticipate that liquidity positions may be considerably impacted by the overall macroeconomic environment and developments in financial markets.

Persistently high interest rates in many markets are expected to continue to affect surrender risk. Continued geopolitical uncertainty could contribute to further market volatility, which could result in margin or collateral calls. Looking ahead, supervisors expect to continue to closely monitor insurers’ liquidity needs and resources.

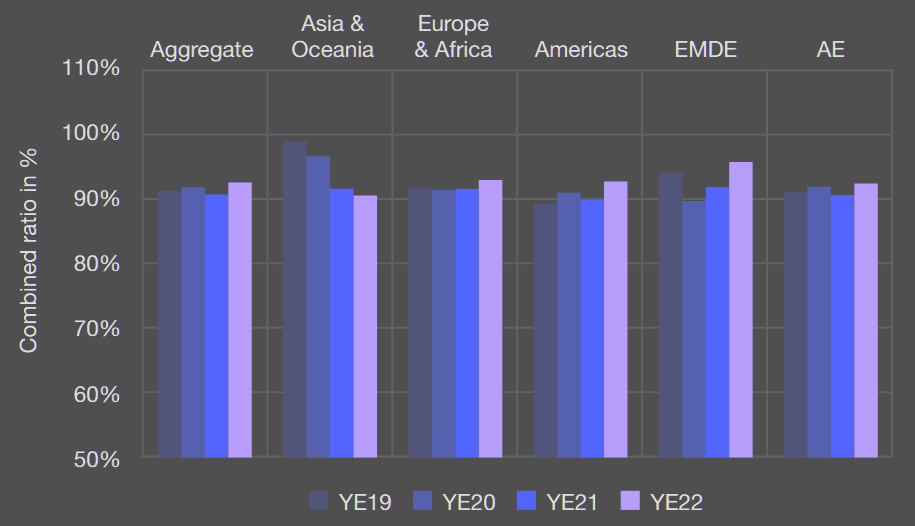

Insurance Profitability

Supervisors reported heterogeneous developments in terms of profitability in 2023. For non-life activities, profitability was negatively impacted by extreme weather events, inflation and the rise in energy prices.

Prices in the reinsurance market rose, weighing further on non-life insurers’ profitability. These developments were partially offset by increases in premiums.

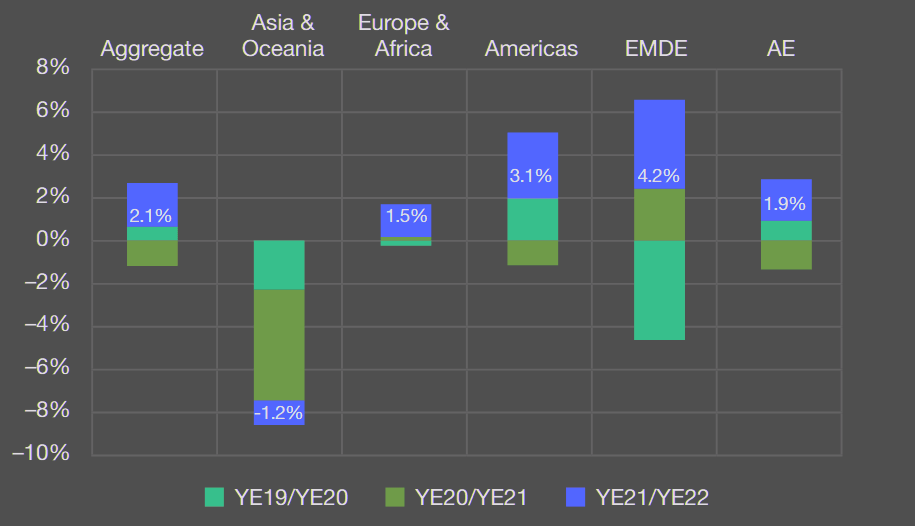

On aggregate, combined ratios increased by 2.1%. An increase in the combined ratio was observed in most regions, except in Asia and Oceania.

Combined ratio

Combined ratio changes in %

Life insurers’ profitability was impacted by changes in interest rates. The return on assets (ROA), excluding unrealised losses, has remained generally stable. If unrealised losses were included, a strong decline in asset returns would be observed. In EMDE markets, the ROA has declined in recent years.

Several supervisors conducted stress-testing exercises and collected additional data to strengthen their monitoring of the profitability of insurers. In addition, some supervisors issued guidance to insurers recommending that they bolster their capital position by moderating dividend payments.

Most supervisors underscored the high degree of uncertainty with respect to future profitability developments in the current economic environment, which is characterised by increased volatility.

Some supervisors, however, note improvements in profitability positions due to higher premiums. The higher interest rate environment is also expected to improve asset returns in the coming years, following years of low, or even negative, interest rates in many jurisdictions.

On the other hand, supervisors identified inflation, potential lapses, significant unrealised loss positions and surrenders and lower demand for insurance due to strains on the purchasing power of households as risk factors for future profitability.

Some supervisors also mentioned the entry into force of IFRS 17 as a potential source of change in profitability for insurers.

……………….

AUTHORS: Shigeru Ariizumi – Chair, IAIS Executive Committee, Vice Minister for International Affairs, Financial Services Agency of Japan, Jonathan Dixon – IAIS Secretary General

Edited by Oleg Parashchak – CEO Finance Media, Editor-in-Chief Beinsure Media