Climate change is an overarching global threat and a source of financial risk. In a recent report, the United Nations (UN) World Meteorological Organization stated that greenhouse gas concentrations continue to rise and fossil fuel emissions are now above pre-pandemic levels.

According to IAIS, the UN report also stressed that mitigation pledges are insufficient to achieve the Paris Agreement and that global warming during the 21st century is estimated at 2.8°C, assuming a continuation of current policies, or 2.5°C even if new or updated pledges are fully implemented.

Enhanced action is needed to prevent the continued warming that is increasing the likelihood of irreversible changes to the climate system.

The UN Environment Programme Emissions Gap Report states that in order to limit global warming to 1.5°C, current greenhouse gas emissions will need to be cut by 45% by 2030.

However, the near-term supply-side energy shortage is causing many countries to continue with or revert to fossil fuel sources, thereby making it more challenging to meet net zero targets.

The IAIS contributes to enhancing this understanding through an annual data collection exercise and analysis, among other actions.

Climate data elements are now a regular feature of the GME, providing a global baseline of climate risk data for the insurance sector. This year, data was collected from individual insurers, as a complement to the sector-wide data provided by supervisors.

A total of 41 jurisdictions, representing about 93% of the global insurance market, provided climate data in the SWM 2023. Thirty-eight jurisdictions also shared asset splits for equities, corporate bonds, and loans and mortgages.

A majority of insurers participating in the IIM 2023 also provided data related to the monitoring of climate-related risks. Individual insurers provided sectoral splits for equities, corporate debt instruments and premiums, NatCat losses and qualitative assessment of the climate-related risks and the initiatives taken to address these risks.

The UN report also states that climate science is increasingly able to show that many extreme weather events have become more likely and more intense due to human-induced climate change (see Cyber Risks, Climate Change & ESG – Main Challenges for Insurance).

These developments may lead to delayed and divergent transitions across jurisdictions. This in turn may have considerable impacts on the insurance industry by increasing physical, transition, liability and reputational risks as well as widening the protection gap.

It is critical for insurance supervisors to strengthen their understanding of the type and magnitude of climate-related exposures of the insurance industry, in order to effectively identify, monitor and reflect climate change risks in their supervisory responsibilities.

This chapter aims to support these efforts by providing a follow-up to the Climate GIMAR published last year.

Climate-related risks to insurers’ investments

It is critical for insurance supervisors to strengthen their understanding of the type and magnitude of climate-related exposures in the insurance industry in order to inform effective supervisory responses.

Data collection, improvements and limitations

The analysis on assets focuses solely on the insurance sector investments in the general account (GA); unit-linked products or separate accounts were excluded from this analysis as their risks are borne by policyholders.

Data quality and completeness have improved relative to the TCDC:

- Several jurisdictions were able to improve their data collection response to better capture climate-related data (eg Belgium, Canada, Switzerland and the UK). The enhancements were related to either improved granularity of climate-related data or to an increased scope of their jurisdictional climate submissions (eg by moving from a sample approach covering only a few large insurers to a population approach capturing the entire insurance market). Other jurisdictions announced plans to improve their supervisory reporting frameworks with regard to climate data in the near future.

- In this year’s SWM, the IAIS also collected additional and new data on various asset classes (eg on reinsurance recoverables, reinsurance assets or deferred tax assets), allowing for a more precise estimate of assets that are “climate relevant” versus other assets. In total, the collected asset classes cover approximately 80% of all insurance sector GA assets.

The main asset classes held in insurers’ balance sheets were equities, corporate debt, sovereign debt, and loan and mortgages. Therefore, the climate risk analysis in this chapter focuses on those asset classes.

The improvement in climate-related data collection this year compared to last year is noteworthy, and the additional contributions and effort put in by relevant jurisdictions are welcome.

The IAIS also monitored changes in asset allocation since the TCDC. These changes were rather limited, affecting less than 5% of total assets globally in the last two years. The majority of changes were caused by enhanced granularity of the IAIS data template and the above-mentioned introduction of new asset classes.33 This complicates the comparison of changes from year-end 2019 to year-end 2021 data.

Despite the improvements in data coverage and quality, the quantitative analysis presented in this chapter should be interpreted with some caution, given the best effort nature of the data collection and the fact that the climate data collection was conducted only for the second time.

The climate data collection will be continually refined over time. In addition, the quantitative analysis provides only a partial and indicative insight into the climate-related risks that the insurance sector faces.

It is partial as it focuses only on investments and does not examine the quantitative impact on liabilities (underwriting), which is expected to be significant, especially for the non-life insurance sector. It is indicative given the limitations on data availability, the top-down nature of the analysis and the relative infancy of available analytical tools.

Quantitative findings on climate-related exposures

One of the main objectives of this chapter is to provide an update on the proportions of different types of climate-related assets held by the insurance sector.

The exposures presented in this section are based on the SWM 2023 data described above, complemented when necessary by other data and/ or assumptions, as specified in the corresponding subsections (eg various climate-related indices used in the analysis).

Asset composition based on climate sensitivity

The analysis performed is aligned with the approach and methodologies undertaken for the 2023 Climate GIMAR to ensure consistency.

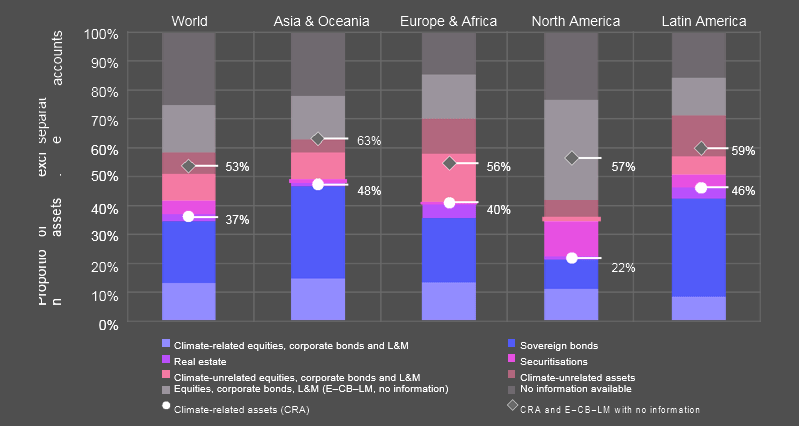

The asset mix of climate-related and climate-unrelated assets for the full data sample, consisting of 44 jurisdictions that provided at least some quantitative climate information to the IAIS.

The overall mix by asset class is complemented by a split of equity, corporate bonds, and L&M in climate-related sectors, providing a comprehensive overview of the asset mix by region with emphasis on their relationship to climate change (see TOP 25 Largest Insurance Companies in the World by Assets). The approach used to consider the relevance of climate change to different asse

The assets may be divided into three broad categories:

- Climate-related assets including sovereign debt instruments, real estate and equities, corporate debt instruments, and L&M belonging to six climate-related sectors: agriculture, energy-intensive, fossil fuel, housing, transport and utilities (labelled with variants of red);

- Climate-unrelated assets including reinsurance recoverables, reinsurance assets, cash and cash equivalents, deferred acquisition costs and equities, corporate debt instruments, and L&M not belonging to the six climate-related sectors (labelled with variants of green);

- Assets without any information regarding their allocation or sectoral split – this category includes equities, corporate debt instruments, and loans and mortgages without any information about their sector, as well as securitisations and assets without information about their asset class (labelled with variants of grey and orange).

The shares of climate-related assets (approximately 33% to 40% of all GA total assets) are comparable in Asia and Oceania, Europe and Africa, and Latin America.

North America reported lower holdings of climate-related assets (around 21%), but this may be driven by the fact that there is no information about climate relevance for a little over half of the assets in this region.

In comparison with the Climate GIMAR, material decreases were found in the shares of climate-related assets. These decreases were driven mainly by improved granularity of reported asset splits and sample changes.

Equity, corporate bonds, loans and mortgages

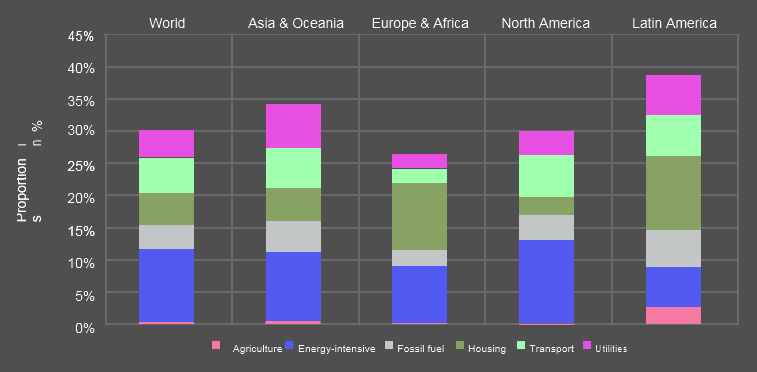

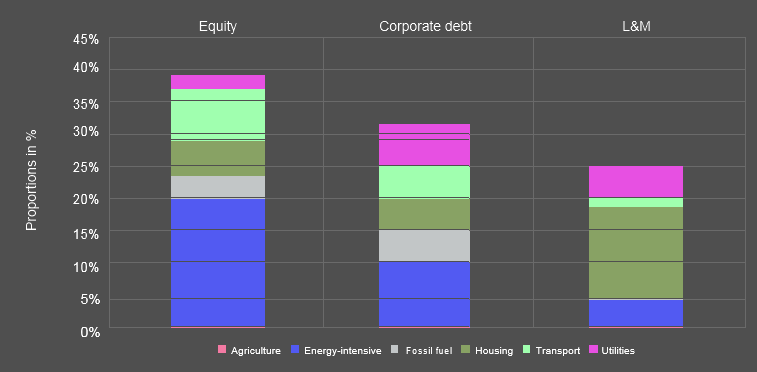

For equities, corporate bonds, and L&M, the choice of climate-related sectors is based on Climate Policy Relevant Sectors (CPRS), a classification of economic activities to assess transition risk, which was developed by Battiston et al. (2017) and refined over the years. The CPRS classification was also used in the 2021 Climate GIMAR.

It provides a standardised and actionable classification of activities for which revenues could be negatively affected in a disorderly low-carbon transition scenario.

One weakness of the CPRS classification is that the climate-related utility sector includes all electricity-generation activities, regardless of the energy source used.

This lack of granularity means that renewable-energy assets are unfairly considered as being climate-related. In line with the Climate GIMAR, a haircut was therefore applied to all amounts reported in the utility sector on a jurisdictional basis.

The size of the haircut was determined by the proportion of renewable power generation in the region of each jurisdiction, as published in the International Renewable Energy Agency regional factsheets.

Another limitation of the data is with respect to the treatment of exposure to the financial sector. Financial sector assets, which for some jurisdictions represent a relatively high proportion of their total reported assets, include participations in other insurers’ or banks’ equity (which may be part of the same group) and holdings of investment funds, which are not looked through.

In practice, indirect exposure to climate-related risks through the financial sector may vary considerably depending on the counterparty type (such as bank, insurer or asset manager), its direct exposure to climate risk, and its financial and operational leverage that may amplify any climate-related impact.

Since the financial sector has not been explicitly classified as climate-related, the absence of look-through of investment funds, as well as the participation in financial entities that are parts of the same group, may result in a significant underestimation of the actual proportion of climate-related assets.

Depending on the region, climate-related sectors represent between 26% (North America) and 43% (Asia) of these asset classes.

Proportions of equity, corporate bonds, loans and mortgages in climate-related sectors

Similar to last year’s analysis, the energy-intensive sector, which is quite broad and encompasses most of the manufacturing industry, remains globally dominant among climate-related equities, while the picture is more balanced for corporate bonds.

Climate-related L&M are primarily associated with the housing sector (due to high investments in mortgages in various jurisdictions).

Climate-related sector proportions are comparable for all three types of assets, ranging between 26% (for corporate bonds) to 52% (for L&M).

The remaining proportions either belong to climate-unrelated assets or no information is available for them. The sectoral charts include only countries that provided asset splits used in the climate analysis.

Equities, corporate bonds, loans and mortgages

In comparison to the Climate GIMAR, changes were identified in the shares of climate-related sectors in equities, corporate bonds, and L&M. These changes were driven mainly by improved granularity of reported asset splits and sample changes.

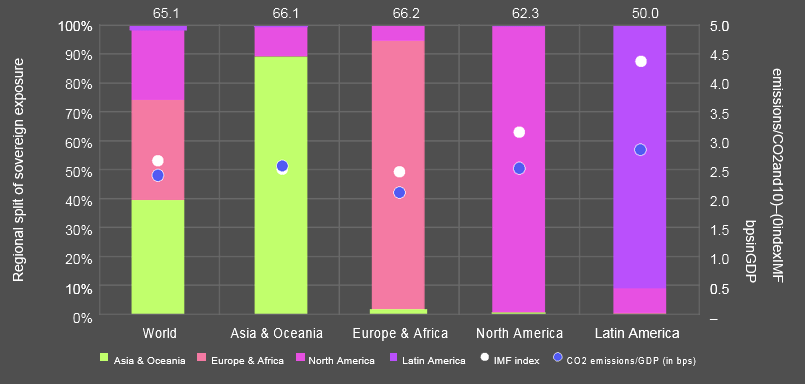

Sovereign bonds

Sovereign bonds are a significant asset class within the average insurance investment mix; however, there is not yet a universally accepted metric to assess climate-related risks for these bonds.

Similar to the Climate GIMAR, the IAIS used the Notre Dame Global Adaptation Initiative (ND-GAIN) Country Index to analyse the exposure of sovereign debt instruments to climate-related risks.

To examine the relative exposure, a “weighted ND-GAIN index” was calculated, reflecting the weighted average ND-GAIN Country Index of the sovereign bond portfolio of the insurance sector in a particular market, based on the top five largest sovereign counterparties where this information was available (values between 0 and 100, where higher score means lower risk).

For this year’s exercise, this was complemented with two additional metrics for illustrative purposes:

- IMF climate-driven INFORM Risk Index, which may give an indication of physical risk;

- Carbon dioxide (CO2) emissions standardised by gross domestic product (GDP), as reported by the Organisation for Economic Co-operation and Development (OECD), provide an indication of possible transition risk.

For both of these metrics, a higher score represents a higher risk. These new metrics were added to provide greater insights specific to physical risk and transition risk and to mitigate limitations of the ND-GAIN index (such as limited differentiation between physical and transition risks a

Sovereign debt holdings – weighted by various climate risk indices

The coloured bars show the distribution of the sovereign bond portfolio by geographic region. A majority of sovereign debt instruments are intra-regional investments.

The INFORM- and CO2-related indices are shown via dots (on the right-hand axis). None of these metrics is able to capture the true extent of climate-related risks in isolation; however, they provide a relative indication of the risks.

The IAIS will continue to refine these metrics. While the ND-GAIN index and INFORM Risk Index suggest that Latin America has higher physical risk relative to other regions (ie lower ND-GAIN score and higher IMF index), Latin America’s transition risk (measured by CO2 emissions/GDP) appears to be relatively comparable with other regions and the world.

Supervisory measures and impact assessment

Given the importance of risks related to climate change, the topic was included as an overarching theme in the GME this year. The aim was to discuss the views of supervisors on the impact of climate change on the insurance sector and on ensuing protection gaps, as well as the measures taken by supervisors to address these risks.

A majority of supervisors consider that the main impact of climate change has been on increasing NatCat claims. Going forward, supervisors expect the impact to increase and materially affect insurers’ assets, risk management considerations, new product development and pricing. They also expect a widening of the protection gap, as a knock-on effect of increasing NatCat claims.

Supervisors are continuing efforts to better assess the impact of climate change on insurers, while recognising the difficulty of performing a complete assessment.

In addition, supervisors are undertaking significant work to introduce climate change-related supervisory requirements; more than 80% of them have already taken some action. This includes wide ranging requirements for governance, risk management, disclosure and climate stress testing.

Some supervisors have considered more limited actions, typically focused on reporting and undertaking surveys to understand industry preparedness. Only 20% of respondents indicated that they have not undertaken any steps or are in the very early stages of developing their thinking in this area.

Many supervisors have observed that insurers are considering wide-ranging actions and incorporating climate change in various activities and functions, including in investments, underwriting/pricing, risk management, reporting and new product development.

In terms of how climate-related risks in the insurance sector can impact the broader financial system and economy, 60% of supervisors expect that the main impact will come through increased insurance premiums and reduced insurability.

In particular, this could lead to a systemic impact in the event of a major natural catastrophe, causing significant uninsured losses to corporates and real estate assets and resulting in losses to the financial assets associated with them.

In addition, there could be contagion to the banking sector, which will amplify financial stability concerns. Alongside reduced insurability, 40% of supervisors expect that the insurance sector could impact the financial system through its role as an investor. In particular, this could be triggered by a sell-off of high carbon assets by insurers, depressing the value of such assets (see 10 Most Important Global Business Risks for 2023).

At the same time, some supervisors recognise that insurers’ proactive role as an investor in net-zero aligned investments could help to reduce climate-related risks in the financial system.

Climate-related risks and insurance protection gaps

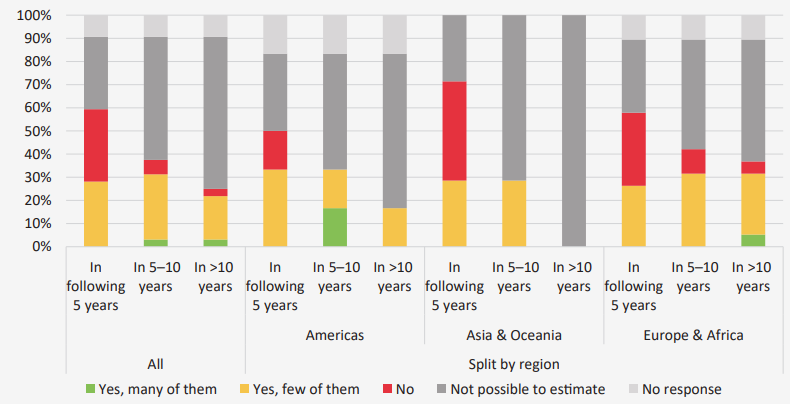

Climate-related risks could have a significant impact on the creation and/or widening of existing (insurance) protection gaps. Some jurisdictions indicated that insurance gaps are expected to widen (across all of the timeframes, but mostly within the next 10 years).

It should be noted though that many supervisors are not able to estimate the impact at this time and these assessments are mostly still under development. It was highlighted that the main concerns will probably be around affordability and awareness levels, rather than products not being available.

Gaps in protection against climate-related risks are in many cases significant and supervisors anticipate that they will continue to increase

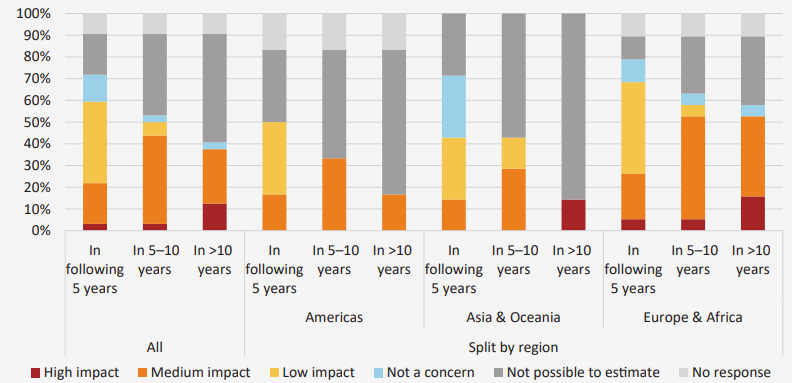

Fifty percent of supervisors indicated a medium to high impact on the pricing of insurance products. The increase in pricing will predominantly be driven by an increase in severity and frequency of natural disasters.

The strengthening of supervisory tools to assess and monitor the availability and affordability of insurance products could play a key role in addressing some of the insurance gap concerns. Supervisors indicated that public-private partnerships, public protection schemes and reinsurance pools could play an important role in finding solutions. However, these measures would have to be decided at the political level.

Widening of protection gaps

Many jurisdictions expect climate-related risks to impact the insurability of NatCat risk, especially in the longer term. For instance, at least half of the supervisors in the Europe and Africa region expect medium to high impact in the longer term.

However, especially for the longer term, a number of jurisdictions indicate it is not possible to make an estimate of the impact at this stage.

Impact of climate change and related risks on insurability of NatCat risk

Climate data elements have become a regular feature of the GME and provide a global baseline of climate risk data for the insurance sector. Similar to last year’s Climate GIMAR, the quantitative analysis this year focuses on the impact of climate change on the insurance sector’s investment portfolio. Given the improvements in the data collected, both in terms of coverage and quality, this year’s analysis provides a more accurate indication of the industry’s exposures to climate-related assets.

The analysis of the impact of climate change on insurer liabilities focused on the possibility of increasing protection gaps.

This year’s data collection from IAIS members continues to set the groundwork for enhanced data collection and analysis moving forward, which, in time, will be complemented by improved climate and sustainability data reporting and disclosures from financial institutions and real economy corporates and businesses.

The IAIS will continue to refine and explore how best to enrich both asset and liability data in order to enable further quantitative analysis on the impact of climate change on the resilience of the global insurance sector and to assess the impact on protection gaps.

The IAIS will continue to refine and explore how best to enrich both asset and liability data for climate risk analysis.

In particular, the IAIS will aim to further refine the liability-related climate data requirements to allow it to analyse quantitatively the impact of climate change on the liability side of insurers’ balance sheets.

………………

AUTHOR: Victoria Saporta – Chair of the Executive Committee of the International Association of Insurance Supervisors and Executive Director, Prudential Regulation Authority (PRA) and the Bank of England