Elevated levels of disruption look set to continue in 2023 and 2024 as dangers from digitalization, the war in Ukraine, high energy prices and inflation, geopolitical and economic uncertainty, and climate change test already strained business models and supply chains, according to the Allianz Risk Barometer.

The Allianz Risk Barometer incorporates the views of 2,712 respondents from 94 countries and territories. The annual corporate risk survey was conducted among Allianz customers (businesses around the globe), brokers and industry trade organizations. It also surveyed risk consultants, underwriters, senior managers, claims experts, as well as other risk management professionals in the corporate insurance segment of both AGCS and other Allianz entities (see Global Risk Management Survey).

The survey focused on large- and small- to mid-size companies. Respondents were asked to select the industry about which they were particularly knowledgeable and to name up to three risks they believed to be most important.

Most answers were for large-size companies (>$500mn annual revenue) [1,281 respondents, 47%]. Mid-size companies ($250mn to $500mn revenue) contributed 519 respondents (19%), while small-size enterprises (<$250mn revenue) produced 912 respondents (34%). Risk experts from 23 industry sectors were featured.

Global risks overview

Despite positive moves to diversify business models and supply chains since Covid-19, businesses continue to experience significant disruption around the world. The pandemic came as a massive shock to business models, creating global shortages, delays and higher prices, while the war in Ukraine triggered an energy crisis, particularly in Europe, turbocharging inflation (see How Insurance Companies Can Increase Inflation Resilience?).

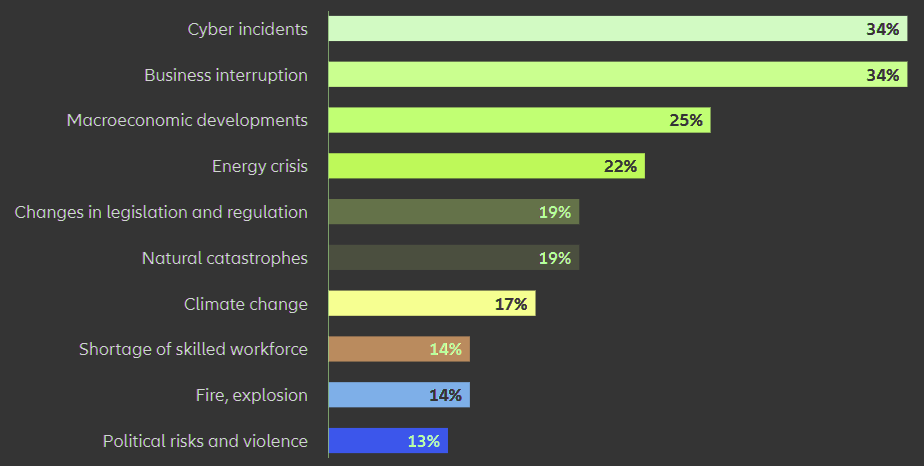

Unsurprisingly, given the current ‘permacrisis’, business interruption and supply chain disruption ranks as thesecond top risk in this year’s Allianz Risk Barometer (34%).

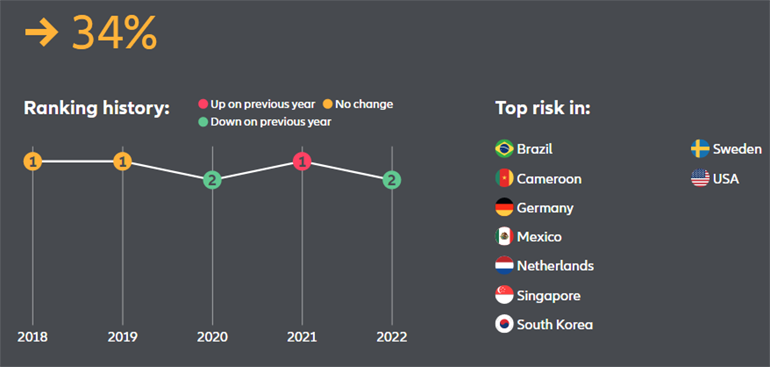

It is second only to cyber incidents (by just a few votes, also on 34%), whose top position reflects the importance of today’s digital economy, the evolving threat from ransomware and extortion, as well as geopolitical rivalries and conflicts increasingly being played out in cyber space.

TOP 10 major business risks for 2023

Indeed, the results show that a number of BI-related risks have climbed this year’s rankings as the new economic and political consequences of the world in the aftermath of Covid-19 and the Ukraine war take hold.

These include the impact of the energy crisis, a new entry in the 2023 survey at #4, while macroeconomic developments, such as inflation and potential recession, peaks at #3 – its highest position since the first Allianz Risk Barometer in 2012.

Cyber risk and business interruption (BI) are closely linked, with cyber also ranking as the cause of BI companies fear most.

Political risks and violence is another new entry in the top10 global risks at #10, shortage of skilled workforce rises to #8, while outside of the top 10, the prospect of critical infrastructure blackouts or failures (#12) is also of moreconcern to respondents than 12 months ago.

Conversely, pandemic outbreak plummets down the list of concerns(#4 in 2022 to #13 in 2023) as vaccines have brought an end to lockdowns and restrictions in most major markets. China sees pandemic risk rise year-on-year (from #9 to #3) – the only country in the survey to do so – following its recent easing of long-in-place restrictions.

Digital danger

Cyber incidents, such as IT outages, ransomware attacks or data breaches, ranks as the most important risk globally for the second year in succession – the first time this has occurred. A data breach is the exposure which concerns companies most – reports show that even the average cost from such incidents reached an all-time high in 2022 of $4.35mn and is expected to surpass $5mn in 2023 – followed by ransomware attacks and failure of digital supply chains or cloud service platforms.

Severe business interruption can result from a wide range of cyber-related triggers, including malicious attacks by criminals or nation state-backed hackers, human error or technical glitches.

Allianz claims analysis shows BI is the single biggest loss driver for cyber insurance claims. Hackers are increasingly targeting both digital and physical supply chains, which provide opportunities to simultaneously attack multiple companies and gain additional leverage for extortion, while one consequence of more large corporations investing in cyber security is that small- and mid-size businesses are increasingly targeted (see How Ransomware Attacks Impacts for Insurance & Businesses?).

It is clear that organizations with good cyber maturity are better equipped to deal with incidents. Frequency of IT security training, cyber incident response plans and cyber-security governance are among the areas where many companies can improve. Incident response is critical as the cost of a claim quickly escalates once BI kicks in.

Macroeconomic malaise

First came Covid-19, then the war in Ukraine. Aside from the human tragedy, the economic and financial market volatility that these major events have caused looks set to continue in 2023.

High inflation, and efforts by central banks to tame it, together with the energy crisis, have resulted in the cost-of-living soaring and the threat of recession.

All three major economic areas – the US, China and Europe – are in crisis at the same time, albeit for different reasons.

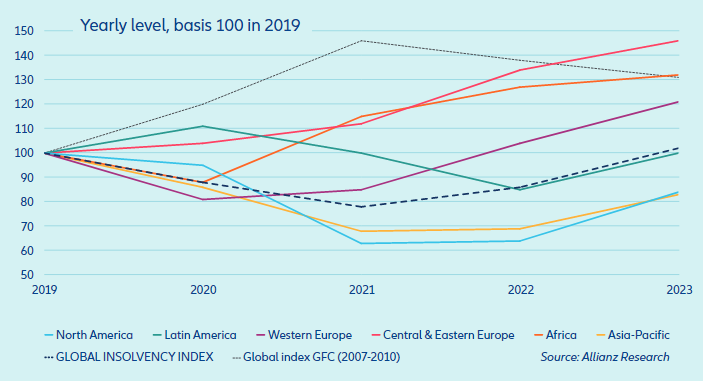

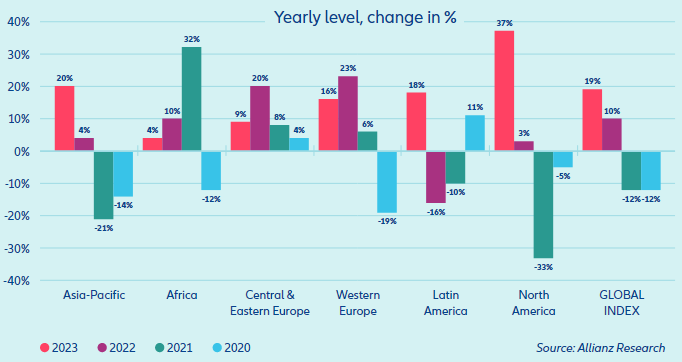

Such macroeconomic developments rank as the third top risk for companies in 2023 (25%), up from #10 in 2022. Inflation is a particular concern as higher costs can make certain business models uneconomic while it also has a direct relationship to the cost of BI. Recession is another likely source of disruption in 2023, bringing the potential for supplier failure and insolvency (a new entry in the top global risks at #17). Global business insolvencies are likely to rise by 10% in 2022 and 19% in 2023 as the cost of energy, rising interest rates and wages weigh heavily on profitability and cash flows.

Energy errors

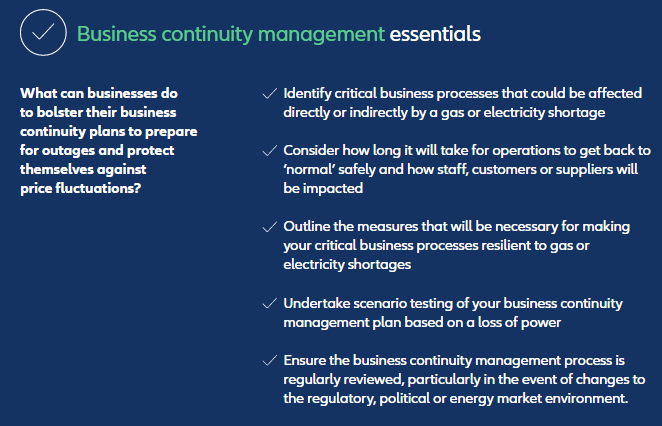

Given its potential to cause widespread disruption through supply shortages or outages and price fluctuations, the energy crisis (22%) is the biggest mover at #4, appearingin the Allianz Risk Barometer for the first time.

The skyrocketing cost of energy has forced some energy-intensive industries to use energy more efficiently, move production to alternative locations or even consider temporary shutdowns.

The resulting shortages threaten to cause supply disruption across a number of critical industries in Europe, including food, agriculture, chemicals, pharmaceuticals, construction and manufacturing. The results show that companies in Europe, which has been heavily dependent on Russian gas, are much more concerned about the impact of the crisis than elsewhere in the world, given its resulting shock to revenues and profitability.

ESG exposures and disclosures

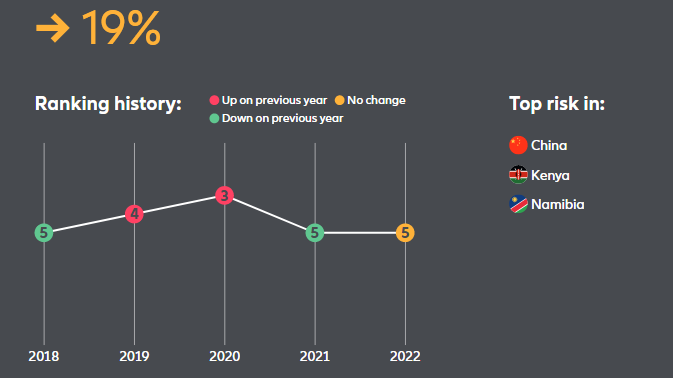

Changes in legislation and regulation (19%) is a perennialtop five peril – appearing three times at #5 in the past five years. The growing corporate reporting and compliance measures around sustainability and other environmental, social, and governance (ESG) issues are high on the risk register for companies in 2023.

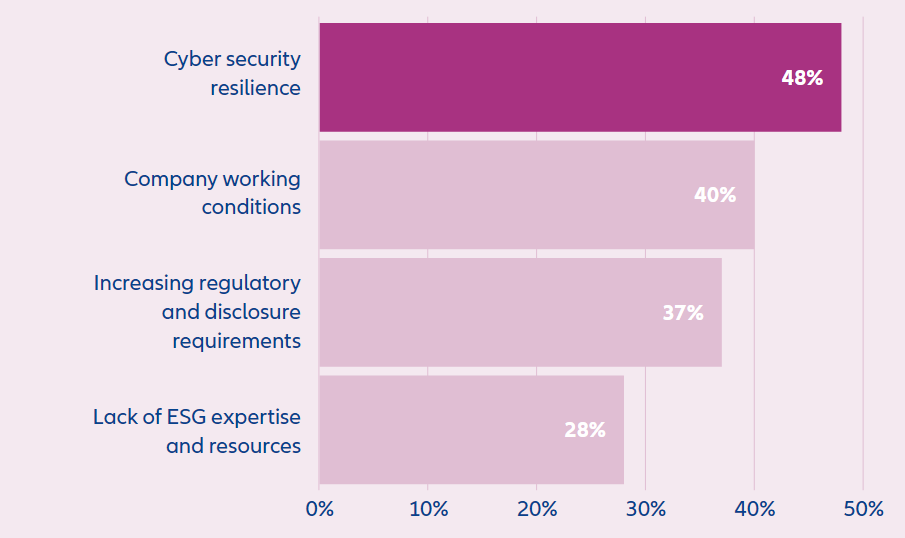

Cyber security resilience; company working conditions; and increasing regulatory and disclosure requirements rank as the top three ESG risk trends for the year ahead. However, a lack of consistent standards and reporting frameworks is hindering ESG knowledge gathering, as is a lack of in-house expertise (see Role of Insurance in ESG).

Changing climate for natural catastrophes

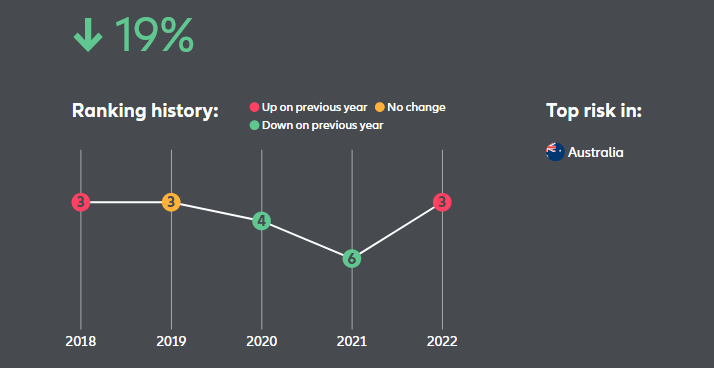

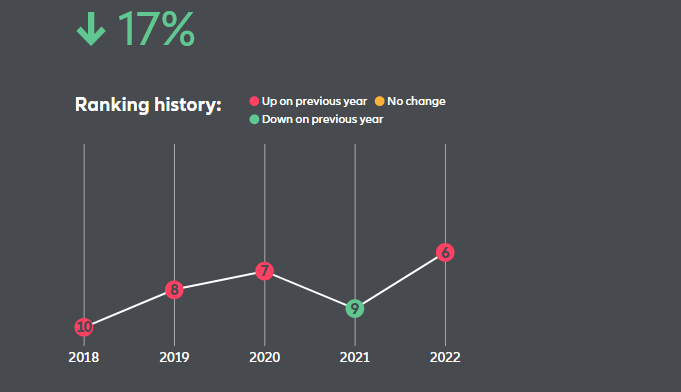

The fall of natural catastrophes (19%) and climate change (17%) to #6 and #7 respectively (down from #3 and #6 in 2022) is driven in part by the perception that, for many, there are more pressing developments to deal with on the risk landscape, such as economic and geopolitical uncertainty.

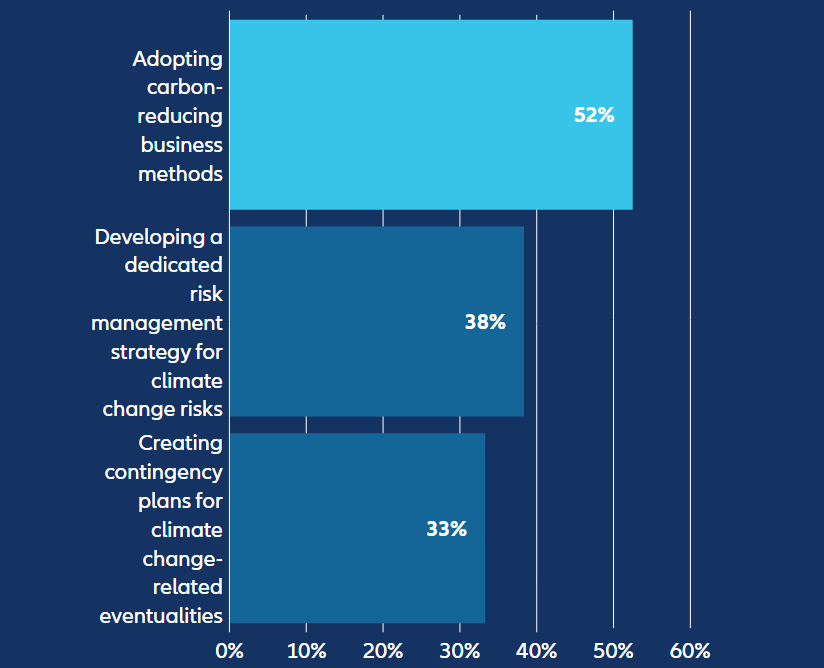

The top three actions firms are taking are: adopting carbon-reducing business models; developing a dedicated risk management strategy for climate risks; and creating contingency plans for climate change-related eventualities.

Certainly, events evidence no room for complacency. Hurricane Ian in the US, widespread flooding in South East Asia and Australia, winter storms in Europe and the US, severe heatwaves and droughts around the world, and even record-breaking hailstorms in France all contributed to another $100bn+ year of insured losses in 2022.

On a positive note the results also show that companies are still taking action against climate change and are continuing their net-zero transition journeys despite these challenges.

Talent travails and fire failures

Another consequence of the pandemic and rising wage inflation is a shortage of skilled workforce, which climbs one place year-on-year to #8 (14%). Some countries have experienced a reduction in the available workforce at a time of high demand for labor, as some older workers took early retirement.

And while the cost-of-living crisis may bring some of these people back into the workforce, at the end of 2022 there were almost two unfilled positions in the US for every job seeker, while another study in 2022 reported that 40% of workers globally said they might leave their jobs in the near future.

Fire and explosion ranks #9 overall (14%), falling from #7 in2022. Risks are often well understood and typically well risk managed.

However, BI and supply chain disruption from fires remains a significant hazard, especially where companies rely on third party suppliers for critical components. Claims analysis by Allianz shows that fire is the largest single cause of corporate insurance losses, accounting for 21% of the value of 500,000+ insurance industry claims over the past five years (equivalent to €18bn).

Political problems

Driven by 2022 being another year of turmoil with conflict and civil unrest dominating the news around the world, political risks and violence is a new entry in the top 10global risks at #10 (13%).

Given the Ukraine-Russia war alone fueled inflation, an energy crisis in Europe and threatened shortages and price volatility for key raw materials, it is unsurprising that war ranks as the top business exposure in this area according to respondents.

However, strikes, riots and civil commotion (SRCC) also score highly, representing the real risk these present to businesses. Recent years have shown the huge impact a coordinated violent SRCC event can have on an economy and politics, such as the Black Lives Matter protests in the US or the South Africa Zuma riots of 2021, while in 2023 the rising cost of living could also bring an increased risk of disruption from such events.

Developing de-risking actions

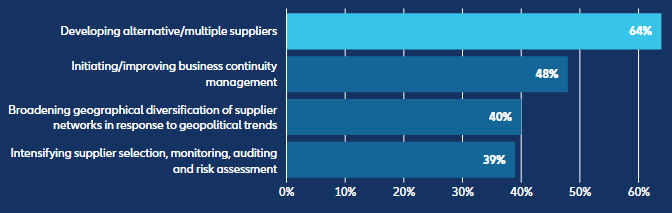

There is little doubt that recent disruptions have increased awareness around BI and supply chain risk and that companies and governments are taking action to build resilience and de-risk.

More time and money is being invested into looking into and documenting the supply chain strategies of businesses. Companies that have suffered disruption are now improving transparency and data on supply chain risks.

According to respondents, the most common action taken by companies to de-risk supply chains and make them more resilient is to develop alternative and/or multiple suppliers – although this can be a lengthy process and is not without its own pitfalls – while broadening geographical diversification of supplier networks in response to geopolitical trends is the third most common action.

The war in Ukraine has been an eye opener for many, demonstrating how a conflict can result in shortages and price increases for raw materials, raising awareness of the need to be more sophisticated in understanding which components and materials are critical, where they are sourced, as well as how to secure them.

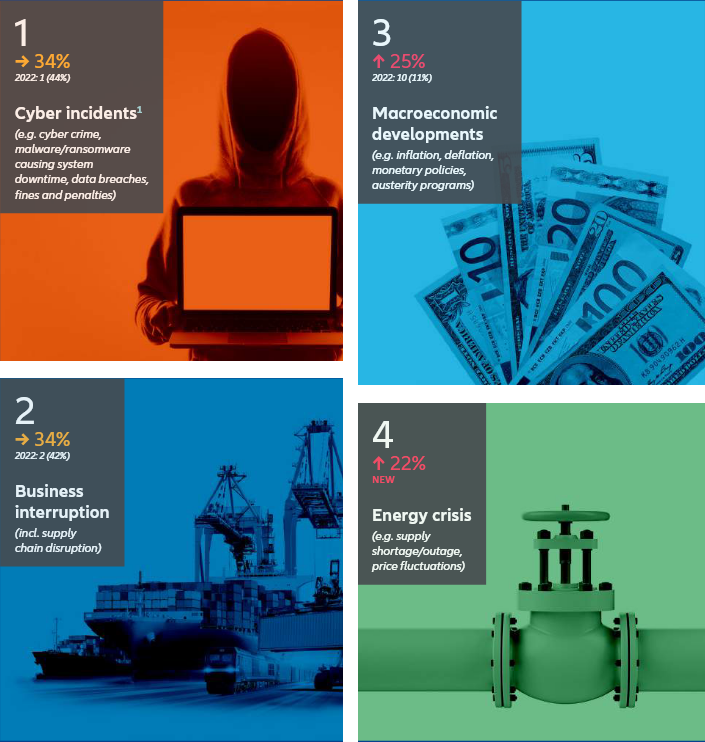

1. Cyber incidents

Cyber risks, such as IT outages, ransomware attacks or data breaches, rank as the most important risk globally (34% of responses) for the second year in succession – the first time this has occurred (see Cyber Insurance Trends in 2023).

Given cyber crime incidents are now estimated to cost the world economy in excess of $1trn a year1 – around 1% of global GDP – it perhaps should come as no surprise that cyber risk is the top customer concern in this year’s Allianz Risk Barometer, selected by more than a third of all respondents.

In addition to being voted the top risk globally, cyber incidents also ranks as the top peril in 19 different countries. It is the risk small companies are most concerned about, is the cause of business interruption companies fear most, while cyber security resilience ranks as the most concerning environmental, social, and governance (ESG) risk trend (see Top 20 Cybercrime Predictions).

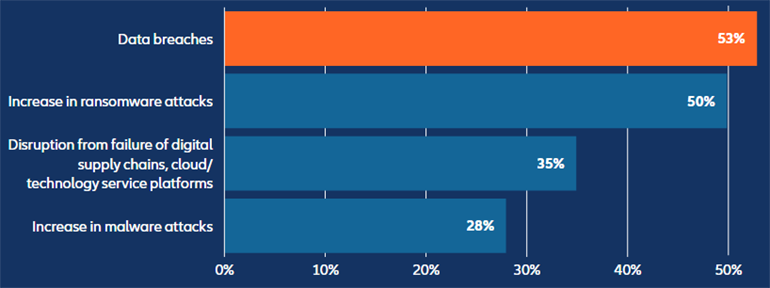

According to Allianz respondents, a data breach is the exposure which concerns companies most (53%), given data privacy and protection is one of the key cyber risks and related legislation has toughened globally in recent years.

Such incidents can result in significant notification costs, fines and penalties, and also lead to litigation or demands for compensation from affected customers, suppliers and data breach victims, notwithstanding any reputational damage to the impacted company.

Which cyber exposures concern your company most over the next year?

The average cost of a data breach reached an all-time high in 2022 of $4.35mn, according to IBM’s annual cost of a data breach report, and is expected to surpass $5mn in 2023, although these numbers constitute small change compared to the costs that can be involved in ‘mega breach’ events (see Global Cyber Crime, Fraud & Ransomware Survey).

An increase in data breaches is expected this year, cyber security firm Norton Labs predicts, as criminals are finding ways to breach standard multi-factor authentication technologies.

Cyber incidents are also the cause of business interruption (BI) that Allianz Risk Barometer respondents fear most (45%), reflecting ongoing concern for disruption caused by ransomware attacks, IT system and cloud outages and the threat of cyber war.

Severe BI can result from a wide range of cyber-related triggers, including malicious attacks by criminals or state-backed hackers, human error or technical glitches.

Which causes of business interruption does your company fear most?

According to Allianz analysis of cyber-related insurance industry claims that it has been involved with over the past five years, BI is the main cost driver for 57% of claims globally and is a significant driver for the rising severity of claims, including from ransomware attacks, which have proliferated in recent years.

Hackers increasingly target both digital and physical supply chains providing opportunities to simultaneously attack multiple companies and gain additional leverage for extortion.

2. Business interruption

Following another year of global supply chain disruption, business interruption ranks as the second most concerning risk. A consequence of many of the other top risks in the Allianz Risk Barometer it is of perennial concern for companies the world over.

Despite positive moves to diversify business models and supply chains since the pandemic, businesses continue to experience significant disruption around the world.

Covid-19 came as a massive shock, creating global shortages, delays and higher prices, while the war in Ukraine triggered an energy crisis in Europe, turbocharging inflation.

Given the current ‘permacrisis’, business interruption and supply chain disruption (BI) ranks as the second top risk in this year’s Allianz Risk Barometer (34% of responses), second only to cyber risk, with which it is closely interlinked and separated by only a few votes.

Indeed a number of BI-related risks have climbed this year’s rankings, reflecting the economic and political consequences of the pandemic and war in Ukraine.

The energy crisis is a new entrant to the 2023 survey, while concerns for macroeconomic developments, political risks, shortages of labor and critical infrastructure failure all increased this year.

Pandemic plunged down the list of concerns as vaccines saw an end to lockdowns and restrictions in most major markets.

Despite dropping in the rankings year-on-year, natural catastrophes and climate change remain major concerns for businesses.

In a year that included Hurricane Ian, one of the most powerful storms recorded in the US, and record-breaking heatwaves, droughts and winter storms around the world, these perils still rank in the top seven global risks, with storms, floods and extreme weather events at #3 when it comes to the most concerning triggers for BI.

Energy crisis fallout

As well as ranking as the fourth top risk globally, the energy crisis is the second most concerning cause of interruption (35%) for companies, given its potential to cause further widespread disruption. The skyrocketing cost of energy has forced some energy-intensive industries to temporarily cut production, find energy efficiencies, or move production to alternative locations.

The resulting shortages threaten to cause supply disruption across a number of critical industries, including food, agriculture, chemicals, pharmaceuticals, construction and manufacturing, forcing companies to seek alternatives or cheaper sources of ingredients and raw materials.

Some industries, such as chemicals, fertilizers, glass, and aluminum manufacturing, can be reliant on a single source of energy – Russian gas in the case of many European countries – and are therefore vulnerable to disruption to energy supply or price increases.

Ukraine impact an eye-opener

With war in Ukraine and growing tensions elsewhere around the world, political risks and violence jumps three places to #10 overall in this year. Such events can also be a significant cause of BI.

The war in Ukraine has been an eye-opener. With many companies and supply chains dependent on energy, raw materials and goods from Russia and Ukraine, this has demonstrated how a conflict can result in shortages and price increases.

The situation has raised awareness of the need to be more sophisticated in understanding which components and materials are critical and where they are sourced, as well as how to secure them.

Disruption from the rising cost of living

The combination of the war in Ukraine and Covid-19 has caused economic and financial market volatility, which looks set to continue into 2023. High inflation, and efforts by central banks to tame it, together with an energy crisis, have resulted in a cost-of-living crisis and the threat of recession.

Inflation is a particular concern and has a direct relationship to the cost of BI, although this varies by industry sector.

Inflation will affect business interruption exposures, especially in sectors that derive revenues from commodities or products that are seeing the biggest inflationary impact.

Conversely, companies’ BI values may fall in sectors that are seeing reduced demand or squeezed margins in a high-inflation environment.

The threat of recession is another likely source of disruption in 2023, with potential for supplier failure and insolvency, which is a particular concern for companies with single or limited critical suppliers.

3. Macroeconomic developments

2022 started with high hopes for a continued global economic recovery after the Covid-19 crisis. The Russian invasion of Ukraine abruptly dashed these. Expectations for 2023 are correspondingly pessimistic, ensuring a top three risk ranking for the first time since 2012.

The current situation is characterized by one peculiarity: all three major economic areas – the US, China and Europe – are in crisis at the same time, albeit for different reasons.

In Europe, the Russian invasion of Ukraine and the ensuing energy crisis are at the forefront: exploding energy prices are driving inflation to ever new heights and “eating” into the entire price structure.

Global and regional insolvency indices

The result is falling real incomes and corporate profits, with corresponding consequences for consumption, production and investment. Restrictive monetary policy to contain inflation expectations is rather counterproductive in this situation, but without alternative.

The US is also struggling with a crisis primarily of its own making. The ill-timed and oversized fiscal packages during and shortly after the pandemic fueled inflation.

This has – somewhat belatedly – brought the Federal Reserve onto the scene, which is now trying to put the genie back in the inflation bottle with hefty interest rate hikes.

The accompanying tightening of financing conditions is forcing companies and households to cut spending and is leading the economy straight into recession. Nowhere is this more evident than in the US housing market, which has seamlessly transitioned from Covid-19-induced soaring to freefall.

4. Energy crisis

The energy crisis arrives in the top 10 global risks for the first time at #4, as the world grapples with spiraling fuel costs, supply disruptions, inflation, and the effects of Russia’s invasion of Ukraine.

Even before the invasion of Ukraine, energy prices had been rising. The post-pandemic economy recovery in 2021 had seen demand surge, while supply chain blockages and delayed maintenance work caused widespread disruptions.

Long winters in Europe and East Asia compounded the power crunch, along with a weak year for wind production, which particularly affected major European wind-power producers like the UK, Germany and Denmark.

The global energy market destabilized further with the invasion of Ukraine by Russia, the world’s largest exporter of fossil fuels, in February 2022.

There followed a drought in much of Europe, impacting hydropower capacities, while in France more than half the nuclear reactors were shut down for maintenance or because of technical issues.

The European Union’s dependence on imported, non-renewable energy sources was thrown into sharp relief by the Ukraine crisis – in 2021, a quarter of all energy consumed in the bloc came from Russia, including 40% of its natural gas.

The energy crisis ranks highly among European businesses in this year’s Allianz Risk Barometer, at #3 (32% of responses), compared to #4 globally (22%), #8 in the Americas (14%) and Africa and the Middle East (16%), and #10 in Asia Pacific (11%).

The EU has banned the import of Russian crude oil and will ban other refined petroleum products from February 5, 2023. Various European governments have emergency plans in place in case of any controlled power cuts that need to be made over the winter – sometimes called ‘load shedding’ or ‘brownouts’.

Gas stores in the EU are at around 90% [as of December 2022], but some analysts have warned against a short-term outlook when it comes to the current energy crisis, saying the winter of 2023-2024 could be even worse.

5. Changes in legislation and regulation

The energy crisis has made it clear: there is no way around decarbonizing the economy. This requires not only billions in investments in new technologies, but also a comprehensive redesign of corporate reporting, helping to ensure compliance challenges remain a top five risk.

In Europe, this aspiration is crystallized in the Corporate Sustainability Reporting Directive (CSRD), which was finally adopted in November 2022 and will become binding for all companies over the coming years – demanding a great deal of additional effort from them.

This is because the CSRD not only targets the environmental aspect of economic activity, but also covers the entire spectrum of sustainability, including social aspects.

This brings the non-financial factors to the forefront of reporting, in line with the logic that it is precisely these factors that become financially material in the long-run.

Extending the reporting scope beyond the current focus on financial risks makes the disclosure of information a much more complex and challenging exercise, not least as the CSRD follows a “double materiality” approach: it requires assessing both impact directions.

While the “financial materiality” is concerned with the impact of environmental, social, and governance (ESG) issues on the financial performance of assets (outside-in perspective), the “impact materiality” concentrates on the environmental and social impacts that an asset causes (inside-out perspective).

Furthermore, in addition to the risk assessment, the CSRD requires a reporting of opportunities related to both sides of materiality. With the CSRD, the EU is taking the lead in sustainability reporting, in line with its claim to be a regulatory superpower.

ESG outlook: cyber, talent and regulation exert pressure

The war in Ukraine, the changing labor market post-Covid-19, and sustainability concerns are helping to ensure environmental, social, and governance (ESG) concerns are high up the corporate agenda, but a lack of expertise is an issue.

Nearly half of respondents cited cyber-security resilience as their foremost ESG concern in the Allianz Risk Barometer.

For many, the war in Ukraine has heightened the risk of a large-scale cyber-attack, which can have wide ESG implications, including the failure of a business to protect its information network, the social consequences of disrupted supply chains, and damage to a company’s reputation.

Which ESG risk trends are of most concern to your company?

With two in five workers reported to be considering changing jobs in the next three to six months, company working conditions also rank highly on the ESG risk list.

The pandemic shifted the social contract between employers and their people. Companies are now expected to address a broad set of labor and employment issues, ranging from health and safety to wellbeing and diversity, while being accountable for driving societal impact, environmental stability and inclusive growth. The ‘S’ in ESG will gain momentum as companies strive to acquire and retain an environmentally and socially conscious talent pool.

6. Natural catastrophes

Nat cat falls three positions, overshadowed by seemingly more pressing developments on the risk landscape, but there is no room for complacency, as events in 2022 showed single events continue to cause losses in the billions of dollars.

Perhaps the drop in rankings for nat cat is no surprise – war in Ukraine, an energy crisis, and the fallout from the Covid-19 pandemic, including inflation and supply chain disruptions, have tested business resources and commanded attention.

Although the Atlantic hurricane season for 2022 was near average after six years of above-average activity, estimates show insured losses from natural catastrophes continue to be above the 10-year average of $81bn, at $115bn. Hurricane Ian, which struck Florida in September, was the year’s costliest nat cat event, with an estimated insured loss of $50-$65bn, which would rank as the second costliest hurricane of all-time.

Other notable events included widespread flooding across South Asia from January to October, which led to the deaths of over 3,500 people, the devastating heatwaves suffered by Europe and China in the sixth warmest July and August since 1880, while winter storms in Europe at the beginning of the year and in the US at the end of it both incurred billions of dollars of insured losses.

As a reminder that secondary perils are not to be underestimated, France suffered record-breaking hailstorms, which are expected to cost the insurance industry $6bn-$8bn, while floods in eastern Australia resulted in insured losses around $4bn, the country’s costliest ever nat cat.

7. Climate change

This critical risk has also declined in importance year-on-year as the war and economic crisis factors such as inflation and the energy crisis again take precedence, but the results also show that companies continue to take risk mitigation action.

Climate change and global warming threaten companies in a number of different ways. First and foremost, higher property damage and business interruption risks as a result of natural hazards and extreme weather events such as floods, storms, thunderstorms or droughts.

Then there is the threat of legal and liability risks due to the comprehensive regulatory framework around the world, increasing disclosure requirements, and the threat of greenwashing accusations or climate lawsuits.

Last, but not least, companies are confronted with a wide range of transformation risks resulting from new market conditions or product requirements, or from changes in business strategy.

Which actions is your company taking to mitigate the direct impact of climate change?

All these effects of climate change are increasingly felt by companies. Nevertheless, those risks which are more immediately experienced such as cyber, high inflation or the energy crisis in the wake of the Russian invasion of Ukraine ultimately determine the risk perception of companies in 2023, whether it is multinational corporations or small enterprises. Climate change remains in the top 10 global risks but slips from #6 in 2022 to #7.

There are some differences regionally. In Europe, it drops further (from #4 to #7), while in the Americas it remains at #7. However, elsewhere it is a different picture. Across Africa and Middle East, climate change rises to #4 from #10 year-on-year. In Asia Pacific it climbs to #5 from #6.

8. Shortage of skilled workforce

Talent and workforce issues climb one place year-on-year to #8. Another consequence of the Covid-19 pandemic and rising wage inflation is a shortage of skilled workforce.

Many countries have experienced a reduction in the available workforce at a time of high demand for labor, as some workers took early retirement.

And while the cost-of-living crisis may see some of these people return, at the end of 2022 it was reported that there were almost two unfilled positions in the US for every job seeker.

At the same time, a study by consultant McKinsey reported that 40% of workers globally said they might leave their jobs in the near future.

Clearly attracting and retaining skilled workers has rarely been more challenging – a Manpower Group survey noted that 75% of companies globally had reported talent shortages and difficulty hiring over the past year, a 16-year high. Respondents rank talent shortage as a top five risk concern in the aviation and aerospace, engineering and construction and professional services sectors.

9. Fire and explosion

Fire perils, excluding wildfires, rank #9 overall, falling from #7 in 2022.

Fire risks are often well understood and typically well risk managed. However, fire remains a significant cause of business interruption (BI) and supply chain disruption, especially where companies rely on third party suppliers for critical components.

Claims analysis by Allianz shows that fire is the largest single cause of corporate insurance losses, accounting for 21% of the value of 500,000+ insurance industry claims over the past five years (equivalent to €18bn).

Aging property and infrastructure, such as in the energy industry for example, is a worrying cause for fire and BI-related losses, as is a lack of trained personnel.

Regularly assessing and updating prudent fire mitigation practices, including preventative measures, fire extinguishing methods and contingency planning, remain essential for all businesses to lower the risk of loss from an incident.

10. Political risks and violence

2022 was another year of global turmoil, with conflict and civil unrest dominating the news, ensuring political risks and violence ranks as a new entry in the top 10 global risks. Activity is expected to continue in 2023.

The invasion of Ukraine by Russia in February 2022 intensified a febrile risk landscape as economies around the world contended with the post-Covid recovery, inflation, and the rising cost of living.

Unrest and protests in the last year ignited over the rights of women and minorities in Iran, fuel prices in Kazakhstan, economic failures in Sri Lanka, abortion rights in the US, corruption in Argentina, and Covid restrictions in China.

The end of the year saw multiple strikes across Europe over pay and working conditions, and even the foiling of a far-right plot to overthrow the German government.

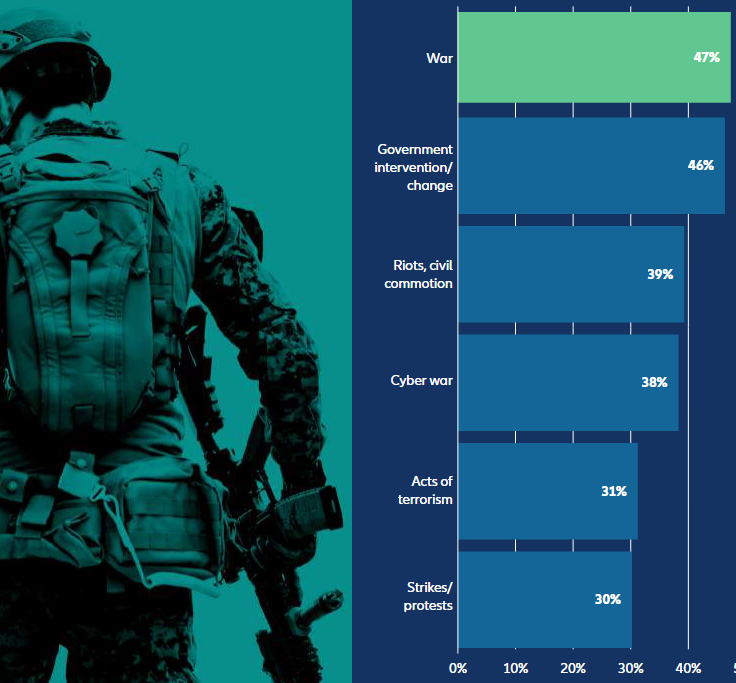

War ranks as the top political risks and violence exposure in this year’s Risk Barometer (47% of responses). As well as Ukraine, there is concern over potential conflict between other nations.

The impact of war in Ukraine has been amplified because it affected the post-Covid recovery and damaged growth, with sanctions on Russia intensifying inflationary pressures.

What type of political risks and violence are of most concern to your company?

Strikes, riots and civil commotion (SRCC) have a combined score of 69% (see graphic), representing the real risk these present to businesses. The last few years have shown the huge impact a coordinated violent SRCC event can have on an economy and politics, such as the Black Lives Matter protests in the US and South Africa Zuma riots of 2021.

Industries at risk – particularly government departments, industry, and the retail, transport and mining sectors – should monitor local activity carefully and identify their supply chain vulnerabilities.

They should then review their insurance policies and update business contingency plans as necessary.

Potential flashpoints in 2023 will include countries with polarized politics and those holding elections. As inflationary frustrations grow, I expect a number of SRCC incidents to occur on most continents, based on economic, ethnic and political grounds.

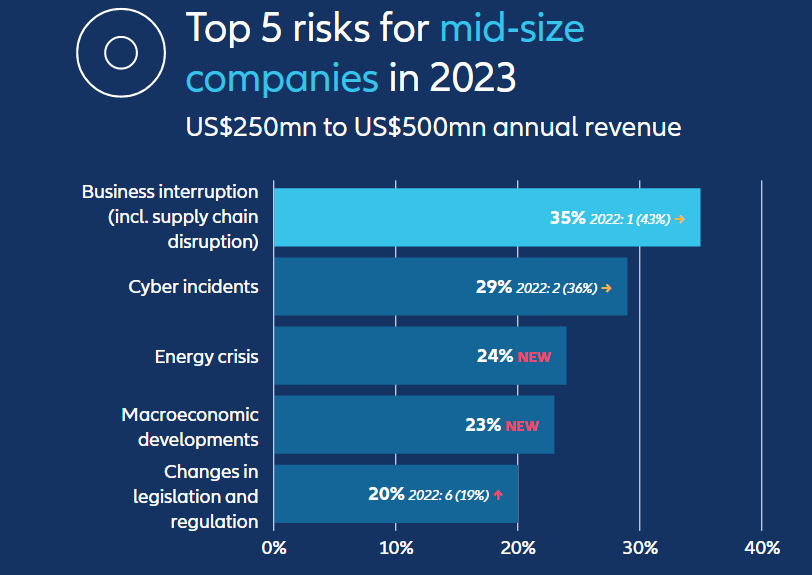

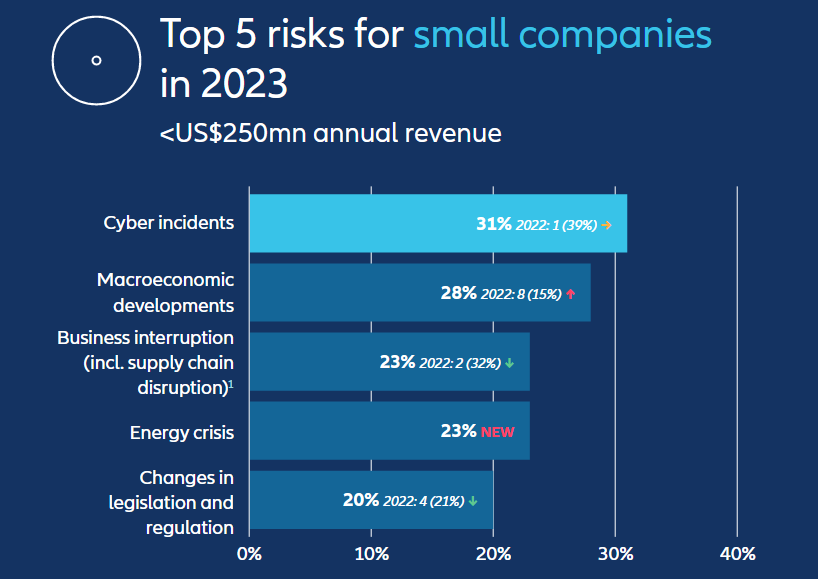

Top risks for small- and mid-size companies

The most concerning perils may mirror the global list with business interruption, cyber, macroeconomic developments and the energy crisis leading the rankings but any potential consequences can be much more severe for these firms.

Collectively, small- and mid-size companies account for half of Allianz Risk Barometer responses (1,400+).

For mid-size companies business interruption (including supply chain disruption) maintains its position as the top risk year-on-year (35%).

For small-size companies, cyber incidents maintains its position as the top risk as well (31%). Both business interruption (BI) and cyber rank as a top three risk in each segment (see Global Cyber Market).

For both small- and mid-size companies the cyber risk situation has changed significantly in the wake of the Covid-19 pandemic. Many had to quickly digitalize their businesses or enable remote working. Development of IT security has not always kept pace.

Smaller companies lack the financial and employee resources of large corporations with IT security often outsourced. Many continue to be under the misconception that cyber-attacks won’t happen to them but as more large businesses ramp up their investments in cyber security tools, more poorly protected smaller companies are being exploited.

Smaller companies can be exposed to supply chain attacks in particular, given they often purchase software program licenses of much larger organizations or vendors.

Which actions is your company taking in order to de-risk supply chains and make them more resilient?

Covid-19 and subsequent disruption has increased awareness around business interruption and supply chain risks, with companies and governments taking action to build resilience and de-risk.

The results show that companies have begun to diversify their businesses and supply chains, as well as stepping up risk management.

According to respondents, the most common action taken by companies to de-risk supply chains and make them more resilient is to develop alternative and/or multiple suppliers (64% of responses, see graphic). Broadening geographical diversification of supplier networks in response to geopolitical trends is the third most common action (40%).

……………………………

Edited by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media by Allianz Global Corporate & Specialty Data