Many insurers around the world have taken significant steps to build an organizational infrastructure addressing the multitude of challenges posed by environmental, social, and governance concerns, gathered under a single and sometimes unwieldy “ESG” umbrella. Some have appointed chief sustainability officers or their equivalent to spearhead reporting, compliance, and mitigation initiatives. This task is unlikely to get easier anytime soon, with each element posing its own potentially thorny economic, legal, and reputational risks.

Yet, how effectively and transparently insurers respond to increasingly vigilant stakeholders— from regulators and rating agencies to sustainability assessment firms, as well as investors and their own employees—will likely determine their ability to adhere to a “higher bottom line,” in which the impact of their ESG efforts on society could be as important as their traditional financial statements.

Up until now, most insurers have been focused on responding to mounting calls for more data and specific statistical commitments rather than proactively seeking opportunities to make ESG initiatives a differentiating part of their go-to-market strategy and corporate culture.

They’ve also generally been focused on regulatory compliance and bolstering enterprise risk management, rather than innovating to differentiate and establish themselves as ESG leaders in thought and action.

Insurers are likely to be judged not just by plans laid out in annual sustainability reports, but by how their initiatives actually

1) limit the impact of climate change and other nascent systemic environmental risks while addressing carbon emissions at the source;

2) diversify their leadership and workforce;

3) enhance inclusivity of their products and services;

4) increase transparency and accountability in their governance structures.

While transitory economic and political developments may affect implementation, globally or regionally, how these four overriding goals are reflected in strategic planning, investment priorities, and budget decisions could very well determine an insurer’s reputation and competitive position in an increasingly socially conscious economy.

For most companies, having a sustainability plan is no longer a differentiator but an expectation from customers and employees. As a strong global franchise, we have an important role to play in the transition to a world where net-zero carbon emissions are a reality.

Sarah Chapman, global chief sustainability officer, Manulife

Having a Chief Sustainability Officer in place is incredibly important, but most effective if the position is senior enough in the organization and if the person has a business mindset. The CSO’s role is to act as a conductor among the different businesses and orchestrate change across stakeholders.

Product innovation and risk-transfer offerings may be key to mitigating climate risk

World leaders are coalescing around the goal of cutting carbon emissions by half within this decade to have a chance of staying below the significant tipping point of a 1.5 degree rise in global warming. In line with the Paris Agreement, there are calls for fossil fuels in general and coal in particular to be phased out by 2040.

Insurers are well-positioned to be among those standing at the cusp of the transition to a low-carbon economy, given their crucial roles as both underwriters of, and institutional investors in, carbon-intensive industries.

To start, since more innovation is likely in order to facilitate the drive toward net-zero, insurers could help mitigate climate exposures through tweaking of existing policies and creation of new risk-transfer products. For example, more property carriers could cover retrofitting with sustainable building materials, while additional auto insurers might offer premium discounts to incentivize the use of electric vehicles.

Insurers could also launch new coverages and services mitigating physical and transition risks for both emerging alternative energy industries and legacy producers transitioning to more sustainable sources.

This could make good sense from both a societal and business perspective, as the Swiss Re SONAR 2020 risk insights report predicts that by 2050, emerging technologies such as carbon capture and storage have the potential to grow to a size that may rival today’s oil and gas industries.

Many European carriers continue to lead insurance industry efforts to limit carbon emissions through their underwriting and investment portfolios.

Aviva declared itself the first major insurer to target net-zero by 2040; setting timelines to divest and stop underwriting insurance for companies making over 5% of revenue from coal or less conventional fossil fuels such as tar sands or oil shale, unless they have signed on to the Science Based Targets initiative.

More European carriers are also joining forces with other companies to address climate risk at the source as well as enhance scrutiny of climate transition plans. Multiple European carriers, for instance, have become members of the Net-Zero Insurance Alliance—a United Nations initiative that brings together insurers from around the world—emphasizing their role in the transition to a carbon-neutral economy, as well as in helping create a methodology allowing carriers to measure emissions from underwriting and empowering them to find ways to reduce them through innovation.

While US insurers have been working on mitigation and adaptation efforts for quite some time to limit the impact of climate risk, they have generally lagged behind European counterparts in addressing the underlying source of greenhouse gases and associated energy transition risks.

This is likely due to a lag until recently in US regulatory pressure and a less conducive domestic political environment. But increasing stakeholder demands on US carriers are now prompting more focus on limiting the cause rather than just the effect of climate risk.

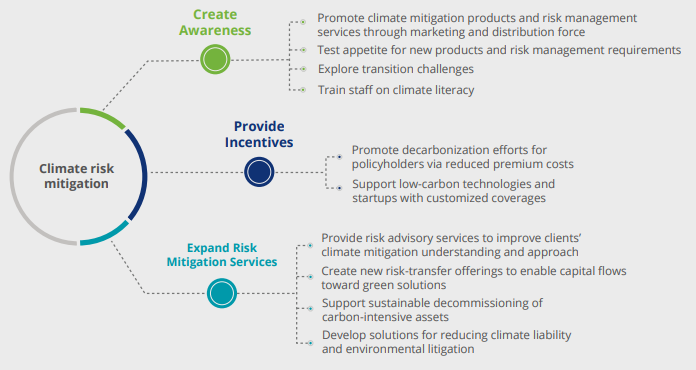

There are a number of steps insurers should consider that could accelerate climate risk mitigation across the value chain, from introducing new products, services, and premium incentives, to raising awareness and adding risk management services.

How might insurers accelerate climate risk mitigation?

Insurers pressed to move further, faster from words to deeds on diversity, equity, and inclusion (DEI)

Since there is generally strength in numbers, some industry associations and individual carriers are forming groups to address the social (“S”) challenges and increased focus on societal issues within ESG.

For example, the American Council of Life Insurers developed its Economic Empowerment & Racial Equity Initiative, making diversity and inclusion a priority for the industry by emphasizing four key areas:

1) expanding access to affordable financial security in underserved markets,

2) advancing diversity and inclusion within companies and on corporate boards,

3) enhancing economic empowerment through financial education,

4) expanding investments in underserved communities.

External pressure emphasizing action over words is also mounting. The National Association of Insurance Commissioners created a Special (EX) Committee on Race and Insurance to help regulators keep track of progress and spur greater action on DEI issues.

While many insurers are taking steps to diversify their workforce, large gaps remain in the industry as a whole—particularly at the executive level.

Racially and ethnically diverse professionals comprise approximately 24% of the industry’s entry-level workforce but only 8% of senior and executive management. And while there are more women (approximately 57%) in entry-level ranks, just 12% of them are racially and ethnically diverse women. Only 18% of the total senior and executive management positions are filled by women, and only 3% of executives reporting to CEOs are racially and ethnically diverse women.

Insurers should be considering several internal options to bolster DEI efforts and results.

How might insurers make social equity a bigger part of their culture?

There are several existing programs insurers could join to enhance racially and ethnically diverse recruitment efforts. The American Property Casualty Insurance Association, for example, collaborated with a number of carriers to create Insurance Apprenticeship USA, designed to attract, develop, and retain younger workers and those from underserved communities into the industry. The initiative was unveiled at the first Women & Diversity: Expanding Opportunities in Insurance conference.

The Black Insurance Industry Collective, a nonprofit affiliated with The Institutes, was launched in 2020 to accelerate the advancement of Black insurance professionals and increase representation of Black leaders at the executive level.

In addition, UNI Europa Finance formed a joint declaration with European insurers “to ensure employees are treated equally, with respect and dignity—regardless of factors such as gender, age, disability, and including LGBTQIA+, trans and intersex workers.”

Effective governance framework should foster transparency

The World Economic Forum (WEF) recommends 21 core and 34 expanded ESG metrics and disclosures around four interdependent pillars: Planet, People, Principles of Governance, and Prosperity.

On climate risk, insurers are being asked to adopt recommendations of the Task Force on Climate-related Financial Disclosures, with a timeline of at most three years for full implementation, disclosing greenhouse gas emission targets in line with goals of the Paris Agreement. On human capital, insurers are advised on disclosure of workforce demographics by age, ethnicity, gender, and other diversity indicators.

The EU directive aims to encourage about €1 trillion into green investments over the next 10 years, address inconsistency in climate-related information from financial market participants, and give sustainable product providers a competitive boost.

The Sustainable Finance Disclosure Rule—part of the 2030 Agenda for Sustainable Development of the European Union and the United Nations—was introduced to boost transparency surrounding sustainability claims made by financial market participants and improve the market for sustainable investment products.

The US Securities and Exchange Commission (SEC) also proposed disclosure of Scope 1, 2, and 3 greenhouse gas emissions, while advising carriers to put climate risk management teams in leadership positions to provide oversight and guidance as well as uniform, consistent, and transparent public communication.

The regulator has social demands in ESG to strengthen human capital initiatives. We assess the demands of ESG agencies through a corporate value enhancement lens. It is necessary to reduce the burden on insurers by standardizing regulations and evaluation standards among stakeholders.”

Ryosuke Fukushima, head of sustainability promotion division, Kampo

While external ESG ratings firms provide some externally vetted transparency about insurer actions and progress, as reporting responsibilities keep growing, the sheer volume of data requests and behavioral examinations could overwhelm relatively small insurer sustainability teams and keep them from taking on more strategic roles.

Insurers should, therefore, consider empowering CSOs with more resources—both in terms of direct reports and ESG liaisons spread throughout the organization—while including sustainability benchmarks in leadership performance evaluations considered when determining compensation and promotions to establish greater accountability.

Part of the problem is that the lack of standardization among requests from ESG reporting agencies has been cited by insurers as often leading to duplication of effort and a waste of limited resources.

Insurers should be stepping up efforts to establish more consistency in such assessments, collaborating with other industries to bring about a common reporting language and convergence in international sustainability standards. Internally, insurers should be integrating new technology tools that automate ESG data collection and improve reporting efficiency.

…………………….

AUTHORS: Karl Hersch – US Insurance leader, Principal Deloitte Consulting, Neal Baumann – Global Financial Services Industry leader, Principal Deloitte Consulting, Michelle Canaan – manager Deloitte Center, Sam Friedman – senior manager, insurance research leader Deloitte Center.