The ESG movement has grown from a corporate social responsibility initiative launched by the UN into a global phenomenon that is reshaping the asset management and the broader business landscape.

Despite the triumphant march of ESG, companies, investors and the public at large have struggled to grasp precisely what role the social or ‘S’ dimension, i.e. the impact of businesses on people, should play in investment and business decisions.

A Global ESG Survey by BNP Paribas found that 46% of investors surveyed considered the ‘S’ to be the most difficult to analyse and embed in investment strategies.

Unlike environmental and governance issues, social factors are less tangible and come with limited data on how they can impact a company’s performance. This lack of understanding has become even more apparent with the recent shift of ESG dynamics towards the ‘S’, driven by the pandemic and war in Ukraine and their global socio-economic implications.

Nonetheless, there is a broad consensus that businesses, including the insurance industry, will have to pay more attention to the ‘S’.

With the adoption of the UN’s Sustainable Development Goals (SDGs) in 2015, there is growing pressure and urgency across society to respond to the social sustainability challenges the world is facing. This is particularly relevant for the insurance industry – as risk takers, promoters of loss and risk prevention, and long-term investors – which is widely recognised as inherently socially beneficial.

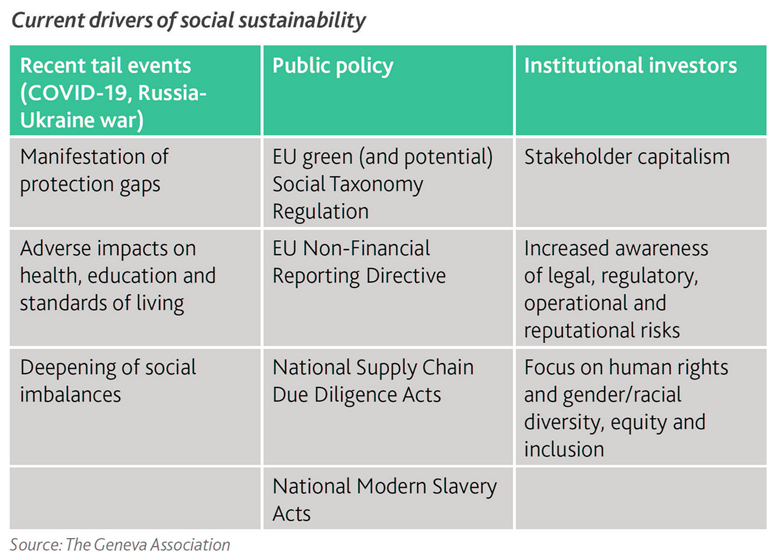

Drivers of the growing importance of social sustainability

The pandemic affected low- and lower-middle-income countries disproportionately, pushing about 100m people around the globe into extreme poverty. It has also highlighted the need to push forward even more resolutely with sustainability initiatives such as the UN’s 2030 Agenda for Sustainable Development and its 17 SDGs.

In addition, Russia’s invasion of Ukraine has sparked significant rises in energy and food prices at a time when developing countries are still struggling to recover from the economic, fiscal and social fallout from the pandemic.

The war is threatening to derail progress towards achieving the SDGs and could push another estimated 40 million into extreme poverty.

Governments increasingly use regulation to improve the information available to stakeholders about corporate social activities, in the hope that they will effectively reward or punish firms, primarily in their capacity as investors.

The social objectives of national and regional regulatory frameworks are often inspired by the UN’s SDGs and the need to mobilise capital at scale for sustainable development.

Finally, investors are increasingly aware of the potential for social sustainability to maximise long-term shareholder value. Academic researchers found evidence that special focus on social factors such as human capital management, workforce diversity and supply chain due diligence can help generate alpha, i.e., excess returns earned on an investment above the benchmark return

How insurers are contributing to social sustainability?

Against this backdrop, insurers are starting to explore the scope for generating additional social benefits, beyond their inherent social utility, from explicitly adopting ESG considerations in their core business activities.

One example is impact underwriting. This enables insurers, consistently with actuarial risk-based principles, to make specific contributions to social objectives by applying their data and risk expertise to the particular benefit of unserved or underserved groups.

Also, insurers increasingly view risk prevention in the bigger context of ESG, contributing to climate, cyber or health risk prevention and mitigation at both the individual and societal levels. Another example is impact investing, through which insurers intentionally pursue a specific and measurable social impact at a financial return commensurate with the project’s risk.

In addition to providing benefits to social sustainability, insurers need to avoid and address potential risks that may arise from their core business activities.

In the P&C business, ESG risks primarily lie with industrial and commercial insurance, potentially related to child labour, forced labour, forced resettlement, poor worker safety and violation of worker rights.

In life and health insurance they include algorithmic underwriting (e.g., the risk of unintentionally excluding certain customers). In view of these risks, insurers have established mechanisms of mitigation. On the investment side, ESG risk is managed through exclusion or negative screening of business activities, e.g., coal mining, tobacco, gambling and certain weapons, or those with human rights violations. In addition, engaging with investee companies is gaining in importance.

A framework for social sustainability

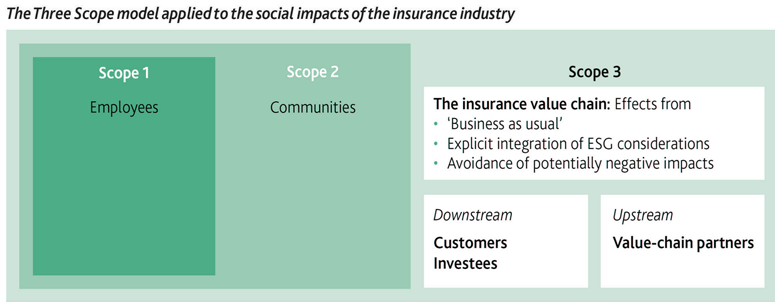

Despite these initiatives and measures as well as mounting stakeholder pressure on businesses to embrace the ‘S’, a decision-useful, conceptual framework that captures the insurance industry’s contributions to social sustainability is still non-existent. We aim to close this gap by offering a systematic approach to assessing an insurer‘s impact on its employees, value-chain partners, customers and communities. The suggested approach draws on the Greenhouse Gas (GHG) Protocol’s well-established Three Scope model of carbon emissions disclosure

Scope 1 could capture an insurer’s social impacts on everything the company directly controls, first and foremost its employees.

Scope 2 could cover the insurer’s impact on communities, directly through its operations and indirectly through its employees (e.g., employee volunteering).

Scope 3 would include the insurer’s social impacts across the value chain, from risk taking and servicing to investing, both upstream (the ‘S’ impact on and of value-chain partners) and downstream (the ‘S’ impact on and of customers and investees). Scope 3 impacts are by far the biggest.

Promoting social sustainability: Recommendations for insurers

- Adopt a three-tier approach to managing social sustainability. First, maximise positive social impacts arising from the core business of insurance (inherent benefits); second, protect those benefits by carefully mitigating potentially negative impacts; and third, explore the scope for additional, commercially viable social benefits which do not adversely affect tiers one and two.

- Review current business models with a view to shifting from pure risk transfer to a blend of risk transfer and prevention in order to build healthier, safer, more resilient and more economically productive societies. In addition, business models should allow for commercially viable, inclusive insurance enabled by low-cost digital distribution and end-to-end processing, coupled with underwriting on a portfolio basis (i.e., across various lines of business).

- Adapt core business operations by incorporating social considerations – both risks and opportunities – in daily operations, addressing the lack of trust as a major factor behind protection gaps and exploring public-private partnerships as a promising route to providing insurance products with substantial social benefits.

- Build governance for the ‘S’ by embedding social considerations in decision-making at the top of the company (board of directors, executive committee), promoting diversity and inclusion in the board of directors and senior management, including the ‘S’ in operational risk governance, appointing senior ‘practitioners’ as ESG market leads and linking top management compensation to performance against social sustainability-related targets.

………………..

AUTHOR: Dr Kai-Uwe Schanz – Deputy Managing Director and Head of Research & Foresight The Geneva Association