Climate risk has once again been the catalyst for insurance and reinsurance market change. Major losses caused by extreme weather events in recent years exceed historical precedent, driven by a myriad of factors from exposure growth and rising insured values to climate change, demographics and even some randomness, according to Howden’s Report.

Climate change, ESG responsibilities and cyber risks are just some of the key concerns facing the insurance industry in 2023 (see Cyber Insurance, Ransomware & Hybrid Warfare Outlook). Climate change, ESG, cyber and the continuing conflict in Ukraine remain centre stage for the insurance industry, creating both new opportunities for insurers and new challenges from a claims and coverage perspective.

Impact of the Climate Risk for Re/Insurance Industry

Isolating the impact of each input is difficult, and all have played a role in the proliferation of mid-sized losses in the last six years.

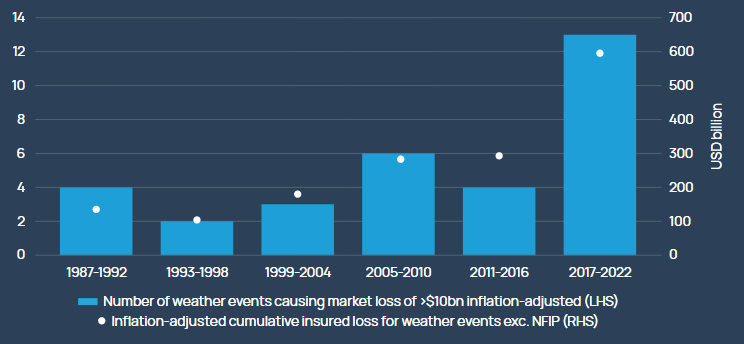

Weather-related insured losses since 2017 are nearing USD 600 billion in aggregate, double anything seen on record.

With scientific research confirming that human-induced climate change is influencing weather and climate extremes around the world, and inflation adding substantially to insured values, especially in areas that have seen rapid exposure growth in recent years, any expectation that loss experience will revert to the old normal is unrealistic.

Number of weather-related insurance industry losses >$10bn in real terms and cumulative insured losses by six-year period – 1987 to 2022

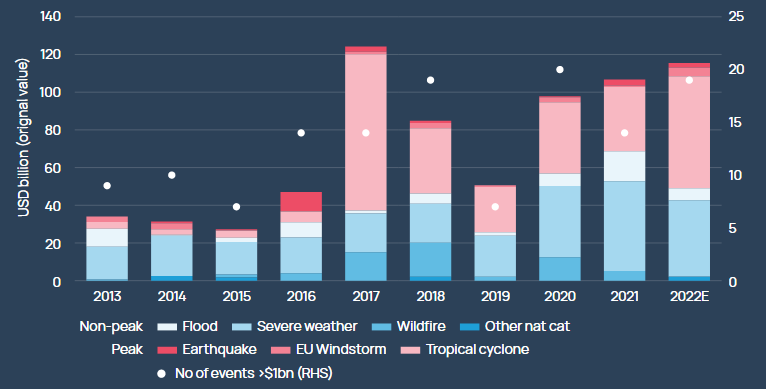

This period of elevated catastrophe losses has been notable not only for its quantum but also for the unusual mix of what were once considered to be high frequency, low severity events such as floods, wildfires, droughts and convective storms.

These so-called secondary perils accounted for the lion’s share of losses in eight of the last 10 years, with 2017 and 2022 being the two exceptions.

The insurance industry is struggling to adapt to a new normal in which losses fueled by climate change are now regularly exceeding $100 billion a year. Insured losses from natural disasters hit about $120 billion in 2022, most of which was weather related, according to data compiled by Munich Re.

Both these years have a major Florida landfilling hurricane in common – Irma in 2017 (category 3) and Hurricane Ian in 2022 (category 4).

Current estimates for Hurricane Ian are projecting losses in excess of USD 40 billion, within modelled expectations for a category 4 hurricane in Florida, but the ranges are wide and there is substantial uncertainty around the ultimate loss quantum, especially in such a high inflationary environment, and in a litigious state like Florida.

Global insured natural catastrophe losses

According to the Florida Office of Insurance Regulation (FLOIR), the state accounted for 80% of U.S. homeowners’ litigation in 2020 but only 9% of claims.

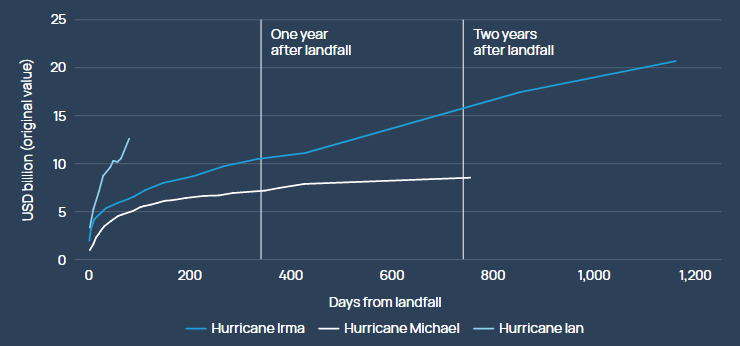

Figure below shows how estimated insured losses based on paid claims in Florida for hurricanes Irma and Michael (category 5, 2018) compare to early data for Ian. At similar post-landfall periods, Ian’s estimated insured loss is close to double that of Irma.

Global insured natural catastrophe losses by peril – 2013 to 2022

Irma’s development over time demonstrates tail risk for hurricane losses in Florida. Having initially conformed to the expected development pattern within the first year of gradual levelling off from an initial spike (as exhibited by Michael), claims for Irma subsequently experienced a rapid and sustained reacceleration, which reflected litigation risks in the state and led to substantial loss creep up to three years after landfall, the bulk of which fell to reinsurers.

Insured losses have been elevated over the last five years due to recurring high-loss secondary peril events such as SCS, floods and wildfire.

However, peak perils have also featured prominently, including Hurricane Ida, the costliest industry event of 2021 with insured losses of USD 30–32 billion. Coming after a dip in 2012–2016, however, the higher insured losses of 2017–2022 signal a return to long-term growth trend of 5–7%, rather than a step-change up in claims.

Paid claims development in Florida for Hurricane Ian vs Irma and Michael

The market will be watching closely to see if legislative changes brought in before and after Ian made landfall can prevent a rerun.

Even if losses end up falling towards the lower end of expectations, pressures in the property market will be acute this year.

Carriers’ catastrophe budgets have failed to keep up with sustained losses from weather-sensitive perils, and, coupled with rising loss cost inflation, portfolio remediation and price adequacy are likely to be areas of considerable focus and action this year.

Flood risk is complex to monitor. Exposure accumulation with economic growth and urbanisation has been the main driver of rising flood-related losses over time. However, many other factors such as aging or lack of flood control infrastructure, “soil sealing” in urban areas, more rainfall from tropical cyclones, and clustering of catastrophe events have also shaped loss outcomes.

Changing climate also needs to be considered in present-day and for future risk assessment. For instance, in scenario analysis, we project for 2050 more pronounced increases in UK flood-related losses for high return periods and assuming no adaptation interventions.

………………..

AUTHORS: Julian Alovisi – Head of Research Howden, David Flandro – Head of Analytics Howden

Fact checked by Oleg Parashchak