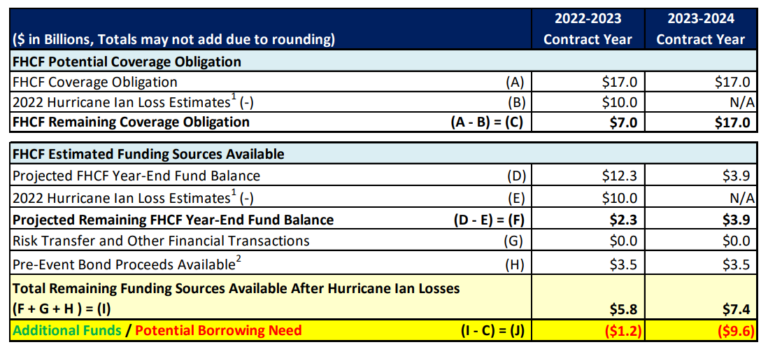

Florida Hurricane Catastrophe Fund, the so-called CAT Fund, plays a vital role in Florida’s property-insurance system as it provides relatively low-cost reinsurance, which is backup coverage needed by insurers. Under state law, the fund’s maximum potential liability for claims is $17 bn.

The FHCF’s average coverage for 2023 has risen to around 87.4% due to higher reinsurance prices and limited capacity in the Florida market.

Hurricane Ian losses and global macroeconomic factors

Due to Hurricane Ian losses and global macroeconomic factors, the global reinsurance markets are expected to remain hard, which will further reduce the reinsurance capacity for the Florida insurance market.

FHCF’s portion of losses related to Hurricane Ian is expected to range between $6 bn and $13 bn, with a projected ultimate loss amount of $10 bn.

We’ve been here before. We’re going to do what we’ve always done, and we’ve done it well. We are well-prepared for Hurricane Ian and we can cover our obligations.

Gina Wilson, FHCF’s chief operating officer of the cat fund

A claims-paying capacity report from the Raymond James investment banking firm, which advises the cat fund, backed up Wilson to a large degree. But it also indicated that the fund’s surplus could fall short next year, even without another storm.

After adjusting for Hurricane Ian loss estimates, the FHCF has liquid resources that are significantly below its statutory limit for the subsequent season.

That is down from around $320 bn in 2021 and near the average of the previous five years. The United States once again accounted for a big portion of the losses with Hurricane Ian, which hit Florida in September, causing $60 bn of insured damages and $100 bn in total losses.

The report shows that the cat fund will likely need to borrow as much as $1.2 bn this year and another $9.6 bn for the 2023-2024 contract year to meet its statutory obligations, according to Insurance Journal review.

The projected 0-12 month bonding capacity of $8.4 bn allows for the FHCF to fund a majority of its maximum statutory obligation, but additional funding sources are needed to fund its statutory limit of $17 bn for the 2023-2024 Contract Year.

And while the cat fund can lay a surcharge on Florida policyholders if needed, and has an excellent credit rating, it’s not guaranteed by state government, according to Global Reinsurance Property Catastrophe Market Outlook. Given the current volatility of the global market now, along with rising interest rates and inflation, the cat fund could expect to pay bond interest rates as high as 7% to 9%.

The past year and half have seen major changes in the global Reinsurance Property Catastrophe (CAT) market. In the recent reinsurance renewals we have seen robust price improvements, increased net retentions and much tighter terms and conditions, according to Swiss Re report.

The briefing below looks to provide valuable insights into the current trends in the reinsurance property CAT market and we hope it will be a useful resource to CFOs, reinsurance buyers and reinsurance brokers.

Florida Cat Fund may borrow billions next year

Due to losses being in the early stages of development, there is considerable uncertainty surrounding the final loss amount. These estimates rely on model outputs and are subject to significant uncertainty, meaning that the actual losses may not necessarily fall within the projected range.

The Hurricane Ian loss estimates, suggests that a repeat of a hurricane that size would need post-event bonding to be issued for a portion of their payments.

This consists of an estimated total liquid resources of approximately $7.2 bn, consisting of projected year-end fund balance of $3.7 bn and pre-event bond proceeds of $3.5 bn.

Additional financing will be necessary as the projected available total liquid resources of $7.2 bn fall short by $9.8 bn compared to the maximum potential liability.

If it issues post-event bonds it would likely need to levy emergency assessments on all property and casualty insurance lines in Florida except workers’ compensation, medical malpractice, federal flood, and accident and health lines.

Global reinsurance markets challenges

The global reinsurance markets, particularly in Florida, have been facing increasingly challenging conditions since 2020, and this trend has persisted into 2023. Florida’s insurance market has witnessed a significant decline in reinsurance capacity as a result.

The report’s findings appear to give some credence to warnings raised earlier this month from analysts who fear that issuing bonds could be prohibitively expensive for the fund and would ultimately mean less cat fund reinsurance for Florida property insurers.

The principal and interest on new debt would mean they never build surplus – even with no losses

Ian Gutterman, Founder and CEO at Informed Group

“There would be years with no debt maturities where surplus would temporarily build but then it would be drained by the next maturity.”

In other words, a bond buyer would have to assume either no more hurricanes will strike Forida for as long as the debt is outstanding, perhaps 10 years, or if there is one, the state of Florida will make good on the bonds if the cat fund doesn’t have the resources.

But there is no path for the FHCF on its own to both pay a future hurricane claim AND pay back bondholders.

The debt can get you through, but the debt has to be paid back. And if you have more hurricanes, what do you have to pay the debt back with?

The crux of the issue is that the fund’s diminished liquidity could force some insurance companies to seek more reinsurance coverage from the private market. With reinsurance prices expected to rise again next year, that could lead to lowered financial ratings and could doom a number of insurers that are now teetering.

Analysis underscored the problem of escalating reinsurance costs

Due to Hurricane Ian losses and global macroeconomic factors, the global reinsurance markets are expected to harden further, which will further reduce the reinsurance capacity for the Florida market.

John Rollins, an actuary and former chief financial officer for a large Florida insurance carrier, also questioned some of the cat fund’s recent assumptions, highlighted in the Raymond James analysis.

The first question is, how lucky do Florida leaders feel about each of those ‘no shock’ assumptions? Irma loss estimates have proved low at each milestone, and the fund must commute with 100+ individual insurers by June 2023 to determine the final tally.

John Rollins, Vice President at AIR Worldwide

The Raymond James review also noted that the retention level – the deductible that insurers must pay before they can tap into the cat fund’s low-cost reinsurance – will rise to $9.1 bn for next year, up from $8.5 bn.

Cat Fund outlook ahead of hurricane season

Jimmy Patronis, Florida state’s Chief Financial Officer, State Fire Marshal, and member of the Florida Cabinet, though, expressed confidence in the market and noted that Cat Fund rates dropped by 3.71%.

The changes made by the Legislature in the Special Session in December to reduce the number and costs of lawsuits faced by carriers is having an impact, although it hasn’t been reflected in the rates paid by consumers.

Rates, in fact, have shot up for most consumers, as several companies have asked state regulators for double-digit increases, including one for as much as 61% on average statewide

Jimmy Patronis, Florida’s Chief Financial Officer

The Cat Fund report notes financial markets have confidence in it, largely because of the ability to impose assessments on multiple lines of policies, leading to the highest ratings issued by ratings agencies.

The strength of this pledged revenue stream is the primary reason the three major rating agencies — Moody’s, Standard & Poor’s, and Fitch — rate the FHCF’s current debt as Aa3, AA, and AA, respectively.

But higher interest rates, rampant inflation and an already beleaguered property insurance market mean borrowing billions right after a hurricane this year could be a different, more expensive proposition than in the past, and the report warned insurers to take that into account.

One additional note of caution is that financial markets and risk transfer markets can be highly volatile and uncertain at various times, as seen in today’s current environment

As such uncertainty is currently present, this may create an additional risk for participating insurers who rely on the FHCF for reimbursements.

Compounding the problem is that Florida insurers are relying on the Cat Fund more than ever. Global reinsurance giants have largely pulled out of the Florida market, or have hiked up prices so much that many smaller companies couldn’t afford it. Despite the changes made by the Legislature, those companies aren’t returning to Florida yet, and in fact are continuing to pull out of Florida.

How Re/Insurers survive an inflation?

Can insurers survive an inflation of the retention to $9.1 bn next year and an increase in premiums to $1.6 bn next year, or will legislators reform the fund and reduce premiums?

Florida Gov. Ron DeSantis said that he will convene a special session of the Legislature, probably in late November or early December, to tackle some of the most pressing issues still facing Florida insurers.

Lowering the retention level on the cat fund has been discussed for years as a way to save Florida insurers on their reinsurance costs.

Florida Gov. Ron DeSantis

But it’s not yet clear if that will be on lawmakers’ agenda. Other ideas include outlawing assignment-of-benefits agreements, a move that could stem the number of claims lawsuits filed in Florida.

Others have suggested that Ian’s impact won’t be so drastic. The cat fund won’t have to pay all of its reimbursement obligations at once but will likely space payments out over the next several years.

For Hurricane Irma, in 2017, and Michael in 2018, FHCF has incurred losses of $9.25 billion but has not quite finished paying on that. The fund has paid 137 insurers for losses in the two storms, but expects to reimburse about seven more carriers.

No insurers have yet requested reimbursement for Hurricane Ian losses. But when they do, the fund should be able to pay quickly.

The $10 bn projected cat fund loss from Hurricane Ian, which made landfall in southwest Florida on Sept. 28 of this year, is a “conservative point” in a range arrived at by the cat fund’s consulting actuary, based on a range of factors.

……………………

QUOTES: Jimmy Patronis – Florida state’s Chief Financial Officer, member of the Florida Cabinet, Ian Gutterman – Founder and CEO at Informed Group, Gina Wilson – FHCF’s Chief Operating Officer Florida Hurricane, John Rollins – Vice President at AIR Worldwide