Because of significant exposure growth, the impact of social inflation, and climate change complications, Florida’s insurance market could struggle to respond to a repeat of a Category 5 hurricane, such as Hurricane Andrew – which hit southwest Florida in 1992.

- The industry would see the insured loss for wind and surge in the range of $80 billion (GR) and $90 billion (GU)

- A repeat of Andrew today could cause as much as $100 billion in insured losses

- This event caused the deaths of 44 people in the state and cost the insurance industry $15 billion (in 1992 values) for Florida claims

- The 25% roof replacement rule – set in 2007, mandated that if 25% or more of a roof is ‘repaired, replaced or recovered’ in any 12-month period

- New law passed by the Florida legislature in May 2022 changed the 25% roof replacement rule to exempt roofs built, repaired, or replaced in compliance with the 2007 Florida Building Code

Catastrophe risk modeling firm AIR Worldwide estimates that if Hurricane Andrew were to recur today the expected total industry insured losses would be approximately $56 billion in the United States, with nearly 95% of the losses coming from properties in Florida.

If a similar Category 5 Andrew-like hurricane were to strike just south of Miami and just 8 miles north of Andrew’s landfall in the city of Homestead, AIR estimates that total insured losses would exceed $138 billion, with losses in Florida exceeding $127 billion.

Andrew killed dozens and caused an estimated $15.5 billion in total insured losses, according to Property Claims Services (PCS), and resulted in the insolvency of 11 insurance companies. The costliest natural disaster in U.S. history at the time, Andrew changed forever how (re)insurers approach hurricane risk management, spurring the growth of the emerging catastrophe modeling industry and ultimately prompting the development of insurance-linked securities.

If a major hurricane were to strike Miami, making landfall between Palmetto Bay and Pinecrest, it would prompt immediate activity in the marketplace for insurance-linked securities (ILS).

For this Andrew-like Category 5 hurricane striking Miami, AIR estimates that 25 catastrophe bonds would be triggered, 47 tranches would take losses, 38 tranches would be completely exhausted, and there would be a $6.3 billion loss to the catastrophe bond market principal.

RMS highlighted that the industry would see the insured loss for wind and surge in the range of $80 billion (GR) and $90 billion (GU), in which other non-modelled losses and social inflation could lead to a $100 billion event.

Our prediction that a repeat of Andrew today could cause as much as $100 billion in insured losses is based in large part on changes in exposure and population since 1992, coupled with updated predictions of the impact of wind and storm surge, with significant anticipated post-event loss amplification.

Mohsen Rahnama, chief risk modelling officer at RMS

Together these components reveal a more complete picture of potential economic and insured losses.

Hurricane Andrew landfall in Florida changed the face of property catastrophe insurance and kick-started many new initiatives, including the development of hurricane risk modelling.

This event caused the deaths of 44 people in the state and cost the insurance industry $15 billion (in 1992 values) for Florida claims, a number higher than the $5 billion predicted.

Despite its great impact, according to the report, the insurance industry once more seems to be in danger of underestimating its exposure to a Category 5 storm hitting Florida again.

With significant exposure growth, the impact of social inflation, and climate change complications, the insurance market could struggle to respond to a repeat of Andrew.

The impact of storm surge, particularly with the climate change-related rise in sea levels, is more pronounced now compared to estimates at the time of Andrew.

Added to this is the significant demographic shift in Florida and the fact that economic exposure has grown substantially within both Andrew’s wind and surge footprints, based on an analysis of the total built floor area.

While the wind was the main driver of loss in 1992, the number of new, high-valued buildings near the coast suggests that storm surge losses may play an increasing role in a repeat of this event.

Cost inflation since 1992 has been substantial, with replacement costs in Florida estimated to have increased between two times and 2.5 times since 1992, based on historical construction cost indices.

One key uncertainty in estimating the losses from a repeat of Hurricane Andrew concerns the impact of claims litigation, the report noted.

The 25% roof replacement rule – set in 2007, mandated that if 25% or more of a roof is ‘repaired, replaced or recovered’ in any 12-month period, then the entire roofing system or roof section must be brought up to the latest building code – contributed to a significant increase in claims frequency and severity.

The roof damage sustained during the storm attracted many roofing contractors, who handed over their exaggerated claims to be pursued by attorneys.

However, a new law passed by the Florida legislature in May 2022 changed the 25% roof replacement rule to exempt roofs built, repaired, or replaced in compliance with the 2007 Florida Building Code, or any subsequent editions of the Florida Building Code.

As the insurance industry would face major challenges if a hurricane like Andrew was to hit Florida again, the best thing that could be done to mitigate losses, according to the report, would be for the risk management industry, the insurance industry and regulators to work together again, similar to post-Andrew.

Insurers need to collect detailed data on their exposures and values and then employ high-resolution modelling alongside all those factors that can affect the ultimate loss, whether from post-event loss amplification or from more resilient construction standards.

Robert Muir-Wood, chief research officer at RMS

To help insurance carriers to remain competitive, regulators and legislators have been working with the industry to prevent claims litigation from getting out of control and potentially threatening the viability of hurricane insurance in Florida.

Legislators also need to keep a close eye on how claims respond to the changes to the 25% roof replacement rule, and in measures that reduce the need for litigation, so as to reduce vexatious claims.

It’s crucial that modelling for hurricane risk takes greater account of the effects of climate change on global warming and sea level rise, and the impact those will ultimately on wind and storm surge in the event of another hurricane like Andrew.

Background information on Hurricane Andrew

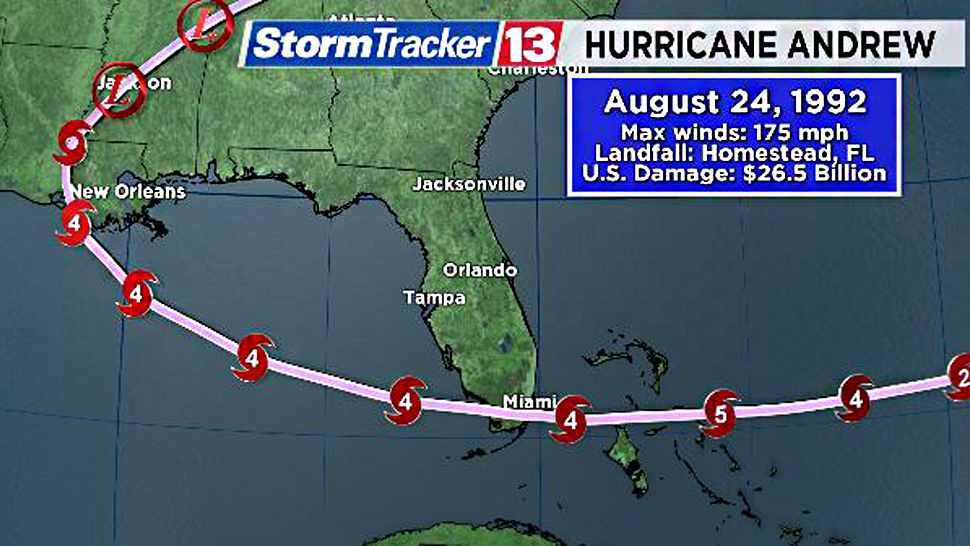

Hurricane Andrew formed August 14, 1992. On August 23, Andrew struck the Bahamas as a Category 5 storm, weakened to Category 4 over land, then regained Category 5 strength in the warm Florida Straits. At 4:40 a.m. on August 24, Andrew slammed into Florida’s Elliot Key and just minutes later made a second landfall, at Homestead Air Force Base, just east of the city of Homestead. The most destructive hurricane to hit Florida since Hurricane Betsy in 1965 and only the third Category 5 hurricane to make U.S. landfall since 1900, Andrew devastated Dade County and caused $15.0 billion (1992 dollars) in insured damage in Florida and an additional $500 million in Louisiana.

A few hours after Florida landfall, Hurricane Andrew entered the Gulf of Mexico, reintensified, and damaged or destroyed nearly 90 offshore platforms en route to a third landfall on August 26, as a Category 3 storm, in south-central Louisiana.

Where did Hurricane Andrew hit Florida?

Andrew made landfall at 4:40 a.m. in Elliott Key, Fla., just south of Miami. It made a second landfall just north of Homestead at 5:05 a.m. The hurricane churned across Miami-Dade County, inflicting significant damage on much of South Florida.

How did Hurricane Andrew affect Florida?

Andrew took 65 lives and cost $27 billion (1992 USD), making it the most expensive hurricane in U.S. history until it was eclipsed by Katrina in 2005. Andrew’s toll in Florida — including more than 60,000 homes destroyed and an additional 100,000 damaged — led to major changes in how structures are built and insured.

Where did Hurricane Andrew hit in Louisiana?

After leaving Florida, Andrew moved into the Gulf of Mexico and made a second landfall near Point Chevreuil, Louisiana, on August 26, 1992, as a Category 3 hurricane with winds of 115 mph and a central pressure of 956 millibars.

What caused most of the damage from Hurricane Andrew?

Almost all the damage in Florida was caused by strong winds. Although effects from Andrew were catastrophic, the extent of damage was limited mainly from Kendall south to Key Largo due to the small wind field of the storm.

How many homes were destroyed in Hurricane Andrew?

In total, Andrew destroyed more than 63,500 houses, damaged more than 124,000 others, caused $27.3 billion in damage (equivalent to $53 billion in 2021), and left 65 people dead.

by Yana Keller

by Yana Keller