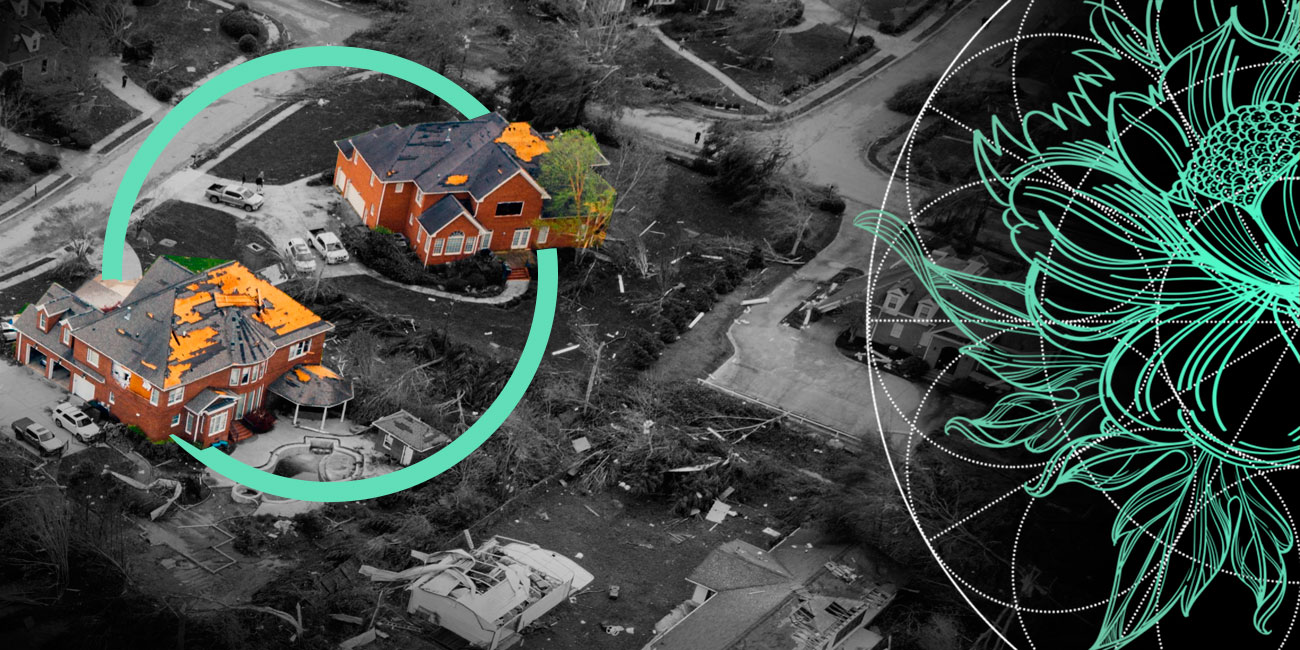

Natural catastrophes will once again break several loss records in 2023. A high number of low-to-medium-severity events will aggregate to insured losses of more than $100 bn in 2023, estimates Swiss Re Institute, with severe thunderstorms (severe convective storms, SCS) being the main contributor. It is the first time ever that severe thunderstorms have caused this level of loss for the industry.

The cumulative effect of frequent, low-loss events, along with increasing property values and repair costs, has a big impact on an insurer’s profitability over a longer period.

The high frequency of severe thunderstorms in 2023 has been an earnings’ test for the primary insurance industry.

Losses from severe thunderstorms have steadily increased by 7% annually in the last 30 years. 2023 marks an increase of almost 90% compared to the previous 5-year average ($32 bn), and more than doubles the previous 10-year average ($27 bn).

Increased losses from severe thunderstorms in the US and in Europe

The US is particularly prone to SCS due to its geographical location. In 2023, the amount of $50 bn insured losses for US SCS activity was exceeded for the first time — and it is set to keep rising.

The US has experienced 18 events year to date which each caused insured losses of USD 1 billion and above.

Similarly, Europe has seen an increase in insured losses from severe thunderstorms: Italy was the most affected in 2023 as was France the year before. Italy experienced losses of more than $3.3 bn, the costliest natural catastrophe-related insured losses ever in Italy.

For the insurance industry, recent events provide robust benchmarks for estimating the increasing loss trends.

Nevertheless, to further progress the deeper understanding of this peril, it is important to get better insights from primary insurers on distributions of insured exposure and detailed claims data.

It is equally important that insurance premiums adequately reflect the risk for the coverage provided especially also in light of increasing loss trends.

Hurricanes, floods, wildfires and earthquakes

While losses from the North Atlantic hurricane season remain below average in 2023 to date, hurricane Otis will likely become the costliest insured event in Mexico according to Swiss Re Institute.

In New Zealand, floods and cyclones caused the costliest weather-related insured losses ever for the country ($2.4 bn), while the wildfires on Maui are estimated to become the costliest insured loss event ever for the state of Hawaii ($3.5 bn).

Urban development, wealth accumulation in disaster-prone areas and inflation are key factors at play, turning extreme weather into ever rising natural catastrophe losses

Rising temperatures are further increasing the risk of severe droughts and wildfires. With 2023 expected to be the warmest year on record, the effects of climate change are becoming apparent.

Global reinsurers will “ultimately be borne” with the insured losses. Insurance losses relating to the series of earthquakes in Turkey and Syria are expected $6 bn, although assessors say it is too early to place a precise figure on the estimated amount.

The death toll has passed 33,000, with the number continuing to rise. Early estimates predict economic losses will pass $10 bn.

Despite reinsurers being expected to cover considerable portions of the losses, Fitch says the amount ceded will hold no implications for the global reinsurance market. The deterioration of economic conditions in Türkiye meaningfully increased the asset and underwriting risks of many (re)insurers.

The earthquake in Turkey and Syria is the costliest natural catastrophe in 2023, while the Morocco earthquake was the strongest earthquake to hit the country since 1900.

The disaster in Morocco also shows that rural areas are not immune to large-scale losses and need to be included in preventative efforts to improve resilience.

Estimated total economic and insured losses in 2023

| USD bn | 2023 | 2022 | Change | 10Y average |

| Economic losses (total) | 269 | 295 | -9% | 235 |

| Nat cat | 260 | 286 | -9% | 223 |

| Man-made | 9 | 9 | -5% | 12 |

| Insured losses (total) | 108 | 141 | -23% | 99 |

| Nat cat | 100 | 133 | -25% | 89 |

| Man-made | 8 | 8 | 9% | 10 |

These catastrophe loss estimates refer to property damage and exclude claims related to COVID-19. Loss estimates are preliminary and are subject to change as not all loss-generating events have been fully assessed yet.

Hailstones the size of tennis balls

Hail frequently occurs in conjunction with thunderstorms. Thunderstorms occur when there is enough warm, moist air that is quickly forced to rise (convection), according Swiss Re report.

Basically, there are three processes that cause the air to rise and the associated cloud formation: warming of the earth’s surface by solar radiation, orographic uplift due to obstacles such as mountains and dynamic ascent at air mass limits.

Single cells create supercell thunderstorms

Generally, we make a distinction between two different types of thunderstorms: single cell or supercell thunderstorms. The former is common but usually short-lived and weak.

If several single cells combine, they give birth to a supercell with more destructive power that can cause large damage.

Supercells are long-lived, have a larger spatial extent and are often accompanied by heavy precipitation, extreme hail, severe downbursts and tornadoes. In Europe, supercells are rare, but important from an insurance perspective.

A flood in the making

The flood event “Bernd” was the most momentous inland flood event in Europe, and globally it is considered one of the most cost-intensive flood events.

Warm and very humid air masses reached Germany from the Mediterranean. A forced uplift and slight congestion effects on the western low mountain ranges occurred regionally at first, spreading later at large scale in the form of recurring or persistent heavy rain.

The subsequent flood event was a complex interplay of many factors and drastic from both a meteorological and insurance point of view.

Natural catastrophes and inflation

A prevailing economic storm was high inflation, which, by raising the nominal value of buildings, motor vehicles and other fixed assets that insurers cover, pushed up claims to cover the cost of repairs.

Hurricane Ian was the costliest event of 2022, resulting in insured losses estimated at $50-65 bn. The storm made landfall in an area of high economic value, urbanisation and population growth, demonstrating the role these factors play as the main drivers of heavy losses inflicted by natural catastrophes.

Rising losses from catastrophes point to the need for full understanding of all risk factors, in particular with respect to secondary perils, which are not always monitored as closely as primary peril risks.

The loss experience offers insights for re/insurers including a need for better monitoring and sharing of granular exposure data; the importance of observation periods and a debiasing of historical losses; and the need for models and underwriting decisions to adjust readily to rapidly changing physical and socio-economic conditions.

Analytics expect hard markets conditions to persist in 2024, based on rising demand for coverage and inflation-driven higher values of insured assets.

On the supply side, a reduction in risk appetite on the part of capital providers has constrained market capacity. Interest rate hikes to fight inflation have also played a role, by increasing the cost of capital and reducing the value of financial assets.

……………………

AUTOR: Jérôme Jean Haegeli – Swiss Re’s Group Chief Economist, Balz Grollimund – Swiss Re’s Head Catastrophe Perils, Rafael Schneider – Swiss Re’s Market Head, Germany Market Units P&C Reinsurance