Q4 has historically been an important time for the Property insurance market, as the peak reinsurance renewal season approaches, and the Atlantic hurricane season runs its course. This Q4 brings with it the additional complexities of persistent inflation, a slow supply chain recovery, and continued property and business interruption valuation concerns, along with geopolitical volatility.

Insurers continue to adapt and respond to the dynamic Property risk landscape by refining their appetite, coverage language, and underwriting practices, and by working to develop approaches and solutions to meet clients’ evolving risk needs, according to Aon’s Global Insurance Market Insights.

Driven largely by inflation, a slow supply chain recovery, and rising labor costs, property and business interruption values have increased materially.

Insurance to value remains a top priority on risk management and underwriting agendas, as underinsurance has proven to lead to longer, more challenging claims adjustment processes and lower than ideal settlement values.

Addressing underinsurance will remain a top priority for insureds and insurers

Insurers have responded by:

- Requiring detailed descriptions of valuation methodologies.

- Imposing coinsurance / valuation limitation clauses / margin clauses where valuations are deemed under-reported or inaccurate.

- Flagging renewals with reported values matching values from the previous year.

To navigate this challenge, Aon recommends to:

- Reassess their valuations (e.g., by engaging professional appraisers), and conduct PML studies.

- Be prepared to explain their values and the methodology used to calculate them.

- Recalibrate their indemnity periods.

- Review Coinsurance and Average Clauses in policies as these present specific risks.

- Consider using proxy exposures that are less susceptible to inflationary impacts.

Geopolitical events triggers underwriting and coverage

Current geopolitical events and civil unrest have had profound and widespread humanitarian and economic impacts – both immediate and long-term.

Businesses may face a loss of revenue from damaged property and inventory, as well as from business interruption from direct or indirect causes

There is also an increased risk of cyber attacks. Due to the widespread nature of these events, insurers have sought to limit their exposure through myriad actions.

Insurers have responded by:

- Clarifying their intent (e.g., further limiting or excluding coverage) related to Strikes Riots and Civil Commotion (SRCC), Terrorism, War, Political Violence, Cyber and Sanctions.

- Adjusting their appetite to limit exposure in affected geographies and excluding affected geographies on existing placements.

- Implementing rigorous underwriting practices related to coverage terms and extensions, loss history,

- Business Interruption redundancy measures, and local political outlooks.

To navigate this challenge, Aon recommends to:

- Review policy language, limits, sub-limits and deductibles related to Cyber, Terrorism, War, Political Violence and Civil Unrest. Look closely at Sanctions Clauses and provisions related to physical loss or damage to property, business interruption and extra expense, as well as Ingress/Egress and Contingent Time Element (CTE).

- Consider purchasing specific coverage for Political Risk, Special Risks, Cyber, War, Terrorism, SRCC, Travel, and Accident and Health.

- Consider Alpha – Aon’s global facility for Terrorism and Political Violence coverage.

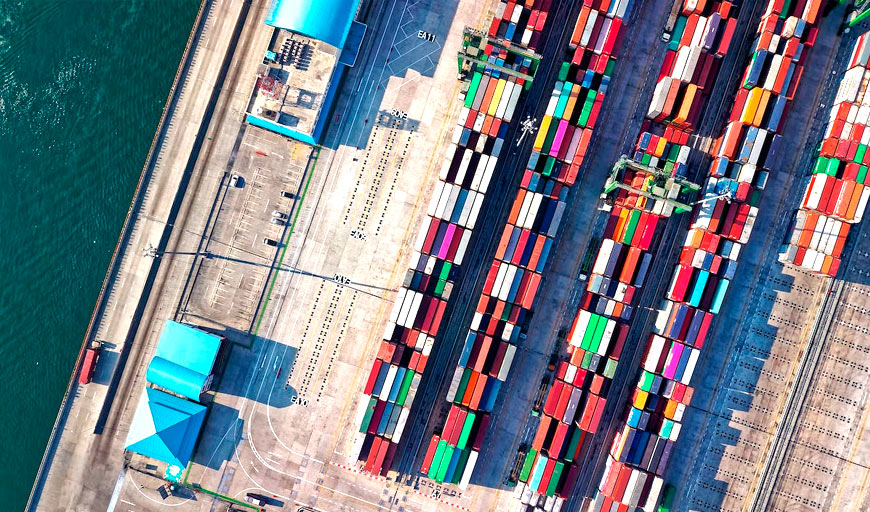

Supply chain risk will continue to impact contingent business interruption coverage

Business interruption insurance (CBI) premiums are tax-deductible as ordinary business expenses, according to Insurance Information Institute report. This type of policy pays out only if the cause of the business income loss is covered in the underlying property/casualty policy. The amount payable is usually based on the past financial records of the business.

In today’s highly interconnected and complex risk environment, supply chain risk from a supplier location and its potential to disrupt business is a major concern among business leaders and risk managers.

The aggregation of business risk can be difficult to quantify resulting in poor visibility into risk severity.

Lack of information on the supplier’s facility attributes and protection leads to information gaps in the underwriting of the contingent business interruption risk.

Insurers have responded by:

- Limiting CBI coverage at supplier locations due to lack of supply chain visibility and low confidence in their ability to quantify the exposure.

- Requiring detailed property underwriting information related to named suppliers / customers.

To navigate this challenge, Aon recommends that clients work with their Aon team to:

- Map their supply chain to understand the revenue dependency on supplier locations.

- Conduct a business interruption impact assessment for critical suppliers to quantify the exposure to the company from a loss at a supplier facility.

- Select critical supplier locations for property loss prevention risk assessments. The construction, occupancy, protection, and exposures (COPE) information detailed in the report will provide the underwriter with information needed to underwrite the CBI risk.

Global reinsurance capital rebounded but Nat Cat pricing remains elevated

The reinsurance market capital increase in 2023 was principally driven by retained earnings, recovering asset values and new inflows to the cat bond market.

Reinsurers’ underwriting and operating returns have improved year-to-date due to increased insurer rates and portfolio retentions, tighter peril scope in terms/ conditions and improved investment income.

As economic inflation cools, reinsurers are shifting focus to social inflation that can impact high value claims costs and reserving implications for insurers.

(Re)Insurers have responded by:

- Maintaining a highly disciplined and rigorous Nat Cat underwriting approach.

- Offering additional supply based on a flight to quality and more name brands during June/July 2023 renewals.

- Acting cautious, but responsive, to insurer needs for frequency coverage as we enter 2024 renewals.

To navigate this challenge, Aon recommends to:

- Consider alternative capital solutions such as the catastrophe bond market.

- Differentiate your portfolio with a custom view of risk and strong data to be prepared to challenge reinsurers’ broad assumptions.

- Directly address reinsurers’ concerns on the impact of inflation on your portfolio and loss experience.

- Use market data to guide placement decisions in the quickly evolving market.

- Measure and quantify rating agency impact of program/structure changes on Best’s Capital Adequacy Ratio (BCAR) during the placement.

……………….

AUTHORS: Cynthia Beveridge – Global Chief Broking Officer Aon, Neil Harrison – Global Chief Claims Officer Aon, Rhonda Jenn – Global Colleague Analytics Leader Aon, Joe Peiser – Chief Executive Officer Commercial Risk Solutions Aon