Insured losses from major natural catastrophes in the second quarter of 2023 are estimated to be less than $10 bn.

According to JP Morgan, this includes $7 bn from the US storms during the month of June, which analysts estimate to be the largest contributor to natural catastrophe losses for the quarter.

JP Morgan has revealed its total natural catastrophe insured losses estimates for H1 2023 to be $23bn, including $15bn from Q1 2023.

This looks to be around the same level as H1 2022 and lighter than the historical average for the industry (see Natural Catastrophes Drivers and Lessons for Insurance Industry).

Total natural catastrophe losses

At the end of the Q2, JP Morgan estimate total natural catastrophe losses to be $10bn or less, with total losses at 1H 2023 being at similar levels to those seen in 1H 2022.

As Gallagher Re has also stated, the total cost to the insurance industry from severe convective storms in the US has likely surpassed $25bn year-to-date.

Flooding in Europe during May is estimated to contribute $300-500 million to insured losses and revised estimates from Cyclone Gabrielle expected losses of $200 mn).

The experience in 2Q 2023 will likely lead to some level of earnings upgrades seen for 2023 or for some of the reinsurers to add to their buffers in reserves whilst maintaining earnings guidance (see Global Insured Losses from Natural Catastrophes: Perspective & Trends).

The major events in the quarter were the storms in the US in June, for which insured losses are expected to cost between $5.5 bn and $10 bn, along with deterioration from Cyclone Gabrielle and floods seen in Europe.

Compared to historical averages, analysts explained, $10 bn of nat cat claims or less are likely to be below recent history and should also be lower than nat cat budgets, with losses on an annual basis expected to exceed $120 bn by catastrophe-modelling firm Verisk.

Taking all these into account, JP Morgan still expects hard market conditions to last into 2024 at this stage (see Global Natural Catastrophe & Hazard Review).

Despite a relatively good first half of 2023 for reinsurers based on top down nat cat losses, JP Morgan do not expect that this will cause any threat to the strong levels of pricing achieved in 2023 to date fading.

Global insured catastrophe losses more than 87% above the 10-year average

Global insured catastrophe losses are running 101% higher than the long-term average (2010-2023) and more than 87% above the 10-year average, as Hurricane Ida adds an estimated $%32.2 bn, according to Jefferies.

Excluding Ida, analysis shows that year-to-date losses are coming in 15% above the long-term average and 7% above the 10-year average.

Jefferies reported that insured losses from catastrophes were running 41% above the long-term average, or 36% higher than the 10-year average.

Ida did occur and brought devastation to Louisiana and surrounding areas before dumping record levels of rainfall in the northeast, with severe flooding hitting New York and New Jersey.

Year-to-date losses in 2023 are already higher than in full-year 2018, 2019, and 2020-2022, but remains below the level of losses seen in 2005, 2011, and 2017.

Analysts warned last month that above-average catastrophe losses were pressuring cat budgets for some carriers. With Ida estimated to have driven industry losses of more than $30 bn, Jefferies expects that reinsurance deductibles will be exceeded, resulting in a higher proportion of net losses falling on reinsurers.

Losses to private and public insurance entities

Analysts from Aon’s Impact Forecasting division have estimated global losses to private and public insurance entities in Q1 of 2023 at $15 bn, while total economic losses are expected to reach at least $63 bn.

According to the analysts, the $15 bn insured loss estimate is close to the average and median of the last 10 years. However, they suggest that potential loss development is likely to increase the total further.

While insured losses in the first quarter of 2021 were largely driven by the historic winter weather event in North America and a Fukushima earthquake in Japan, the beginning of 2023 saw costly windstorms in Europe, the costliest Australian disaster on record, as well as another earthquake in Fukushima.

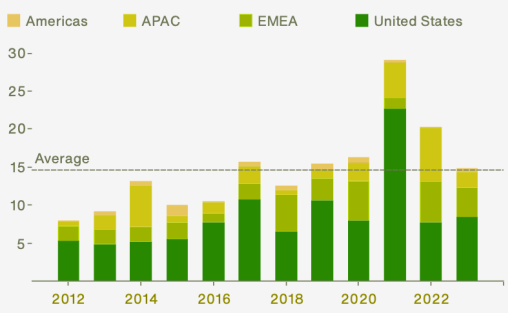

Global Insured Losses by regions

$ bn

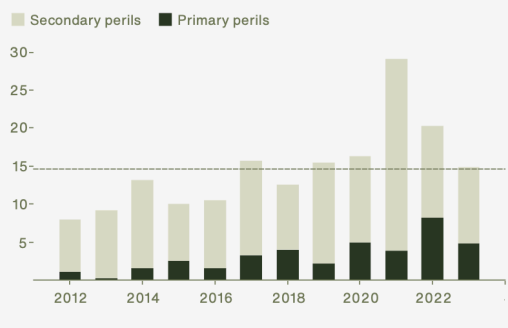

The picture was different in 2023, as severe convective storms in the United States were the primary driver ($5.4 bn). A large part of losses was also attributed to the earthquake peril at approximately $3.5 bn.

Global Insured Losses by perils

$ bn

58% of the insured losses were generated by events in the US, while Europe, Middle East and Africa (EMEA) accounted for 25%.

Meanwhile, the Q1 2023 $63 billion total economic loss forecast is well above the average when compared to the 21st Century baseline ($53 bn) and significantly higher than the median ($38 bn).

Aon states that economic losses were dominated by the impact of the earthquake in Türkiye and Syria, which comprised more than half of total losses ($39.1 bn). It was the costliest Q1 in EMEA since at least 1990, when windstorms hit Europe and a deadly tremor impacted Iran.

Q2 2023 was also by far the deadliest since 2010, when a destructive earthquake in Haiti resulted in approximately 160,000 fatalities.

Based on conversations whilst marketing in recent weeks, we believe that there is a level of nervousness that capital is coming back to the reinsurance industry and that this will lead to pricing rolling over in 2024.

Whilst there has been a strong level of Catastrophe Bond issuance YTD, JP Morgan do not see this disrupting the reinsurance market and new capital issued by other market participants does not seem to be substantial at this stage.

U.S. Severe thunderstorm losses

Severe thunderstorm activity from June 11-15 brought strong straight-line winds, record-sized hail, and tornadoes, causing substantial damage to property across the United States. Wind speeds in excess of 100 mph and hail greater than four inches in diameter were recorded in Denton County, Texas.

CoreLogic estimates that the straight-line winds and hail from June 11-15 caused between $7 and $10 billion in insured losses.

This loss estimate encompasses hail damage and straight-wind damage and was enabled by CoreLogic’s weather monitoring technology, which allows for comprehensive tracking of all losses from severe convective storm events.

This loss estimate includes damage to residential, commercial, and industrial property, as well as automobiles. The estimate also excludes damage to infrastructure such as roads, utilities, and governmental facilities. Hail alone is estimated to make up 95% of losses from this event, making it one of the biggest hail losses in history.

Edited & Fact checked by