The January 2023 renewal marks a turning point for the reinsurance market, signaling a new reality for buyers. It was the most challenging January 1 renewal in a generation as the reinsurance market underwent a fundamental shift in pricing and risk appetite, especially for property catastrophe risk, according to AON.

Following 6 years of underwhelming returns and above average catastrophe losses (capped by Hurricane Ian in late September of 2022), the market had started to experience firming in 2022.

Different from prior market cycles, there were a number of exogenous factors including forty-year record inflation, unrealized investment losses driven by a precipitous rise in interest rates, dramatic foreign exchange moves, climate change driving evolving investor sentiment, and a war in Europe, the reinsurance market took action to put itself back on an even keel (see Global Natural Catastrophe Insight).

Pricing for U.S. property catastrophe and global property retrocessional business hit multi-decade highs at January 1. Reinsurers moved away from frequency layers and sought to redraw the scope of property catastrophe protection with narrower coverage definitions and more excluded perils. Insurers were challenged in navigating these changes, especially those that have not ceded losses and were not in peak zones, concerned that reinsurers were treating all buyers in the same way (see Top Trends 2023 Global Reinsurance).

Pragmatic Outcome to a Turbulent Reinsurance Renewal

The January 1 renewal process was strained with quoting delays (driven at least in part by dislocation in the property retro market) and a broad divergence in terms and conditions requested by reinsurers. Despite headwinds, however, clients were able to purchase the reinsurance protection they need, securing core coverages albeit at significantly higher rates and retentions.

While capacity was constrained, fears of a major capacity crunch in the wake of Hurricane Ian were not realized.

Insurers responded to market dynamics by adjusting increased retentions and scaled back demand for additional limit, while improved pricing helped free up additional reinsurance capacity as the renewal progressed.

Reinsurers that communicated their position early in the renewal process, provided collaborative and workable solutions and maintained midyear capacity commitments were the most successful at January 1 and are now better positioned to capitalize on growth opportunities going forward.

Lessons of a Hard Market and Future Capital Flows

‘Hard markets’ are fundamentally characterized by the inability to purchase desired levels of capacity. Successfully navigating such a market requires preparation and high-quality data.

At January 1, insurers that went to the market early with a well informed and proactive strategy were best positioned to secure capacity.

Portfolio differentiation and client advocacy were also critical in a market where challenging reinsurers’ broad assumptions can make a big difference to client outcomes.

Clients that were able to leverage strong relationships and clearly demonstrate how they have mitigated the impact of inflation on exposures were able to access more favorable terms and capacity.

According to Global Reinsurance Market 2023, meaningful new capital did not enter the market in advance of January 1. In late December, we saw encouraging signs that reinsurers were looking to take advantage of improved conditions, although the capacity entering the market at January 1 fell well short of withdrawals earlier in the year. New capital may flow into the reinsurance market in the first quarter attracted by the certainty of returns and improved underwriting conditions that were established at the renewal.

Capital entering the reinsurance market in 2023 will be rewarded by strong demand and attractive terms. We believe many clients will reevaluate their retained volatility in the first quarter and several may consider additional reinsurance purchases.

Reinsurance Capital Optimization is More Important than Ever

Reinsurance remains an accretive source of capital for insurers when compared with debt and equity. However, the re-setting of the reinsurance market at January 1 has important implications for insurers’ capital management and balance sheet protection (see Top 10 Global Economic & Insured Loss Events).

As the reinsurance market puts itself on more of a sustainable footing, traditional reinsurance is returning to its core role of protecting capital, which will potentially increase earnings volatility for insurers.

Clients have many tools at their disposal to optimize capital efficiency and retained volatility.

List of key considerations for a successful renewal upon which we have expanded below given lessons learned at January 1, 2023:

- Consider alternative capital for optimal placement results

- Discuss integrated placements across property and casualty leveraging a diversified portfolio

- Access a new facultative facility for capacity for terrorism exclusions from property cat covers

- Leverage strategic consulting and data analytics to refine risk appetite, adjust investment and underwriting strategies, or review business lines, as well as differentiate your portfolio at renewals

- Explore structured reinsurance covers and legacy reinsurance solutions to manage volatility and free up capital to absorb higher retention levels and/or support growth opportunities

- Articulate clearly how you underwrite for inflation and its impacts on your risk profile

- Develop a custom view of risk to de-risk and reduce exposure concentrations, as well as to improve understanding of secondary perils and emerging risks

- Understand your true cost of capital, including volatility of returns, which is critical to optimizing the long-term return on capital

- Partner with a true client advocate that can provide advice and analytics to ensure your portfolio is best positioned across capital providers to achieve your capital optimization goals

The industry faces a moment of truth. The January 2023 renewal season was buffeted by a confluence of events many of which are macroeconomic and geopolitical, existing outside of the loss experience that typically drives changes in reinsurance market terms and conditions.

Joe Monaghan, Global Growth Leader Reinsurance Solutions, Aon

Many of these variables remain and will be part of our industry’s landscape for the foreseeable future. This tumult comes on the heels of a global pandemic and war in Europe. Risk premiums have increased across asset classes globally. Uncertainty seems to be the order of the day.

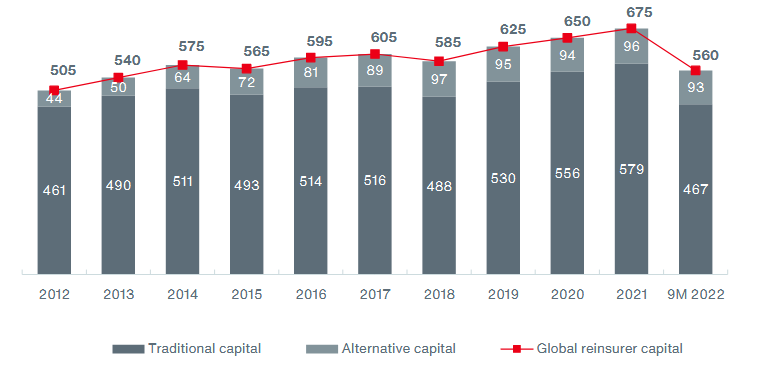

Global Reinsurer Capital: Reduced Asset Prices Erode Reported Book Values

Aon estimates that global reinsurer capital declined by 17%, or $115 billion, to $560 billion over the nine months to September 30, 2022. The reduction was principally driven by substantial unrealized losses on investment portfolios (see How Global Reinsurance Market Endured a 2023 Renewals?).

Global Reinsurer Capital ($ billions)

Traditional Capital: Accounting Mismatches Drive Volatility

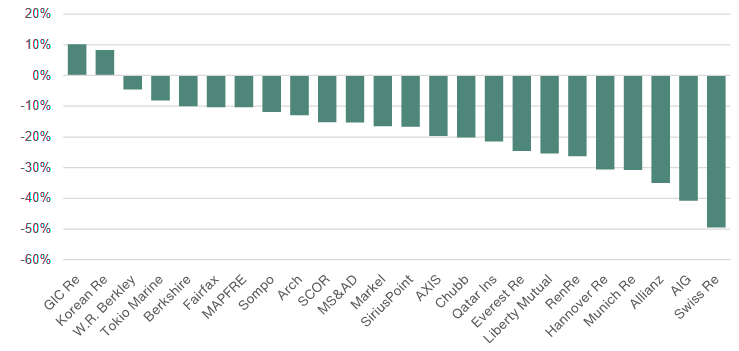

Reported equity levels were down across the industry in the first nine months of 2022, with some of the world’s largest insurance and reinsurance groups showing the most significant declines (see Catastrophe Bond & ILS Market Review).

Underwriting results were generally resilient in the period, despite the impact of Hurricane Ian, but investment portfolios were impacted by material unrealized losses, driven by rising bond yields, widening credit spreads and declining equity markets. These effects undermined overall earnings and eroded reported book values.

Reinsurer management teams pointed to mismatches in the major accounting regimes that were driving volatility in reported equity.

Mark-to-market losses are being immediately recognized on the asset side, while there is little to no offset on the liability side to reflect the long-term benefits of higher interest rates. In addition, bonds are generally held to maturity and recover value as that date approaches.

2022 Changes in Total Equity (Original Reporting Currencies)

Risk-based regulatory and rating agency capital models tend to take a more economic view, which explains why regulatory solvency ratios and financial strength ratings have so far been resilient, despite the reductions in reported equity. That said, sensitivities to major losses and recessionary risks are likely to have increased, while debt leverage tolerances are being tested in some cases (see Global Insurer’s Structured Securities Investments).

New capital formation is currently limited, reflecting significant uncertainties in what has become a very challenging risk environment.

Investors are particularly concerned about the impact of climate change and inflation, but there are expectations that the prospect of higher returns will drive new allocations going forward, particularly as the benefit of higher pricing and interest rates becomes visible in earnings.

Reinsurer Results

Most reinsurers continued to report strong property and casualty (P&C) premium growth in the first nine months of 2022. Underwriting results are benefiting from compounding rate increases and the move to more restrictive coverage terms seen in recent years.

Major loss activity is continuing at elevated levels, the most notable event in the period being Hurricane Ian at the end of September. The net combined ratio across the 17 ARA companies that reported was 98.2 percent.

The ordinary investment yield was down again in 2022. Higher interest rates will be very positive for future earnings, but existing bonds typically need to mature before higher yielding instruments can be purchased, creating a lag in reported results. Total investment returns were heavily impacted by market volatility and, as a result, the aggregate return on equity was -0.6 percent for the ARA companies (Average Losses of Higher-Risk Focused ILS Funds Increased After Hurricane Ian).

Reinsurer valuations were under pressure in the first half of 2022 but moved sharply higher in the final quarter of the year. The prospect of better returns has benefitted share prices since Hurricane Ian and these increases are being set against some significant reductions in book value.

Reinsurance Sector* Performance

Reinsurers have generally performed poorly since 2017. Over the six-year period to the end of 2022, the ARA has reported an average combined ratio of around 101 percent and an average return on equity of just under 5 percent. This is one of the driving forces behind current underwriting discipline.

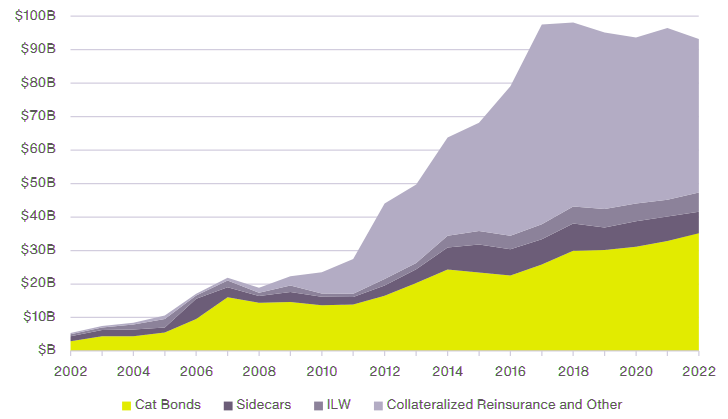

Alternative Capital: Poised for Strong Market Growth from Attractive Returns

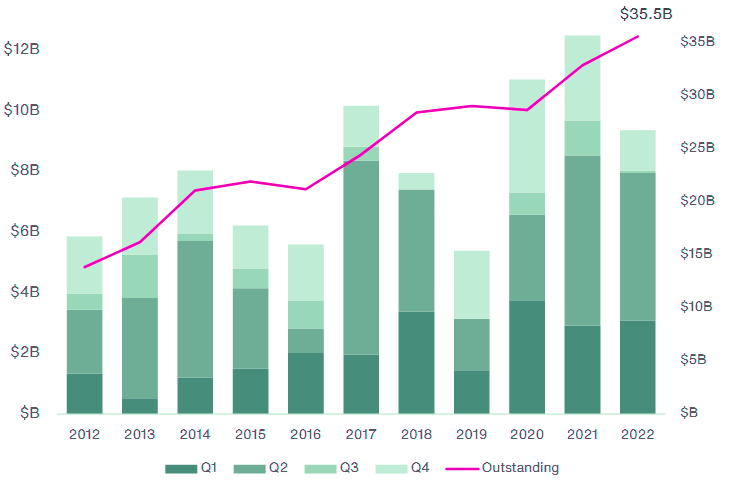

The 2022 property catastrophe bond (cat bond) market was supported by new and repeat insurance and reinsurance sponsors and maintained an orderly manner despite the macroeconomic headwinds facing the market, Hurricane Ian, the war in Ukraine, inflationary concerns and rising interest rates (see Global Insurance-Linked Securities Market Outlook).

The market grew year-over-year (as measured by limit outstanding); issuances outpaced maturities by $2.2 billion, or roughly 7 percent, consistent with the growth seen in 2021.

We observed a supply-demand imbalance for cat bond capacity, as more insurers and reinsurers sought to tap the cat bond market to mitigate challenging traditional reinsurance and retrocession renewal seasons. This, along with increased catastrophe activity over the past five years, has pushed the bond market into a higher total return environment, with material increases in overall pricing, accompanied by higher collateral returns.

AON anticipate Insurance-Linked Securities (ILS) investors to take advantage of attractive returns and diversification opportunities presented by the ILS market in 2023, driving further growth and delivering valuable capacity for re/insurers.

Gross committed assets in ILS declined by an estimated 3% in 2022; the combination of Hurricane Ian and redemptions throughout the year put a strain on existing investor capital, while inflows were constrained partly due to macroeconomic factors and concerns around the severity of Hurricane Ian in the fourth quarter. The estimated allocation across various product types is shown below.

Alternative Capital Deployment (Limit in $ billions)

Resiliency of the Market

Relative to collateralized reinsurance, ILWs and sidecars, we observed investor preference for cat bonds, as the liquidity and structure of the instrument continues to be favored, resulting in an increase in capital allocated to the cat bond market, overall.

Cat bond issuance during the first half of 2022 was robust with 8 percent growth in overall bonds outstanding. However, Hurricane Ian, which occurred in late September, slowed down the issuance of further deals and those that came to market typically received smaller overall sizing.

Post-Ian, average transaction sizes roughly halved from $232 million to $116 million as investors, which had limited capacity, looked to maintain relationships and reward repeat sponsors that came to market. That said, the amount of cat bonds outstanding gained slightly throughout the fourth quarter and the first week of January as investors managed to reallocate maturities into new issuances.

Property Catastrophe Bonds Issued and Outstanding

The sidecar market continued to be constrained by several factors, notably, concerns around coverage written, portfolio composition and general global loss experience. While reserves for COVID-19 losses have largely settled across the industry, uncertainty remained for unmodeled losses in (re)insurance portfolios.

As a result, investors have become more stringent in their selection of ceded sidecar risk; investors prioritized structures and portfolios with profitable track records, regular and transparent reporting and more favorable terms and conditions, e.g., ceding and profit commissions.

Hurricane Ian

Following Hurricane Ian, ILS investors paused to understand their exposures to – and valuations of – their portfolios, resulting in a number of deals being subsequently delayed. As one of the largest loss events to hit the (re)insurance industry in the 25-year history of the cat bond market, Hurricane Ian is expected to result in roughly $400 million of losses for cat bond investors (assuming overall loss reserves and the industry estimates increase during 2023).

While a manageable loss for the $36 billion market, Hurricane Ian put a significant dent in the earnings of ILS funds in 2022.

It is likely that much of the losses can be attributed to mark-to-market movements as opposed to principal reductions. Such losses are likely to be recouped as bonds ultimately revert to par at maturity (assuming no further losses or significant adverse development of Hurricane Ian reserves).

The hurricane, the fourth most powerful storm to hit Florida since records began in 1851, positively affected ILS funds’ ability to raise capital to meet increased demand, appreciate the immediate price widening and take advantage of the opportunities presented by challenging conditions in the traditional reinsurance market.

Investors’ concerns for climate change, catastrophe risk modeling and loss development have impacted the risk-return profile of ILS (i.e., increased margins), particularly when considering the challenging investment environment experienced in 2022 with respect to inflation, higher interest rates and considerable movements in foreign currencies.

As time has passed since Hurricane Ian made landfall and investors have gained a better understanding of their losses and capital positions, we have observed a return to larger issuance sizes, relative to the immediate aftermath of the event.

Risk Spreads and Capital

Margins in ILS have increased significantly during 2022. Some of the increased margins observed in 2022 are directly attributable to Hurricane Ian and the material rise in collateral yields. Conversely, global equity, fixed income and credit markets struggled during 2022 and investors benefited from the lack of correlation between ILS and other asset classes.

From an ILS sponsors’ perspective, the increasing prices seen in traditional reinsurance and retrocession markets is increasing the demand for ILS capacity.

We are now in a market where demand for ILS capacity exceeds supply, and while this has resulted in higher overall pricing and tighter terms and conditions, regular sponsors of cat bonds and other ILS products have been appreciative for this alternative source of capital, having developed stronger relationships with ILS investors.

Market Outlook

ILS capital has become an essential source of capacity for insurers, and an important component of reinsurance purchasing strategy. We expect demand for all forms of alternative capital to remain elevated throughout 2023 as insurers and reinsurers look to mitigate both macro-economic and reinsurance market challenges.

Historically, higher margins and the diversification of the asset class, relative to the broader financial markets, has resulted in meaningful market growth and could be a net positive for new and existing sponsors.

This is likely to occur once the markets better understand Ian loss development, inflationary trends, interest rates and the overall geopolitical uncertainties that have pervaded the broader financial markets in 2022.

The overall theme remains that diversification is playing out well compared to prior ‘bull run’ of the broader financial markets. The investment case for ILS remains strong, and will be further bolstered by reinsurance and retrocessional rate increases sustained at year-end 2022.

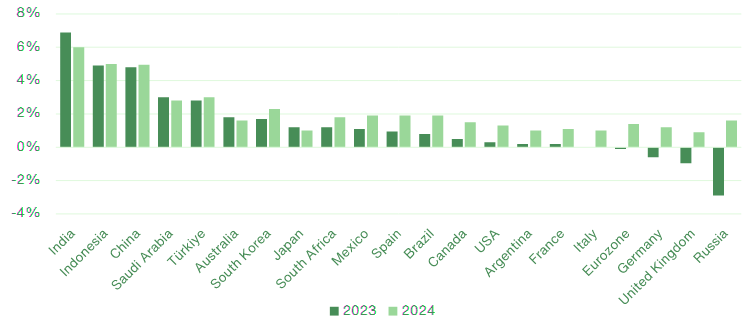

Forecasted Real GDP Growth for the G20

To tame inflation, central banks have been raising interest rates. The US Fed raised its benchmark policy rate on seven occasions in 2022, ending the year at 4.25-4.5 percent, the highest level in 15 years.

The European Central Bank hiked its main lending rate from 0 percent to 2.5 percent, in the second half of the year, and expects to raise rates again this year.

………………

AUTHORS: Mike Van Slooten – Head of Business Intelligence for Aon’s Reinsurance Solutions division, Richard Pennay – CEO of Insurance-Linked Securities for Aon Securities