According to Artemis Cat Bond & ILS Market Report, catastrophe bond and related insurance-linked securities in Q4 2022 issuance fell when compared with the prior year quarter, but remained robust at $1.6 bn, helping the outstanding market hit a year-end high of $37.9 bn.

Higher-risk focused ILS fund strategies appear to be averaging losses around the 17% mark after hurricane Ian.

There is a particularly wide dispersion of losses, as indicated by disclosures seen to date and side-pockets set, with a range of 3% to around 30% seen by Artemis.

For Q4 2022 specifically, the average multiple of cat bond issuance was 4.93, which is the highest multiple seen in a single quarter since Q1 2013. Throughout 2022, the average multiple has increased for each quarter when compared with the prior, which shows the strong pricing achieved by investors, notably after Hurricane Ian.

Transaction Recap

Fresh capital will enter the insurance-linked securities (ILS) market, but while catastrophe bond deals successfully closed for year-end, others failed to complete, suggesting there’s no rush to enter the space.

In Q4 saw 15 transactions come to market mostly from repeat sponsors, with GeoVera Insurance Holdings and PICC Property and Casualty Company being the only debut sponsors to feature in the period.

Alongside 10 property catastrophe risk 144a transactions, quarterly issuance included four privately placed deals, and one deal covering other, non-catastrophe risk.

In terms of issuance by month, the fourth quarter of 2022 was a typical one, with the majority of new risk capital coming to market in December, with October being the least active month of the period. However, issuance in each month did come in below the respective ten-year average, as shown by the Artemis Deal Directory.

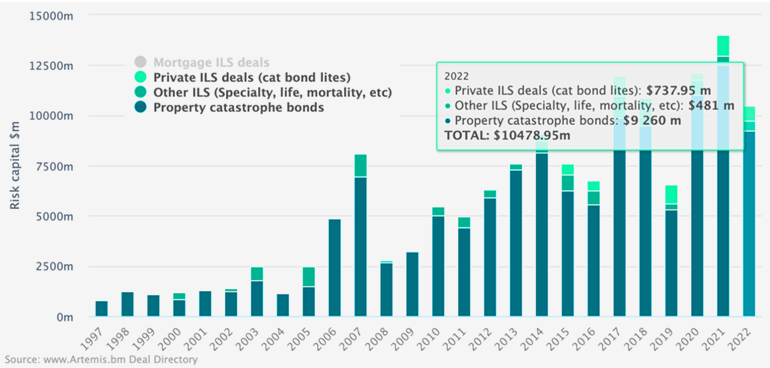

For both Q4 and full-year 2022 issuance fell when compared with the prior year, hitting $1.6 bn for the quarter and $10.5 bn for the year. Despite the dip from 2021, full-year 2022 issuance still came in above the ten-year average for the sector, and has now exceeded the $10 bn mark for the past three years.

Catastrophe Bond & ILS risk capital issued by type & year

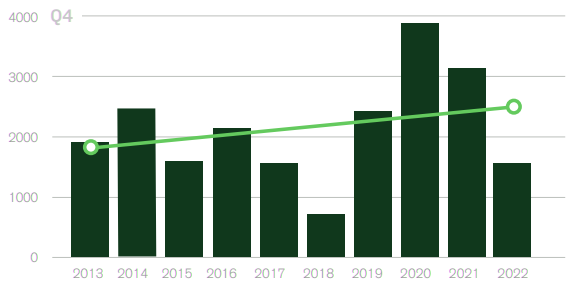

Q4 ILS issuance by year ($ mn)

When compared with the prior year period, catastrophe bond and ILS issuance fell by more than $1.5 billion in Q4 2022 to $1.6 billion, which is also roughly $560 million below the ten-year average for the quarter, as shown by the Artemis Deal Directory. However, the solid level of new risk capital brought to market means that for all but one of the last ten years (2018), Q4 issuance has exceeded the $1.5 billion threshold.

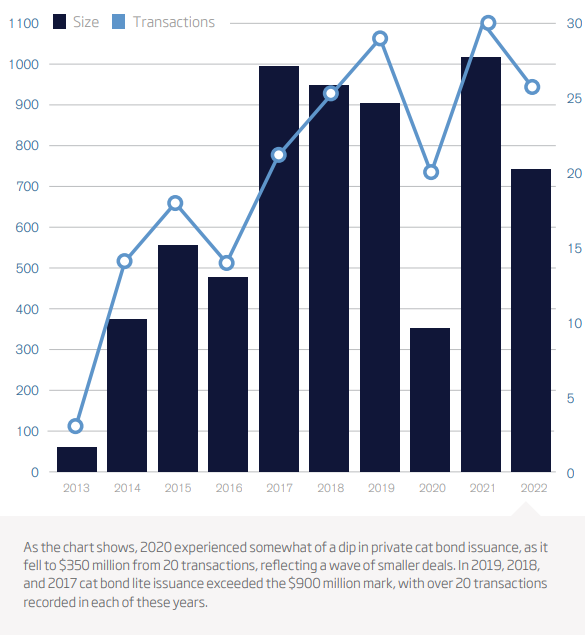

ILS average transaction size & number of transactions by year ($ mn)

Despite issuance volume falling year-on-year, the 15 transactions issued in the fourth quarter is slightly above the average for the quarter, although significantly lower than the 24 issued in Q4 2021.

At the same time, at approximately $105 million, the average size of deals issued in the quarter is also down on last year, and well-below the ten-year average of $185 million.

Q4 issuance by month & year ($M)

December was the strongest month of the quarter, both in terms of the number of deals, which hit 12, and the volume of risk capital issued from these transactions, which amounted to almost $1.2 billion.

In November, just three deals came to market, bringing a combined $425 million of risk capital to market. For the third time in the past decade, no deals were issued in the month of October.

Private ILS issuance by year

During the past 12 months, the Artemis Deal Directory recorded 26 privately placed, or cat bond lite transactions, amounting to nearly $738 million of annual issuance.

Artemis’ data shows that this is above the ten-year average in terms of size, which is $642 million, and also above the average number of transactions over the past decade, which stands at 20.

However, 2022 cat bond lite issuance failed to keep pace with the previous year, which was a record for the sub-sector, when 30 transactions brought more than $1 billion of annual cat bond lite issuance for the very first time.

In Q4, the large majority, 88% or $1.37 bn, provided cedants with protection against a range of catastrophe risks across numerous geographies.

For the full-year, cat risk deals accounted for almost $9.3 bn, or 79% of total risk capital issued.

The roughly $10.5 bn of issuance in 2022 took the outstanding market size, at the end of the year, to $37.9 bn, which represents growth of more than $2 bn from the end of 2021.

Investors pushed for higher pricing on the back of consecutive loss years and financial market volatility, resulting in the spread above expected loss reaching its highest point in a decade, while the average multiple also rose.

……………….

AUTHOR: Artemis // FULL Artemis’ Report Q4 2022 Cat Bond & ILS Market

All catastrophe bond and ILS issuance data sourced from the Artemis Deal Directory.