Insurance companies continued to follow a years-long trend by increasing their structured securities investments, with 3% growth year over year to $1.14 trillion. CLO holdings are concentrated in larger insurers with a greater capacity for rigorous due diligence and extensive research on the underlying collateral pool.

According to AM Best report “Insurers’ Structured Securities Holdings Continue to Rise”, indications portray an uncertain picture for 2022 as issuances have dropped significantly.

Insurers’ allocations to structured securities

Despite the overall increase in holdings, insurers’ allocations to structured securities have shifted somewhat. Residential mortgage-backed securities still represent the largest allocation among structured securities despite insurers pulling back holdings by more than 30% since 2011.

At the same time, commercial mortgage-backed securities have increased by 46% during the same timeframe and other asset-backed securities, which include collateralized loan obligations (CLO), have more than doubled (see about Investors in Insurance-Linked Securities (ILS)).

Insurers have been investing more heavily in CLOs is the search for better yields on their portfolios, although the quality of CLOs is lower than that of the popular mortgage-backed securities, when viewed by NAIC ratings.

In the past few years, other asset-backed securities, including CLOs, have made up a much greater proportion of other-than-temporary-impairments, rising to 27.3% in 2021 from 10.7% in 2019, and may continue to rise if concerns about pressure on the underlying collateral are realized

Helen Andersen, industry analyst, AM Best.

However, CLO issuance saw a drastic decline in 2021, and holdings are concentrated in larger insurers with the capacity for more rigorous due diligence and extensive research on the underlying collateral pool.

CLOs’ floating interest rates can be an advantage

As demand rises in the rising rate environment, the issuance of structured securities has seen a stark drop through October 2022, according to published reports, with credit cards being the only asset-backed security to see growth.

CLOs’ floating interest rates can be an advantage in a rising interest rate environment, although they also can increase risk on the underlying pool of borrowers.

Most structured securities are held by the life/annuity industry, at more than $800 billion in 2021. These securities have consistently made up a little less than a third of the bonds held by life/annuity companies the last decade.

The property/casualty insurance industry has been investing more heavily in structured securities the last few years, with its share of the industry’s bond holdings increasing to just under 30% in 2021.

Health insurers hold the smallest dollar amount of structured securities, but the holdings represent the highest percentage of their total bonds (see about Cyber Insurance Linked Securities).

Structured securities can provide bond portfolio diversification, and AM Best views allocations to various types of structured securities as it would many other traditional asset classes.

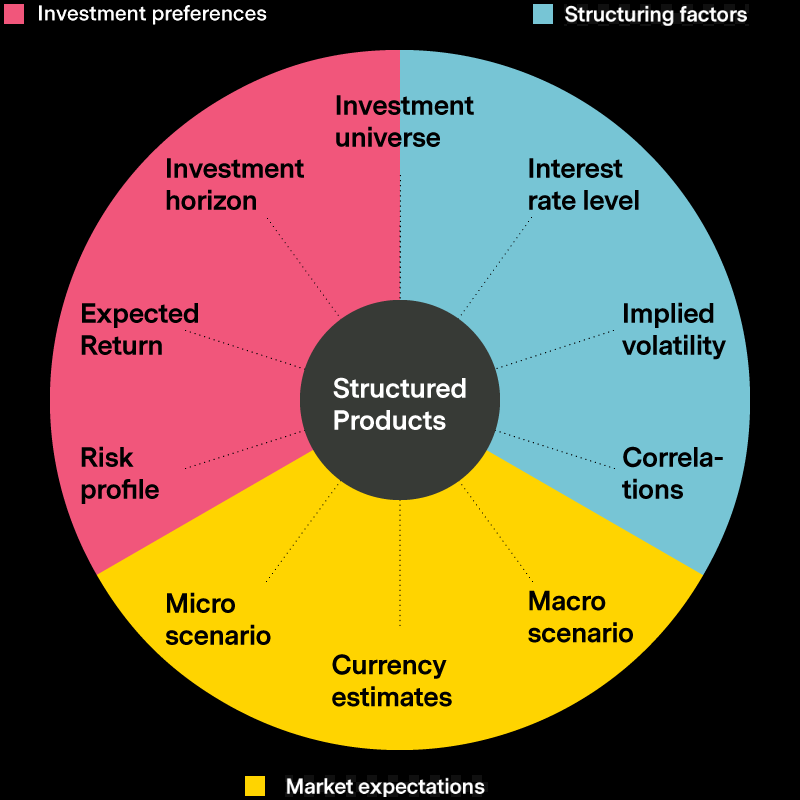

What Is a Structured Investment Products (SIPs)?

Structured investment products, or SIPs, are types of investments that meet specific investor needs with a customized product mix.

SIPs typically include the use of derivatives. They are often created by investment banks for hedge funds, organizations, or the retail client mass market.

- Structured products are created by investment banks and often combine two or more assets, and sometimes multiple asset classes, to create a product that pays out based on the performance of those underlying assets.

- Structured products vary in complexity from simple to highly complex.

- Fees are sometimes hidden in the payouts and fine print, which means an investor doesn’t always know exactly how much they are paying for the product, and whether they could create it cheaper on their own.

SIPs are distinct from a systematic investment plan (SIP), in which investors make regular and equal payments into a mutual fund, trading account, or retirement account in order to benefit from the long-term advantages of dollar-cost averaging (see How High Inflation Impacts to Insurers Balance Sheets?).

Understanding Structured Investments

A structured investment can vary in its scope and complexity, often depending on the risk tolerance of the investor. SIPs typically involve exposure to fixed income markets and derivatives.

A structured investment often starts with a traditional security, such as a conventional investment grade bond or a certificate of deposit (CD), and replaces the usual payment features with non-traditional payoffs, derived not from the issuer’s own cash flow, but from the performance of one or more underlying assets.

A simple example of a structured product is a $1000 CD that expires in three years. It doesn’t offer traditional interest payments, but instead, the yearly interest payment is based on the performance of the Nasdaq 100 stock index.

If the index rises the investor earns a portion of the gain. If the index falls, the investor still receives their $1000 back after three years. This type of product is a combination of a fixed income CD a long-term call option on the Nasdaq 100 index.

The Securities and Exchange Commission (SEC) began scrutinizing structured notes in 2018, due to widespread criticism over their excessive fees and lack of transparency.

As an example, in 2018, Wells Fargo Advisors LLC agreed to pay $4 million and return ill-gotten-gains to settle SEC charges after it was found that company representatives actively encouraged people to buy and sell one of their structured products which was supposed to be bought and held till maturity. This churning of trades created big commissions for the bank and reduced investor returns.

……………………………

AUTHOR: Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media