Overview

The convergence of geopolitical and macroeconomic shocks – war in Europe, fractured energy markets, 40-year high inflation, interest rate hikes, depleted capital – as well as the second most expensive natural disaster ever (Hurricane Ian), has introduced significant volatility into the market.

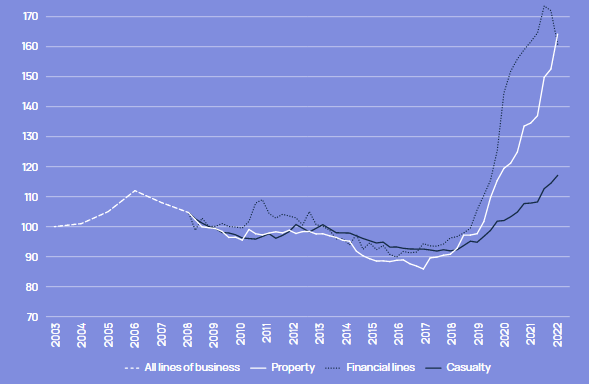

According to re/insurance broker Howden Report, divergent rate momentum by class of business had been the recent norm as individual mini-cycles responded with varying levels of sensitivity to losses and broader macroeconomic factors.

Unlocking capital in order to find solutions for the risks of today (and tomorrow) will be crucial to maintaining relevance and offering clients coverage that meets their rapidly changing needs

Pricing cycles in the commercial insurance and reinsurance sectors are now converging, marked by price increase moderation overall for the former, albeit with strengthening in challenged areas, and rapid acceleration (dislocation even) for the latter (see How Global Reinsurance Market Endured a Renewals?).

The great reinsurance market realignment

The world has become a riskier place. Any hope of a return to normality in the wake of COVID-19 has been shattered by a succession of geopolitical and macroeconomic shocks that brought war back to Europe, triggered an energy crisis and ended the era of cheap money and low prices (see Reinsurance Rates for Property Catastrophe Forecast).

The effects of COVID – huge fiscal and monetary stimulus, supply constraints and high debt burdens – have collided with the devastating fallout from Russia’s invasion of Ukraine to bring about a great realignment, characterised by structurally higher inflation, rising interest rates, heightened security threats and accelerated deglobalisation.

Throw into the mix increased recessionary risk, turbulent financial markets, climate change, one of the most expensive natural disasters (Hurricane Ian), a challenged, if relenting, cyber market, and the operating environment is acute.

In 2024, the global reinsurance market faces significant challenges. Renewals will become more difficult due to increasing risks and changing market dynamics. Insurers and reinsurers must realign their strategies to adapt.

These adjustments will involve reassessing risk management practices and pricing models. The industry needs to innovate and respond swiftly to evolving conditions. Success will depend on proactive measures and strategic foresight.

Global insurance and reinsurance pricing index

The corollary for risk managers and underwriters is a complex and nuanced (re)insurance market, driven by line specific, mini-cycles with varying levels of sensitivity to losses and broader macro risks (see TOP 50 Largest Global Reinsurance Groups in the World).

The big renewal story of the last 12 months has been the reversion of pricing cycles in the commercial insurance and reinsurance sectors, marked by price increase moderation overall for the former, albeit with strengthening in challenged areas, and rapid acceleration for the latter.

Biggest reinsurance capital squeeze since 2008

Commercial insurance market

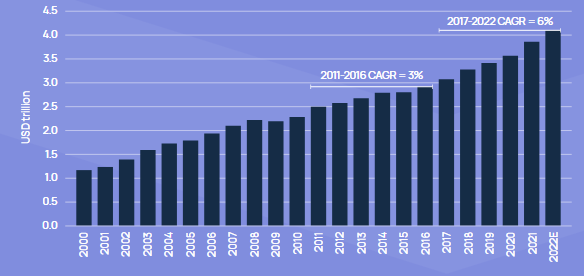

Prices across most commercial insurance lines continued to rise in 2023, the fifth year of a hardening market cycle. Buyers’ hopes for a return to softer conditions have been complicated by multi-decadal inflation highs and sizeable losses from Hurricane Ian (see M&A Transactions in the Global Reinsurance Sector).

The commercial pricing cycle began in 2018 with diminished underwriting appetite, itself a reaction to weak results and earnings volatility. Returns have improved significantly since despite exceptional market losses so far this decade, and impairments to sector capital in 2023.

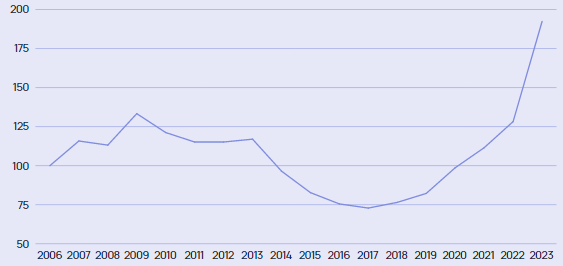

Global commercial insurance pricing index

Although pricing continues to rise on an indexed basis overall, annual increases have begun to diminish. Commercial insurance rate rises averaged 9.8% year-on-year during the first three quarters of 2023, a deceleration from the 12.5% recorded for full-year 2022 (see The Role of Insurance & Reinsurance in Minimizing Risks of the War`s Impacts).

Most areas continued to achieve rate-on-rate gains in 2023, with some lines even bucking the tapering trend to record accelerated increases.

Strong competition in financial lines on the other hand saw pricing moderate initially and then decrease towards the end of the year. Classes with the highest price rises included cyber and catastrophe-exposed property whilst premiums for worker’s compensation and directors and officers (D&O) were subject to less pressure and registered decreases in certain regions.

Buyers can expect similarly bifurcated dynamics in 2024, with pockets of stress in areas such as property and other markets affected by adverse loss experience and rising claims inflation contrasting with capacity abundance elsewhere as insurers look to grow in lines where performance is strong (see Why US Property Catastrophe Reinsurance Rates Up?).

The hard reinsurance market and higher financing costs, not to mention an unbroken six-year run of above-average catastrophe losses, mean insurers’ costs of capital are increasing.

The commercial market is well placed to navigate this environment. The underwriting uplift from 20 consecutive quarters of price increases is substantial and the delta between price and loss costs across commercial portfolios remains in insurers’ favour. Demand for protection continues to be robust, and crucially, higher investment returns will boost earnings as interest rates normalise.

Global non-life insurance premium

The viability of additional hardening must be weighed against the danger of businesses buying less protection and retaining more risk following four years of compounded rate increases and additional cost pressures elsewhere, not least energy.

The intricacies of the current marketplace require the highest level of broking experience and expertise to unlock supply.

For all the challenges confronting commercial insurance buyers, capacity is available as more carriers pivot from remediation to growth. These are disciplined plays designed to leverage the firming rate environment, and competition creates opportunity (see Global Reinsurance Sector Outlook).

As the risk landscape undergoes structural change, and inflation requires careful adjustments to limits to address higher insured values, differentiated advice and creative risk management solutions can make all the difference.

Reinsurance market

Mounting pressures in the reinsurance market, already evident during last year’s mid-year renewal cycle were exacerbated significantly by Hurricane Ian after it made landfall in Florida as a category 4 storm, reinforcing one of the hardest reinsurance markets in living memory. Demand-side pressures coincided with a severe capacity crunch, as capital providers pulled back whilst others were only willing to maintain allocations.

This was, in turn, driven by a significant impairment of dedicated reinsurance capital, which fell sharply as investment grade securities experienced their worst performance in over 40 years.

Historically, the sector’s gearing to high grade, short-to-medium duration securities has bolstered its capital position in an era of ultra-loose monetary policy. Reinsurers must now navigate an environment of rising inflation expectations and higher interest rates, which has driven assets lower on a mark-to-market basis (see Exclusions into International Reinsurance Coverage for Ukraine, Russia & Belarus).

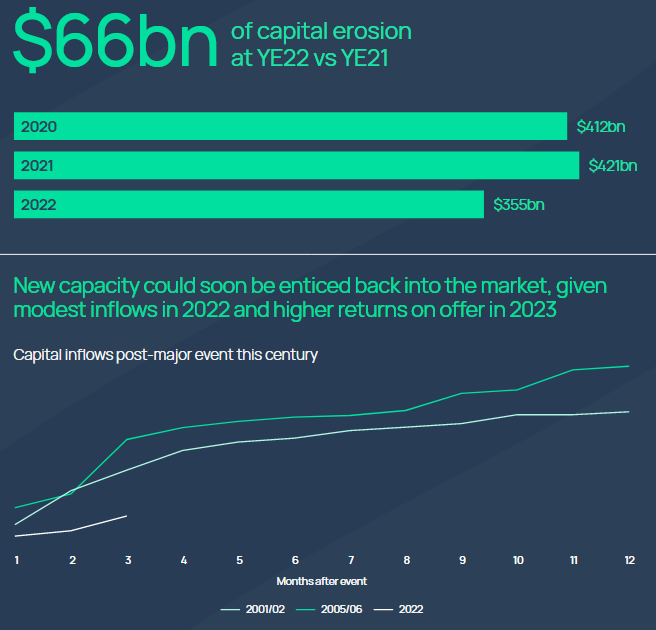

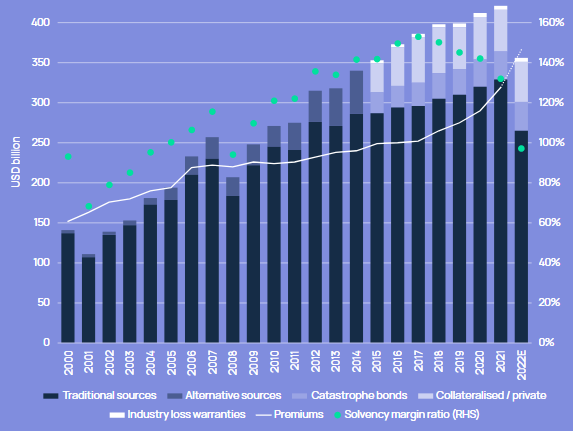

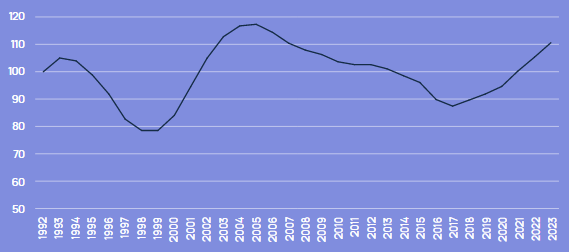

Howden’s estimate of total dedicated reinsurance capital has trended relative to gross reinsurance premiums written since the turn of the century. Capital erosion of 15.7% to USD 355 billion at YE22, the first full-year decline since 2008, together with significantly higher premiums, sent the sector’s solvency margin ratio (capital divided by premiums) to below 100, a level last recorded during the global financial crisis. It also left certain reinsurers more exposed to liquidity and credit risks at a time of heightened claims uncertainty.

Capital raises from incumbent carriers in 2023 were restricted amidst heightened market uncertainty and higher financing costs.

Nor was there any meaningful reload from third-party capital investors, who were inclined to assess 1 January renewal outcomes before weighing potential deployment opportunities in 2023.

Capital inflows of USD 3.3 billion plus post-Hurricane Ian were stunted compared to the USD 14 billion and USD 18 billion that entered in 2001 and 2005 during similar timeframes. Trapped capital compounded the dearth of supply. Future allocations into the reinsurance market will be weighed against the changing risk landscape, along with potential opportunities in other asset classes as ‘risk-free’ yields rise, especially at shorter durations.

Dedicated reinsurance capital and global gross reinsurance premiums (all lines)

Reinsurance renewals

All of which converged to create highly challenged and complex reinsurance renewals at 1 January 2023. Structures and coverage terms were at the forefront of property-catastrophe negotiations this year, amidst recognition from all parties that prices would rise significantly. Reissued firm order terms, non-concurrent terms and diversification plays leveraging demand for catastrophe capacity as a way to improve access and margins for non-property business reflected shifting market conditions.

Persistent and elevated catastrophe losses, along with the attendant issue of catastrophe model efficacy, continued to drive sentiment in property lines amidst concerns that changing weather patterns are increasing both the frequency and severity of climate-sensitive perils.

Higher retentions, tighter terms and reduced frequency coverage (i.e. aggregates, lower excess-of-loss layers, quota shares) reflected reinsurers’ resolve to focus more on capital protection after six consecutive years of above-average catastrophe losses.

Navigating more restricted retrocession coverage terms, and having been hit by surprise losses in recent years, reinsurers looked to enhance coverage certainty by adding exclusions to all-risks cover or moving to named perils.

Terrorism and strikes, riots and civil commotion (SRCC) in particular came under scrutiny, with a number of reinsurers willing to maintain all-perils coverage as long as robust exclusions were in place for these risks.

Others pursued more restrictive solutions, with coverage offered on a specific named peril basis only. Some cedents agreed to narrower, peak peril protection for higher layers in order to close deals and entice capacity.

Several lines in specialty reinsurance likewise underwent a correction at 1 January 2024 in response to sizeable losses from the Ukraine war. Casualty renewals were more orderly in comparison, although market conditions also tightened here. Concerns about loss costs in a high inflationary environment, along with moderated rate increases on original casualty business, counterbalanced favourable supply dynamics to yield firming renewals overall.

Global direct and facultative

Even in this highly challenged environment, the direct and facultative (D&F) market recorded strong growth in 2023 and continued to support clients renewing programmes at 1 January 2024. Increased demand for D&F catastrophe cover – driven by an inflation-induced rise in insured valuations on original business, attendant requirements for increased reinsurance limits and reduced retrocession capacity – added to pre-existing supply and pricing pressures.

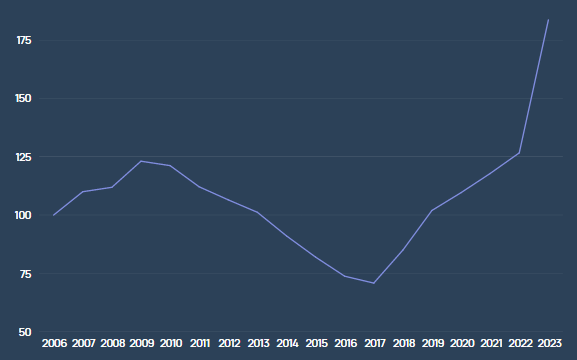

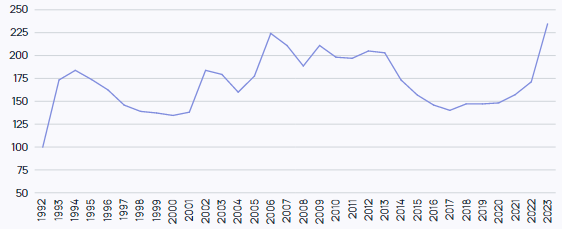

Six successive years of significant reinsurance rate rises, with a marked acceleration of 45% in 2023, has yielded a cumulative increase of 160% plus since 2017 to take pricing levels above those recorded in the aftermath of Hurricane Katrina in 2006.

The underlying market has benefitted from even more substantial pricing tailwinds during this time.

Changes to programmes’ structures and terms were substantial at 1 January 2024, making any comparison to prior years difficult given that the degree of change in coverage provided. Retentions were up significantly, coverage terms moved towards named perils and terms and conditions tightened. Price movements varied significantly depending on loss experience and performance.

Global D&F reinsurance pricing index

Capacity nevertheless continued to be available at the right price and level at 1 January 2023. Late activity in the retrocession market yielded more favourable outcomes than expected for some carriers, which relented D&F supply constraints in late December.

This saw most deals over the line and enabled certain cedents to push back successfully on attempts by markets to limit coverage. Named natural catastrophe perils prevailed in most cases, meaning any remnants of non-natural catastrophe coverage ceased at 1 January 2023, unless caused by natural catastrophes.

Favourable pricing trends on original business, along with changes to terms and conditions and improved risk selection, has seen D&F underwriting outperform in recent years.

Improved underlying deductibles have reduced attritional losses whilst exclusions around communicable disease, cyber terrorism and SRCC have limited unpriced losses. Efforts to de-risk in other areas have also paid off, as carriers have improved retention levels and reduced PMLs whilst maintaining income levels.

All of which has supported D&F reinsurance profitability during a period of heightened loss activity. Whereas carriers operating in the regional, nationwide and retrocession spaces in the past six years suffered several losses that breached programmes (e.g. U.S. hurricanes, Japanese typhoons, U.S. wildfires, floods and convective storms), D&F reinsurers have been less exposed and escaped with low layer losses for peak perils and ran largely clean for secondary perils. D&F losses from Hurricane Ian also appear to be developing favourably compared to other markets.

Retrocession

Hurricane Ian’s impact on an already dislocated retrocession market meant a sizeable portion of collateralised retrocession capital was trapped going into 1 January 2023 renewals. The second most expensive real-terms loss on record added to challenges that included significant prior year losses, investor fatigue and withdrawals from traditional carriers following several years of lacklustre performance.

The timing of Hurricane Ian also meant that many retrocession buyers were forced to reassess their underwriting plans for 2023, causing a temporary slowdown in the market.

The corollary was more limited and more expensive retrocession capacity in 2023, although supply dynamics varied as capital providers prioritised performance and long-standing partners. When capacity was secured, higher attachment levels and another round of pricing increases were required to mitigate rising inflation and other loss amplifiers, including claims from Hurricane Ian and a succession of expensive secondary peril events.

Howden Risk-Adjusted Non-marine Retrocession Catastrophe Rate-on-Line Index

Risk-adjusted retrocession catastrophe excess-of-loss rates-on-line rose by 50% on average at 1 January 2023, with a range of up 20% to up 90%.

Following significant remediation to aggregate covers and low-attaching occurrence layers at previous renewals, double-digit increases were also recorded for layers further up occurrence programmes at 1 January 2023, indicative of the acute supply constraints across the market.

Rated carriers continued to de-risk or withdraw whilst difficult fundraising conditions, marked by a volatile macro environment, added to investor caution for a market that has underperformed in recent years.

Diversification benefits, so important to ILS investors, are now being weighed against evidence that loss frequency and severity are being impacted by climate change and other factors, including potential catastrophe model limitations.

Property-catastrophe reinsurance

Late or incomplete retrocession placements meant that property-catastrophe reinsurers had less clarity than usual around their net positions when offering renewal lines at 1 January 2023. Given capacity constraints, several reinsurers prioritised existing renewals despite significant submission inflows. This, along with gaps in some programmes, is likely to see continued purchasing activity leading up to this year’s North Atlantic hurricane season.

Howden Global Risk-Adjusted Property-Catastrophe Rate-on-Line Index

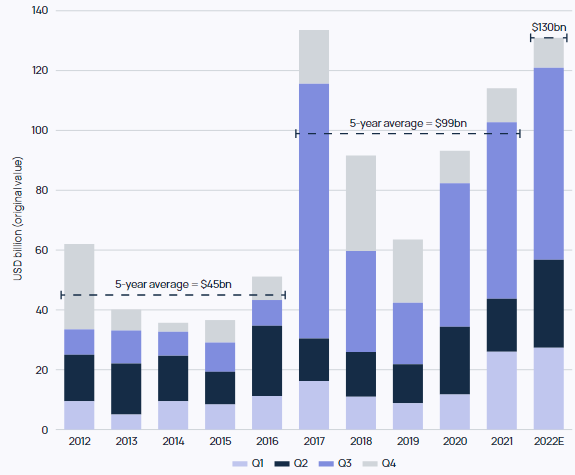

The result reflected a seismic shift in supply and demand dynamics. Retention levels, which in several cases have been stable for much of the last decade, rose significantly (in the U.S. especially) to reduce reinsurers’ frequency exposures and meet demand from cedents for top-end cover following inflation-induced increases to insured valuations. And with no let-up in loss experience – the USD

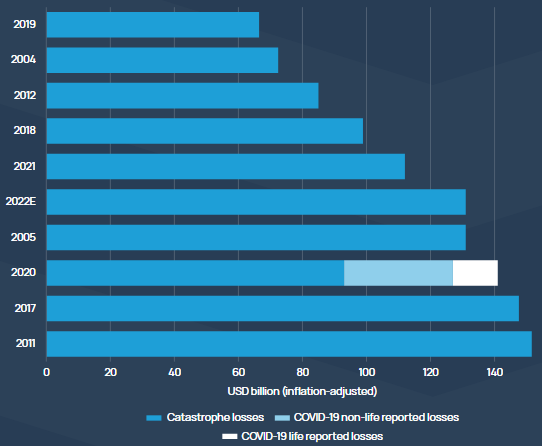

100 billion threshold was breached once again in 2022 whilst cumulative insured losses over the last six years are now in excess of USD 600 billion – reinsurers were determined to achieve outcomes commensurate with the levels of risk absorbed.

Global insured catastrophe losses by quarter

From a pricing perspective, this typically translated into mid double-digit increases depending on performance and loss experience. Equally consequential changes were made to terms and conditions, event definitions and scope of coverage as reinsurers looked to reduce earnings volatility following the unusual mix of major losses. Where reinsurers’ demands were not met, participations were often reduced and some layers went unfilled.

Casualty reinsurance

Casualty reinsurance supply dynamics, facilitated by reinsurers’ diversification strategies, remained stable throughout 2022 and into the 1 January 2023 renewal. Despite deteriorating macro fundamentals in 2022, reinsurers have benefitted from a prolonged period of compounded price increases on original business, even if these moderated last year.

Investment portfolios will also soon yield improved returns as interest rates rise. Casualty renewals nevertheless tightened at 1 January 2023

Concerns about inflation and reserve adequacy for prior (soft market) years, along with tapering casualty insurance rates and a desire for market tightening to mirror conditions in the primary market, prevailed to shape outcomes. Isolated instances of loss deterioration reported by certain cedents last year for financial lines exposures reinforced the cautious outlook.

Howden London Market Casualty Risk-Adjusted Reinsurance Rate Index

As a result, London market casualty reinsurance excess-of-loss rates, including adjustments for exposure changes and inflationary impacts, rose by 5% on average at 1 January 2023. Reinsurers cited rising inflation and the prospect of higher claims severity for the increases.

Outcomes were similar to those recorded last year (where the corresponding data point was also +5%), as strong demand and discerning supply told.

Upward pressure on ceding commissions seen in recent years abated. A select number of improved or outperforming accounts were able to achieve flat commissions, with reinsurers still keen to tap into attractive economics derived from underlying remediation.

Most other accounts saw decreases of one to two percentage points, with steeper reductions for those that have not performed so well or where underlying pricing deteriorated. U.S. D&O commissions in particular came under pressure as original rates saw significant reductions and unfavourable reserve development was reported.

2024 was not just about macroeconomics

Loss activity was equally fraught, as Russia’s invasion of Ukraine delivered another shock industry loss (so soon after COVID) and highlighted the complexities of the cyber risk landscape as raised concerns about a transnational fallout coincided with reduced claims activity.

2023 was the second most expensive catastrophe to hit the (re)insurance market ever.

Hurricane Ian and the war in Ukraine accounted for approximately 50% of insured losses last year. A quick analysis of the industry’s ten largest loss years on record – with National Flood Insurance Program (NFIP) claims excluded – underscores the painful run sustained by insurers and reinsurers in recent times. Indeed, each of the last six years feature in the list.

Top 10 largest loss years on record

The global economy is in a precarious position heading into 2024. The war in Ukraine has superseded COVID-19 as the dominant economic driver, even as China continues to grapple with fresh outbreaks. The combination of an energy shock, rapid inflation, rising interest rates and geopolitical tensions has seen economic growth lose momentum.

FAQ

Events such as the war in Ukraine, energy crises, and record-high inflation have created significant volatility. These shocks have disrupted capital and increased the frequency of large-scale claims, impacting both insurance and reinsurance pricing cycles.

The reinsurance market faces challenges from rising natural disasters, economic pressures, and increased demand for coverage. This is compounded by limited capital availability, causing complex renewal conditions and higher rates.

In commercial insurance, rate increases are slowing but remain elevated in certain high-risk areas. In contrast, reinsurance pricing is rapidly accelerating due to factors like rising catastrophe losses, making it one of the hardest markets in recent memory.

Unlocking capital is essential to address evolving risks and provide adequate coverage in a volatile market. As risks grow, insurers and reinsurers need to adapt by leveraging capital efficiently to remain competitive and meet client needs.

Inflation has driven up claims costs, particularly in property and catastrophe lines, where rates continue to rise to match increased insured values. This environment pressures insurers to adjust pricing to maintain profitability.

Hurricane Ian, one of the costliest natural disasters, intensified capital constraints and highlighted the need for rate increases in reinsurance. It also caused insurers to reassess risk management and coverage structures, leading to stricter renewal terms.

Innovation in risk management and pricing models is crucial to adapt to rapidly changing market dynamics. By employing advanced solutions, insurers can better navigate challenges, optimize capital use, and provide tailored protection in a high-risk environment.

………………..

AUTHORS: Julian Alovisi – Head of Research Howden, David Flandro – Head of Analytics Howden