The global reinsurance industry reached a tipping point during the 2023 renewals as their bargaining power vis-à-vis their cedents moved substantially in reinsurers’ favour.

Property and specialty lines entered into a hard market. As a result, Fitch Ratings expects underwriting margins after retrocession to expand by 4pp on average in 2023.

Hard Property and Specialty Markets

The unparalleled concurrence of seismic shifts in the macro-economic environment, high geopolitical uncertainty, persistently high natural catastrophe claims and capacity limitations led to a sharp increase in premium rates and, equally as important, a tightening of terms and conditions rarely seen in this market before.

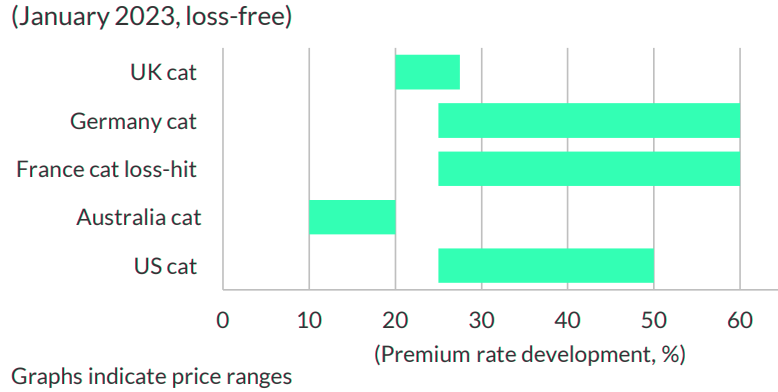

Reinsurance price increases of 20%-60% were observed in most property markets, which had been affected by natural catastrophe events in 2021 or 2022.

In the US, which had been hit by hurricane Ian, prices sometimes even doubled. Retrocession (retro) prices moved up in lockstep. The Russia-Ukraine war led to price increases of 50% or more in affected specialty lines such as political risk and aerospace.

Reinsurance Capital Down on Asset Losses

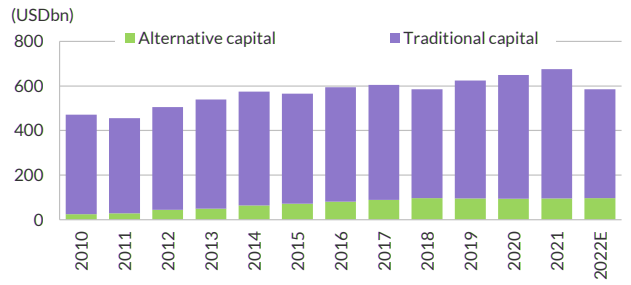

The reinsurers’ aggregate accounting capital base declined by around 15% in 2022 largely due to mark-downs on their fixed income portfolios on the back of rising interest rates (see about Global Reinsurance Market 2023). This is likely to have reinforced reinsurers’ underwriting discipline despite higher interest rates having a neutral to positive impact on economic and regulatory capital in 2022.

In 2022, capital inflows into the alternative capital space remained below the levels seen in the previous two years.

This negatively affected capacity in the retro market and added pressure on rates. Disappointing returns for the past five years and the risk of trapped capital led to outflows in collateralised programmes in favour of catastrophe bonds. However, Fitch expects capital inflows to accelerate in 2023 as trading conditions improve.

Natural Catastrophe Claims Stayed High in 2022

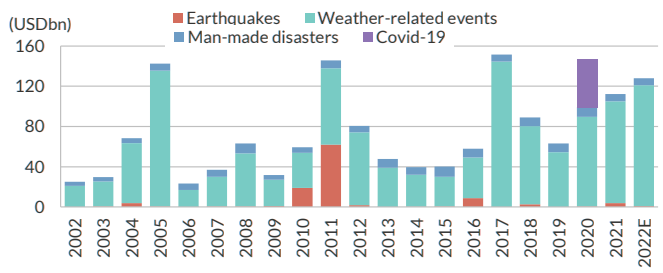

In 2022, Fitch believes that a series of secondary peril events across North America, Europe and Australia, and hurricane Ian in Florida caused insured natural catastrophe claims of about USD120 billion. This would make 2022 the third-costliest year, after 2017 and 2005, for the (re)insurance industry with respect to weather-related events.

Cedents found it increasingly difficult to place natural catastrophe risks with reinsurers raising the question of insurability of property catastrophe risks during the January 2023 renewals process (see Catastrophe Bond & ILS Market Review).

Prices Sharply Up in Property and Specialty

The January 2023 renewals were characterised by significant price increases across the board and tighter terms and conditions, serving as a market reset in property and select specialty lines of business.

Cedents experienced substantially higher retentions, reduced limits and increased attachment points.

However, the initiative of some reinsurers to move from all-perils to named perils covers did not get much traction during the renewals. Still, reinsurers demonstrated strong underwriting discipline leading to a more sustainable level of profitability after five disappointing years.

Property markets, which had suffered from heavy natural catastrophe activity recently, including those in the US, France, Germany and Australia, saw prices move up by 20%-60%, in some cases even 100%.

Climate change, high inflation rates for repair work and spare parts, and rising insured values and wealth all contributed to a sharp increase in claims inflation.

Limited retro capacity added to the upward pressure on prices for property covers. Some reinsurers partially or completely withdrew from the property catastrophe market to limit earnings volatility, while new capital flows remained low in 2022 and demand increased.

Fitch Ratings believe the price dynamics also mirror a catch-up effect as price increases achieved by the reinsurance industry since 2017 have been insufficient to protect underwriting margins.

Risk-Adjusted Price Changes – Property

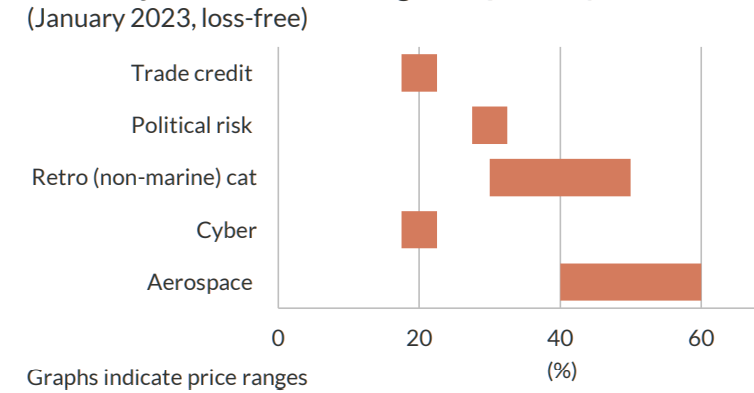

Selected specialty lines, such as aerospace and political risks, including civil unrest and war, were also confronted with limited available capacity.

Prices moved up by 30%-60% for loss-free programmes and 50%-200% in loss affected ones. The war in Ukraine was the main trigger and slows growth of Global Re/Insurance market.

Trade credit also saw double-digit price increases as claims frequency started to rise to more normal levels after the expiry of fiscal support programmes in the wake of the coronavirus pandemic in many developed markets.

Risk-Adjusted Price Changes – Specialty

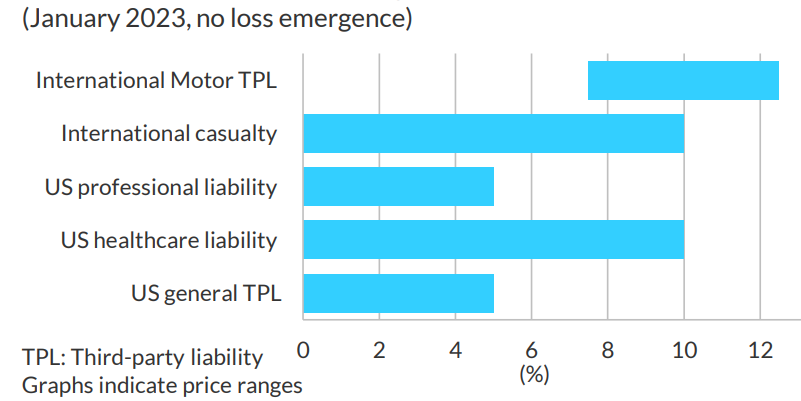

The January 2023 renewals for casualty lines of business were conducted in a more orderly fashion as underwriting margins in the underlying direct business as well as for excess-of-loss treaties remained healthy in 2022 after a significant price correction in previous years.

Prices increased by around 5% on average as reinsurers wanted to make sure prices remain adequate should claims inflation pick up in 2023 due to a spill-over from economic inflation or an acceleration of social inflation.

Ceding commissions for casualty and professional liability quota-share business were down 1pp-2pp after having peaked at the mid-year 2022 renewals.

Risk-Adjusted Price Changes – Casualty

Underwriting Margins to Improve in 2023

Underwriting margins of rated global reinsurance universe to improve by around 4pp in 2023 on the back of significant price increases, tighter terms and conditions, and the withdrawal of cover related to the war in Ukraine.

Claims inflation should remain high, driven by a sustained high level of economic inflation, a potential pick-up in social inflation and climate change.

However, price adjustments achieved in the 2023 renewals season should be sufficient to compensate for claims inflation and provide some buffers for unforeseen events.

Better underwriting margins should also provide some wiggle room for dealing with the large amount of unrealised losses on the reinsurers’ bond portfolios. Accelerating the turnover of fixed-income portfolios would allow reinsurers to benefit from higher reinvestment yields more quickly while the realised investment losses would then be absorbed by higher technical profits.

Fixed-Income Losses Depress Reinsurance Capital

The steep rise in interest rates in 2022 has led to mark-downs on large parts of reinsurers’ bond portfolios.

Fitch estimates that this caused accounting capital to shrink by around 15% in 2022 due to the accounting mismatch between assets and liabilities in many jurisdictions.

However, the impact of higher interest rates on economic and regulatory capital has been neutral to positive, and we do not consider the industry’s capitalisation to have suffered materially. Traditional reinsurers did not show a heightened issuance of new capital in 2022 as financial market conditions remained challenging and solvency capital robust.

The decline in accounting capital will have reinforced reinsurers’ underwriting discipline during the January 2023 renewals as important stakeholders, such as investors, may still assess the loss in accounting capital negatively.

Fitch expects alternative capital to have stagnated in 2022 as collateralised programmes continued to suffer from trapped capital and heightened losses.

In contrast to past large loss events, hurricane Ian did not trigger significant new capital inflows into reinsurance (see How Global Reinsurance Market Endured a 2023 Renewals?).

Poor performance for the past five years, low reliability of catastrophe models and seemingly more attractive investment alternatives given the rise in interest rates largely explain why inflows were so low in 2022. This may change in 2023 as expected returns have moved up and could attract more capital over the course of the year.

Traditional and Alternative Reinsurance Capital

Within the alternative capital space, catastrophe bonds gained in importance at the expense of collateralised reinsurance programmes and sidecars in 2022, continuing a trend that started in 2019.

Investors stuck to their preferences as catastrophe bonds offered higher liquidity, a better performance and a more clear-cut definition of what perils are covered.

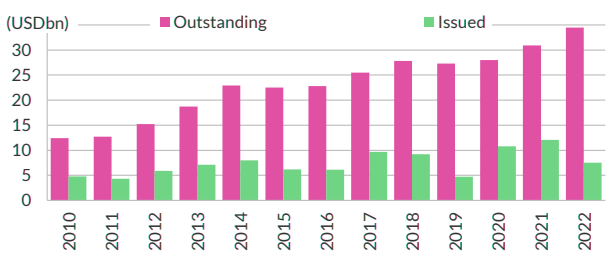

In 2022, USD7.5 billion of new catastrophe bond notes were issued – markedly below the record USD12.1 billion issued in 2021. Outstanding volumes increased by 11% to USD34.5 billion as a lower number of maturing programmes needed to be replaced. Fitch expects that catastrophe bonds will see high inflows in 2023 and continue to gain market share in the alternative capital space.

Catastrophe Bonds

Hurricane Ian Was One of the Costliest Catastrophe Events Ever

We expect insured natural catastrophe claims of around USD120 billion for 2022, more than 60% above the 10-year average based on data from the Swiss Re Institute.

Hurricane Ian, which hit Florida in September, accounted for around 40% of the total, making it one of the costliest natural catastrophe events ever.

In addition, a series of secondary peril events, such as flooding in Australia, hailstorms in France and winter storm Elliott in the US, contributed significantly to the insured bill. Climate change and the increase in value of insured goods on the back of high inflation and wealth creation will continue to drive natural catastrophe claims higher in 2023 and beyond.

Annual Insured Catastrophe Losses

Recent loss events have fuelled once again the debate on whether and how the (re)insurance industry can provide sufficient cover against natural catastrophe events. Some reinsurers have decided to withdraw part or all of their capacity to reduce earnings volatility.

The lack of capacity has been felt most strongly in Florida, as fraud and litigation have made this market increasingly unattractive for the reinsurance industry.

A bill to amend the situation was signed by Florida’s governor in December and existing state funds to cover natural catastrophe claims have been increased by USD1 billion.

Other countries, including France and Spain, have long-established state-sponsored back-stop facilities to support the private (re)insurance industry in case of extreme natural catastrophe events.

Other countries will follow suit in the medium to long term as natural catastrophe events become more frequent and severe, while the alternative of imposing mandatory insurance covers on households remains unpopular.

Neutral Sector Outlook Maintained

Fitch maintains its neutral sector outlook for the global reinsurance sector. This view balances stronger underwriting margins on the back of more favourable pricing, terms and conditions with a still elevated degree of macro-economic and geopolitical uncertainties, high claims inflation, as well as rising natural catastrophe claims driven by climate change.

…………………..

AUTHORS: Robert Mazzuoli – Director in Fitch Ratings’ EMEA insurance group, Brian Schneider – Senior Director in Fitch Ratings’ North American insurance rating group