The global economy is in a precarious position in 2023. The war in Ukraine has superseded COVID-19 as the dominant economic driver, even as China continues to grapple with fresh outbreaks. The combination of an energy shock, rapid inflation, rising interest rates and geopolitical tensions has seen economic growth lose momentum.

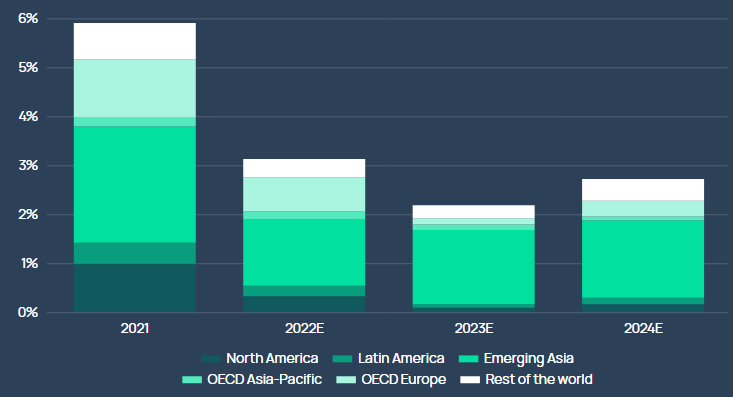

The diminished contribution advanced economies are forecast to make to global growth in 2023 and 2024, according to Howden.

The uncertainty around economic forecasts is high

Wholesale energy prices, which have fallen from recent highs, are tied closely to the Ukraine crisis and the outlook for inflation is complicated further by issues that link back to the pandemic, including workforce participation rates, wage pressures and supply chains.

Labour markets remain tight, which is likely to prevent monetary policy loosening in most major economies (see How Insurers Respond to Inflationary Shocks?).

Although headline inflation is likely to fall in 2023, pressures may be penetrating into stickier parts of economies.

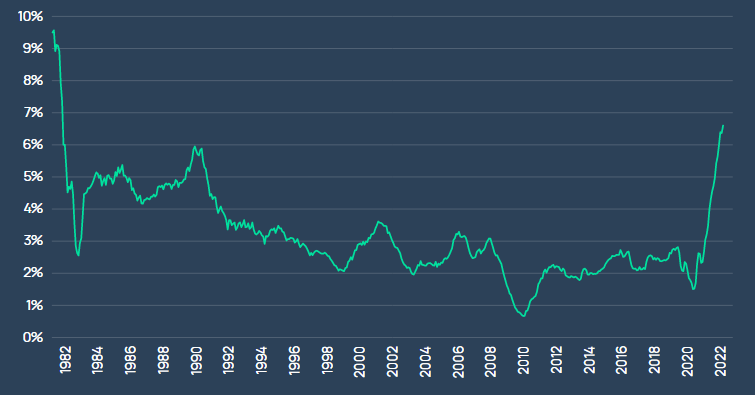

According to Global Economic and Insurance Market Outlook, the Sticky Consumer Price Index for the U.S., which is weighted towards more rigid service-based categories, was at a 40-year high at the end of 2022, suggesting inflation will remain elevated for some time to come.

Projected contributions to global GDP growth – 2021 to 2024

Sticky Consumer Price Index – 1982 to 2022

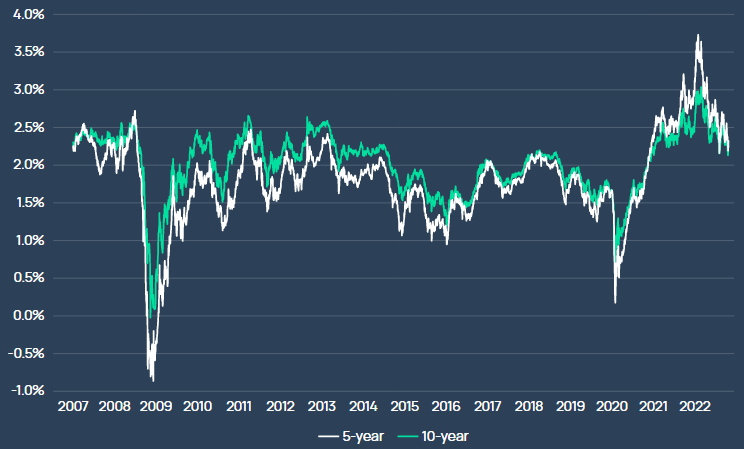

Bond market-based measures of forward inflation have long-term expectations relatively well anchored, however.

Whilst 5-year and 10-year U.S. breakeven rates peaked at record highs in the immediate aftermath of Russia’s invasion of Ukraine last year, they had fallen back to the top-end of more normalised ranges by year-end.

How inflation develops over the next year or two will be a key input into reinsurance demand, loss cost inflation and investment income. Global reinsurance market has faced a very late, complex and in many cases frustrating renewal 1/1 2023.

As anticipated before negotiations commenced, the two areas of most constraint were peak-zone US property catastrophe capacity and coverage for strikes, riots & civil commotion and war. As renewals approached the end of the year, the market became more bifurcated/

U.S. breakeven rates for 5-year and 10-year inflation-linked Treasury securities –2007 to 2022

Resilience and Innovation

The macroeconomic backdrop is just one of several factors that will shape the (re)insurance sector from here. Others, such as social inflation, climate change, the net-zero transition and war, are more difficult to quantify and predict, and (re)insurance is playing a crucial role in indemnifying clients when losses occur (see Global Reinsurance Market Renewal).

How inflation develops will be a key input into (re)insurance demand, loss cost inflation and investment income.

There is also an opportunity for the sector to go beyond traditional risk transfer and move into the realms of mitigation and adaptation by offering risk reduction incentives to policyholders and rewarding positive measures.

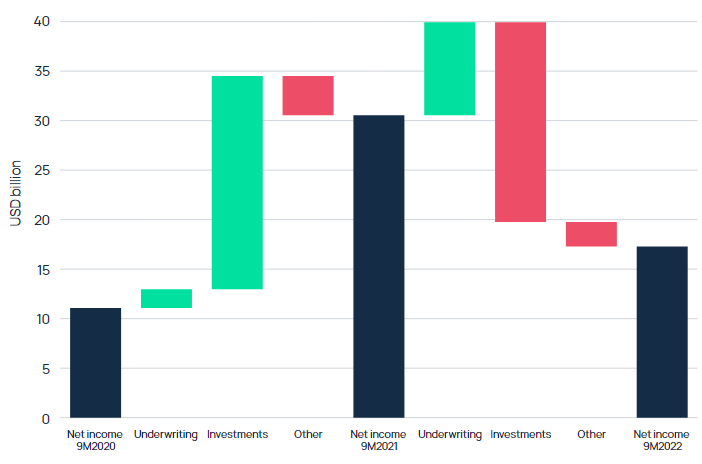

Reinsurers are in a strong position to do just that. Even after the effects of multi-decade high inflation, another USD 100 billion plus loss year and substantial investment losses, the sector remained profitable in 2022.

Drivers of (re)insurance sector net income – 9M2020 to 9M2022

Future prospects for the market look positive too. Investment income will benefit significantly from higher reinvestment yields whilst underwriting gains are likely to be sustained by the favourable pricing environment. This is especially true for reinsurance following the re-pricing and restructuring of programmes at 1 January 2023.

These tailwinds are likely to be sufficient in offsetting higher claims inflation and more expensive reinsurance / retrocession.

Capital inflows

Capital will be crucial to servicing growing demand for reinsurance protection. The sector has previously attracted substantial amounts of capital post-shock events to compensate for the loss of capacity and leverage the attendant pricing opportunities.

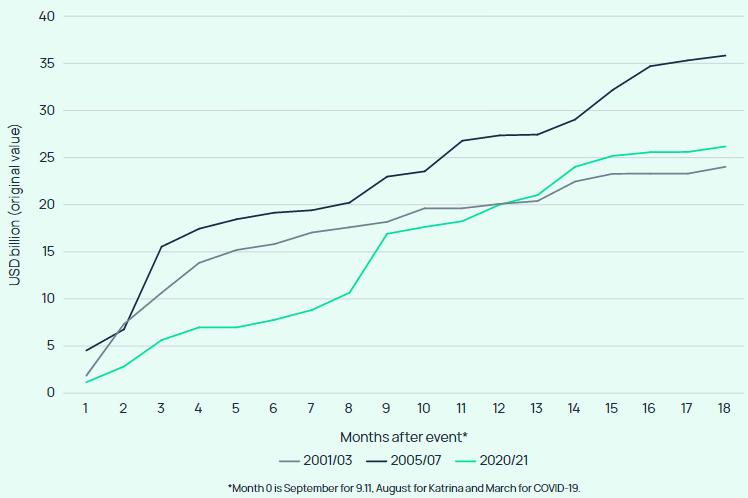

Quantum and timeline of cumulative capital inflows following COVID, Katrina and 9/11

Following capital raises of more than USD 25 billion in 2020/21, comparable in quantum to what entered the market in the 18 months that followed 9/11, inflows slowed significantly last year.

Having made commitments early in the cycle, investors with sector experience were more circumspect about where to allocate capital in 2022, particularly after recent losses tested risk tolerances and returns in other asset classes have become relatively more attractive.

Corrections in the equity and bond markets prompted some pension funds to manage down (re)insurance allocations and prevent ILS portfolios exceeding maximum target limits.

Most reinsurers also prioritised improving risk-adjusted returns across existing catastrophe portfolios rather than raising additional capital to underwrite more exposures. ILS & Cat Bonds Have Seen Little Signs of New Capital Entering in 2023.

Higher potential returns could soon entice capital back into the market

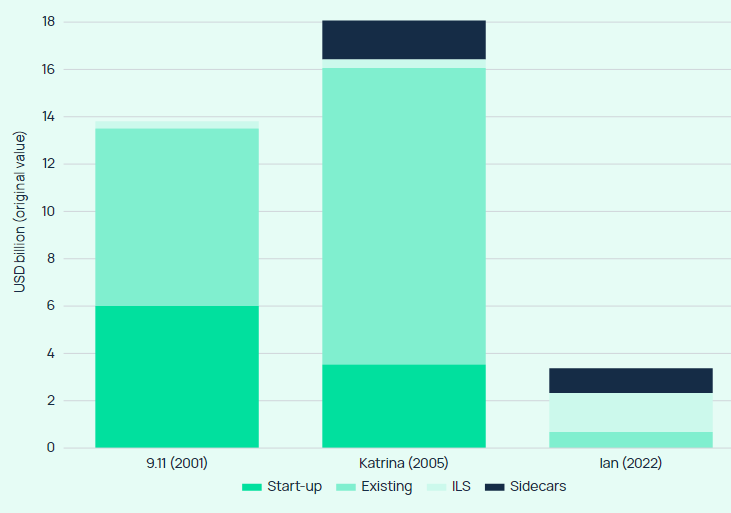

Figure below compares capital inflows in the months leading up to 1 January renewals following 9/11, Hurricane Katrina and Hurricane Ian.

Announced capital inflows leading up to 1 January renewals – 2022 vs 2005 and 2001

Timeframes to year-end are similar for all three events but capital generation post-Ian has been negligible compared to the amounts raised in the final months of 2001 and 2005.

Investor caution hindered attempts to launch new initiatives in 2022 whilst ILS inflows, the main source of capital growth in 2020/21, were also limited.

Risk and reward

Higher potential returns on offer following one of the hardest reinsurance renewals in living memory could soon entice capital back into the market, however.

Several capital providers deferred deployment opportunities in late 2022 to assess a number of factors, including 1 January renewal outcomes, loss development for Hurricane Ian and broader macroeconomic conditions.

Clarity around these issues will be crucial to lifting the capital squeeze.

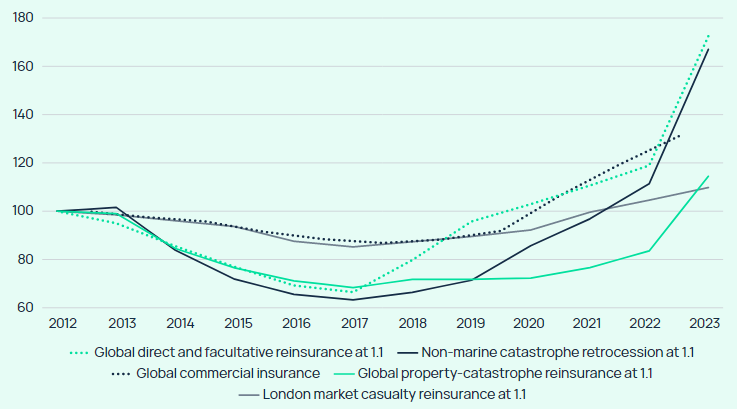

Developments in early 2023 portend well for the year ahead. Figure below shows how differing rate momentum across commercial and reinsurance lines has already gone a long way to reversing the long-standing lag for reinsurance.

Howden pricing index for primary, reinsurance and retrocession markets – 2012 to 2023

The current pricing landscape reflects supply and demand dynamics and perceived levels of risks. Corrections for reinsurance at 1 January 2023, combined with equally important changes to structures, terms and scope of cover, are likely to yield stronger underwriting margins in spite of rising loss cost inflation, higher costs of capital and structural changes to the loss environment.

The ability to demonstrate profitability over the long-term will be crucial to capital providers.

Given the backdrop of elevated catastrophe losses, climate change concerns and broader inflationary trends, not to mention opportunities for improved returns in other asset classes, investors will be looking for evidence of strong underwriting performance over a sustained period and across cycles.

Whilst this long-sighted view may prevent inflows akin to those synonymous with the Class of 2001 or the Class of 2005 in the near-term at least, investor appetite is likely to increase over the next year or two as margins improve and the macroeconomic environment stabilises (see Insurance and Macroeconomic Outlook in Financial System Stresses).

Securing access to capital will therefore be a key differentiator for (re)insurers, MGAs and ILS funds, which plays to the strategic investments Howden has made in this area in order to facilitate inflows, create capacity and find solutions for clients across the insurance value chain.

Current market conditions demand a new approach to broking that is cycle-savvy, innovative, aggressively entrepreneurial and home to the sector’s strongest talent.

Expert advice in extraordinary times

A complicated new world order has emerged, heralding an era of higher inflation and interest rates, heightened geopolitical tensions, elevated catastrophe losses, supply chain vulnerability, cyber risks and potential loss aggregation. Global crises are following each other in rapid succession, and the value and importance of (re)insurance comes to the fore during such volatile times.

Unlocking capital in order to find solutions for rapidly changing risks will be crucial to maintaining relevance and offering clients coverage that meets their needs.

The megatrends driving extraordinary change also reinforce the need for access to original insights and research.

………………..

AUTHORS: Julian Alovisi – Head of Research Howden, David Flandro – Head of Analytics Howden

Fact checked by Oleg Parashchak