The immediate impact of inflation on non-life (property & casualty and health) insurers’ earnings is negative, primarily through rising future claims costs on current insurance policies, the need to bolster loss reserves and, in case of stag-flation, reduced demand.

Acording to The Geneva Association Report, the effect on life insurers’ earnings is more neutral. As opposed to non-life insurance, most life insurance products, e.g. mortality, wealth accumulation and longevity protection, offer benefits that are nominally fixed. Having said this, inflation tends to erode the value proposi-tion of life insurance with fixed benefit payouts, weighing on new business and leading to higher lapses.

The affecting insurers’ balance sheets through mark-to-market valuation losses

Lower equity markets, rising interest rates and widening credit spreads adversely affect insurers’ balance sheets through mark-to-market valuation losses. On the other hand, higher interest rates, i.e. discount rates, have a favourable effect on the net present value of future liabilities.

There is a wide range of management actions insurers can take to respond to the new macroeconomic environment. In terms of product design, with customers typically suffering a reduction in real income, insurers could offer more affordable, low-cost products with an increased focus on risk and loss prevention (see How Artificial Intelligence Can Help Insurers Reduce the Inflation Impact?).

With tight labour markets and increasing wage pressure, insurers will also maintain their drive to improve opera-tional cost efficiency and overall productivity, i.e. output per employee.

Digitalisation is one obvious route to achieve this objective in areas such as distribution (the biggest non-claims cost block), marketing and customer service.

The main underwriting response is to reprice insurance risks that exhibit elevated claims costs. The need and scope for doing so depend on the competitive environment in the relevant insurance markets, insurers’ assumptions concerning central banks’ ability to tame inflation within a reasonable period of time and the degree of public policy and regulatory constraints and interventions (see How P&C Insurers in the US Can Increase Inflation Resilience?).

The impact of inflation on non-life insurers’ earnings is negative while the effect on life insurers is more neutral

To counter rising claims costs, insurers may further accel-erate claims automation and straight-through processing as well as expand (or build) partner and supplier networks in order to negotiate fixed prices for a longer period of time.

In investment management, there is some scope for inflation protection on the back of tactical asset allocation, for example by tilting the investment portfolio away from bonds towards commodities, equities and real estate. For insurers, however, such benefits remain elusive in light of very high solvency capital requirements for those asset classes.

Inflationary episodes typically hurt demand for insurance. Arguably, however, in times of inflation the value of insurance goes up.

Inflationary episodes typically cause lower economic growth or even recessions, which hurt demand for insur-ance, especially in areas where customers consider insur-ance a discretionary or non-essential expense.

However, we argue that for customers, and society at large, the value of insurance increases in times of inflation, for the following reasons:

- Customers’ reduced financial flexibility adds to the relevance of financial protection and stability afforded by insurance coverage;

- The role of insurance in encouraging loss prevention and reduction becomes more relevant as individuals, households and businesses face a higher financial burden from any uninsured losses and a lower inflation-adjusted value of fixed payouts;

- Financial intermediation further gains in importance. Life insurers in particular can help transform individuals’ and households’ short-term (cash) deposits into longer-term, higher-yielding savings, which are less prone to value erosion than deposits;

- By stabilising people’s financial situation, insurance also contributes to mitigating social inequality. As long as insurance coverage is in place and remains affordable, vulnerable people are less exposed to falling (back) into poverty following a financial shock exacerbated by a sudden surge in inflation.

Insurance demand could benefit as a result of sharpened risk awareness

Going forward, demand for insurance could benefit from the shock experience of resurging inflation. Such shocks – similar to what we witnessed as a result of COVID-19 – typically affect risk perception and sharpen risk awareness.

Demand for non-life insurance could also benefit from portfolio shifts from financial to real assets. Furthermore, increasing prices of real assets such as cars and property translate into higher demand for insurance as asset owners seek to expand policy limits.

For life insurance, inflation presents particular challenges as it erodes the value of future fixed payouts, making in-force life insurance products less attractive, adversely impacting sales and increasing lapses and surrenders.

However, the effects of inflation on interest rates are widely considered more relevant. Customers might have more appetite for savings-oriented life insurance products that come with higher yields and inflation-protection features.

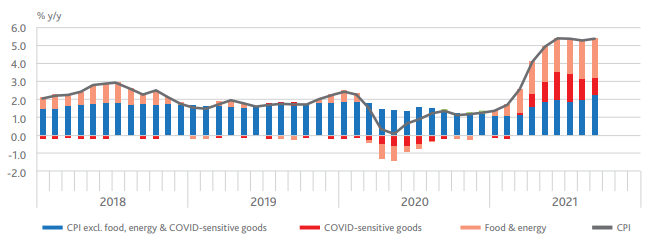

Components of inflation in the US

More generally, as professional absorbers and managers of risk, macroeconomic shocks such as unexpected inflation challenge insurers’ role in society, but they also offer opportunities.

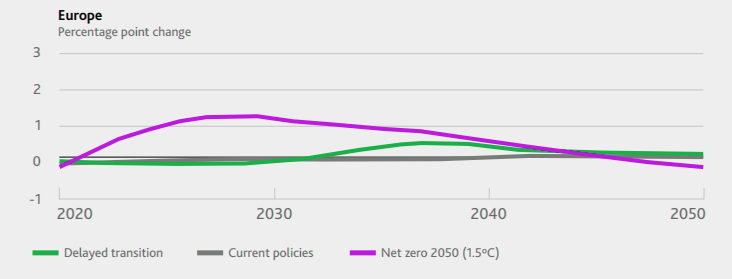

Changes to base case inflation in different decarbonisation scenarios

With that in mind, this research report offers the following conclusions and recommendations for insurers, policymakers and regulators:

- Similar to the pandemic, insurers could use the shock of inflation to demonstrate their value and resilience in times of uncertainty. Insurers help customers remain resilient in times of increasing financial stress and volatility when the value of protection becomes much more apparent;

- At the same time, insurers need to respond to the profitability and solvency challenges presented by inflation. The spectrum of measures ranges from product redesign, repricing and cost management to changes to asset allocation;

- Customers have woken up to the risk of unexpected rampant inflation. Insurers’ perceived value going forward will therefore also depend on their ability to manage inflation risk on behalf of their customers. Evolving customer expectations may result in changes to product design, especially in life insurance (e.g. insurance products that combine yield guarantees with profit-sharing features);

- Policymakers and regulators should adapt solvency regimes, designed in an era of lower interest rates, to the new macroeconomic realities. As interest rates rise and normalise, there will be growing appetite from customers for the protection offered by financial guarantees. Prohibitive risk capital charges for such guarantees ultimately hinder the insurance industry from tackling the pension savings gap.

The impact of inflation on insurers

The Geneva Association distinguish between the impacts on insurers’ earnings, primarily from a claims perspective, and the effects on balance-sheets, which are driven by rising interest rates.

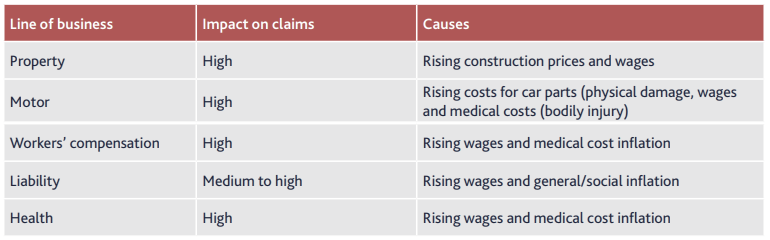

Inflation effects on Non-life insurance

The immediate impact of inflation on non-life (property & casualty and health) insurers’ earnings is clearly negative. It occurs through two main channels: first via rising future claims costs on current insurance policies and the need to bolster loss reserves,38 and second via inflation-induced changes to interest rates which lead to higher realised capital losses.

The immediate impact of inflation on non-life insurers’ earnings is negative and occurs mainly through rising future claims costs and inflation-induced changes to interest rates

During bouts of inflation, especially those accompanied by wage increases, property and car repair costs typically rise faster than consumer-price inflation, leaving claims ratios in property and motor insurance particularly vulnerable.

‘3D’ inflation and key forces at work

Another major component of property & casualty (P&C) claims is for medical services, for example under workers’ compensation or as part of a liability claim. In general, medical claims costs tend to exceed the general inflation rate.

According to P&C Insurance Pricing Trends Outlook, longer-tailed P&C lines of business, where claims may need years to settle, are most exposed to unanticipated surges in inflation that are not accounted for in the pricing of insurance contracts and may accumulate over time. Among those lines of business are medical malpractice and general liability.

With claims payouts based on indemnity, health insurance is as vulnerable to inflation as P&C insurance, both due to higher claims and the risk of reserve deficiencies. On top, as mentioned before, health cost inflation typically exceeds consumer-price inflation.

Non-life claims inflation is expected to translate into hardening rates to makeup for rising loss costs

Having said this, P&C and health claims inflation is expected to translate into hardening rates to make up for rising loss costs. Policies are typically repriced every year, based on claims experience and other factors.

Inflation effects on non-life claims costs by line of business

As a result of inflation, non-life insurers are also likely to experience adverse development (i.e. insufficiency) on loss reserves for unsettled claims. Loss reserves are typically set based on the assumption that recent years’ inflation rates will continue. For some casualty lines of business, however, loss settlement periods may take decades. Therefore, if inflation starts to rise, the loss reserves established to settle these claims will prove insufficient. Any reserve increase will diminish the insurer’s earnings and shareholders’ equity.

On the investment side, in principle, gains in returns from inflation-induced higher interest rates could offset higher claims.

However, at least in the short run, this is unlikely to happen and the overall impact of inflation on non-life insurers’ prof-itability is set to be negative, driven by the claims and reserving channel as well as potentially lower investment income due to higher-realised capital losses in the short term. With fixed coupons and principals, bond values decline if interest rates rise or are anticipated to rise.

High or rising inflation tends to erode the value proposition of life insurancewith fixed benefit payouts

Stocks also tend to decrease in value because a higher discount rate is applied to future earnings. Over time, however, bond and stock returns benefit from higher reinvestment yields and corporate earnings, respectively.

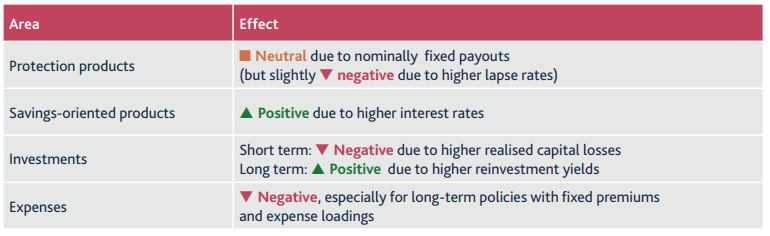

Inflation effects on Life insurance

Most life insurance products, e.g. mortality, wealth accumulation and longevity protection, offer benefits that are nomi-nally fixed. Payouts are defined at the inception of the policy and not indexed to inflation. Therefore, and in stark contrast to non-life insurance, the effect of inflation on life insurers’ earnings is neutral for most segments of business. This is not the case, however, with certain morbidity products, such as disability and long-term care, which typically offer cost-of-living adjustments.

Inflation has significant indirect effects on life insurers’ earnings by weighing on sales and the persistency of various products.

High or rising inflation tends to erode the value proposition of life insurance with fixed benefit payouts. If inflation is 5% per annum, a death benefit paid out to the beneficiaries in five years will have lost almost 30% of its current value. This not only discourages people from buying life insurance, it also leads to increased lapses for savings poli-cies with fixed returns as policyholders try to capitalise on higher rates of return on newer life insurance or other financial products.

Inflation and interest rate effects on the profitability of life insurance

On the other hand, if, as a result of inflation, people expect interest rates to stabilise at higher levels, sales of (guaranteed) savings-type life insurance will increase. Also, as interest rates climb, the nominal profitability of in-force life savings products with guarantees will improve, partially offsetting negative earnings effects from higher lapses and surrenders.

Administrative expense inflation is another challenge for life insurers. It primarily affects long-term policies with fixed premiums where the administrative expenditure premium load could soon prove insufficient to cover actual expenses.

As life insurers invest primarily in long-dated bonds, higher reinvestment yields will take time to positively affect earnings as bond portfolios gradually roll over into higher yields. In the short run, investment income is likely to suffer as a result of higher-realised capital losses.

Balance sheets

Lower equity markets, rising interest rates and widening credit spreads adversely affect insurers’ balance sheets through mark-to-market valuation losses.

As insurance investment portfolios are dominated by fixed-income securities held to maturity, these interest-rate-induced valuation losses do not impair earnings but reduce the insurer’s net asset value (shareholders’ equity) in Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) accounting.

The impact of inflation and rising interest rates on insurers

On the other hand, higher interest rates, i.e. discount rates, have a favourable effect on the net present value of future liabilities. The economic effect on an insurer’s balance sheet is neutral if assets and liabilities are matched and the declining economic value of assets is fully offset by a declining value of liabilities.

If the duration of an insurer’s assets is shorter than the duration of its liabilities, the company’s economic value will benefit from rising interest rates as liabilities will be devalued more than their matching assets.

This is the case for the European Union’s life insurance sector, for example. The economic impact on P&C balance sheets tends to be negative as the duration of assets is typically longer than those of liabilities.

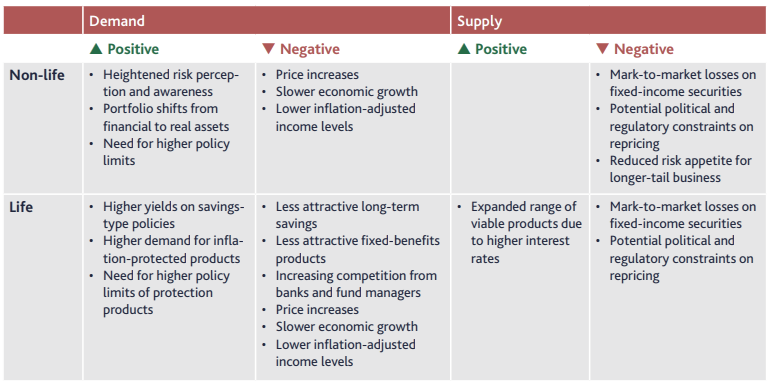

Effects of inflation on insurance demand and supply

Non-life insurance

Financial shocks typically affect risk perception and sharpen risk awareness. This is a fertile ground for increased demand for insurance.

As early as 2011, Feyen et al. found inflation to positively affect demand for non-life insurance. The authors argued that, in theory, “this result could reflect the portfolio shifts from financial to real assets and the anticipation of consumption in very high inflationary environments, resulting in additional demand for non-life insurance.”

Shocks such as inflation affect risk perception and sharpen risk awareness, providing a fertile ground for increased demand for non-life insurance

Inflationary asset bubbles in the real estate sector, which boost insurable economic activity, could be a case in point.

Hodula et al. also believed that the positive relationship between inflation and non-life insurance demand could be at least partly explained by increasing prices of real assets such as cars and property. Price increases of such goods translate into higher demand for insurance as asset owners seek to increase policy limits.

The impact of inflation and rising interest rates on insurance demand and supply

On the other hand, inflationary episodes that come with lower economic growth or even recessions are typically associated with overall lower demand for non-life insurance, especially in areas where customers consider insurance a discretionary (non-essential) expense item. Lower inflation-adjusted income reduces the demand for insurance.

Life insurance

An early empirical study for Brazil found customers to be sensitive to inflation by lowering their demand for life insurance. Numerous later studies confirmed these findings for different countries and regions. Outreville and Black and Skipper suggested that inflation has a negative effect on personal savings, also in the shape of life insurance.

Inflation erodes the value of future fixed payouts, making in-force life insurance products less attractive, adversely impacting sales and increasing lapses and surrenders

Similar to non-life insurance, slower economic growth, eroding inflation-adjusted incomes and price increases are set to curb demand for life insurance products (both protec-tion and savings), especially as life insurance has been found to be more price elastic than non-life insurance, potentially reflecting the fact that their investment components have close substitutes in the form of investment products provided by banks or funds. For protection products, however, this negative impact on demand is somewhat offset by customers’ desire to insure higher benefit limits.

Effects of inflation on insurance penetration

Insurance penetration is defined as the ratio of premium volume to GDP. It measures the importance of insurance relative to the size of the economy. As it is based on the product of quantity and price, penetration is, however, not a perfect measure of consumption.

A higher premium volume might reflect a higher quantity or a higher price. In life insurance, a higher pene-tration may simply be the result of a shift from premium-light mortality to premium-heavy savings products.

Also, a lack of competition may increase the price of insurance without implying a higher level of insurance consumption. Despite these shortcomings, we use insurance penetration as a proxy for the insurance industry’s relevance in economy and society.

Given the ambiguities around the effects of inflation on insurance demand and supply, there are no unequivocal conclu-sions as to the impacts of inflation on insurance penetration.

Based on the logic outlined above, relevant factors (with contradictory effects) to examine include:

- Sums insured

- Prices (premium rates)

- Changes to the product mix (savings versus protection, long tail versus shorter tail)

- Competition

- Customer behaviours in the face of affordability issues and changing risk perception.

For those policyholders who are financially able to avoid underinsurance, sums insured and prices will rise in tandem with inflation for most non-life insurance and protection-ori-ented life insurance policies, pushing up (nominal) premium volumes.

Changes to the product mix are expected to favour life insurance penetration as savings-type policies become more attractive. Non-life insurers’ reduced risk appetite and shift to more short-tail products may weigh on premium volumes

However, as outlined before, eroding inflation-ad-justed incomes, slower economic growth and price increases may offset those effects. Changes to the product mix are expected to favour life insurance penetration as savings-type policies become more attractive. In non-life lines of business, on the other hand, insurers’ reduced risk appetite and shift to more short-tail products may weigh on premium volumes.

…………………..

AUTHORS: Kai-Uwe Schanz – Head of Research & Foresight and Director Socio-economic Resilience The Geneva Association, Pieralberto Treccani – Research Support Manager The Geneva Association