A property & casualty insurer must maintain a certain level of surplus to underwrite risks. This financial cushion is known as “capacity.” When the industry is hit by high losses, such as a major hurricane, capacity is diminished. It can be restored by increases in net income, favorable investment returns, reinsuring more risk, and/or raising additional capital.

P&C Insurance Industry Statistics

| P&C Insurance, $ bn | 2020 | 2021 | 2022F |

|---|---|---|---|

| Net premiums written | $655.5 | $715.4 | $747.7 |

| Premiums earned | $642.7 | $690.2 | $705.7 |

| Losses and loss adjustment expenses incurred | 450.8 | 500.6 | 550.1 |

| Other underwriting expenses | 179.3 | 188.8 | 193.8 |

| Net income after taxes | 60.7 | 63.4 | 61.8 |

| Net investment income | 53.4 | 56.0 | 55.0 |

| Operating income | 59.0 | 54.6 | 52.2 |

| Realized capital gain | 44661 | 44821 | 44940 |

| Percent change | 2.5% | 9.1% | 4.5% |

| Policyholder dividends | 44749 | 44716 | 44700 |

Source: NAIC data, sourced from S&P Global Market Intelligence; Insurance Information Institute

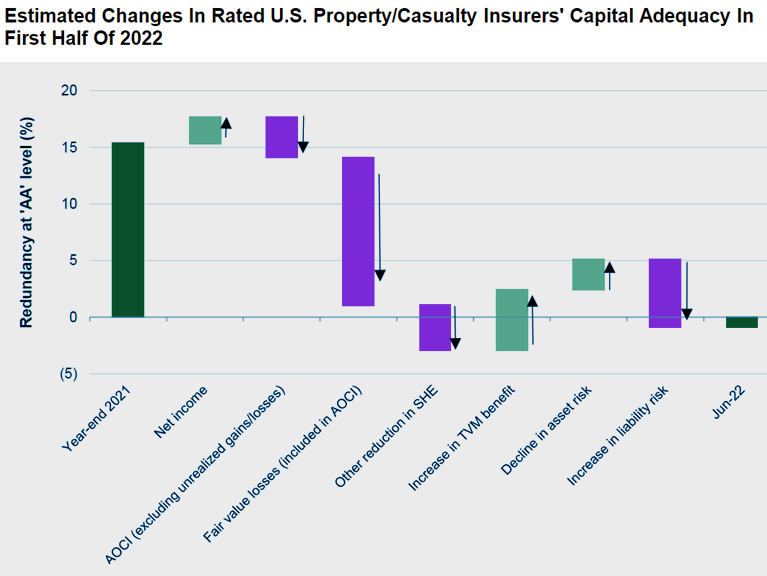

One benefit of rising rates in our capital model is the reserve discount adjustment for the time value of money, which provides a partial offset to reduced shareholders’ equity. The decline in investment portfolios will also reduce the amount of capital required to support asset risk, but this benefit will be offset by higher required capital as premium volume and technical reserves continue to increase.

Given the further rise in interest rates through the third quarter, we anticipate another significant decline in bond portfolio valuations and shareholders’ equity. S&P note that interest rates have continued to increase, so we expect further capital deterioration in the fourth quarter.

Bond market indices are suffering their worst year in decades, and although there may be a partial recovery over the next two to three years, we do not expect all the unrealized losses in insurers’ bond portfolios to be reversed.

The amortization of unrealized losses to par is expected to contribute only modestly to a recovery in valuations over our projection period as most of the losses are on longer dated bonds. In addition, some insurers are selling securities to reinvest the proceeds in higher yielding securities, converting unrealized losses in realized ones.

Reported GAAP earnings have been reduced by realized and unrealized capital losses on equity holdings, which flow through the income statement.

Personal lines writers have had a sharp deterioration in their underwriting results because of the impact of higher inflation and supply chain disruptions on the cost of car parts, building materials, and labor.

The sharp increase in inflation and higher claims litigation costs is also leading some insurers to strengthen prior year loss reserves. An elevated level of convective storm losses and, more recently, losses from Hurricane Ian, have also depressed underwriting performance.

Fortunately, commercial lines pricing and underwriting results remained strong, partially mitigating the deterioration in personal lines for multiline insurers.