US corporate bankruptcy filings gained more momentum in February 2024, underpinned by a flurry of filings in the healthcare sector.

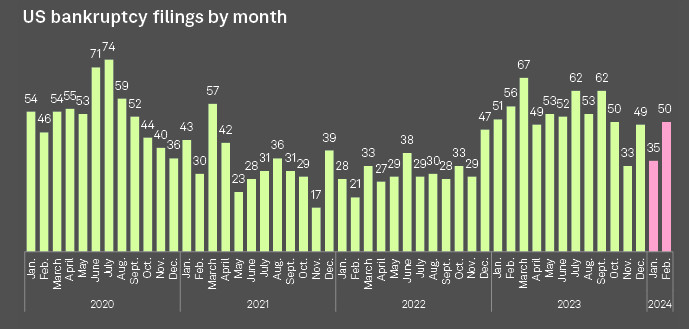

S&P Global Market Intelligence recorded 50 new bankruptcy filings in February, up from a revised 35 in January.

The increase came amid cooling expectations for lower interest rates as inflation remains above the Federal Reserve’s 2% target, challenging the ability of US companies to service their debts.

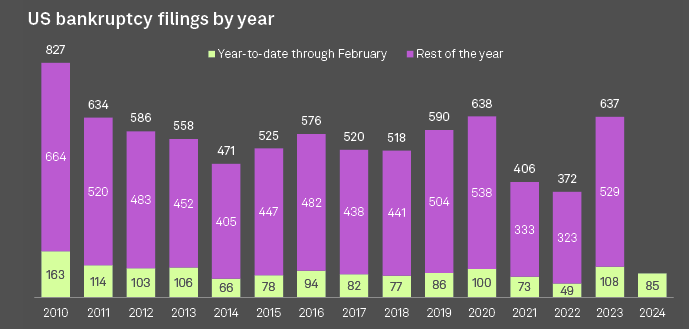

Year-to-date corporate bankruptcies totaled 85, down from the previous year’s number of filings by the end of February but above comparable 2021 and 2022 totals (see Impact of Inflation & Rising Interest Rates on Insurance Industry).

The trend in U.S. corporate bankruptcies has been influenced by a variety of economic, regulatory, and market dynamics over the years. The nature and impact of corporate bankruptcies within the United States have evolved, reflecting changes in the broader economic environment, legislative frameworks, and industry-specific challenges.

As of February 2024, the largest bankruptcy filing in U.S. history remains that of Lehman Brothers, an investment bank based in New York.

This indicates that no new bankruptcy in 2024 has surpassed the magnitude of Lehman Brothers’ collapse (see Impact of Economic Inflation for US Liability Insurance Claims).

For current and detailed data on the largest U.S. corporate bankruptcies as of 2024, including specific companies and their assets at the time of filing, one would need to refer to comprehensive financial databases or reports by authoritative financial analysis firms.

While no concrete data for 2024 was available at that time, understanding the potential trajectory of corporate bankruptcies involves examining prevailing economic conditions, interest rate trends, corporate debt levels, and the overall business climate.

Economic Indicators and Market Conditions

Economic indicators such as GDP growth, unemployment rates, and consumer spending are critical in forecasting corporate bankruptcy trends. A slowing economy, rising unemployment, or decreased consumer spending can increase the risk of corporate bankruptcies. Conversely, robust economic growth and strong consumer spending can mitigate this risk.

Interest Rates and Corporate Debt

Interest rates play a pivotal role in corporate bankruptcies. Low-interest rates post-2008 financial crisis led to an increase in corporate borrowing.

As interest rates rise, corporations with high levels of debt may face increased financial stress, potentially leading to higher bankruptcy filings.

Analyzing the trend of interest rates and corporate debt levels leading up to 2024 can provide insights into potential bankruptcy trends.

Industry-Specific Dynamics

Certain industries may face unique challenges or opportunities that affect their bankruptcy risk. For example, technological disruption, changes in consumer preferences, and regulatory changes can significantly impact industries differently. An analysis of industry-specific trends is essential for a nuanced understanding of potential bankruptcy filings.

Regulatory Environment

Changes in the regulatory environment, including bankruptcy laws and corporate governance regulations, can also influence bankruptcy trends.

For example, the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 made it more difficult for companies to file for bankruptcy under Chapter 7.

Any regulatory changes leading up to 2024 could impact the ease with which companies can declare bankruptcy or restructure their debts.

US bankruptcy filings by year

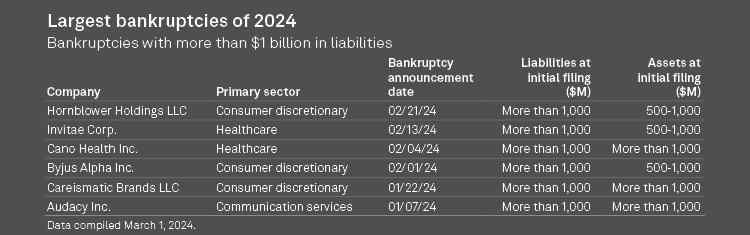

Medical genetics company Invitae Corp., which had been listed on the New York Stock Exchange until a week before its announcement, filed for bankruptcy Feb. 13. In a statement, the company said it had worked to better its cash position over the past 18 months but still needed to pursue a sale to lower its debt.

US bankruptcy filings by month

Hornblower Holdings LLC — which operates cruises, land-based excursions and ferry services across 114 countries and 125 US cities — sought bankruptcy protection Feb. 21 with plans to reduce its debt by $720 million.

Among several announced strategic changes, including Strategic Value Partners LLC becoming a majority owner, the company will target a sale of its overnight cruising business, which it said had not rebounded from the pandemic.

The number of filings was on par with May 2023, which registered the most such filings last year.

Four companies with more than $1 billion in liabilities — consumer discretionary companies Byjus Alpha Inc. and Hornblower Holdings, and healthcare companies Cano Health Inc. and Invitae — filed for bankruptcy in February (see Inflation, Insurance Losses from Natural Catastrophes).

Largest bankruptcies of 2024

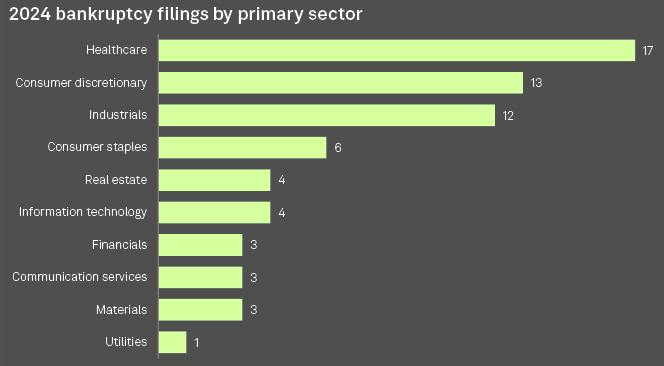

Healthcare shot to the top of the list of sectors with the most bankruptcies with 12 in February, followed by seven filings in the consumer discretionary sector and six among industrials companies.

By sector, consumer discretionary and healthcare stocks were the two most-shorted by mid-February.

US bankruptcy filings by sector

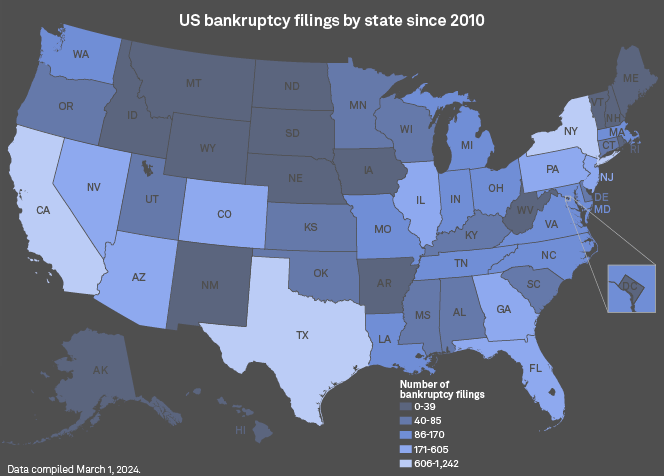

Geographically, California and Texas combined accounted for nearly half of the month’s filings at 13 and nine, respectively. Five of the month’s 12 healthcare company bankruptcies originated in California.

New York and Florida each recorded three filings over the month, while all remaining states saw fewer than two.

US bankruptcy filings by state

Predicting the exact trend of U.S. corporate bankruptcies in 2024 requires a comprehensive analysis of current and projected economic conditions, interest rates, corporate debt levels, and industry-specific challenges.

While historical data provides a basis for understanding potential trends, the unique economic and regulatory environment leading up to 2024 will play a crucial role in shaping the landscape of corporate bankruptcies. As such, ongoing analysis and monitoring of these factors are essential for accurate forecasting.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

……….

AUTHORS: Ingrid Lexova, Umer Khan – S&P Global Market Intelligence analysts

Reviewed by