InsurTech companies rank among the top-performing US insurance stocks in early 2024. The US insurance technology space has grounds for optimism in 2024. Beinsure Media analyzed S&P Global reports on Insurtech stocks maintain momentum, among top performers and presents you with the key highlights.

Industry consolidation is well underway, and the companies strong enough to survive on their own have made progress on their expense reduction plans.

Our analytics expect the insurtech space to continue recovering in 2024, as the industry keeps consolidating and companies with the best prospects for profitability survive.

According to an analysis by S&P Global Market Intelligence, a return to the heady valuations of 2021, when interest rates were near zero, seems unlikely, and we would argue many companies were overvalued at the time.

But a gradual decline in interest rates would help the sector, coaxing public market investors back into growth stocks and making venture funding less expensive for startups.

According to InsurTech`s evolution and investment landscape report, public insurtech market investors seem less bearish on growth stocks, with many insurtech stocks rebounding in 2023.

The insurance industry has generally been a laggard when it comes to digital transformation. Yet a new class of venture-backed insurtech startups is beginning to disrupt incumbents by exploiting the weaknesses of the traditional insurance ecosystem.

The US insurtech space has grounds for optimism in 2024

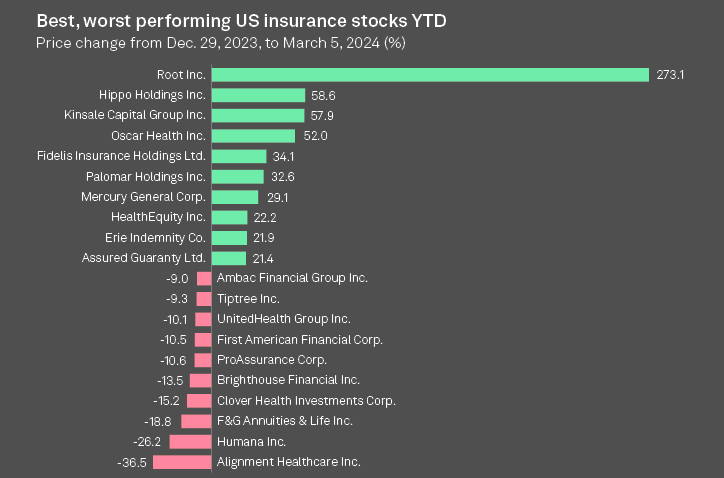

Root leads the pack of publicly traded insurance firms with a remarkable 273.1% rally by March 5, 2023, partly due to its record-breaking quarterly results announced on February 21. Hippo Holdings Inc. recorded a 58.6% increase, securing the second position (see Global Landscape of Insurance Digital Transformation).

Despite significant gains, Root’s CEO, Alex Timm, in a conversation with Market Intelligence, expressed a deliberate disregard for market volatility.

He emphasized the company’s commitment to the core aspects of their operation, such as maintaining industry-leading loss ratios, controlled growth, and meticulous expense management.

Timm highlighted a sustained focus on customer needs, trusting that the market will ultimately recognize the company’s value.

Insurtech stocks have shown notable improvement

According to Global InsurTech Data Highlights, insurance technology stocks have shown notable improvement after facing challenges for several years. Kaenan Hertz, Managing Partner for Insurtech Advisors, highlighted that both Root and Hippo realized the need for significant changes to their business models around two years ago to ensure their survival.

Root implemented more aggressive adjustments earlier, including cutting marketing costs, reducing staff, and overhauling their business models, which has now begun to yield positive outcomes.

In 2023, a milder catastrophe season benefitted underwriters broadly, and Hippo achieved greater revenue diversification.

Hertz observed that perceptions are changing regarding the viability of insurtech companies, although the final outcome remains uncertain.

Best / worst performing US insurance stocks

Insurance technology companies, particularly Insurtech Oscar Health, have demonstrated impressive performance in the U.S. insurance stock market as of 2024, continuing the upward trend from 2023 with a 52% growth.

Oscar Health attributes its success to expanding in the marketplace, making health insurance more consumer-friendly, and providing its technology to other healthcare entities.

Analysts described Oscar Health as a “nimble small pirate ship” in his Hospitalogy newsletter, highlighting its strategic exit from unprofitable markets, focus on core strengths, and departure from the previous “growth at all costs” approach.

In contrast, traditional managed care insurers have not fared as well, becoming some of the worst performers in 2024. These companies, including Alignment Healthcare Inc. and Humana, have seen significant stock declines of 36.5% and 26.2%, respectively, due to unexpectedly high medical costs affecting their earnings in the fourth quarter of 2023.

Scott Fidel, an analyst from Stephens, noted in a research brief that Alignment Healthcare posted mixed results for the fourth quarter of 2023. Although revenue surpassed expectations, the company’s medical loss ratio was higher than anticipated.

Managed care insurers, including Humana and UnitedHealth Group, which also saw a 10.1% decline in its stock as of 2024, reported higher-than-expected utilization rates in the fourth quarter of 2023.

Humana executives clarified during their earnings call that the increased costs were due to a mix of outpatient and inpatient services not related to COVID-19 or the respiratory syncytial virus (RSV) season.

Humana intends to use the fourth quarter’s elevated medical utilization as a new baseline for future operations, with CEO Bruce Broussard anticipating a Medicare Advantage repricing across the industry in 2024.

US Insurtech Market Report

Regardless of the macro environment, we think artificial intelligence will be key for the space. It has the power to transform industries and, as we have seen, create more investor enthusiasm in tech stocks.

Insurtech companies should fully embrace AI and promote those efforts to investors.

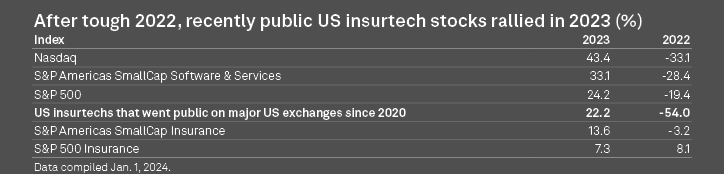

After a dismal 2022, public market investors warmed back up to the stocks of insurtech companies that have gone public on the major US exchanges in the past four years. A market-cap weighted index of these companies was up 22.2% in 2023 versus a decline of 54.0% in 2022.

Public market investors warmed back up to the stocks of insurtech

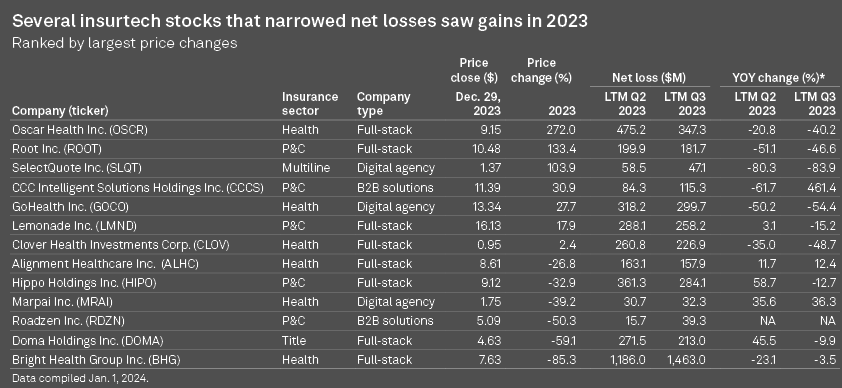

The stocks are still very cheap relative to their 2021 valuations, and companies have made progress on lowering net losses.

Several insurtech stocks

This recovery happened sooner than we expected. We anticipated insurtech stocks bottoming out in January 2024, based on the dot-com era. Our insurtech index peaked in June 2021, and it took the Nasdaq about 2.5 years to recover after the dot-com bubble burst.

Some US insurance stocks saw gains from unique situations

Oscar Health experienced a rise in its stock value after naming ex-Aetna Inc. CEO Mark Bertolini as its new CEO.

Similarly, Root’s stock increased in June following rumors of a takeover bid by Embedded Insurance, while GoHealth saw its shares climb in May after receiving a buyout offer from its two biggest shareholders. Despite these offers, Root and GoHealth decided against accepting them.

The reduction in short interest also contributed to the stock gains for five out of the seven companies that saw their shares rally, indicating a decrease in bets against these stocks from December 2022 to mid-December 2023.

Lemonade, however, stood out with a roughly 37% rise in short interest during the same timeframe.

These event-driven increases and the decline in short interest suggest that these companies may now have improved prospects and valuations.

This trend could lead to more IPO activities in 2024, despite Roadzen`s unsuccessful market debut in 2023, where its stock fell by 40.9% on the first trading day post its special purpose acquisition company deal.

Insurance Insider US reports that Slide Insurance Holdings is considering a public offering in the first half of 2024 among other financing options.

The company, specializing in homeowners insurance, emphasizes its extensive data assets and analytics capabilities as key strengths.

Slide Insurance Co., its carrier subsidiary, has shown rapid growth, expanding from no direct premiums in 2021 to $481.9 million in 2022 and continuing to grow in 2023.

A significant portion of Slide’s business comes from Florida homeowners insurance. It increased its premiums significantly by acquiring renewal rights from Farmers Insurance Group of Cos. and two companies in receivership in Florida.

In 2023, it further expanded by assuming $122.1 million in premiums from Citizens Property Insurance on October 17.

Despite reporting a net loss in 2022, partly due to Hurricane Ian’s impact, Slide Insurance achieved a net income of $1.2 million in the first three quarters of 2023. However, the final quarter’s results could potentially reverse this positive outcome.

Kin Insurance might also explore an IPO, particularly if Slide’s public offering succeeds. Kin, which focuses on tech-driven homeowners insurance in disaster-prone areas like Florida, had planned a public merger in 2021 but canceled it in January 2022.

These companies’ strategies highlight the lucrative potential of entering capacity-constrained markets, although success heavily depends on accurate pricing and regulatory approval for desired rates.

…………..

AUTHORS: Thomas Mason – senior research analyst at Research Advisory Specialty Solutions, Tyler Hammel – S&P Global Market Intelligence contributor

QUOTES: Alex Timm – Root’s CEO, Kaenan Hertz – Managing Partner for Insurtech Advisors

Edited & Reviewed: Oleg Parashchak — CEO & Owner Finance Media Holding