The aforementioned hardship has resulted in a number of different InsurTech businesses being forced to make some decisions that would have been previously unthinkable, even as recently as in the last 12 months. Several businesses have publicly laid staff off, and in more extreme cases, been forced to shut shop. At the end of 2019, there were nearly 3,000 global InsurTech businesses. We estimate that currently there are 2,050 businesses that are actively open for business.

According to Gallagher Re Global InsurTech Report, 2022 began with a lot of uncertainty, with a number of macroeconomic factors (many not directly relating to reinsurance) impacting venture capital and the general bullishness in InsurTech industry of the impact that technology was actually having.

2022 has been a year of macro-realism (for many InsurTechs, investors and risk partners alike), and micro company hardship

While so much is made of the capital invested into InsurTechs, this feeling of constructive accreditation hit its highest point at the end of 2021, culminating the crescendo of a rise that at times seemed to have no end.

2022 has been the most important year for InsurTech

With the downturn of investment came the revision of company values and a rethinking of what ‘success’ should mean in a more conservative environment. As a direct result, the ability to leverage individual company equity for loss-propping risk capacity became increasingly difficult, and several InsurTechs had some very challenging decisions to make as they reviewed their own margins and likelihood of (near term) future rounds.

While it is very difficult to get any real insight on the accuracy of companies no longer in existence, staff layoffs have been profoundly visible, especially with better known InsurTechs.

In some extreme cases, InsurTechs have laid off up to 40% of their working headcount, which for larger InsurTechs can translate into 300 to 500 people in one swoop.

As mentioned in prior reports, some of the InsurTech company ‘restructuring’ is simply streamlining redundant positions (which is completely normal in a fast-paced business where some roles are no longer required), but it is also a sign of belt buckling, a pulling back on valuation peacocking (hiring lots of staff prior to an investment round can artificially increase a company’s ‘value’), and in many cases an unclear view on the next significant financial event (see How Insurers and InsurTechs Can Transform Insurance Platforms?).

In the past few months of 2022, the global technology sector has seen an incredible number of public layoffs—including many of the world’s most notable tech companies.

It is estimated that from some of the largest and most established tech firms, approximately 120,000 layoffs across close to 800 companies has been recorded in the second half of 2022 (see How InsurTechs & Tech-Driven Innovation Changing the Insurance?).

The current risk capacity market is also applying pressure to the squeeze being felt by many (in terms of costs, margin returns and availability to support originated business from an ‘InsurTech player’ where so many incumbent risk partners have been historically burnt).

We are arguably in the hardest (re)insurance market since the tragic events of 9/11. In such environments, as rates go up/harden, (re)insurance capacity simply becomes a more expensive sought-after commodity, and frankly most InsurTechs were either ill-prepared for this scenario, or simply did not understand the industry well enough to model for it and respond appropriately.

Tighter risk capacity has been mostly the result of reduced risk appetite rather than capital shortage, and the onus is on risk-originating InsurTechs to make their business look attractive – this shift for many is culturally a huge one, ‘not what you can do for me, but what I can do for you’.

With modelling uncertainty affecting a lot of incumbents’ written books, InsurTech capacity allocation is simply not a risk worth taking for a number of reinsurers (see TOP 50 Largest Global Reinsurance Groups in the World).

On the venture capital side of things, VCs are really drilling into the focus on profitability and well-understood, well-seasoned KPIs. It would appear that the investment capital is still available for the most part but it has two padlocks on it where it may have once had one (see InsurTechs Need to Keep Pace).

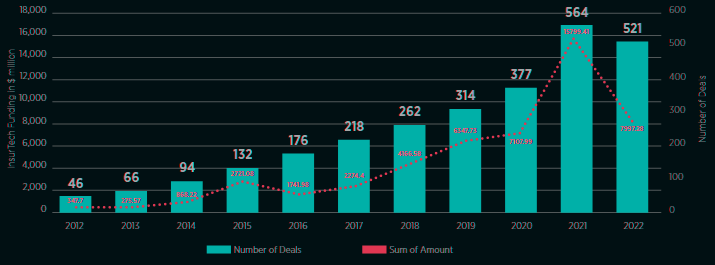

The numbers are still impressive in isolation, but there has been a dramatic drop from 2021. In fact 2022 is the first year since 2016 to observe a year on year downturn of InsurTech investment activity (and 2015 to 2016 was skewed by the enormous ZhongAn deal).

Another observation is the seeming reversal of how things are ordered and lined up for investment due diligence, particularly for risk originating InsurTechs.

Whereas venture capital historically preceded risk capital commitments, VCs are now looking to see that (re)insurers are actually going to come to the table (first in some cases) before writing a cheque. Understandably this has created a chicken and egg type situation for a number of InsurTechs looking to raise money in this environment.

What is possibly the most significant feature of 2022 (as we review the ‘key events’ of each year leading up until this point) is that the narrative around ‘disruption’ seems to be truly over.

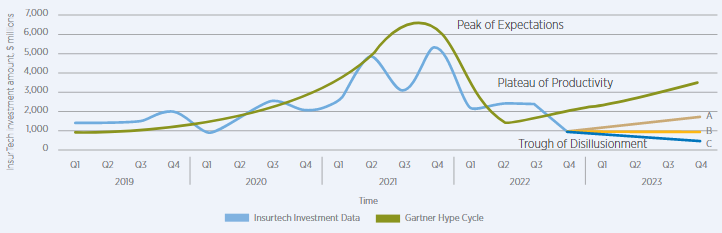

InsurTech Investments to Date and the Gartner Hype Cycle

2016 to 2019 was awash with InsurTechs telling the industry to brace itself for the cataclysmic revolutionary forces it was preparing to unfold, and 2020 and 2021 seemed to really focus on spectacular raises, IPO’ing and blessings of unicorns (see InsurTech Market Faces a Valuation Decline). Neither evolutionary cycle seemed to demonstrate much robustness en masse.

However, was the creation of a select number of individual businesses, associated with the label of ‘InsurTech’ who have done remarkably well. They all have one thing in common, however; they treat the industry as the community that it is, and realise that giving is equally (if not more) important than to simply take.

They are conscientious partners who understand our industry, and utilise technology as an enabling force, not just a product to masquerade bad business behind.

Many InsurTechs tried to unpick the traditional value chain and put it back together in an even more convoluted and complex way than it is today – this failed experiment, for the most part, has provided new InsurTechs with many cautionary tales to read from.

We are at the dawn of a new age where the role of technology, being brought to the table by InsurTechs is to support the global trillion dollar industry of ours, not to use it as justification to raise absurd amounts of money against unjustifiable valuations. The future for technology in our industry is very bright indeed, and InsurTech will undoubtedly play a huge role in that.

One could make the case that the over-active participation of VCs and PEs up until the end of 2021 has actually done a lot of damage to the underlying value that InsurTech was expected to deliver to our industry (improved outcomes via the use of technology) as valuations and capital raises became highly distracting.

The reality check that 2022 has ushered in is already presiding over an exodus of third-party capital.

This reprieve may give InsurTech the chance to breathe and focus in on the real prize(s) that our industry has been hoping for – wider adoption of appropriate technology to make the entire process more efficient, more cost effective and ultimately better (see Biggest InsurTech Unicorn Startups in the World).

With the seeming inflection point of InsurTech upon us, it is interesting to see how the reality of InsurTech investment data stacks up against a well-understood model designed to represent the maturity, adoption and social application of specific technologies, the Gartner hype cycle.

The hype cycle attempts to provide a graphical and conceptual presentation of the maturity of emerging technologies through evolutionary phases from early-stage adoption, maxed-out expectations and then the long-term relevance/applicability and general acceptability over time. The model is in no way ‘complete’ but an interesting interpretation of events in any case.

If 2021 does in fact turn out to be the year of ‘greatest’ volume of InsurTech investment, we might crudely associate that event as ‘the peak of inflated expectations’, giving us the basis for projecting the current InsurTech investment amount on the Gartner hype cycle.

Looking at the projection, there are certainly some correlated trends which appear to stand out; notably the dramatic rise of interest and the sharp return down again. The InsurTech data we are presenting is on a quarter by quarter basis – if consolidated annually, it would be even ‘truer’ to the hype cycle model. What is intriguing is what comes next.

If InsurTech investing does in fact continue any kind of correlation with the model, there will be an elevated ‘plateauing off’ over time.

That is to say that a natural harmony will be met between investing, valuations and consumer expectations/tech productiveness.

There is also the distinct possibility that 2022 marks the beginning of an overall downward trend which continues to ebb away at the historically observed phenomena of significant investing into ‘InsurTech’. And finally, it is quite possible that we will see a revival in InsurTech investment and in fact what we are currently experiencing is nothing more than a temporal deviation away from the model itself. Only time will tell but it is certainly something that we will track (see Biggest FinTech Unicorns in the World).

Before jumping into the numbers and InsurTech data, there is one final aspect of all this that is worth revisiting.

There is rightfully so, a huge amount of pressure on the label ‘InsurTech’ – now more so than ever it has the potential to be extremely misleading.

Technology in insurance industry is here to stay and is being applied in our business at unprecedented rates that is simply a fact.

And yet we are simultaneously observing a dampening down of ‘InsurTech’ investment numbers and market penetration successes (as failures) that could mislead others into thinking that technology in our industry is also somehow floundering.

For some, any insurance practice yoking technology warrants the use of the label ‘InsurTech’, for others it refers specifically to the cultural phenomena of outside forces looking to disrupt our industry under the guise of being technologically enabled (as its sole competitive advantage).

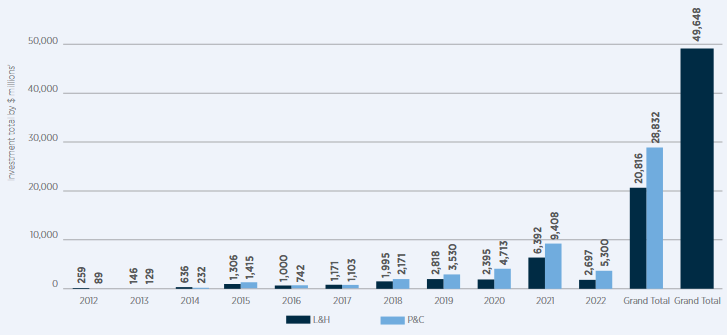

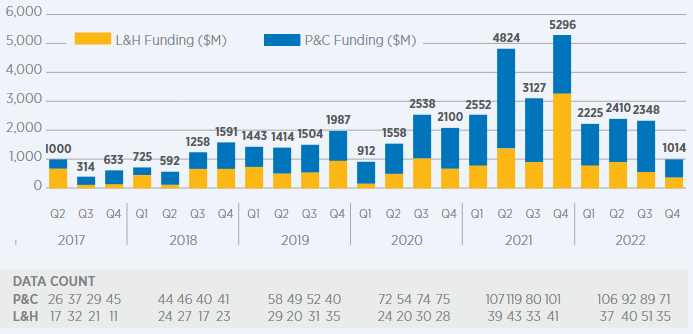

$50 billion having been invested into InsurTech businesses since 2012

2021 saw the peak, and this most recent year (2022) has brought the reality of the issue back to down to earth somewhat. As the graph also shows, 40% of the total funding has gone into life, accident and health InsurTechs, with the other 60% being invested into InsurTechs focused on property and casualty.

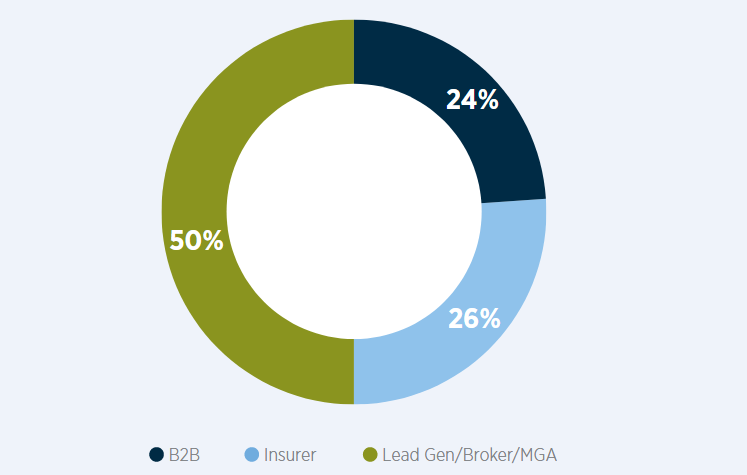

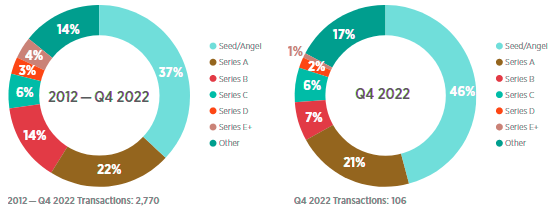

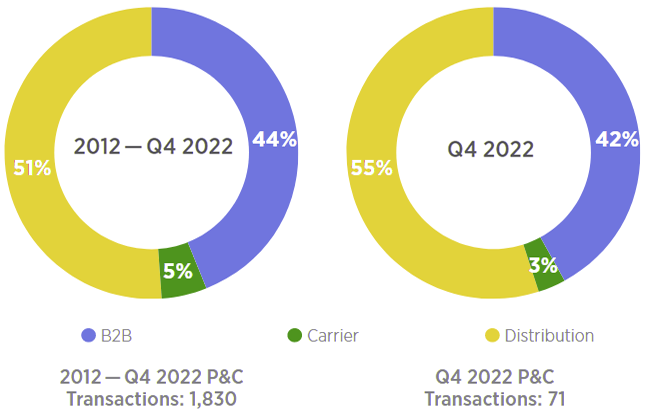

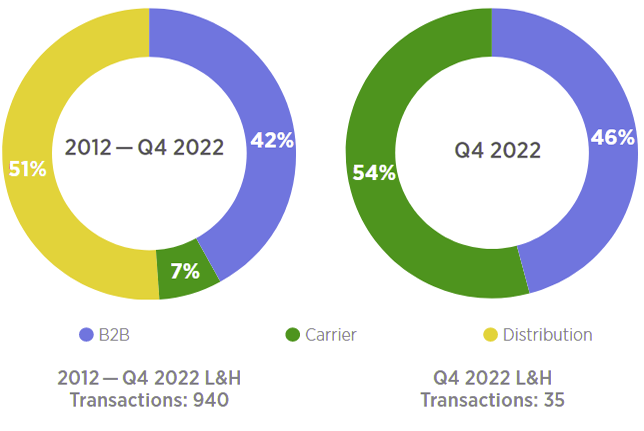

If we break each InsurTech that has raised capital since 2012 until now into its respective business model, the pie chart to the right clearly shows that the significant majority, 50% in fact, of InsurTechs that have completed successful fundraises are focused on the model of ‘distribution’ whether that be as a lead generator, as a broker, or as an originator of risk (but no risk bearing functionality).

Full-stack (end to end) insurer model InsurTechs then take a closely contested second spot with 26% of raises, and B2B (SaaS) technology vendors complete the rest of the picture with 24% raised.

When we think about the re-imagining of the label of InsurTech, this is possibly a good place to begin. How similar is the role of a digital broker who may work between incumbents but not provide direct technological support, versus a B2B player who could in fact be running an entire insurer’s backend office operation?

Similarly, those InsurTechs who grab the headlines are nearly always those companies that originate risk, whether it be as an MGA or full-stack insurer. It is from these headline companies that many derive their overall view on InsurTech which is misleading when we consider the broader environment.

Before diving into this quarter’s data, we just want to spend a moment recounting some of the key observations from Q3’s data set to provide the stage for presenting the end of year final totals.

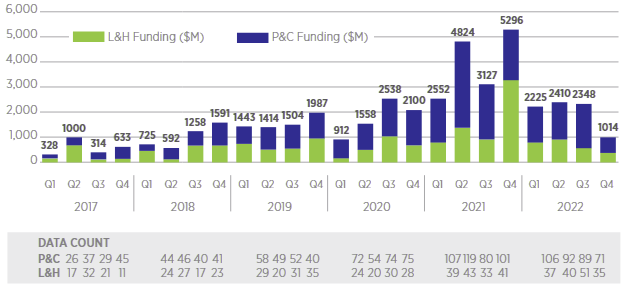

Total InsurTech Investment by Year and Grand Total Split by P&C and L&H

The $2.3 billion raised in Q3 was the lowest level of InsurTech funding since Q2’20. Sixty-three percent (63%) of total funding came from mega-rounds, the highest percentage of mega-round contribution since Q4 2021.

There are now a total of 42 InsurTech unicorns, but Q3 produced no new unicorns at all as a quarter (the first time since Q2’18)

Preexisting InsurTech unicorns wefox, HiBob, At-Bay and Coalition all raised additional funding in Q3. There were seven $100 million+ mega rounds (totalling $1.5 billion) accounting for more than half of all InsurTech funding. This was a stark difference from FinTech trends globally, which saw mega-round funding share fall to 34% this quarter.

Property and casualty (P&C insurance) InsurTech funding grew for the first time since Q2 2021 to reach $1.8 billion, up 20% quarter on quarter. It represented over 75% of all InsurTech funding in Q3. However, P&C InsurTech deals declined by 11% to 89, the lowest level since Q3 2020. Q3 saw 48% growth in Asian InsurTech funding, increasing to $584 million.

Deals also grew by 52% quarter on quarter, and Asia came second to the US in regional deal share with 25% of all InsurTech deals.

Total Split Type of Business (2012–2022)

Asia also had three megadeals, with HiBob, Carrot General Insurance and InsuranceDekho raising $150 million, $145 million and $100 million, respectively. Asia surpassed Europe to take second place in deal share (in 2022 to date).

For investors, CVC deal share dropped to 5% among investor groups, reaching a 5-year low (private equity was at 7%, investment management at 7%, incubator/accelerator at 8%, corporate at 9%, angel 11%, other 20%, and VC 32%).

Prior to Q3, CVC had been at 12% (Q2), 10% (Q1), (12%, 2022 Q4) levels. A possible indication that incumbents’ interest in InsurTech is declining? They were certainly (significantly) less active in Q3. For VCs, Q3 saw UK’s Anthemis the most active investor with four deals done, with Eos, Greycroft and Lerer Hippeau all joint second/ most active with three deals done by each.

Average and median deal sizes were down 35% and 29%, respectively, compared to the full year of 2021’s totals from $31 million to $20 million in average size deals, and $7 million to $5 million in median size deals, with median deal size shrinking in the US and Asia, and remaining flat in Europe. Private equity was the only investor group to see an increase in median deal size in 2022 (up to Q3), from $50 million to $55 million. Angel, asset management, CVC, corporate and VC all otherwise dropped across averagesrawn from comparative 2022 and 2021 levels.

InsurTech Data Highlights

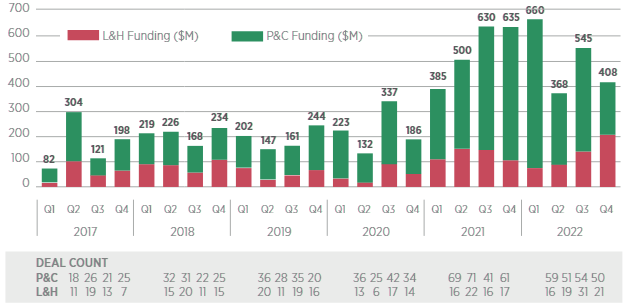

Quarterly InsurTech funding for Q4 fell to the lowest level since Q1 2020, decreasing 57.0% quarter on quarter from $2.35 billion in Q3 to $1.01 billion in Q4. InsurTech deals dropped to 106 in Q4, the lowest number of deals since Q4 2020.

Mega-round funding fell 89.7% quarter on quarter, from $1.48 billion in Q3 to $153 million in Q4.

Funding increased 46.5% quarter on quarter for early-stage L&H InsurTechs, from $145.84 million in Q3 to $213.64 million in Q4. Seventy percent (70%) of corporate InsurTech investments from (re)insurers in Q4 were early stage.

Total Annual InsurTech Funding

Annual funding for InsurTech halved between 2021 and 2022, decreasing 49.5% year on year from $15.80 billion in 2021 to $7.98 billion in 2022. 2022 saw $6.51 billion less in mega-round funding than 2021 – a 66.7% year on year drop. Early-stage funding as a percentage of total InsurTech funding increased to 24.8% in 2022 – a five-year high.

Early-stage funding for L&H InsurTech increased 0.1% year on year. This was the only funding increase among total and early-stage activity across both L&H and P&C.

Deal share for United States-based InsurTechs rose 3.7 percentage points between 2021 and 2022 – the largest gain among all countries.

P&C InsurTech funding fell 43.7% year on year, from $9.41 billion in 2021 to $5.30 billion in 2022. Meanwhile, L&H InsurTech saw funding decrease from $6.39 billion in 2021 to $2.70 billion in 2022 – a year on year drop of 57.8%. Global InsurTech deals saw a lessened year on year decrease than funding, from 564 in 2022 to 521 in 2021.

The funding decline is most attributable to a 66.7% year on year drop in mega-round funding. 2022 saw $6.51 billion less funding to mega-rounds than 2021. P&C InsurTech mega-round funding fell 54.5% year on year, from $5.23 billion in 2021 to $2.38 billion in 2022. As with overall funding, L&H experienced a greater percentage drop in mega-round funding than P&C – falling 80.8% year on year from $4.52 billion in 2021 to $866.93 million in 2022.

2022 saw a lessened drop in early-stage InsurTech funding, relative to overall funding and mega-rounds. Early-stage InsurTech funding dropped 7.9% year on year, from $2.15 billion in 2022 to $1.98 billion in 2021.

P&C InsurTech raised the majority of early-stage funding in 2022 – $1.44 billion compared to $537.31 million in L&H funding. However, early-stage L&H InsurTech saw a positive funding trend. Funding increased 0.1% year on year, from $536.69 million in 2021 to $537.31 million in 2022.

2022 saw a 22.5% year on year increase early-stage deal count for L&H InsurTech – from 71 in 2021 to 87 in 2022. Given the overall InsurTech funding drop, early-stage funding as a percentage of total InsurTech funding increased to 24.8% in 2022 – a five-year high.

Average Deal Size

The quarterly decrease is largely attributable to a 64.4% quarter on quarter drop in P&C InsurTech funding, from $1.77 billion in Q3 to $630.16 million in Q4. L&H InsurTech also experienced a large quarter on quarter drop in funding, falling 33.7% from $579.19 million in Q3 to $383.76 million in Q4.

Average InsurTech deal size also decreased quarter on quarter, falling 42.3% from $20.42 million in Q3 to $11.79 million in Q4. The drop was more pronounced within P&C – falling 52.7% from $22.97 million in Q3 to $10.86 million in Q4.

L&H average deal sizes only dropped 10.0% from $15.24 million in Q3 to $13.71 million in Q4. Quarterly InsurTech deals fell to a two-year low, dropping from 140 deals in Q3 to 106 deals in Q4. P&C InsurTech deal count fell 20.2%, from 89 in Q3 to 71 in Q4, whereas L&H deal count fell 31.3%, from 51 in Q3 to 35 in Q4.

Funding for mega-round deals fell 89.7% quarter on quarter, from $1.48 billion in Q3 to $153 million in Q4.

Clearcover, a Chicago-based digital auto insurer, raised $153 million in a venture-backed funding round – also the quarter’s only mega-round deal. Q4 2022 saw the lowest mega-round funding within InsurTech since Q1 2020 (which saw $100 million in one deal).

InsurTech by the Numbers

Funding increased 46.5% quarter on quarter, from $145.84 million in Q3 to $213.64 million in Q4. Moreover, average early-stage deal size jumped 115.4% quarter on quarter to $12.57 million.

This was driven by four early-stage L&H InsurTech deals over $40 million and a decreased deal count for the category, from 31 in Q3 to 21 in Q4.

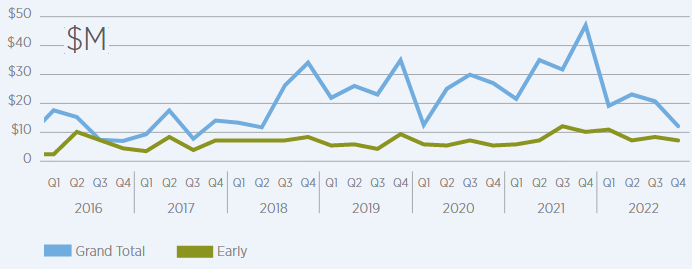

Quarterly InsurTech Funding Volume — All Stages

Early-stage funding saw a less substantial decline, falling 25.1% quarter on quarter from $545.35 million in Q3 to $408.27 million in Q4. The decrease is attributable to a 51.3% quarter on quarter drop in early-stage P&C InsurTech funding, from $399.51 million in Q3 to $194.63 million in Q4.

Early-stage P&C InsurTech deals also declined, falling from 54 in Q3 to 50 in Q4, and average deal sizes dropped 44.4%, from $8.32 million in Q3 to $4.63 million in Q4. In line with the annual trend for total L&H funding, early-stage L&H InsurTech saw a positive funding change in Q4.

Quarterly InsurTech Funding Volume — Early Stages

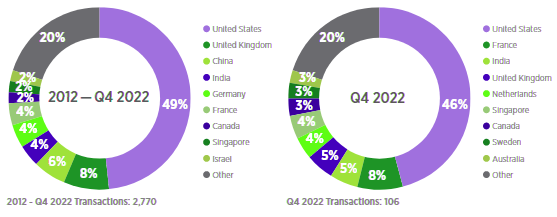

Global deal share among United States-based InsurTechs rose 3.66% between 2021 and 2022 – the largest gain among all countries.

Specifically, the United States saw a year on year increase in deal share percentage from 42% in 2021 to 45.68% in 2022.

Other nations with the largest deal share increases within InsurTech between 2021 and 2022 are: France: 1.46%, from 3.72% to 5.18%, Germany: 1.13%, from 2.13% to 3.26%, Chile: 0.99%, from 0.35% to 1.34% and the Netherlands: 0.81%, from 0.53% to 1.34%.

Quarterly InsurTech Funding Volume — All Stages

China experienced the largest decrease among all countries in global InsurTech deal share – falling 3.35%, from 5.85% in 2021 to 2.50% in 2022. Other nations with the largest deal share decreases within InsurTech between 2021 and 2022 are Brazil: -1.52%, from 2.48% to 0.96%, Israel: -1.28%, from 3.01% to 1.73%, United Kingdom: -1.08%, from 7.80% to 6.72% and Spain: -0.99%, from 1.95% to 0.96%.

Quarterly InsurTech Transactions

by Target Country

by Investment Stage

The largest deal for the year was raised by Germany-based wefox – a $400 million Series D deal in Q3. The three next largest deals were raised by United States-based companies – Pie Insurance, Coalition, and Newfront Insurance. Finally, France-based Alan raised the fifth-largest deal of the year. Together, these deals raised a combined $1.36 billion in funding.

P&C InsurTech Transactions by Subsector

L&H InsurTech Transactions by Subsector

70% of corporate InsurTech investments from re/ insurers in Q4 2022 were early-stage. Q4 2022 saw 20 corporate InsurTech investments from (re)insurers. This was the lowest quarter for investments from (re)insurers in 2022. Q4 brings the 2022 total to 105 investments, with an average of 26.25 per quarter for the year.

2020 and 2021 saw 96 and 107 corporate InsurTech investments, respectively.

Comprising 30% of all investments, Q4 also saw the highest percentage of seed or angel corporate InsurTech investments from (re)insurers since Q4 2015.

In addition, Q4 saw 40% of all InsurTech investments from (re)insurers – the highest percentage since Q2 2020. Lastly, for the first time since Q3 2016, there were no Series C or Series D InsurTech investments from (re)insurers.

MS&AD Ventures led corporate venture activity among re/insurers in Q4 2022 with 4 investments. Four other (re)insurers made multiple investments in Q4 were AXA Venture Partners, CMFG Ventures, Munich Re Ventures and Tokio Marine Holdings.

Notable partnerships from Q4 2022 between (re)insurers and InsurTechs (as well as Amazon) include Aviva and Lemonade, Amazon and Ageas, Co-op Insurance, and LV= General Insurance, CSAA Insurance Group and Zesty:ai, Nationwide and Human API and The Travelers Companies and Corvus.

……………………

AUTHOR: Dr. Andrew Johnston – Global Head of Gallagher Re

Fact checked by Oleg Parashchak