For nearly a decade, insurtechs have experienced rapid growth and skyrocketing valuations. But in 2022, investors’ optimism has been tempered by compounding pressure from inflation, rising interest rates, and geopolitical and macroeconomic uncertainty (see How insurers can increase inflation resilience?).

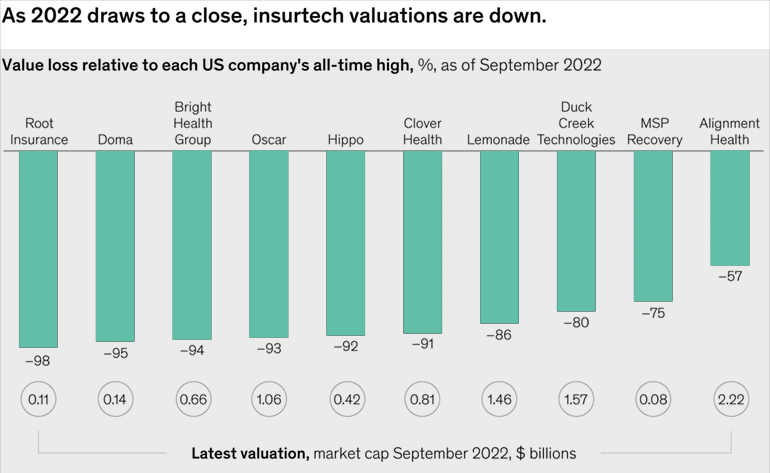

According to McKinsey Research, investors are increasingly looking for a sustainable business model advantage—a far cry from the “growth at all costs” focus in recent years. As a result, major publicly listed insurtechs have seen their valuations plummet compared with their all-time highs.

Insurtech is discovering solutions such as offering ultra-customized policies, social insurance, and using new streams of data from Internet-enabled devices to dynamically price premiums. Insurtech helps insurers to collect and analyze customer data, which can be specifically used to target right customer, with affordable price quotation (see How Insurers and InsurTechs Can Transform Insurance Platforms?).

Moreover, with the use of machine learning, artificial intelligence, and cloud computing, Insurtech helps in making better predictions of consumer needs, purchase quantity, and improves decision making and insurance planning.

After years of growth, the US insurtech market faces a sharp decline in valuations. How should established insurance carriers respond?

The exhibit shows the compression of valuation for ten publicly traded insurtechs that had previously enjoyed some of the largest funding rounds of the industry (see Biggest InsurTech Unicorn Startups List). This cooling has sent shock waves through the insurtech community and reminded players to balance their hunger for growth with scalable business performance.

At the same time, rising interest rates and hard markets are benefiting many insurance carriers. This stands in contrast to the previous decade, in which insurers struggled to earn their cost of capital.

This struggle persisted due to a prolonged period of premium growth below GDP growth and was compounded by the impact of sustained low interest rates on life and retirement carriers. There was also an influx of alternative capital and elevated catastrophe losses on property and casualty carriers.

The global insurtech market is expected to grow from US$8.07 billion in 2021 to $10.42 billion in 2022, at a compound annual growth rate (CAGR) of 29.2% – worth $29.75 billion by 2026, with a CAGR of 30%. According to FMI, the insurtech market is forecasted to reach a net worth of US$ 165.4 Bn in 2032.

The market dynamics today, with insurtech players facing headwinds and incumbent insurers benefiting from certain tailwinds, have effectively “turned the tables” across the insurance landscape, putting traditional insurance companies in a much more advantageous position relative to insurtechs (see How Artificial Intelligence Can Help Insurers Reduce the Inflation Impact?).

In light of this, executives should consider the acute, strategic, and tactical opportunities now available to them.

Strategic implications for insurers

The current environment has created new opportunities for carriers to raise their aspirations and move more quickly on their strategic priorities. To capture the opportunities, insurers will want to prioritize three strategic actions.

Make bold moves

During the 2007–2008 financial crisis, a dichotomy emerged between the winners (what we call “resilients”) and the losers. The subset of resilients not only widened the performance gap during and immediately after the crisis but also carried that outperformance into the next decade.

Across sectors, resilients differentiated themselves through similar actions:

- fast, decisive moves on productivity during the downturn to preserve growth capacity;

- M&A strategies characterized by proactive divestments and acquisitions to reshape the portfolio as needed;

- the preservation of operational and financial options that allowed them not only to survive the crisis but also to accelerate through it.

In the current economic landscape, bold strategic moves will be similarly essential.

Raise the aspiration for strategic bets and business building

The current downturn in the insurtech market might seem to suggest that big digital bets are not worthwhile.

But according to McKinsey’s latest global business-building report, in insurance and financial services, every dollar of revenue from new businesses generates more than twice the enterprise value compared with every dollar of core business revenues.

Therefore, it is no surprise that eight in ten surveyed CEOs reported new-business building as a top five priority despite recent heightened economic volatility.

In insurance, companies with capital to deploy may be able to significantly accelerate the growth of strategic bets by building new businesses and boosting the trajectory of nascent businesses in their portfolio.

Reevaluate build-buy decisions

According to InsurTech Market Outlook, since their emergence, insurtechs have been continually transforming insurers’ build-or-buy equations. Given the relative discount on existing solutions in the market and insurtechs’ need for capital, now is the time to reevaluate those equations for both new and in-flight initiatives.

As insurers raise the aspiration for strategic bets and business building, there likely will be substantially more opportunities to buy market access and capabilities now than at almost any time in the past decade.

Two tactics for traditional insurance carriers

Tactically, insurers can capitalize on the current valuation pressures on insurtechs in two ways.

1. Transform Insurer’s talent structure

Compared with other industries, insurers have historically struggled to attract digital and analytical talent, even within financial services. As the initial disruption of insurtechs settles into and becomes part of the industry landscape, insurers could find themselves in closer proximity to the data scientists, machine-learning engineers, and other next-generation talent initially attracted to the industry by insurtechs.

Especially amid fluctuations in the insurtech market, insurers can strengthen their digital talent through recruiting (as insurtechs are forced to downsize) or M&A (as an “acqui-hire” strategy becomes more viable with depressed valuations).

2. Insurers must be aggressive in procurement

Insurtechs have come to play a critical role in enabling the insurance value chain. In fact, according to McKinsey’s Insurtech database, 63% of insurtechs enable the value chain and cooperate with insurers (as opposed to prioritizing industry disruption).

Given that the current insurtech environment is characterized by a scarcity of capital and urgency to achieve profitability, insurers could have their strongest negotiating position in years with many of their current digital and technology vendors, as well as with vendors of platforms that they are considering as part of technology improvements and upgrades.

5 important takeaways for insurers & investors

- Data and AI are expanding beyond personal lines of property and casualty insurance but are slow to replace manual work. Last year, analytics noted the expansion of property-intelligence solutions; this year, it was again seemingly the most popular category among providers on the expo floor. The COVID-19 pandemic improved customers’ comfort with using digital channels, and now many insurance carriers have shifted significantly to become digitally enabled. The industry has started adopting more sophisticated data across commercial lines beyond real estate and property in areas such as commercial auto, workers’ compensation, and general liability (see New Customer & Technology Trends in the Changing Insurance Market). Automation is more challenging, however. Many companies can complete a wide spectrum of actions digitally—from product customization to efficient claims processing—but many of those services have yet to be built or offered with enough accuracy to fully replace human capabilities. Claims estimating in auto insurance has been the most prominent use case for replacing manual processes with automation and AI to improve customers’ experiences. Beyond auto claims, AI applications in areas such as universal workflow and liability detection are starting to emerge. As these new capabilities become more prolific, it’ll be important for companies to distinguish their competitive advantage and develop clear use cases to stand out.

- Risk prevention and resilience is moving from human-enabled to data-enabled. In certain lines of business, such as cyber and general liability, managing general agents (MGAs) and other service providers focused on providing insights that assess risk levels and make risk prevention recommendations, in order to drive down loss ratios for insurance carriers and other capacity providers. What has historically been a very consultative process is now increasingly shifting to include data and tools to understand risk on a more granular level, focusing at times on very specific niches to deliver better results for the industry overall. This is particularly important given rising climate risk and physical risk, in addition to the risk of catastrophic events and their unforeseen effects.

- Digitally enabling specialty commercial insurers, particularly through wholesale distribution, is the next way to improve workflows in the industry. Some companies are working with wholesale brokers to create digital platforms that make connecting retail brokers, wholesale brokers, and insurance carriers easier. Others are building digital wholesale brokers to connect retail brokers directly with insurance carriers. The goal is to improve retail brokers’ efficiency, broaden access to markets, and reduce the total cost of distribution, all of which are particularly important in the current environment. Digital wholesalers aim to create solutions that are flexible and often on no-code or low-code platforms, which can help them navigate fragmentation between commercial lines and address each line of business across all 50 states.

- The balance sheet is out, and profitability is in. This year, we noticed a significantly lessened presence from digitally native full-stack carriers that own the balance sheet. With valuations down and funding harder to come by, especially for the middle phases of growth, the main strategy from insurtechs has evolved from building a full stack—for example, MGAs expanding to have a balance sheet—to developing a strategic plan for growth from the get-go to become profitable faster. This approach is enabling investments with the expectation of returns in six to 12 months.

- Cyber is seen as a looming catastrophic risk. Many investors and business executives in 2022 were excited about the increasing demand and flourishing supply of propositions across distribution, MGA, and threat intelligence, which contrasts the mood on cyber. Many insurtechs were offering new cyberprotection products, and MGAs were vying for capacity and equity investment. The most important conversation about cyberrisk was about the evolving role of cybersecurity in the industry. Many believed that cyberprotection can work as a vaccine against risk—the more companies that have protection, the more cushioned entire industries are. Furthermore, customers might be excited about cybermonitoring services as part of their policy because it can help them earn premium credits for responsible cyberrisk practices.

Opportunity in the insurance industry remains strong, whether that means moving away from manual processes or using data in better ways. Companies that innovate around these pain points are well positioned to gain traction and scale.

………………………

AUTHORS: Doug McElhaney – Partner in McKinsey’s Washington office, Jason Ralph – Partner in McKinsey’s Minneapolis office