The US P&C insurance industry continued to generate significant underwriting losses in 1H2023 despite strong premium growth. Results are anticipated to improve in 2H2023 as pricing increases continue to take hold, but uncertainty remains regarding future catastrophe losses, effects of inflation on loss costs, and loss reserve experience.

According to Fitch Ratings research, sector outlook on US P&C insurance is Neutral, with results expected to be stable to improving, with a gradually emerging recovery in personal auto, continued stability in commercial lines underwriting and investment income growth.

The industry will be hard pressed to match the 102.8% combined ratio (CR) posted in FY2022

Higher natural catastrophe losses and a lack of improvement in personal auto results drove the industry underwriting CR to 104.4% in 6M2023, compared with a 100% CR at mid-year 2022.

Insured natural catastrophe losses for 2022 are estimated at between $105 billion and $120 billion, according to several sources, making it the third highest natural catastrophe loss year since 2011.

Insured losses from major natural catastrophes in the second quarter of 2023 are estimated to be less than $10 bn.

WTW reports that property insurance premiums will continue to rise throughout 2023, but these increases will mostly be driven by inflation raising insurable values, as opposed to rate increases. No single event caused this upswing, but rather an accumulation of catastrophes, which included hurricanes, floods, tornados and freezes, well exceeded the $70 billion average annual loss since 2011.

P&C industry net statutory earnings

P&C industry net statutory earnings declined to $9 bn in 1H2023, corresponding with a 1.8% annualized return on surplus. Statutory earnings fell 73% YoY, and 63% excluding a one-time $10.8 billion investment distribution to a Berkshire Hathaway insurance subsidiary.

Industry policyholders’ surplus increased by 5.4% in 1H2023, again exceeding $1 trillion, despite the sharp drop in earnings as the equity market recovery contributed to large unrealized investment gains.

P&C Industry Statutory Performance Highlights

| $ bn | 1H2023 | Change |

| Loss Ratio | 78.7% | 5.1% |

| Expense Ratio | 25.3% | -0.6% |

| Dividend Ratio | 0.3% | -0.1% |

| Combined Ratio | 104.4% | 4.4% |

| Return on Surplus | 1.8% | -4.7% |

| Net Written Premiums | 417.4 | 8.0% |

| Underwriting Gain Excl Policy Divs | (24.0) | 275.8% |

| Investment Income | 33.5 | -12.6% |

| Realized Investment Gains | 2.3 | -37.0% |

| Policyholders’ Surplus | 1,043.8 | 8.1% |

| Net Income | 9.0 | -72.5% |

P&C insurance written premium growth

Written premium growth remains highly positive with direct written premiums (DWP) increasing by 8.6% and net written premiums 8% YoY.

Sharp increases in auto and homeowners premium rates in many jurisdictions led to personal lines DWP increasing by 11% for the period, while commercial lines DWP was up 6%, a reduction from the growth rates reported in 2021 and 2022.

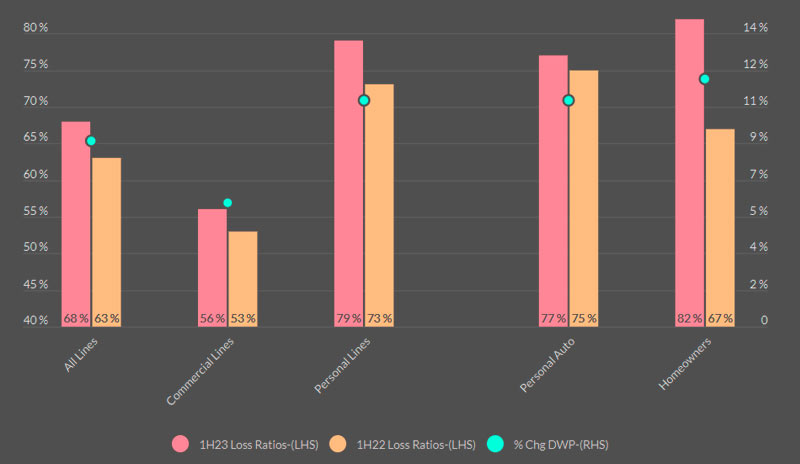

Industry reported direct loss ratios by segment show ongoing sharp divergence in underwriting results for personal lines versus commercial lines.

The personal insurance lines direct loss ratio rose by 6 percentage points YoY to 79% at 6M2023. The increase is in large part due to a 15 point increase in the homeowners loss ratio to 82% tied to higher catastrophe losses.

P&C Industry Statutory Direct Loss Ratios

The personal auto loss ratio

The personal auto loss ratio also remains elevated at 77% compared with 75% at 6M22, despite substantial pricing and underwriting actions taken by carriers. Unfavorable loss severity patterns in physical damage and bodily injury coverages, as well as higher litigation related costs, continue to plague this line.

Personal auto results are poised to improve as CPI data indicates a 19% increase in US auto insurance rates, and loss severity trends are moderating, but a return to broader underwriting profits may still take some time.

Homeowners writers face challenges in managing aggregate catastrophe exposures in a more restrictive and costly reinsurance market, as well as properly insuring properties to value in a high inflation environment.

In contrast, the commercial lines sector loss ratio remains favorable with a 56% direct loss ratio in 1H2023 versus 53% in the prior year period. Product segments that are most profitable include workers compensation and other liability – claims made.

Industry Combined Ratios Increased to 104% in 2023 vs 100% in 2022

Commercial lines are positioned to maintain favorable underwriting results through 2023, but future performance is reliant on pricing actions keeping pace with loss cost trends, which will prove challenging under more volatile economic conditions.

Top 15 US P&C Insurers Combined Ratios

| Insurer | 1H2023 | % DWP Personal Lines |

| Berkshire Hathaway | 91% | 67% |

| Chubb | 92% | 15% |

| The Hartford | 94% | 20% |

| Progressive | 99% | 83% |

| AIG | 100% | 7% |

| Travelers | 101% | 38% |

| Auto-Owners | 106% | 54% |

| Liberty Mutual | 109% | 54% |

| Farmers Insurance | 114% | 81% |

| Allstate | 114% | 93% |

| USAA | 115% | 94% |

| Nationwide | 116% | 51% |

| State Farm | 116% | 92% |

| American Family | 117% | 84% |

| Erie Insurance | 121% | 70% |

| P&C Industry | 104% | 50% |

Industry statutory results contrasts with performance compiled for 40 GAAP reporting entities in Fitch’s recent report, as this group had an aggregate 97.1% CR and an 8.4% operating ROE for 1H2023.

The higher proportion of personal lines business written by several large mutual insurers greatly influences US statutory industry aggregate performance relative to the GAAP universe.

The 1H2023 statutory underwriting results for the 15 largest US underwriters reveals five mutual or reciprocal insurers with a 115% or higher 6M CR. Four large publicly traded underwriters posted a CR below 100% for the period.

……………………..

AUTHORS: James Auden, CFA – Managing Director, North American Insurance Fitch Ratings, Christopher Grimes, CFA – Senior Director Fitch Ratings, Laura Kaster, CFA – Senior Director, Fitch Wire North and South American Financial Institutions