U.S. Property & Casualty (P&C) insurers should see stabilizing to modestly better industry operating performance in 2023, supported by commercial and personal lines price increases, a reversion to historical average catastrophe loss levels and higher investment yields. That said, inflation and economic volatility to contribute to higher loss cost uncertainty.

According to Fitch Ratings, statutory financial performance for U.S. P&C insurers weakened in the first nine months of 2022, driven by sharp deterioration in personal auto results, higher catastrophe losses particularly from Hurricane Ian and poorer investment performance.

P&C Insurance industry underwriting performance

The industry underwriting combined ratio (CR) rose to 102.3% in 9M2022, corresponding with a $22 billion underwriting loss for the period, and in contrast to a 99.6% CR in the year-earlier period. Property & Casualty industry net earnings decreased by 19% versus the prior year period to approximately $35 billion as higher investment income was outpaced by higher underwriting losses and reduced realized investment gains.

Industry investment income was influenced by a one-time $10.8 billion investment distribution to a Berkshire Hathaway insurance subsidiary. Adjusting for this unusual item, net income in down by an estimated 38% YTD 2022, and the industry return on surplus is well below historical norms at 3.4% for the period.

Reduced earnings and large unrealized investment losses from equity market declines contributed to a 6% YTD reduction in industry policyholders’ surplus from record levels of over $1 trillion at YE 2021.

P&C Industry Statutory Performance Highlights

| % | 9M2022 | 9M2021 | % Change |

| Loss Ratio | 76.4% | 73.0% | 3.4% |

| Expense Ratio | 25.6% | 26.1% | -0.5% |

| Dividend Ratio | 0.4% | 0.5% | -0.2% |

| Combined Ratio | 102.3% | 99.6% | 2.7% |

| Return on Surplus | 4.5% | 6.0% | -1.4% |

| $ Billions | 9M2022 | 9M2021 | % Change |

| Net Written Premiums | 585.7 | 545.4 | 7.4% |

| Underwriting Gain Excl Policy Divs | -21.9 | -6.6 | – |

| Investment Income | 55.4 | 40.7 | 36.3% |

| Realized Investment Gains | 3.0 | 13.2 | -77.2% |

| Net Income | 34.7 | 42.9 | -19.1% |

| Policyholders’ Surplus | 986.5 | 988.5 | -0.2% |

Written premium growth remains robust with direct written premiums (DWP) increasing by 8.0% and net written premiums increasing by 7.4% yoy.

Ongoing favorable pricing activity in most commercial lines segments led to continued strong growth of 11% yoy in commercial lines DWP, while personal lines premiums increased by 5%.

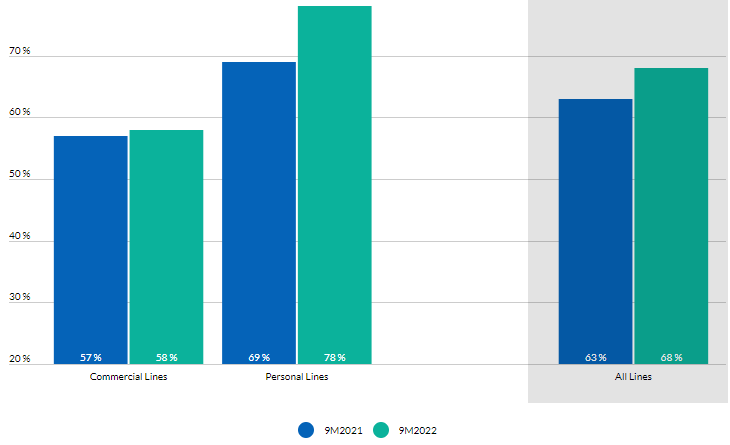

Industry-reported direct loss ratios by business segment reveal sharp differences in underwriting performance in personal lines versus commercial insurance lines segments.

Incurred loss experience is anticipated to stabilize in personal auto as carriers take corrective pricing and underwriting actions, but improvement toward break-even results may not materialize until 2024.

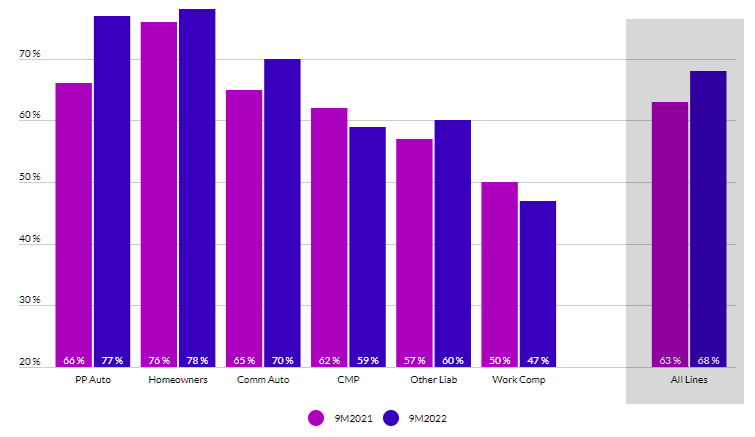

The personal auto loss ratio rose by nearly 12 percentage points yoy to 77% at 9M22 due to unfavorable loss severity trends tied to inflation and supply chain issues boosting auto repair costs and used vehicle values, as well as higher litigation related costs.

The auto physical damage segment posted record direct loss ratios above 80% for the period (see about P&C Insurance Claims Landscape). Another year of above historical average insured catastrophe losses contributed to the homeowners segment direct loss ratio rising to 77% YTD, one point higher than the prior year period.

The commercial lines sector loss ratio remained relatively consistent yoy with a 58% direct loss ratio. Product segments that generated favorable results for the period include: workers compensation, other liability – claims made, and commercial multi-peril.

Commercial lines are positioned to maintain favorable underwriting results through 2023, but results could face pressure from growing loss cost uncertainty due to inflation and other economic volatility, particularly in longer tail business lines.

P&C Industry Direct Loss Ratios Rose

P&C Industry

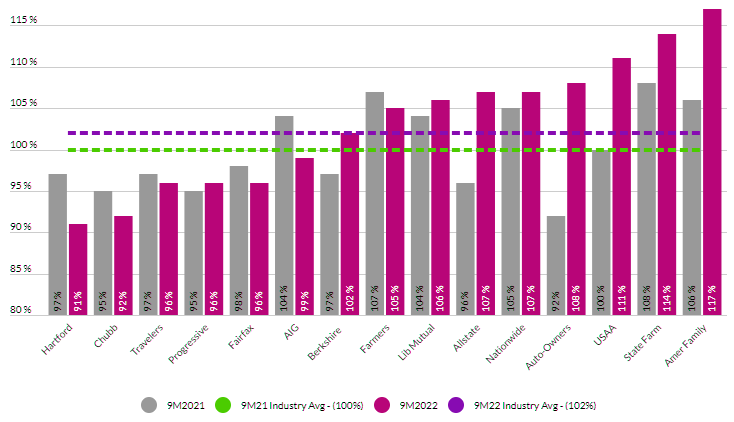

Differences in commercial versus personal lines results are also evident when comparing statutory underwriting results for the largest U.S. underwriters based on net written premiums.

P&C Sector

Personal lines writers have experienced sharp deterioration in 2022 underwriting results with companies including American Family, State Farm and USAA reporting combined ratios above 110%.

Progressive is a notable outlier in 2022, with a YTD combined ratio of 96%. Among large commercial or multi-line underwriters, Hartford, Chubb and Travelers each posted combined ratios of 96% or below.

Top 15 U.S. P&C Underwriter Combined Ratios

Average Combined Ratios Rose to 102% from 100% in the Year-Ago Period

TOP 20 U.S. P&C Insurance Companies

| № | Insurers | Premiums Written, $ mn | Change, % |

|---|---|---|---|

| 1 | State Farm | 69,648 | 6,1 |

| 2 | Berkshire Hathaway | 68,341 | 20,7 |

| 3 | Progressive | 46,611 | 13,7 |

| 4 | Allstate | 38,623 | 5,9 |

| 5 | Liberty Mutual | 36,139 | 3,1 |

| 6 | Travelers | 29,794 | 7,1 |

| 7 | USAA | 24,548 | 2,1 |

| 8 | Chubb INA | 21,704 | 10,6 |

| 9 | Nationwide | 18,824 | 4,9 |

| 10 | Farmers | 15,965 | -10,7 |

| 11 | AIG | 13,225 | 5,3 |

| 12 | American Family | 12,661 | 9,7 |

| 13 | Hartford | 12,552 | 9 |

| 14 | Fairfax Financial (USA) | 10,409 | 21 |

| 15 | Munich-American Hldg | 9,784 | 38,6 |

| 16 | Auto-Owners | 9,654 | 7,6 |

| 17 | Tokio Marine US PC | 8,188 | 12,4 |

| 18 | W.R. Berkley | 8,002 | 20,8 |

| 19 | Erie | 7,996 | 4,1 |

| 20 | Everest Re US | 7,736 | 16,1 |

The America’s 10 Largest Commercial P&C insurance companies command almost half (47%) of the market, with the top 25 insurers accounting for two-thirds of the overall share. Direct written premiums (DWP) from these insurance providers reached almost $517 bn at the end of last year, while earned premiums slightly exceeded $488 bn.

What is property and casualty insurance in USA?

Property and casualty insurance is a broad insurance, which includes coverage to your structure, property and belongings in the event of vandalism, theft, and more. If a thief were to break into your home, you would be protected up to your covered limits under your homeowners insurance policy.

What does P&C stand for insurance?

Property and casualty insurance, commonly referred to as P&C insurance, is a broad term that refers to various types of insurance. In simple terms, it’s insurance coverage that helps protect your assets, including the property you own.

Is P&C insurance a commercial insurance?

What is commercial P&C Insurance? Property and casualty insurance is a category of small business insurance that includes policies that are designed to protect business from a wide range of accidents, threats and losses regarding belongings and environments.

What are the five types of property casualty insurance?

5 Types of Property and Casualty Insurance a Small Business Should Consider:

- Workers’ Compensation

- Liability Coverage

- General Liability

- Professional Liability

- Product Liability

- Automobile Liability

- Property Insurance

- Employment Practices

Is P&C same as general insurance?

Non-life insurance covers property, businesses and individuals andis also known as general insurance in India. In some markets this type of insurance is known as Property and Casualty (P&C) insurance.

…………..

AUTHORS: Jim Auden – Managing Director, Insurance Fitch Ratings, Christopher Grimes – Director, Insurance Fitch Ratings, Laura Kaster – Senior Director, Fitch Wire

Fact checked by Oleg Parashchak