The P&C insurance claims landscape is becoming increasingly challenging due to unprecedented claims inflation. There are many underlying causes—among them, the COVID-19 pandemic, the invasion of Ukraine, and global supply chain disruptions. Claims executives have already been dealing with steadily increasing costs over the past few years. Results are being threatened by growing inflationary pressures and the already razor-thin margins in many markets that further exacerbate the problem.

According to McKinsey, the entire market is struggling to cope with these challenges, as a competitive advantage is becoming increasingly difficult to maintain and customers are becoming more demanding (see How P&C Insurance Companies Can Increase Inflation Resilience?).

The time to act is now, given the magnitude of challenges the P&C industry is facing. In times of turmoil, leading companies can find ways to accelerate their capabilities.

Claims executives can use a structured approach that includes transparent tracking, tactics, and strategic actions to tackle claims inflation in the short term and in the future.

A postpandemic rebound in claims frequency and significant increases in average indemnity per claim in motor and property across Europe pose additional problems for the P&C industry. But following a robust action plan can help insurers not only survive this challenging inflationary environment but also thrive and pull out ahead of their competitors.

Every insurance peril is experiensing inflationary presures

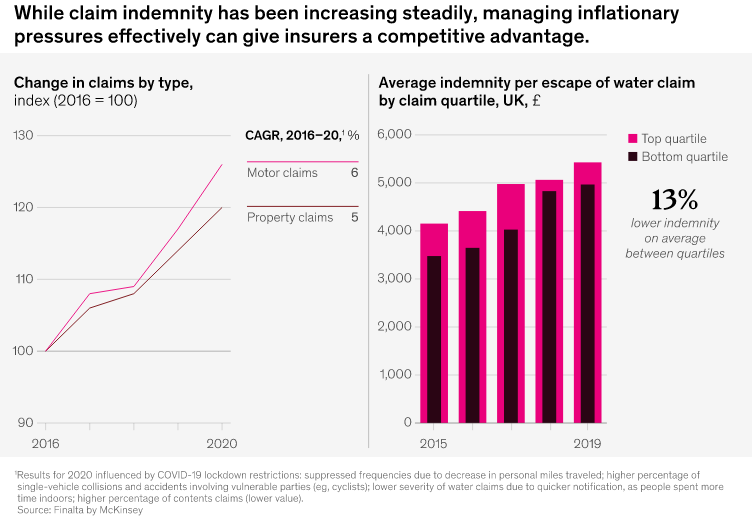

Insurers have always had to persevere through extreme inflation in their market—the most recent example is the steep increase in indemnity for escape of water claims in the UK market. In this situation, top-performing players managed to tightly control inflation and achieve substantially lower indemnity (see about Global Commercial P&C Insurance Sector).

A structured approach to managing claims inflation

This challenging situation puts pressure on all players in the market. Yet top performers are addressing the new landscape using a planned, three-step approach that includes transparent tracking as well as various tactical and strategic actions (see about Insurance Claims Management).

Step 1: Transparent tracking on a granular level

Chief claims officers (CCOs) can break down claims inflation into the following four areas of direct impact that affect insurer portfolios and drive the recent acceleration in claims cost increases.

These areas can then be tracked with the help of a dedicated dashboard:

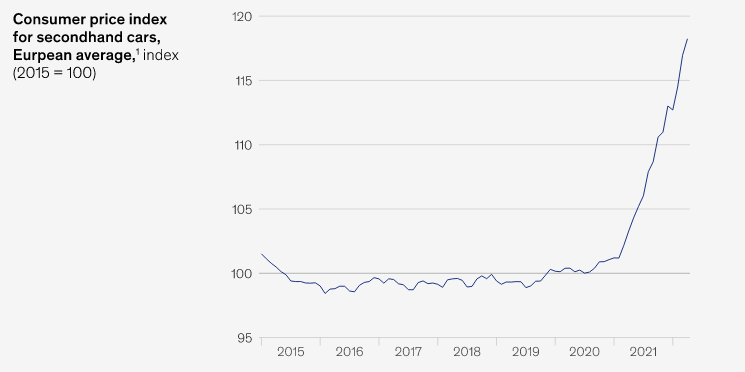

- Underlying inflation. This is reflected in the rising consumer price index (CPI) and higher labor costs. Inflation has always been an issue, but right now, it’s especially high, more spontaneous, and more frequent (Exhibit 3). Underlying inflation contributes an estimated 45 to 50 percent (end of 2021) to the total claims spending increase, but the contribution has increased over 2022.

- Claims composition. Changes in peril mix and claims composition are driving increases in claims costs, accounting for 40 to 45 percent of the total. This is mainly due to the greater severity of accidents and shifting economic parameters around losses. The increase in incidences of theft plays an additional role—possibly driven by the economic downturn in combination with the higher resale value of vehicle components.

- Risk mix. We’re seeing shifts in underlying risk factors and mobility, which make up 5 to 10 percent of the claims cost increase mix. Vehicles are becoming more expensive as new technologies proliferate, and we’re seeing a higher concentration of claims in urban areas as mobility patterns change (consider the rise of street scooters, for example).

- Policy changes. Changes in policy distribution, such as the increase in comprehensive policies in recent years, contribute even further (1 to 3 percent) to the rise in claims costs.

Extreme market pressures further increase the severity of motor claims

Having cracked open the black box of the recent acceleration of claims cost increases, CCOs still face a tricky question: What will the situation look like in a year or two? It’s difficult to predict right now; however, insurers can conduct a scenario analysis.

For example, in a bullish scenario, we might see some moderate real GDP growth in the eurozone from 2022 to 2024.

In contrast, a bearish scenario might initially record a decline in 2022 and in early 2023 and some moderate growth in late 2023 and in 2024 (see report about US Property & Casualty Insurance).

Regardless of which scenario plays out, the root cause of the difficult economic situation comes down to the reduced availability of goods and materials, such as semiconductors. This has significant implications for all lines and claim types. Insurers face the possibility of not being able to deliver everything they’ve offered to customers.

Step 2: Tactics for immediate impact

To cope with this problem and navigate in an economy of scarcity, CCOs can shape their response from an array of possible immediate actions. These have the potential to mitigate the loss ratio increase by approximately 1.5 to 2.0 percentage points, depending on the individual starting position:

- Reduce supplier spending. Start by renegotiating contracts with repair networks to share cost pressures, redistributing repairs to areas with lower demand, and redesigning business rules to increase remote inspection.

- Redesign decision engines for optimal settlement. Show the changing cost and availability of labor, parts, and replacement solutions—for example, update spending thresholds for repairs to achieve capacity faster and mitigate the increased cost of replacement vehicles.

- Implement incentives for customers. Ensure behavioral alignment with customers to make the settlement process more efficient.

- Launch focused anti-fraud actions. Review current fraud prevention actions and implement best practices to realize quick wins; historically, we have seen increases in fraud in times of economic downturn.

- Share claims insights within the organization. Improve the quality of insights by integrating detailed data on cost evolution and share internally to define short-term product adjustments.

Step 3: Strategic actions to counter long-term inflation effects

Aside from pursuing immediate actions, CCOs can implement certain steps to counter long-term inflation effects. The following can potentially mitigate the loss ratio increase by approximately 3.0 to 3.5 percentage points, depending on the individual starting position:

- Define supply chain strategy. Examine the benefits of vertically integrating or defining a partnership model with vendors, possibly helping suppliers upskill their workforce.

- Boost the use of green parts. Increase the share of green parts used, as this can reduce both repair cost and repair time significantly, while saving valuable resources that would otherwise be needed to manufacture a new part.

- Improve the performance and valuation accuracy of salvage and recovery. Keep track of market developments such as secondhand-vehicle prices and adapt valuation models.

- Holistically transform the end-to-end claims journey. Implement AI/machine learning solutions to optimize decision making in situations with constantly changing factor costs and to improve productivity (countering long-term salary inflation).

- Jump to a higher level of fraud prediction. Map fraud patterns onto economic distress periods and invest in AI-driven fraud identification across domains.

To use a structured approach, claims executives may want to consider organizing the steps above into two categories of action

Set up a claims inflation task force

This group should focus on two core tasks. First, implement transparent tracking in all relevant claims segments. This includes developing scenarios and identifying volatile segments that are affected or at high risk of being affected soon. Second, analyze and align tactical levers in claims (see TOP 50 P&C Insurance Companies in U.S.).

This includes, for instance, redesigning decision engines for optimal settlement and gathering information on trends to share with other stakeholders, such as the executive board and product management. To stay ahead of recent developments and to adapt the tactical levers put in place, CCOs can institutionalize a weekly cadence of updates on the claims inflation data and on the effectiveness of the steps taken.

Undertake claims transformation

CCOs should consider executing a claims transformation aligned with the four direct-impact areas of claims inflation. At the outset, CCOs should thoroughly analyze the trends, especially the timeline and impact on risks, as short-term effects tend to be overestimated and long-term effects underestimated.

CCOs also must consider their organization’s underlying structure because this can affect the timing and extent of the impact of different trends.

Based on this analysis, claims executives can put in place lasting measures to avoid falling into long-term traps and ensure that they can adapt the workforce based on volume changes. Measures such as defining the supply chain strategy, holistically transforming the end-to-end claims journey, or jumping to the next level of fraud prediction would fall into this category.

………………

AUTHORS: Simon Behm – partner in McKinsey’s Stuttgart office; Kristian Hall – leads the global insurance benchmarking functions at Finalta and is a partner in McKinsey’s London office, Michael Müssig – partner in McKinsey’s Munich office, Volker Sieg – associate partner in McKinsey’s Cologne office