ILS and property catastrophe bond market supported new and repeat insurance, reinsurance and government sponsors, and maintained an orderly manner despite the macroeconomic headwinds facing the market, Hurricane Ian and the conflict in Ukraine, according to AON Securities.

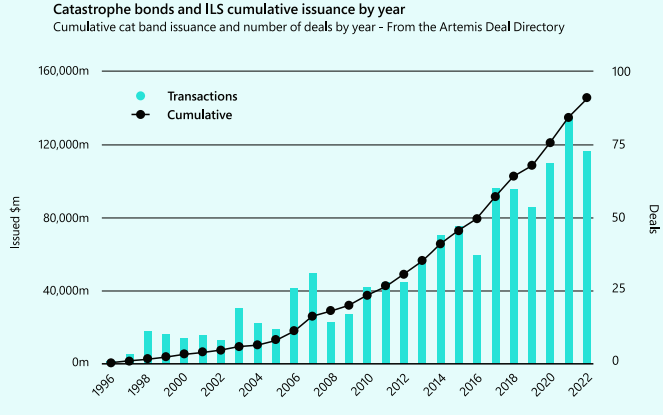

The market grew year-over-year (as measured by limit outstanding); issuances outpaced maturities by $2.2 billion, or roughly 7%, consistent with the growth seen in 2021.

We observed a supply-demand imbalance for cat bond capacity, as more insurers and reinsurers sought to tap the cat bond market to mitigate challenging traditional reinsurance and retrocession renewal seasons.

Richard Pennay – CEO Insurance-Linked Securities at Aon Securities

The culmination of the aforementioned, along with increased catastrophe activity over the past five years, has pushed the bond market into a higher total return environment, with material increases in overall pricing, accompanied by higher collateral returns.

Insurance-Linked Securities (ILS) have played a key role in allowing catastrophe risk to be transferred from the commercial insurance market to investors, providing much needed additional (re)insurance capacity. There has been talk for years about the potential of cyber ILS to transform the cyber insurance market.

While issuance volume was short of record-setting, sponsors were able to secure meaningful capacity from the ILS markets to complement their traditional reinsurance and retrocession placements. According to Lockton Re’s Cyber ILS Report, the conditions of the market today are at a point where this potential can be fulfilled.

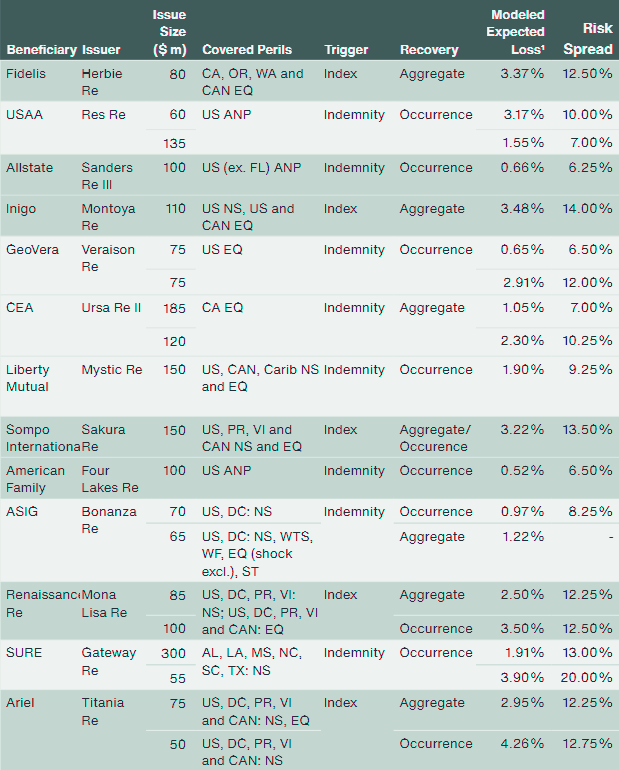

Q4 2022 saw $1.34 billion in notional issuance from 9 sponsors, including Inigo, a first-time sponsor in early 2022, returned for a second issuance in Q4.

The overall size of the market, as measured by cat bonds outstanding, remained stable during Q4, as investors sought to maintain their relationships with sponsors by reallocating maturities into new issuances.

Q1 2023 has built on this orderly year end renewal; initial indications suggest a positive shift in momentum across the market.

With the early year pipeline smaller than anticipated, maturing issuances not entirely matched with new capacity and investors experiencing capital inflows, Q1 2023 sponsors of cat bonds have benefited from positive execution, both from a pricing and size standpoint.

Such market signaling is sure to bolster the cat bond pipeline through the end of Q1 and into Q2 as sponsors continue to seek alternate capital solutions.

The dramatic growth of the ILS market in the last 25 years

Perils covered in ILS transactions have evolved significantly from the peak natural catastrophes of hurricane and earthquake to broader natural perils including wildfire, winter storm, severe thunderstorms, and flood as well as non-natural perils including mortgages, mortality, and longevity (see about ILS & Cat Bonds).

Primary Market Observations

Investors’ concerns for climate change, catastrophe risk modeling and loss development have impacted the risk-return profile of ILS (i.e., increased margins), particularly when considering the challenging investment environment experienced in 2022 with respect to inflation, higher interest rates and considerable movements in foreign currencies.

Following Hurricane Ian, ILS investors paused to understand their exposures to – and valuations of – their portfolios, resulting in a number of deals being subsequently delayed.

As potentially one of the largest loss events to hit the (re)insurance industry in the 25-year history of the cat bond market, Hurricane Ian’s current principal loss estimate is manageable for the $35 billion market. However, the mark-to-market movement of spreads across all bonds was significant and clearly much larger than the potential principal losses alone.

Natural disasters resulted in global economic losses of USD 275 billion, of which USD 125 billion were covered by insurance, the fourth highest one-year total on sigma records. Beyond the natural catastrophes themselves, other factors such as the impacts of economic inflation and financial market losses have also fed into market hardening, according to Swiss Re’s sigma report “Natural Catastrophes and inflation: a perfect storm”.

Many bonds will revert to par at maturity, providing there are no further loss events, and such gains will clearly benefit investor returns in the coming years. In the months since the Hurricane, this trend has further been realized as the true industry loss of Ian is not as severe as initially feared, with investor confidence returning as a consequence.

The widening of spreads in the secondary market was also matched by higher issuance spreads during Q4.

In general terms, catastrophe bond issuance spreads widened out by upwards of 50% for both indemnity transactions for insurance companies and also industry loss catastrophe bonds for reinsurers. Additionally, investors worked with catastrophe bond sponsors to further refine some coverage terms and conditions during Q4.

Historically, higher margins and the diversification of the asset class, relative to the broader financial markets, has resulted in meaningful market growth, which is likely to be welcomed by sponsoring companies in 2023, as reinsurance pricing remains elevated.

The re/insurance rate gains of recent years coincide with a trend period of heightened natural catastrophe activity and elevated losses that started in 2017. The 2022 insured loss outcome reaffirms a 5‒7% annual growth trend in place since 1992, this based mostly on rising severity of losses resulting from primary and secondary peril events (see Listing of Global Events & Economic Loss).

Secondary ILS Market Observations

As of February 10, Aon Securities’ pricing valuations show a mark-to-market reduction in total cat bond market value of 6.80% since the week prior to Hurricane Ian. Such valuation losses are likely to be recouped as bonds ultimately revert to par at maturity (assuming no further losses or significant adverse development of Hurricane Ian reserves).

The secondary market started Q4 at a standstill as investors paused to digest the impact of Hurricane Ian to their portfolios and to their capital positions.

As trading began to open back up, most trades were executed in US EQ bonds. Some investors were looking to shore up capital by trading the least mark-to-market impacted bonds while others were concerned that potential losses and aggregate erosion would leave them overly concentrated in US EQ.

As Q4 progressed, Ian’s impact became clearer and the new issue pipeline opened back up leading to increased secondary market activity albeit at wider spread levels.

The effects of losses across the reinsurance market both to nat-cat portfolios and to balance sheets hampered supply and led to spread widening of between 40-60% on average.

Overall, secondary trading activity in Q4 was down compared to 2021. October and November were relatively light months (in terms of volume), with 55 and 47 trades, respectively as reported by TRACE.

However, trading volume accelerated in December; TRACE reported 71 trades in the month as investors gained a better understanding of their potential exposure to Ian and repositioned the portfolio in light of the year-end reinsurance renewals. All trades were at a discount to par, reflecting the widening of spreads seen across the market.

Highlighted ILS Transactions

Herbie Re

Herbie Re, the first property cat bond priced after Hurricane Ian, provided Fidelis Insurance with industry-index retrocessional protection on an annual aggregate basis across a four-year term. The single $80 million tranche of notes offers protection against North American earthquakes in California, Oregon, Washington and Canada.

Sanders Re III

Allstate returned to the market with a $100 million multi-peril bond across a five-year term. Consistent with the prior year’s transaction, the single tranche covers US named storms (ex. Florida), earthquakes, severe weather events, wildfires, volcanic eruptions and meteorite impacts on a per occurrence basis.

Montoya Re

Inigo Insurance sponsored the three-year, industry-index cat bond providing retrocessional protection on an annual aggregate basis. The single $110 million tranche provides coverage for North America, including Canada, named storm and earthquake events with an initial expected loss of 3.18% and initial attachment probability of 4.25%.

Sakura Re

Sakura Re, issued its second catastrophe bond, this one provided coverage solely to the underwriting entities of Sompo International, after Sompo Holdings used the vehicle for a previous $400 million issuance that covered Sompo Japan and their international arm in 2021. Sakura Re is providing $100 million in retrocessional coverage on a per occurrence basis for earthquakes and annual aggregate basis for named storms. The tranche of notes is spread across a three-year term. The dual trigger feature has been used by the Japanese parent entity before but is far less common for US-focused perils.

Four Lakes Re

Four Lakes Re, is the third catastrophe bond in the Four Lakes Re series of deals that provide American Family Mutual Insurance (“AmFam”) with $100 million in coverage across a three-year term. The notes will provide coverage against losses from named storms, earthquakes, severe thunderstorms, winter storms and wildfires across the US on a per occurrence basis and initial base expected loss of 0.49% with a spread of 6.5%.

Summary of ILS Issuances

There were many large natural catastrophes in 2022 demonstrating the wide variety of risks across different perils around the world. The different events shed light on the underlying drivers of the long-term trend of rising catastrophe-related insured losses. The loss drivers at play across the insurance value chain.

In August 1992, Hurricane Andrew devastated many parts of Florida and the southern United States. It became notorious for the terrible property destruction and loss of life. But the far-reaching consequences for the reinsurance industry lasted long after the rebuilding was complete.

It became an inflection point for (re)insurers and regulators – more than a dozen insurers were declared insolvent due to the scale of the losses, with insured claims of over US$53 billion in today’s dollars.

There was a critical development because of the storm: the emergence of the ILS market. This enabled insurance risk to be transferred to investors in the form of a tradeable security.

ILS focused on providing (re)insurance capacity for extreme natural catastrophe events and trading in niche areas of property catastrophe (re)insurance until another dramatic milestone: the significant cumulative losses caused by hurricanes Katrina, Wilma, and Rita in 2005. Insured losses alone were over US$98.5 billion in today’s dollars (see Global Insurance-Linked Securities Market Outlook).

Capital markets were able to address the subsequent capacity shortage and provided a critical injection of over US$8 billion of catastrophe bonds in 2007.

…………….

AUTHOR: Richard Pennay – CEO Insurance-Linked Securities at Aon Securities