Immense growth in the use of sensors and smart devices in almost all areas of life and the gradual roll-out of 5G technology are fuelling the generation of an increasing amount of data, much of it in real time.

For insurers, such data can provide valuable insights. While it improves risk assessment and transfer, it creates the potential to predict and prevent risks, as well as offer wider insurance coverage.

IoT is a key driver of data generation. Such data can provide insurers with valuable insights, with the potential to predict and prevent risks, as well as offer wider insurance coverage.

According to The Geneva Association Report “From Risk Transfer to Risk Prevention”, a key driver of this development is the Internet of Things (IoT), the growing network of connected devices ranging from consumer wearables to industrial control systems. This report looks at how insurers can translate these IoT applications and corresponding data into risk prevention and mitigation services.

IoT-enabled services of the insurance industry also support the implementation of the UN Sustainable Development Goals (SDGs) in several respects: fostering innovation and building resilient infrastructure, promoting good health and well-being, supporting sustainable cities, and fighting poverty by offering affordable insurance coverage and enhancing financial wellness.

Prevention services are not new in the insurance industry; for years, insurers have provided individual consumers with loss prevention advice and risk engineering teams advise businesses in commercial lines. Ways to prevent risk, however, are changing.

It is still early days for the Internet of Things (IoT) in insurance. But scratch beneath the surface and there is a lot of work already underway that puts the industry in a strong position to harness potential for a new generation of risk prevention services. There is much to be learned from these early innovations.

Jad Ariss, Managing Director The Geneva Association

IoT-driven risk prevention services are at an early stage of maturity. Knowledge is limited to a few experts and most companies are still at the experimental stage – there is evidence of only a handful of commercially successful approaches internationally.

Nevertheless, the wide variety and impact of these early services demonstrate the enormous potential for the insurance industry to promote safer and healthier workplaces and lifestyles for the benefit of society as a whole.

Why is Internet of Things (IoT) so important?

Over the past few years, IoT has become one of the most important technologies of the 21st century. Now that we can connect everyday objects—kitchen appliances, cars, thermostats, baby monitors—to the internet via embedded devices, seamless communication is possible between people, processes, and things.

By means of low-cost computing, the cloud, big data, analytics, and mobile technologies, physical things can share and collect data with minimal human intervention. In this hyperconnected world, digital systems can record, monitor, and adjust each interaction between connected things. The physical world meets the digital world—and they cooperate.

What technologies have made IoT possible?

While the idea of IoT has been in existence for a long time, a collection of recent advances in a number of different technologies has made it practical.

- Access to low-cost, low-power sensor technology. Affordable and reliable sensors are making IoT technology possible for more manufacturers.

- Connectivity. A host of network protocols for the internet has made it easy to connect sensors to the cloud and to other “things” for efficient data transfer.

- Cloud computing platforms. The increase in the availability of cloud platforms enables both businesses and consumers to access the infrastructure they need to scale up without actually having to manage it all.

- Machine learning and analytics. With advances in machine learning and analytics, along with access to varied and vast amounts of data stored in the cloud, businesses can gather insights faster and more easily. The emergence of these allied technologies continues to push the boundaries of IoT and the data produced by IoT also feeds these technologies.

- Conversational artificial intelligence (AI). Advances in neural networks have brought natural-language processing (NLP) to IoT devices (such as digital personal assistants Alexa, Cortana, and Siri) and made them appealing, affordable, and viable for home use.

The variety and impact of early IoT-driven risk prevention services demonstrate the enormous potential for the insurance industry to promote safer and healthier workplaces and lifestyles for the benefit of society.

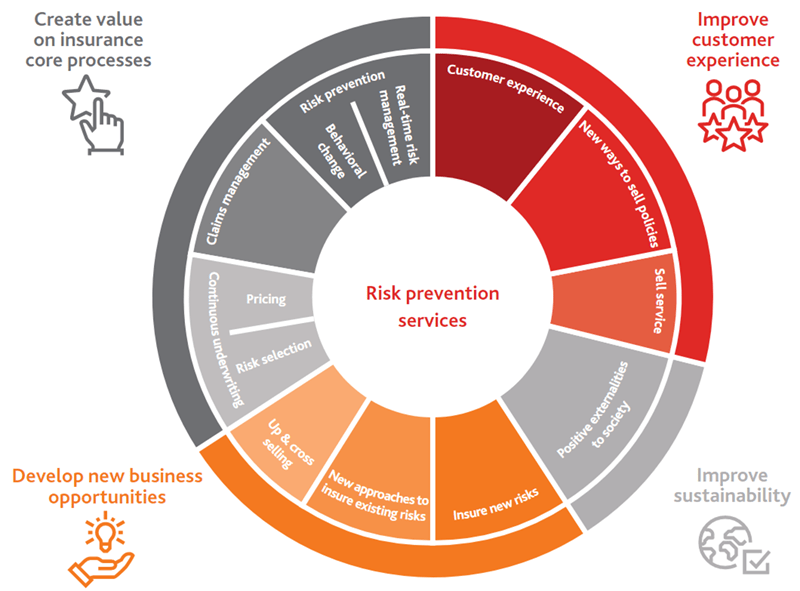

Two approaches to risk prevention are examined: real-time risk mitigation and the promotion of less risky behaviours.

In many cases, the technologies behind prevention services are tried and tested and offered by other industries. The use case for the insurance industry – namely how IoT could be used for risk mitigation – is also well established. The missing piece of the jigsaw, however, is how to translate the use case into a sustainable business case that benefits insurers, technology providers and customers alike.

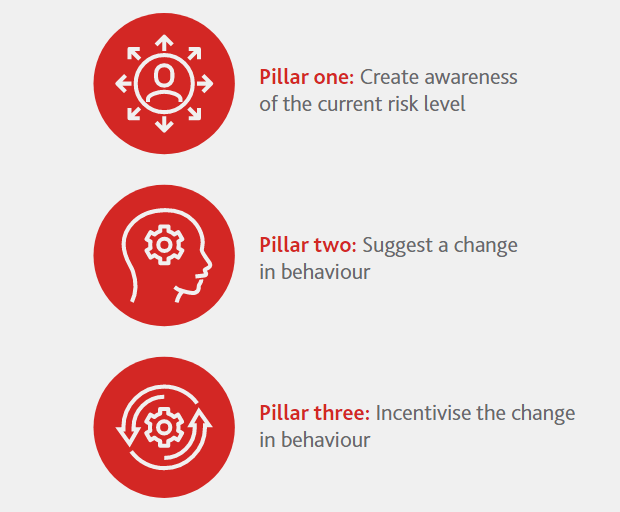

A three pillar concept IoT technologies

For real-time risk mitigation, approaches and services vary widely between insurers but all successful services are based on a multi-year journey. Through numerous examples, the report illustrates the journeys, success factors and outcomes of applications to date to provide inspiration on how to approach the development of such prevention services.

A three pillar concept can be distilled from the successful experiences:

The sustainable adoption of safer habits for the benefit of all stakeholders can only happen when all three pillars are successfully implemented. Reward systems that incentivise and reinforce positive behaviour are the most important aspect.

The customer’s perception of the value of the rewards, their cultural context and frequency, and the intersection with behavioural economics are all integral. Agents and brokers must also be included in the process.

The integration of technology into prevention services greatly increases complexity. As a result, the enablers for success are effective business transformation, successful cultural change and a good understanding of the complexities around financial management rather than the technology itself.

5 recommendations are offered for insurers, regulators and tech companies

- Insurers, their technology partners and regulators must improve their insurance IoT literacy and understanding of IoT translation into insurance prevention services to provide the best service to customers.

- Insurers should consider the development of technology and data-driven prevention services as a form of holistic business transformation.

- Insurance regulators should adapt regulatory frameworks to be more conducive to the implementation of large-scale prevention services.

- Tech companies should go beyond simply acting as technology vendors by co-creating technology-driven prevention services with insurers and being actively involved in the corresponding business transformation.

- Tech companies should engage in a dialogue with the insurance industry to better understand its value and leverage it to benefit consumers and society.

The Geneva Association report is the first of its kind to study the shift towards IoT risk prevention in insurance. It is based on interviews with over 60 insurers, technology companies, start-ups, global organisations and leading academics across all insurance business lines and geographies.

The interviews focused on insurers that have already developed successful IoT-driven prevention services and, as such, are biased towards successful applications. They need to be contextualised to reflect the general state of different insurance markets.

The examples included also represent IoT-driven prevention services with above-average maturity compared to the insurance market in general.

Synergising risk transfer with loss prevention

Technology is transforming people’s daily lives as well as businesses. Machines, devices and sensors generate data that can be translated into actionable information and make prediction and prevention of incidents possible.

This trend could shift, or even eliminate, some of the risks faced by insurance customers1 by providing real-time risk mitigation solutions, or enabling insurers to encourage less risky consumer behaviour.

Data is key to real-time prevention services and promoting behavioural change among insureds. This data is being generated by physical objects and people.

IoT, or smart connected products, allow remote transmission and usage of information about these objects and people. IoT solutions have an increasingly pervasive presence in both our personal lives and the commercial world.

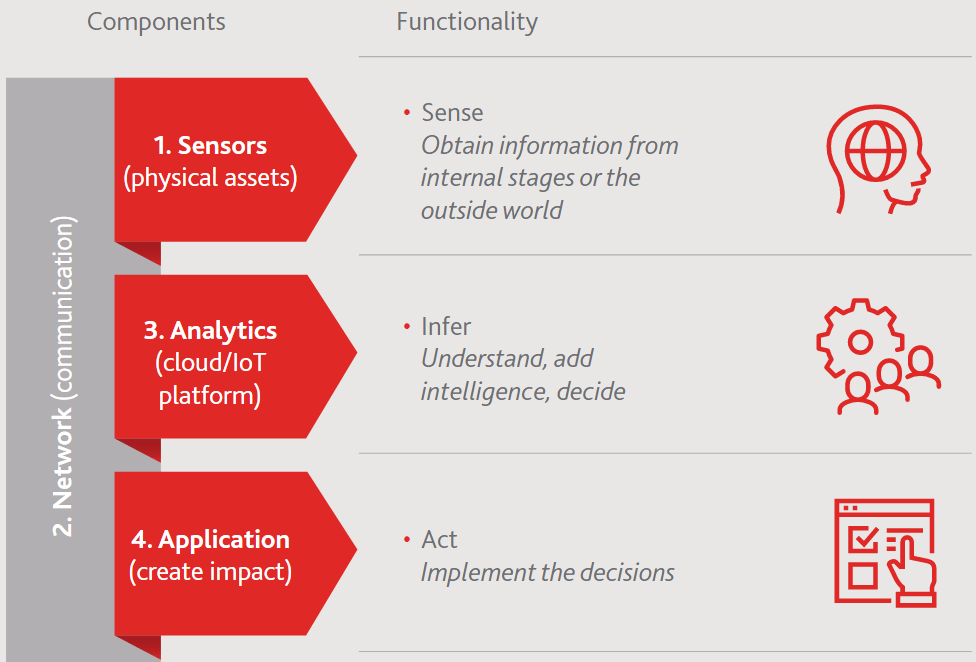

An IoT solution consists of four key components: sensors, a network communication, analytics and cloud, applications. All components sense, react and make decisions for our benefit.

These four components allow information to be used in order to take smarter actions that would otherwise be impossible in the traditional, disconnected, physical world.

IoT provides new opportunities for the insurance industry to use data, not only for the traditional insurance business but also for the prevention of incidents and claims. It also offers an opportunity to connect directly and more frequently with clients.

The four components of an IoT solution

IoT usage is maturing in both corporate and consumer environments. The adoption of IoT is steadily growing in all industries and, according to a recent report by Kaspersky,6 61% of enterprises already use IoT applications. This gives insurers the opportunity to integrate the data generated into insurance services for corporate customers.

61% of enterprises already use IoT applications, giving insurers the opportunity to integrate the data generated into insurance services for corporate customers. There are many different estimates about the size of the IoT market, ranging from 10 billion to 22 billion connected devices.

The hyperconnection between people, machines and organisations is a prevalent megatrend that we see at almost all levels of society and around the world.

IoT applications are expected to increase year by year as sensors evolve and become smaller, combined with greater computing power and connectivity (5G) and the use of artificial intelligence (AI) applied to the data generated by connected devices.

These developments can neither be ignored nor prevented, and the insurance industry has to adapt to this new world. Insurance IoT represents a new paradigm that impacts strategy, business cases and models, and technical and leadership capabilities along the insurance value chain and in the societal risk landscape at large.

How is IoT changing the world? Take a look at connected cars

IoT is reinventing the automobile by enabling connected cars. With IoT, car owners can operate their cars remotely—by, for example, preheating the car before the driver gets in it or by remotely summoning a car by phone. Given IoT’s ability to enable device-to-device communication, cars will even be able to book their own service appointments when warranted.

The connected car allows car manufacturers or dealers to turn the car ownership model on its head. Previously, manufacturers have had an arms-length relationship with individual buyers (or none at all). Essentially, the manufacturer’s relationship with the car ended once it was sent to the dealer.

With connected cars, automobile makers or dealers can have a continuous relationship with their customers. Instead of selling cars, they can charge drivers usage fees, offering a “transportation-as-a-service” using autonomous cars. IoT allows manufacturers to upgrade their cars continuously with new software, a sea-change difference from the traditional model of car ownership in which vehicles immediately depreciate in performance and value.

The approaches to risk prevention

The reduction of risks faced by insurance customers can either be achieved directly – through real-time risk mitigation solutions – or indirectly – by promoting safe behaviours over a longer period.

IoT allows risks to be better managed. This can be seen as the very essence of the evolution from pure risk transfer to a ‘prescribe and prevent’ scenario.

There are several concrete examples in insurance where risk prevention successfully provides value to clients. Although at different levels of maturity – many launched services are quite recent – cases are now present in all geographies and across all lines of insurance business.

These stories should motivate insurers in different business lines and geographies to question which of their clients’ risks should be mitigated and what is the best approach for doing so.

Leveraging IoT data for multiple use cases

The examples provided also show the contribution of IoT and the insurance industry to the UN SDGs.

According to a World Economic Forum study, 84% of IoT applications can address the SDGs.

The IoT-enabled services of the insurance industry support the implementation of the UN SDGs in several respects:

- fostering innovation and building resilient infrastructure on a corporate level (SDG 9)

- promoting good health and well-being for all individuals (SDG 3)

- supporting sustainable cities and communities (SDG 11)

- fighting poverty (SDG 1) by enabling affordable insurance coverage and financial wellness

Real-time risk mitigation can either involve automated actions by IoT actuators that impact the risky situation without any human intervention, or a warning to trigger it.

1. Commercial property and casualty (excluding auto).

Real-time risk prevention is most mature in commercial lines, driven by the loss control culture present in commercial insurance. Field inspections by engineering teams are well established and enhancing this work with new technologies seems like a natural step. In addition, the higher costs of commercial claims makes investment in risk prevention more effective than in personal lines.

IoT-based prevention services also allow insurers to expand coverage and protect against previously uninsurable risks. Where corporates have found it difficult to secure insurance coverage at an affordable premium, or indeed at all, insurance based on real-time risk mitigation provides coverage solutions at affordable rates. All commercial property and casualty insurers interviewed for this report either already provide such an option or intend to offer it.

2. Commercial auto

Commercial auto insurers have taken the opportunity to introduce telematics-based, real-time solutions. Heavy vehicle auto insurance is often expensive, reflecting large losses. As a result, investment in technologies balances well with the potential for reduced claims costs. For buyers, using telematics-based technology will increase the safety of their drivers and vehicles, again demonstrating a win-win situation for both customers and insurers.

3. Personal auto

Proactive roadside assistance triggered by telematics-based crash detection has proved to be an effective form of risk mitigation in personal auto insurance. In rural areas in particular, this can be a life-saving service, helping to ‘make the world a safer place’.

4. Personal property and casualty (excluding auto)

Water leakage sensors are one of the most cited prevention services in home insurance. However, as of today, insurers have struggled to introduce approaches that generate substantial demand and a sustainable business case.

Finding a sustainable business case in the smart home insurance market is challenging, but ongoing innovation will make homeowners the ultimate winners.

5. Life and health

Life and health is the least mature field for real-time risk mitigation services. There have been many insurance pilots over the past few years around early detection, care optimisation and medication adherence but only a few examples have scaled to market level.

There are several reasons for the slow pace of adoption in the life and health space:

- Health costs in most countries are not fully covered by insurers, but by a public health system. Real-time risk mitigation would not, therefore, mainly benefit private insurers but the public health system, which has government-driven health budgets independent of prevention.

- Entering into the medical device space means entering into the medical regulatory field and dealing with different regulatory authorities.

- Giving medical advice comes with significant responsibility and requires deep and specialist knowledge.

- To execute at scale, insurers would need to deal with many different stakeholders, i.e. medical service providers inevitably involved in policyholder care (from general practitioners to specialists and hospitals).

Medical devices that prevent risks related to blood pressure or glucose levels are in the very early stages of development. In the U.S., early detection solutions for diabetes use identification of pre-diabetes factors and the costs are reimbursed by insurers.

Health insurers in the U.S. incur increasing costs for diabetes treatment. Early prevention helps cap costs for insurers and potentially improves the health and lifespans of individuals

Unlike other regions with national healthcare systems, health insurers in the U.S. incur increasing costs for diabetes treatment. Early prevention helps cap costs for insurers while potentially improving the health and lifespans of individuals.

Promoting less risky behaviour

The second way to prevent risk is to encourage less risky behaviour. Insurers have a role to play in creating a positive safety culture and raising awareness in society. Expected losses can be modified by human behaviours.

Insurers must adjust rewards systems on an ongoing basis and evolve them year by year. They must constantly monitor the costs of the different elements of the programme and their contribution to reducing risks.

It is clear from the interviews that simply introducing an IoT device – from a camera that records driving behaviour to wearables that monitor physical activity – is not enough to generate long-term and lasting safer behaviours. Instead, a structured approach that engages the customer to achieve a sustainable change in behaviour is necessary.

The adoption of sustainable and safer habits can only happen when all three pillars are successfully implemented.

Incentivising individuals to change their behaviour

Raising awareness of risky behaviour and identifying ways to change it are not enough. There is a need to proactively incentivise people to instigate real and sustainable changes in their behaviour. Data is the foundation for developing these incentives.

Premium discounts at renewal are the most basic form of incentivisation, but data show that they only influence a third of auto telematics policyholders to change their behaviour.

Customers are not offered an upfront discount. On the contrary, there are fees for enrolling in the telematics programme. In exchange, however, is an attractive reward system for safe drivers.

The incentivisation is a mix of status-based rewards that include monthly rewards of up to 50% fuel cash back (the most important and relevant for customer engagement) and weekly rewards of points that can be redeemed for partners’ products (from a coffee to travel-related products).

Vitality Drive has recorded a material improvement in drivers’ risks, improving driving behaviour by 12% within 30 days from enrolment in the programme. This level is sustained over time.

Reducing the risk of the insured portfolio is achieved most effectively by incentivising every policyholder to improve, rather than only rewarding the lowest risks.

Discovery is one of the first insurers to extend incentiv-isation programmes to commercial lines, leveraging its knowledge developed in personal lines. In commercial auto insurance, it introduced two-fold incentives to driv-ers, who are ultimately responsible for their own driving behaviours, and to the corporate.

Many of these developments will contribute to the prevention of risks and further enhance insurers’ potential to introduce effective ex-ante loss prevention solutions in the near future. In addition, similar to real-time risk mitigation cases, insurance coverage could potentially expand and facilitate the insurabili-ty of hitherto uninsurable risks.

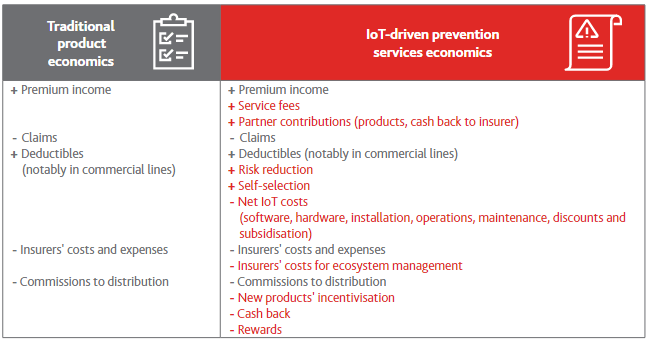

Increased financial complexity of IoT-driven prevention services

Enablers of prevention services

Rolling out IoT initiatives across the insurance organisation allows for smarter actions, such as preventing risks.

The main obstacle in the adoption of ex-ante loss prevention is not technology but people.

As for other financial service innovations, “cultural, structural, legal, political and practical factors will converge to work against major shifts in a world that is, again, designed by intent to be resistant to rapid change”.

From the interviews, the following main success factors are identified:

- C-level commitment

- Development of vision and strategy

- Development of culture and capabilities

- Finding an effective value-sharing scheme with the customer

- Management of new and complex financials

From a cultural perspective, loss prevention has always been part of insurance companies’ DNA.

For individuals, insurers provide a lot of advice on home protection or safer driving. In commercial lines, insurers conduct field visits and develop bespoke loss prevention reports, vulnerability analyses, risk management programmes or human factors programmes to prevent losses.

The philosophy is not new and it has worked well for decades. This principle does not need to be changed. What is changing with technology, and particularly insurance IoT, is the approach to preventing risks faster, more effectively and with more precision. In a nutshell, IoT-based prevention services are an insurtech enabler for improving existing services offered by insurers.

Current insurance regulations sometimes pose a barrier to leading experiments in prevention solutions, leaving insurers at a competitive disadvantage.

………………………..

AUTHORS: Isabelle Flückiger – Director New Technologies and Data The Geneva Association, Matteo Carbone – Founder and Director IoT Insurance Observatory