Artificial Intelligence (AI) is becoming increasingly proficient at performing tasks historically difficult for computers to execute, including recognizing images, identifying spoken words, and using unstructured data.

Insurance professionals are getting more comfortable with recommendations coming from AI systems and utilizing them for decision-making in underwriting, pricing, marketing, and claims

AI is a wide-ranging branch of computer science concerned with building smart machines capable of performing tasks that typically require human intelligence.

Coupled with alternative data and advanced analytics, AI should have a significant impact across the entire insurance value chain—if it is deployed correctly and those using it are properly trained.

According to Deloitte’s global outlook about Digital and Talent Transformation, AI refers to the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions. The term may also be applied to any machine that exhibits traits associated with a human mind such as learning and problem-solving.

Insurers are already increasing investment in conversational AI or chatbots to facilitate communications among a variety of stakeholders and reduce wait times. In underwriting, AI solutions can utilize behavioral analytics and machine learning to help identify misrepresentation or fraud while improving speed and accuracy.

It can also be used in claims processing to identify suspicious patterns beyond traditional signals and raise red flags about potentially fraudulent submissions.

According to Deloitte’s outlook, the ideal characteristic of artificial intelligence is its ability to rationalize and take actions that have the best chance of achieving a specific goal.

A subset of artificial intelligence is machine learning (ML), which refers to the concept that computer programs can automatically learn from and adapt to new data without being assisted by humans. Deep learning techniques enable this automatic learning through the absorption of huge amounts of unstructured data such as text, images, or video.

Mitsui Sumitomo Insurance, for example, utilizes an AI-powered “agent support system” to better identify customer’s potential needs by analyzing internal and external data. The system has provided agents with 860,000 individual and 80,000 corporate sales leads per month, with agent productivity increasing between 20% and 130%, compared to the conventional sales model.

AI could similarly be instrumental in enabling insurers to adopt new business models and take advantage of market opportunities.

One potential problem that insurers should watch out for are questions raised by regulators and consumer groups about the accuracy and fairness of AI-driven systems.

Survey indicated that only 24% of respondents were currently training AI and machine learning programs to identify algorithmic biases and ethical dilemmas. Insurers should be taking more proactive measures to ensure that automated decision-making is equitable and fair to policyholders and stakeholders and does not result in additional compliance and reputational risks.

At the same time, to overcome other challenges in adopting AI identified by respondents, insurers should look to develop AI awareness programs while improving the overall technical fluency of their workforce to advance digital maturity.

Top challenges facing respondents in AI

- Technology is not mature enough

- Regulatory and compliance

- Short-term focus on returns

Artificial intelligence is based on the principle that human intelligence can be defined in a way that a machine can easily mimic it and execute tasks, from the most simple to those that are even more complex.

The goals of artificial intelligence include mimicking human cognitive activity. Researchers and developers in the field are making surprisingly rapid strides in mimicking activities such as learning, reasoning, and perception, to the extent that these can be concretely defined.

Some believe that innovators may soon be able to develop systems that exceed the capacity of humans to learn or reason out any subject. But others remain skeptical because all cognitive activity is laced with value judgments that are subject to human experience.

As technology advances, previous benchmarks that defined artificial intelligence become outdated. For example, machines that calculate basic functions or recognize text through optical character recognition are no longer considered to embody artificial intelligence, since this function is now taken for granted as an inherent computer function.

Improved analytics should enable differentiation via alternative data

Rapid virtualization across industries and digital workflows accelerated the already exponential rise in the amount of data available to insurers from internal and third parties. This was driven in part by the proliferation of sensors, digitization of physical records, and the expanding digital footprint left by consumers from online activities.

Almost seven in 10 of respondents said they planned to increase spending on data-related technologies—specifically privacy (70%), collection (69%), and analytics (67%).

Insurers should be taking a multidimensional approach with alternative data by:

- leveraging enhanced analytical capabilities to derive real-time insights for faster and more accurate decision-making

- automating routine risk selection, pricing, and fraud detection, resulting in improved loss and expense ratios.

These goals to advance analytics are fundamental but may be difficult to realize in the short term, given concerns over reliance on legacy systems, complexity of implementation, and technology not being mature enough—cited by our outlook survey respondents as their top-three challenges.

Therefore, insurers should focus on developing a strong data management system that is secure and scalable. It should also be flexible enough to enable integration of multiple internal and external datasets, as well as advanced analytical and automation capabilities. Most importantly, insurers should keep modernizing outdated legacy systems that could prevent them from extracting value and making new types of data actionable.

Top challenges facing respondents in advanced analytics

- Reliance on legacy systems

- Complexity of implementation

- Technology is not mature enough

There also likely needs to be a comprehensive data strategy that addresses integration across platforms—legacy and new. Data can often be fragmented, of poor quality, and difficult to access—especially across operating units and lines of business. Continued reliance on legacy systems may be part of the challenge, but this also might reflect the lack of a holistic data management system.

In parallel, insurers should develop programs to upskill their internal data analysis capabilities. AXA UK invested in a data academy program, open to all its employees, to upskill and futureproof its workforce, support decision-making, and improve customer experience. In addition, experienced legacy underwriters should be working closely with cross-functional data scientists to design, develop, and ultimately own analytic and predictive models underlying more robust, data-driven risk assessment and pricing systems.

The foundation for digital transformation initiatives

Cloud technology should be considered foundational for achieving most digital transformation goals, as a key enabler of workforce, technology, and operational flexibility. At the same time, cloud often provides improved expense management, greater speed of deployment, and more rapid scaling of products.

72% of outlook respondents said they planned to increase spending on cloud, which would boost adoption across the board.

The applications that insurers first started deploying on cloud platforms are systems of engagement such as portals, digital customer engagement channels, and consumer analytics. However, only a small number of insurers have a majority of their systems of record (such as underwriting, policy administration, billing, or claims systems) on the cloud.

That’s likely to change fairly soon, however, as the ability of cloud platforms to seamlessly integrate with insurer vendors and partners makes a compelling case for accelerating the migration of core applications to the cloud.

That said, respondents noted that availability of supporting skill sets, alignment to business strategy, and return on investment were the top challenges in adopting cloud strategies.

Cloud adoption should, therefore, be part of broader business transformation, which includes upgrading workforce skills and processes to align to the advantages offered by the cloud platform.

Top challenges facing respondents in adopting cloud strategies

- Availability of technical skill sets

- This technology is not important to our business strategy

- Return on investment (ROI) is low/not clear

Insurers should also keep privacy and data security top of mind as they move more data and systems to the cloud, since they are still accountable for protecting customer information and applying appropriate security and access controls to information and applications even though they are stored in a public cloud.

Cybersecurity takes center stage with increasing ransomware attacks

Global cyberattacks across all industries increased by 29% in the first half of 2021 compared to the same period last year. This trend was largely driven by a 93% surge in ransomware events, as hackers continued to exploit the shift to remote work prompted by the pandemic55 amid other factors.

Attackers not only targeted sensitive data from organizations for ransom. They also went after supply chains and network links to partners, making the attacks farther-reaching and potentially much more damaging.

Implementing zero-trust principles by imposing verification requirements on anyone seeking access to data or systems, regardless of being internal or external, is a leading practice that can help carriers protect company assets under these conditions.

Insurers also should develop third-party risk management strategies to ensure suppliers and vendor networks are not impacted even if insurers’ systems are compromised.

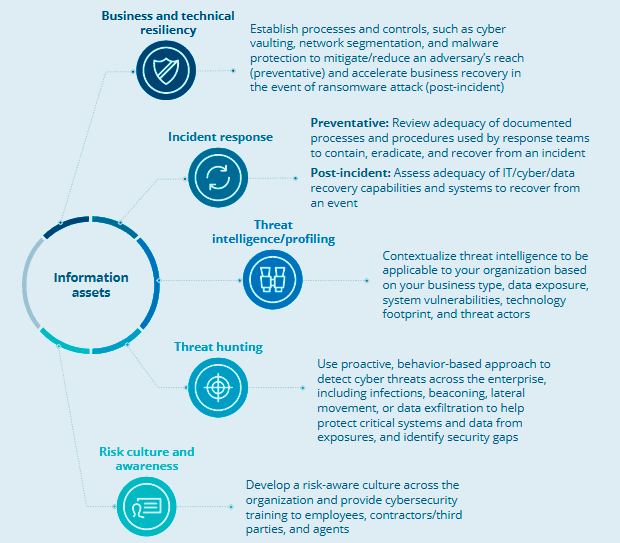

Insurers may also consider several additional measures to detect, prevent, respond, and recover from ransomware threats more effectively.

Insurers should enhance capabilities to detect, prevent, respond, and recover from ransomware attacks

Another option for carriers is to adopt a data-vaulting strategy that provides backups for critical business processes that are disconnected from the network, which should help get a compromised operation up and running more quickly while a ransomware incident is resolved.

Cybersecurity teams should also continuously be developing enhanced controls and endpoint protection technologies to exert greater control over end user devices. Training and awareness activities, focusing particularly on remote guidelines and standards for work-from-home environments, are particularly important with so many likely to remain outside a traditional office setting.

At a minimum, insurers should consider devoting more resources to meet added regulatory requirements being implemented or considered by several authorities worldwide. For example, the New York Department of Financial Services has established a wide-ranging cyber insurance risk framework with multiple reporting expectations.

………………………..