China’s reduced capital charges for specific investments and amended solvency calculation will relieve insurers’ capital burden and enhance stability in the reported solvency ratios, as the sector recovers from the pandemic while coping with the challenges of high volatility and declining interest rates in domestic markets, according to Fitch Ratings Report.

Analytics believe the changes announced by National Administration of Financial Regulation (NAFR) on September 2023 are partly in response to the difficulty some insurers face in maintaining their solvency stability amid a less favourable investment environment and lower surplus growth.

Reduced Capital Charges for Investments Relieves Insurers’ Life

The amendments to the China Risk-Oriented Solvency System (C-ROSS) phase 2 are effective immediately.

The revised framework takes a more differentiated approach and bases minimum capital requirement on insurers’ operating scales.

Most small- and medium-sized insurers, with assets under the CNY500 billion and CNY200 billion thresholds for life and non-life insurers, respectively, will be subject to lower capital requirements under the revised framework (see InsurTech`s evolution and investment landscape).

The new rules are likely to have a neutral impact on the insurers’ credit profiles as we do not expect issuers to significantly increase investments in the affected categories.

Fitch’s assessment of insurers’ capital strength also uses proprietary models and, therefore, will see minimal impact from the potential improvement in insurers’ regulatory capital adequacy ratios.

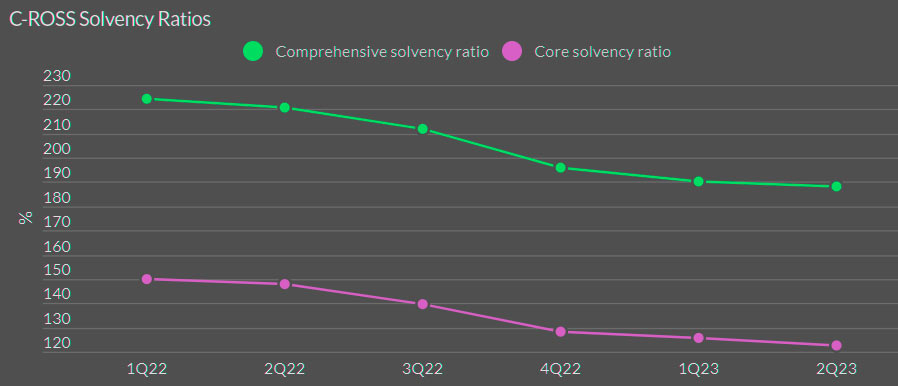

Chinese Insurance Sector’s Capital Ratios Have Declined

Several Insurers’ investment categories

Several investment categories are subject to a lower risk charge, including the top 300 stocks traded on China’s two main boards, stocks listed on the STAR Market, insurtech businesses, infrastructure real estate investment trusts (REITs) with opaque underlying assets, and unlisted entities operating in certain government-defined strategic and emerging industries.

The inclusion of listed stocks may be part of the government’s efforts to bolster the domestic markets.

Many life insurers already hold sizeable exposures to listed and unlisted equities and, therefore, have limited capital to increase investments in the asset class despite the lowering of risk charges.

They will also have to re-evaluate the structures and durations of their liabilities before making any adjustments commensurate with their risk appetites.

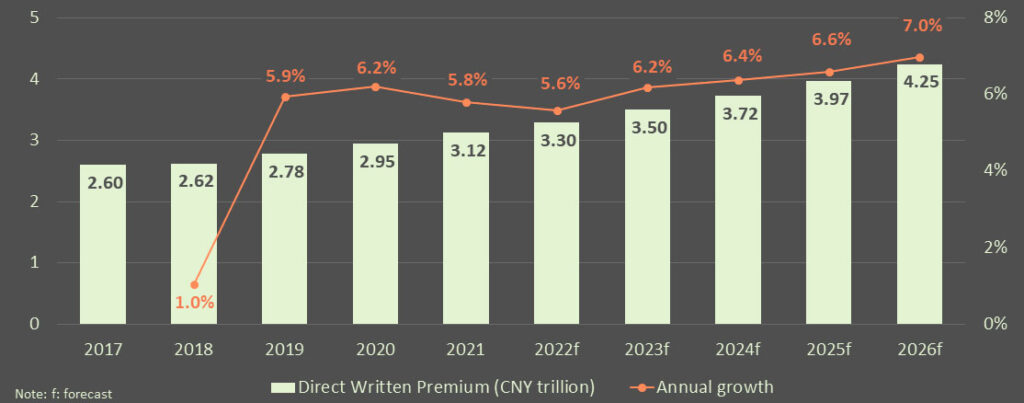

China life insurance industry to reach $665.6bn in 2026

The life insurance industry in China is set to grow at a compound annual growth rate (CAGR) of 6.3% from CNY3.1 trillion ($484.4 billion) in 2021 to CNY4.25 trillion ($665.6 billion) in 2026, in terms of direct written premiums (DWP).

The country’s general insurance market is set to grow at a compound annual growth rate (CAGR) of 7.2% from CNY1,367.7bn ($212.1bn) in 2021 to CNY1,943.1bn ($304.4bn) in 2026, in terms of direct written premiums (DWP).

According to Global Insurance Market Report, non-life insurers, meanwhile, are constrained by the short-tail nature of their businesses and will have to contain their holdings of illiquid assets to meet potential payouts. Most affected investment categories have a long-term investment horizon.

The new rules may enhance the insurers’ solvency stability

The new rules may enhance the insurers’ solvency stability, as they are likely to drive a greater focus on long-term investment return instead of short-term results by mandating quarterly reporting of moving three-year investment performance.

The adjusted inclusion of future profits for life policies with maturities exceeding 10 years in the solvency calculation will also give insurers more incentive to increase longer-term, higher-business value policies.

This lessens the impact of the original C-ROSS phase 2 standards that potentially undermine the stability of life insurers’ core solvency margin, especially for those with considerable exposures to ultra-long-term life policies.

The implementation of the more stringent C-ROSS phase 2 capital framework, which went into effect in January 2022, has partly led to a decline in Chinese insurers’ regulatory capital ratios.

The sector’s comprehensive and core solvency ratios slid to 188% and 122.7% at end-1H2023 from 224% and 150% at end-1Q2022, respectively.

Lower investment return, stagnant new business growth, and shrinking agency channels contributed to the material deterioration in the life sector’s profitability in 2022.

Many non-life insurers reported improvements in underwriting results due to lower frequency of motor claims amid restrictive pandemic-related mobility controls.

………………..

AUTHORS: Terrence Wong – Senior Director Fitch (Hong Kong), Lan Wang – Senior Director, Fitch Wire