The U.S. directors & officers (D&O) liability insurance segment continued to generate favorable loss ratios through the first half of 2023 despite heightened pricing pressure and material declines in premium volumes tied in part to increased competition.

The likelihood of sustainable segment profitability at current levels has been greatly reduced by weaker pricing and potential for claims volatility from a myriad of sources, according to Fitch Ratings Review.

Recognition of insurers’ reserve redundancies

According to D&O Insurance Insights, recognition of insurers’ reserve redundancies from the most recent accident years may support near-term underwriting results.

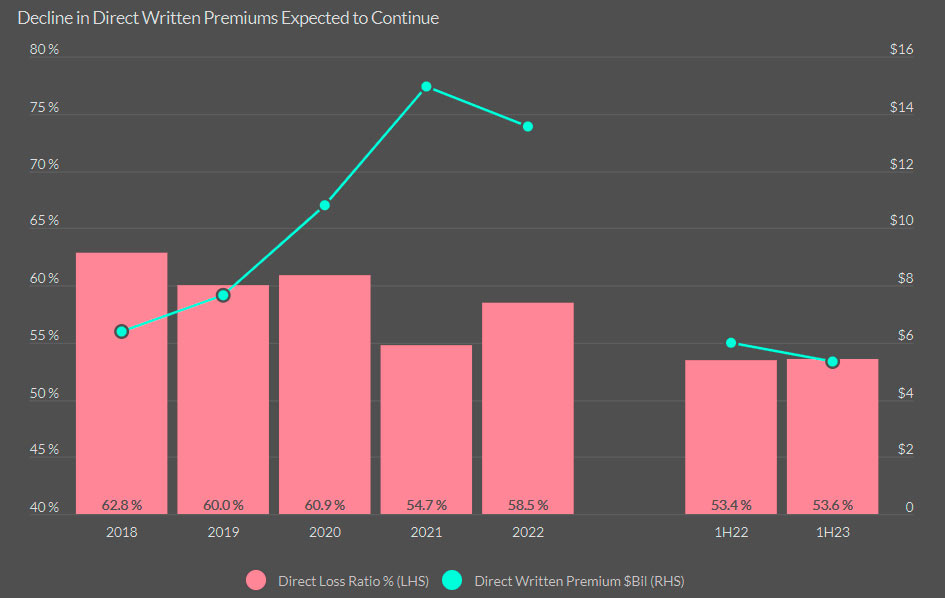

Year-to date D&O direct written premiums fell by 11% yoy, and direct earned premiums declined by 9%, based on property/casualty industry aggregate statutory results.

Loss ratios are expected to worsen, as heightened competition has reversed resulting in lower renewal rates. However, the segment direct loss ratio of 53.6% for 1H2023 was relatively unchanged from 53.4% for mid-year 2022 (see Top 5 Risk Trends D&O Insurance Market).

P&C Industry D&O Underwriting Results

Source: Fitch Ratings, S&P Global Market Intelligence

A wave of sharp premium rate increases and improvements in US market underwriting practices from 2019 to 2021 led to a significant recovery in segment performance.

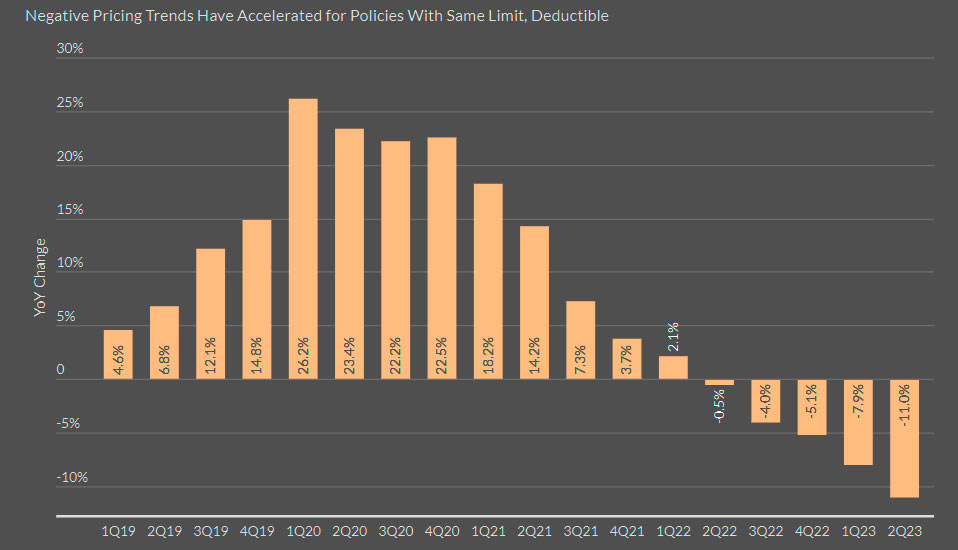

These better market fundamentals subsequently promoted an expansion of underwriting capacity from recent entrants and established players that is fostering a reversal of pricing trends.

Aon’s quarterly D&O market index indicated a flattening of premium rate changes in 1H2022 that has shifted to progressively larger pricing decreases in the latest four quarters, including an 11% decrease in rates for 2Q2023 for primary policies renewing with the same limit and deductible.

This unfavorable pricing momentum is unlikely to subside in the near term. D&O pricing is running counter to most other US commercial lines product segments that continue to report positive price movement over the last four years.

Aon Quarterly D&O Pricing Index

Filing volume for securities class action litigation, a key contributor to D&O claims losses, fell sharply during the pandemic, particularly from a sharp decline in merger objection related claims.

The latest research from NERA Economic Consulting projects a 15% increase in total securities class action filings in full-year 2023.

Weaker GDP growth and Fitch’s expectation for a recession in 4Q23/1Q24 may lead to higher D&O claims frequency, particularly if corporate insolvencies rise or equity markets meaningfully decline.

Risks in other areas, including regulatory and compliance issues, employment practices, cyber threats, climate risk, and cryptocurrencies may also contribute to future D&O losses.

The current persistent rising U.S. general inflation trend adds to the risk of ongoing adverse loss severity patterns across most property/casualty insurance lines, including D&O.

The phenomenon of social inflation has garnered a great deal of attention in the property and casualty P&C insurance industry. The term defies strict definition, though it is widely acknowledged to involve excessive growth in insurance settlements. Insurance Information Institute estimate that social inflation increased commercial auto liability claims by more than $20 billion. Evidence of a similar trend is also present in two other lines of business: other liability—occurrence and medical malpractice—claims made.

…………………

AUTHORS: James Auden, CFA – Managing Director, North American Insurance Fitch Ratings, Christopher Grimes, CFA – Senior Director Fitch Ratings, Laura Kaster, CFA – Senior Director, Fitch Wire North and South American Financial Institutions