Most U.S. personal auto insurers continue to report underwriting losses despite sharper improvement in premium rates, with the 2023 marked by continued unfavorable claims severity and higher catastrophe related losses. Future profit improvement will continue to be hindered by unusually high loss severity (see TOP 10 Largest U.S. Auto Insurance Companies 2023).

According to Fitch Ratings, a review of personal auto segment results from public company GAAP filings reveals that for a group of nine insurers that report quarterly personal auto segment results, aggregate written premiums were up 10% from the prior year.

U.S. Auto Insurance Written Premium and Combined Ratios

The segment’s combined ratio (CR) moved down slightly to 100.4% from 101.3% in 2022, attributable to a return to strong underwriting profit at GEICO.

Aggregate GAAP Written Premiums Rose 10.2% YoY

U.S. Auto Insurers Written Premium

| Written Premium, $ mn | 1H2023 | % Chg |

| 1. Progressive | 23,714 | 23.6% |

| 2. GEICO | 19,509 | -0.9% |

| 3. Allstate | 16,618 | 10.6% |

| 4. Travelers | 3,680 | 10.2% |

| 5. Kemper | 1,675 | -12.1% |

| 6. Hartford | 1,072 | 6.6% |

| 7. Hanover | 691 | 8.6% |

| 8. Cincinnati Financial | 374 | 18.4% |

| 9. Horace Mann | 208 | 7.4% |

| Group Aggregate | 67,540 | 10.2% |

All other reviewed carriers reported weaker year-over-year CRs and Progressive Corporation (PGR) was the only other carrier to report a sub 100% CR. Carriers reporting an auto CR above 110% for the first half of 2023 include: Kemper Corporation, Horace Mann Educators Corporation and The Hartford Financial Services Group (see U.S. Auto Insurance Claims Satisfaction Study).

U.S. Auto Insurers Combined Ratios

| Combined Ratios, % | 1H2023 | 1H2022 |

| 1. GEICO | 93.7% | 103.4% |

| 2. Progressive | 99.1% | 95.1% |

| 3. Allstate | 106.4% | 105.0% |

| 4. Travelers | 106.9% | 101.9% |

| 5. Hanover | 107.9% | 98.1% |

| 6. Cincinnati Financial | 108.1% | 103.0% |

| 7. Kemper | 111.2% | 111.1% |

| 8. Horace Mann | 112.8% | 110.6% |

| 9. Hartford | 113.3% | 97.0% |

| Group Aggregate | 100.4% | 101.3% |

An inordinate number of convective storm events across the U.S. created substantial losses in the homeowners’ market, but also added incurred claims to auto writers. For this subject group, catastrophe losses were 2.0% of 1H23 earned premiums, compared to 0.9% in the year earlier period (see U.S. Auto Insurance Performance & Underwriting Results).

GEICO’s performance recovery efforts over the last 12 months included a 16% increase in average premium per policy, reductions in advertising expense, and a 14% reduction in policies in force, which contributed to conceding the second largest personal auto market position behind perennial leader State Farm to PGR.

All auto carriers are taking more aggressive pricing and underwriting actions in response to recent results.

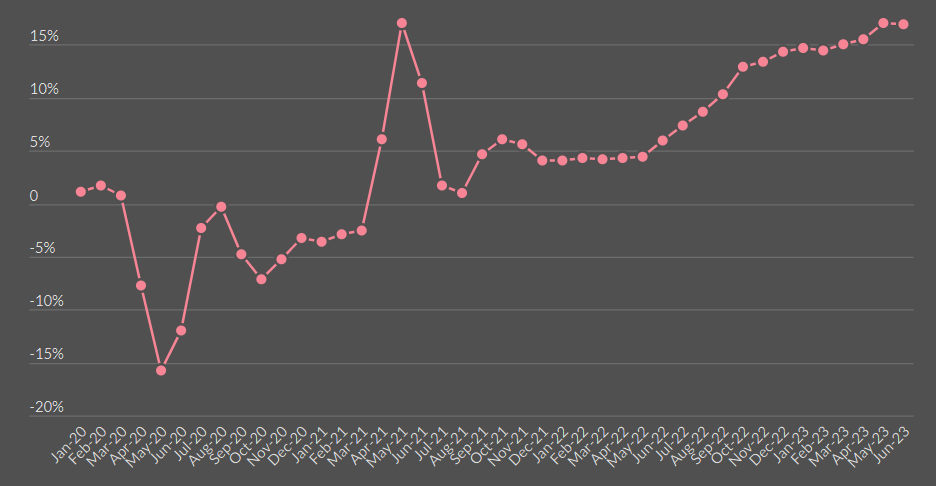

CPI data from the Bureau of Labor Statistics indicates that Motor Vehicle Insurance costs have increased by over 10% annualized for each month since September 2022, including a 17% jump in June 2023 (see 6 Major Types of Car Insurance in U.S.).

U.S. Motor Vehicle Insurance Cost Changes

Insurance Costs Were Up 16.9% YoY in June, the 10th Consecutive Month > 10% Growth

Personal auto loss severity patterns spiked beginning in 2H21 tied to higher general inflation, with higher costs in particular for auto parts and components, repairs, medical costs, and used vehicles.

Higher litigation and settlement costs also contribute to rising claims severity. Major auto writers continued to report sharp severity increases in their latest earnings releases.

PGR and Allstate Corporation each reported an 11% YTD increase in claims severity across all coverages. These more volatile, negative claims trends increase the likelihood of insurers reporting adverse development on personal auto loss reserves in the near term.

…………………….

AUTHORS: James Auden, CFA – Managing Director Fitch Ratings North American Insurance, Christopher Grimes, CFA – Senior Director Fitch Ratings, Laura Kaster, CFA – Senior Director Fitch Wire – North and South American Financial Institutions