U.S. personal auto insurers saw a sharp deterioration in underwriting performance for 1H2022, according to mid-year segment results from public company GAAP filings, with many insurers’ combined ratio (CR) rising above 100% for the period, Fitch Ratings says. These loss trends are likely to remain elevated in the near term as higher inflation, supply chain issues and tight labor markets are leading to sharply rising claims severity for physical damage, collision and bodily injury coverage.

Carriers are taking more aggressive pricing and underwriting actions in response to recent results. However, a turnaround to prior profitability may take time to materialize, as efforts to raise premium rates are hindered by regulatory constraints in some jurisdictions, including California.

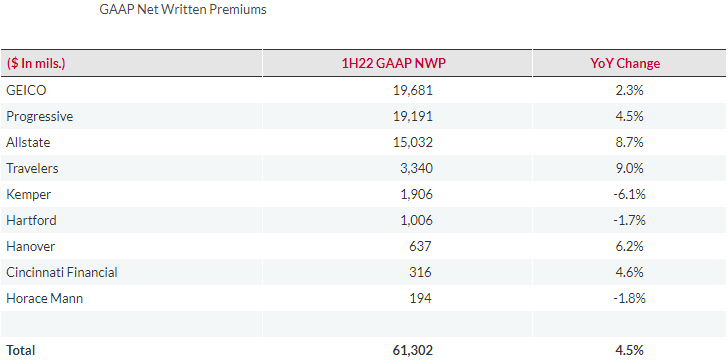

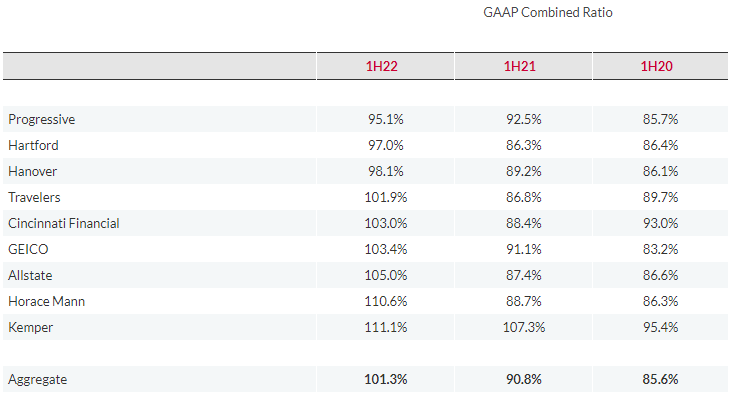

According to World Insurance Outlook, personal auto results for 1H2022 from supplemental GAAP earnings disclosures for nine publicly traded companies representing approximately 45% of industry market share deteriorated sharply, with the aggregate CR increasing to 101.3% from 90.8% in 1H2021, and a record low of 85.6% reported in the early stages of the pandemic in 1H2020.

US Insurer Personal Auto Insurance Segment Results Weakened in 1H2022

Premium Growth Should Accelerate in 2H22

Each company in the group reported weaker YoY results. Only three of the nine companies in the group reported an underwriting profit for the period, led by Progressive (PGR) with a 95.1% segment CR in 1H22, followed by Hartford Financial at a 97.0% CR and Hanover at a 98.1% CR. Personal lines underwriters Kemper (KMPR) with a 111.1% CR and Horace Mann Educators (HMN) with a 110.6% CR reported the weakest segment results for the period among the group.

The group’s 1H2022 auto insurance loss ratio included 0.3 percentage points (pps) from adverse prior year loss reserve development compared with approximately 1.8 points of favorable development for 1H2021.

Companies’ reserve experience varied significantly for the period. Cincinnati Financial, GEICO and KMPR each reported favorable development greater than 1 pp on the loss ratio, while Allstate (ALL) (2.9 pps) and HMN (6.2 pps) reported significant adverse experiences in auto loss reserves largely tied to physical damage losses (see US Property & Casualty Insurance).

Written premium growth was a relatively modest 4.5% for the group in 1H22, suggesting that rate increases and other corrective actions take recently will take time to flow through the income statement. Premium growth will likely be more robust in the second half of the year.

US Auto Insurance Underwriting Results Take A Negative Turn

Claims frequency patterns are moving toward past norms as miles driven increase to prior levels and driving behavior may be less cautious than the past. Among the larger auto writers in the group, PGR reported a YoY reduction in claims frequency for 1H2022, while ALL and GEICO reported increases across all coverages. ALL indicates that auto property damage claims frequency remains down nearly 15% from pre-pandemic 2019 levels.

Unfavorable loss severity patterns that became more evident in 2H21 show little signs of subsiding in the near term.

Rising claims costs are a function of sharply higher costs for auto parts and components, used vehicles and skilled mechanic labor amid higher inflation and supply chain issues that unfolded during the pandemic. Increases in claims with attorney involvement and higher litigation and settlement costs also contribute to rising claims severity.

Major auto underwriters continued to report sharp severity increases in latest earnings releases. PGR reported a 26% increase in collision severity in 1H22 while GEICO’s ranged between 19% and 20%. Similarly, for physical damage coverages, PGR reported 23% higher severity for 1H22, while GEICO reported an 11%-12% increase.

The FY2021 Aggregate Combined Ratio Rose YoY to the Highest Level Since 1997

Following record performance in 2021 from pandemic-induced reductions in driving activity, U.S. personal auto insurance underwriting results deteriorated sharply in 2022, with more pronounced weakness emerging in the fourth quarter. Carriers are adjusting prices upward to offset the return to more normalized claims frequency and a persistent rise in loss severity.

However, the magnitude of rate increases may be hindered by regulatory constraints and competitive forces, with inflation and supply chain issues continuing to boost incurred losses.

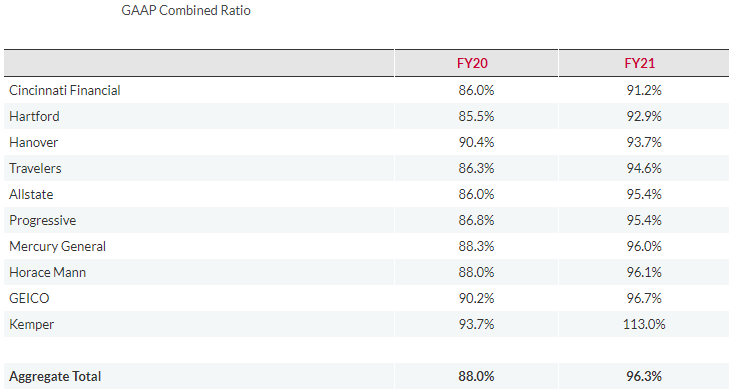

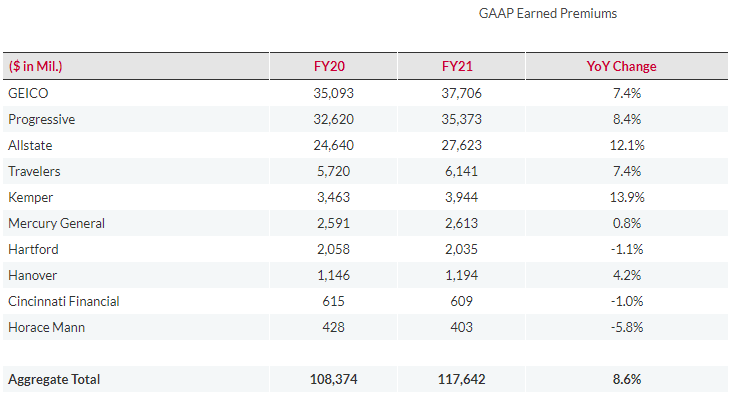

Personal auto performance in 2021 revealed a sharp deterioration from record 2020 results, according to information in supplemental GAAP filings for a group of ten publicly traded companies that represent approximately 44% of industry market share.

The group’s personal auto combined ratio rose to 96.3%, a figure last exceeded in 2017 and a sharp departure from the highly profitable 88.0% ratio reported a year earlier. Earned premiums expanded by 8.6% in 2021 year over year (YoY), due in part to acquisition activity.

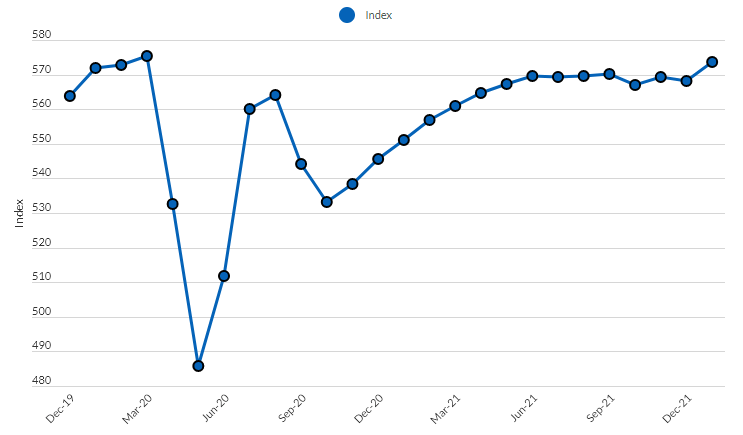

CPI – Motor Vehicle Insurance Cost Index

According to US Insurance Industry Report, all of the companies reported weaker auto results in 2021 relative to a year earlier. Cincinnati Financial and Hartford Financial Services led peers with the lowest segment combined ratios at 91.2% and 92.9%, respectively. Aggregate results are heavily influenced by larger carriers, including GEICO, Progressive, and Allstate, each of which reported 6-9 percentage point increases in their 2021 auto combined ratios. Kemper was the only insurer in this group to report an underwriting loss for the year with a 113% auto combined ratio tied to deteriorating non-standard auto results and reported reserve deficiencies.

State Farm, the market leader, reported a $3.4 billion (8.2% of earned premiums) statutory underwriting loss in auto (before policyholder dividends), compared with a $3.5 billion gain (8.3%) in 2020. GEICO and Progressive, which rank second and third, respectively, could surpass State Farm in premium volumes in the next two years if current growth rates are sustained.

Heightened litigation activity in automobile claims are a driver of loss severity for the last several years. More recently, loss severity increases are influenced by more aggressive driving practices leading to serious accidents and rising physical damage costs influenced by tight labor markets and supply chain issues. GEICO, for example, reported auto bodily injury coverage severity rose by 8%-10% in 2021 and collision severity was up 15%-16%.

Larger carriers reported a 25%-30% decline in auto claims frequency in 2020. A return toward normal driving activity promoted a YoY rise in 2021 frequency.

However, Allstate reported that gross physical damage claims frequency in 2021 remained nearly 20% lower relative to 2019. Progressive reported that 2021 auto claims frequency remained 7% below 2019 levels.

CPI data on motor vehicle insurance costs indicate unprecedented reductions in motor vehicle insurance costs during 2020, with a recovery throughout 2021 bringing costs roughly in line with pre-pandemic levels. We expect premium rates to rise significantly in 2022, which will promote stabilization in results. However, performance improvement could be muted by further volatility or rising claims frequency trends and limited change anticipated in severity patterns.