2022 year started in a dramatic, unexpected way. While the COVID-19 epidemic has gradually subsided, fueling hopes for the economic recovery, On February 24th, the start of the Russian War in Ukraine changed completely turned the tables by confronting the global economy with a new looming crisis that also impacted the insurance business as well, according to XPRIMM Report.

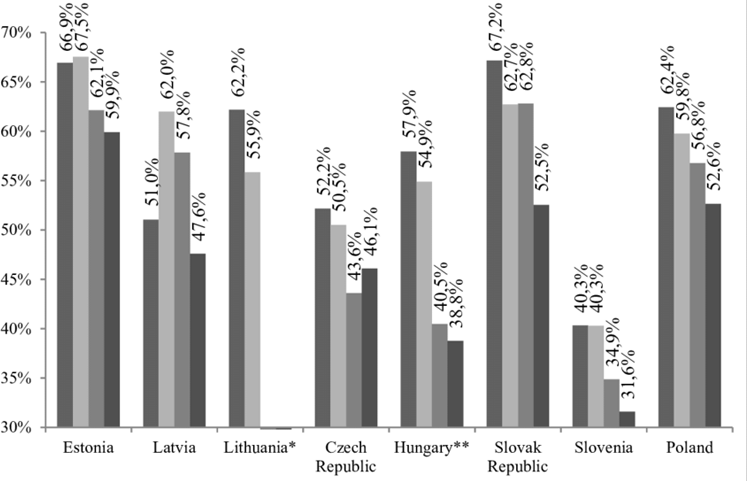

Like in other economic areas, differences between the Eastern European countries and the rest of Europe are also disappearing in insurance. CEE states have travelled a long way after the fall of the Iron Curtain: they started at a very low point of insurance volume, but insurance penetration has steadily been growing, “Western” insurance practices and legislations have been introduced very fast.

While insurers’ exposure to the direct economic impact of the war was rather insignificant, the industry is not immune to the worsening economic conditions.

At this stage, inflation remains the main reason of concern, but not the only one. Weakening purchasing power is also quite worrisome, while climate change remains a stress factor on yop of current economic situation. Secondary perils are particularly relevant in this equation, their share in the total NatCat losses amounting to about 50%.

CEE insurance markets fared well, despite the hard economic environment

While 3Q results are not yet available for all the markets in the region, there are strong indications that the positive dynamics seen in the first half of the year were maintained also in the third quarter. There are few relevant exceptions from this general trend.

As a result of the large number of insurance companies operating on the local markets and at the same time multinational groups repositioning their presence in the region, in a tightening regulatory environment, we expect an increase in the number of M&A deals in the forthcoming years.

While the Romanian market’s growth pace remained impressive, in the double-digit range, it has slowed down to a less spectacular level as compared with the first half of the year.

The best growth rates were recorded in Romania (+45%) and Czechia (+23.2%), among the bigger markets of the region, while other 6 markets recorded double digit growth rates. Slovakia was the only market reporting decreasing GWP, but the negative trends was mostly driven by the local Generali company becoming a branch of an insurance company from another Member State.

In other cases, as Hungary, while in local currency the market trend remained almost unchanged as compared with the half-year results, the further strong depreciation of the local currency made the market results denominated in Euro seem weakening.

Once we will have a complete image for the region in 2022, we will be able to confirm our first impressions based on the available results for 3Q.

From what we have seen for the time being, it seems life insurance remains somehow under strain, especially on what life insurance products with an investment component are concerned; also, prices in motor insurance seem to take a rising path, although the high competition and need to maintain products affordable are determining insurers to do their best to avoid massive price increases.

Pressure on profitability is increasing

Health insurance products are becoming increasingly interesting for customers all across region.

Pressure on profitability is increasing, many markets reporting deteriorating technical results in comparison with the previous periods, even if the aggregated market results remain in positive territory.

Meanwhile, another trend worth noting is the apparently rather modest impact of the inflation of the paid claims volume in 3Q.

However, a closer look to paid claims’ evolution for different classes in the market portfolio shows, in many countries, paid claims for the motor insurance lines have increased y-o-y about 10% to over 20%.

Other markets have seen a strong increase in the claims expenses for property insurance, mostly due to extreme weather events that have generated important effects even if not catastrophic ones.

Overall, one might say that 2022 was better than expected subsequently Russia’s military aggression in Ukraine in February of this year.

Of course, it is by far to soon for the final conclusions, especially considering that the economic impact of the war will be felt for a rather long time ahead. In their interim report, several big insurers in the region state their conviction that their year-end results will be align with the targets set in the beginning in the year, before the start of the war.

However, there is also unanimity in expressing a real concern with regards to not only the economic volatility, but also to other factors, among which “regulatory inflation” is as important one.

Two legislative changes adopted in 2022 had already a strong impact on insurers’ business

- A product “intervention”, which entered into force from the beginning of 2022, highly affected sales of Unit-Linked (UL) products and was the main cause of the overall decrease in GWP for the life insurance line of business. Aiming at preventing the exposure of customers acquiring UL insurance contracts to excessive investment risk, the measure taken by the Polish insurance market authority imposed significant restrictive rules on the UL products distribution, thus slowing down the entire sales process and, at least temporarily, hindering the business growth.

- The Polish authority also issued new recommendations concerning the liquidation of motor insurance claims and which are expected to have a significant impact on repair costs. They entered into force on 1 November this year. Insurers are legally obliged to ensure that the premiums they collect from drivers cover at least the costs of paid claims and the costs of their business. As a result, higher damage costs will directly lead to higher policy prices for customers. According to local analysts claims inflation may reach up to 19-27% increase in the Polish MTPL prices in Q1 2023.

Far from being an exclusively Polish trend, the regulatory “rush” is visible at European level, with EU institutions striving to increase customers’ protection.

However, as Insurance Europe has stressed out on several occasions by giving its input on several legislative initiatives, insurers fear that the market is becoming more and more over-regulated, which poses a threat to its effectiveness and, in the longer term, to its stability.

Although this trend is more visible in the Polish market than elsewhere in the region, given the context it is rather probable that similar situations will occur also in some of the other markets.

Leveraging on the success of our NPL study which provides an overview on non-performing loan markets in 17 countries across CEE and the Baltics, we decided to introduce a new study on insurance M&A dynamics with the same geographical scope, covering Poland, Czech Republic, Slovakia, Hungary, Romania, Slovenia, Croatia, Bulgaria, Serbia as well as Estonia, Latvia and Lithuania.

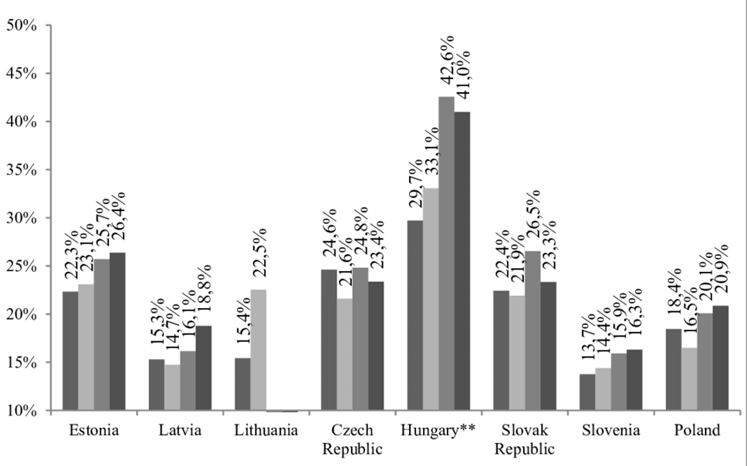

Recent performance of the insurance industry in CEE has been reassuring, the average penetration (GWP compared to GDP) remained stable over the last three years with paid claims increasing the same time.

These positive dynamics were fostered by stable economic growth accompanied by improving labour market conditions in the region. Besides insuretech solutions, another long-awaited trend picking up momentums market consolidation, which is driven by non-core exits and acquisitive growth strategies to reposition business and optimize economies of scale.

……………………………

AUTHOR: Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media by XPRIMM Data