Dealmakers were riding high from the best year on record for global M&A Market, with more than 60,000 publicly disclosed deals breaking US$5tn in value for the first time. PwC predicted that this year wasn’t likely to top in the face of growing headwinds—but the market expected M&A to continue to prosper. Fast-forward to mid-year. Not only have the headwinds grown stronger, but new ones have emerged, including rapidly accelerating inflation and interest rates, lower stock prices, and an energy crisis deepened by the Russia–Ukraine conflict.

Accorsing to PwC Global M&A Industry Trends: 2022 Mid-Year Update, despite these challenges, we believe that M&A will play an increasingly important role in corporate strategies—and there might even be better opportunities for investors to generate healthy returns in today’s environment, as valuations come down.

Indeed, dealmakers have good reasons to reset their strategic priorities and make bold moves to get deals done in the areas of their M&A pipeline that matter most.

Economic optimism remains high, there’s a strong deals pipeline, capital is in abundance, and companies across all industries badly need technology. It is true that there are growing headwinds. The trifecta of low operating costs, lower regulation and taxes, and ever lower interest rates have, over the past decade, helped companies achieve year-on-year earnings growth, pushed stock markets to seemingly endless record highs, and generally spurred M&A Transactions.

But now, each of those pillars is facing pressure for the first time in a decade, as the pandemic has disrupted the status quo. As a result, higher interest rates, rising inflation, increased taxes and greater regulation could introduce structural or financial hurdles or delays for deals in 2022.

We are already seeing greater volatility in financial markets, further disruptions in the global supply chains and increased levels of fiscal debt, as shockwaves from the pandemic continue to play out globally.

As we’ve already learned from the pandemic, dealmakers should stay alert to how the new accelerated pace of change can bring these factors—or others—into play earlier and with greater impact.

M&A transactions in the global reinsurance sector will be limited into 2023 amid investor concerns over macroeconomic risks and heightened catastrophe losses linked to climate change. Consolidation of the global reinsurance industry will continue, as intense market competition and capital levels drive mergers and acquisitions (M&A), while smaller players lacking scale and diversification see further pressure on growth and profitability.

Specifically, it is imperative to plan or prepare to win over stakeholders early, understand how inflation can be a game-changer, and prioritise increasingly urgent workforce strategies in acquisitions and integration.

Looking to the second half of the year, dealmakers are facing arguably one of—if not the—most uncertain and complex environments in recent memory.

Deal values declined by 20% compared to the first half of 2021, and are likely to decrease further as the economic fallout is priced into global markets.

Deal volumes have fared better, falling back to strong pre-pandemic levels, when M&A activity averaged 50,000 deals per year from 2017–19. But of particular note, the number of megadeals (deals with a value in excess of US$5bn) decreased by almost 40% between the second half of 2021 and the first half of 2022, as executives grew more cautious and regulatory scrutiny increased in several key markets.

A PwC analysis found better returns for buyers during a downturn and shows how deals launched during such times can achieve outsized growth. We believe that dealmakers who are bold—and strategically pursue M&A with a strong capabilities fit—will be best positioned to create value for the longer term. What’s more, the factors that underpinned the M&A market in the first half of the year will remain influential for deal-making in the latter half: supply chain resilience; portfolio optimisation; environmental, social and governance (ESG); and, above all, the competition for badly needed technology.

Marginalized companies are increasingly incentivized to explore M&A, as they face the challenges of operating in a difficult market environment. These factors, coupled with the impact of the US tax reforms and the record insured catastrophe losses, should support M&A activity for the sector.

Now is not the time to sit on the sidelines, but to reassess—even reset—M&A strategy. I expect to look back at 2022 to find the successful dealmakers of tomorrow who will be defined as those who boldly execute on their M&A goals today and overcome the current market challenges.

Brian Levy, Global Deals Industries Leader, Partner, PwC US

Win over stakeholders

M&A volumes and values tend to rise during periods of economic growth and favourable markets, and decrease during times of uncertainty and market volatility. We saw this happen in early 2020 at the onset of the COVID-19 pandemic, and we have seen similar trends in prior economic recessions, such as the global financial crisis and the dot-com bust. It should be no surprise therefore that M&A softened during the first half of 2022. Dealmakers are facing higher costs of capital and increasing pressure on returns. And their boards and investment committees may be advocating for caution, even delays, in M&A pipelines, as rising inflation, concerns over energy supply, labour shortages and supply chain disruptions put pressure on balance sheets and put longer-term priorities, such as deals, on hold.

However, acquirers in a competitive bid situation run the increased risk of dilutive rather than accretive acquisitions, particularly when assessing the reserve adequacy of a target company and the potential complications in execution and efficient integration. Reinsurers are also focusing on cost efficiencies and expanding penetration in developing markets. Recent reinsurance acquisition multiples have ranged from 1.1 times to 1.6 times the book value, with revenue multiples ranging from 0.7 times to 1.9 times (see Global Reinsurance Sector Outlook).

Deals in the US$1bn–US$5bn range have typically been the sweet spot for PE firms. But we expect to see a growing appetite among PE for larger and more complex deals.

Examples include the US$30bn acquisition of Medline Industries, Inc., by a partnership comprised of funds managed by Blackstone, Carlyle and Hellman & Friedman, and the proposed US$14bn acquisition of McAfee Corp. by an investor group led by Advent and Permira, Crosspoint Capital, Canada Pension Plan Investment Board, GIC, and a wholly-owned subsidiary of the Abu Dhabi Investment Authority.

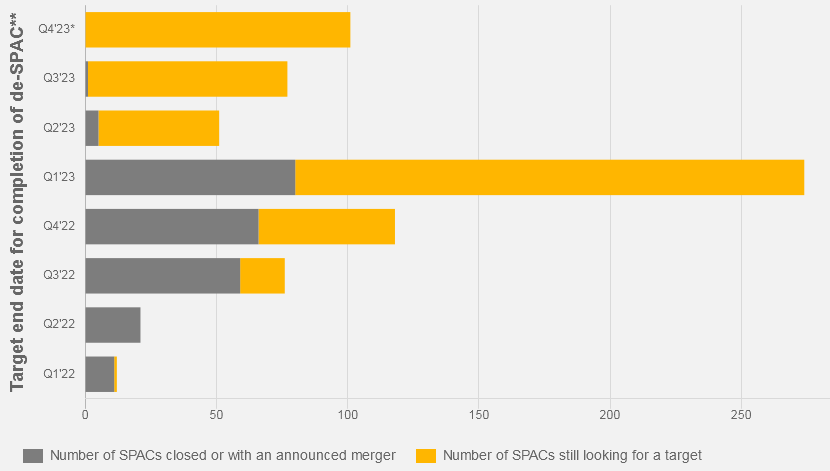

Status of SPACs that went public

A SPAC typically has two years to identify and complete a merger with a target company. Often referred to as a de-SPAC, this is where the SPAC and target company complete their proposed transaction and the target company effectively “takes over” the public company status of the SPAC. To illustrate, a SPAC IPO from Q1 2020 will typically have until Q1 2022 to de-SPAC.

How can dealmakers successfully overcome stakeholder concerns?

How can dealmakers successfully overcome stakeholder concerns and win trust to get deals done in the current environment? Consider the following approaches.

- Build the case for M&A now: Don’t wait until the target is identified. Advocate for a deals strategy aligned with strategic goals, rather than waiting to bring stakeholders on board until you are engaged on a deal. Highlight the importance and impact of pursuing M&A irrespective of the current market climate.

- Focus on the long term: The best leaders outperform the worst markets by seeing value beyond the short-term horizon. Periods of rapid change create space for new ideas and can create opportunities to present new visions for the future. Build trust with your stakeholders and generate support for your M&A strategy—one that will deliver results and successful outcomes for the long term.

- Expand your due diligence: There is an even greater need to perform robust due diligence—both deeper and beyond traditional areas—in order to get comfortable with the investment rationale, company projections, competitive landscape and impact of an inflationary environment.

- Capitalise based on the value reset: Valuations in both public and private markets are under pressure. In particular, with the decline in stock market performance, many high-quality companies are trading at significant discounts to recent highs. With the number of public-to-private transactions in early 2022 almost 50% higher than the same period last year, many investors are already jumping into the market.

The inflation game-changer

Inflation in many countries is hitting a 40-year high—with US and Eurozone rates climbing over 8% by the mid-year—and is expected to persist through the remainder of 2022 (see 11 Types of Merger & Acquisition). A generation of business leaders who have never operated in an inflationary market are facing a paradigm shift in the economic landscape. As inflation represents a threat to company earnings and erodes shareholder returns in real terms, the historical due diligence dealmakers have become accustomed to needs to be approached differently.

We’re seeing an acceleration of strategic decisions to enhance portfolio optimisation, as dealmakers divest to free up capital to focus on acquiring capabilities and transforming core business areas through M&A.

Malcolm Lloyd, Global Deals Leader, Partner, PwC Spain

Dealmakers need to take into account both present and expected future inflation in their valuations. This involves forecasting different inflation scenarios and using real-time analytics to assess the impact of inflation on the company’s operations and earnings. Pricing, cost management and cash flow are part of a company’s response to operating in an inflationary environment, and require an understanding of the wider implications on market share, price elasticity, customer and supplier relationships, and employee compensation and retention.

Workforce strategy is now a priority

With M&A increasingly being used as a means to find the right talent, coupled with the empowerment of labour that has resulted from the pandemic, workforce is a growing priority for deal-making for the second half of the year and beyond. Whether companies buy, borrow or build to meet their workforce needs, PwC research has found that workforce is the number one risk to growth—driven by the highest wage inflation in decades, the “great resignation,” skills shortages, and an increased stakeholder spotlight on employee diversity and inclusion.

Dealmakers cannot therefore afford to take workforce matters for granted. Human capital issues operate on the frontline of several critical aspects of the M&A integration process.

However, assessing the impact of a deal on workforce was often overlooked as part of the upfront due diligence and only tackled as part of the broader integration. For acquirers, diligence topics such as workforce composition, compensation and benefits, and future organisation design and culture all impact future business performance(see 4 stages of M&A deals).

As workforce strategy also plays an outsized role in post-deal integration, questions not often on top of the deal-making agenda become more important than ever: What is the right culture to cultivate? How do you drive better results in recruiting, retention and development? Do your compensation, benefits, flexibility and other programmes create incremental motivation and harness workforce longevity?

Deal volumes and values by regions

Although M&A through the early part of 2022 has undoubtedly been lower than that of 2021, the numbers are not catastrophic—in fact, they are in line with healthy, pre-pandemic levels. But the growing uncertainty has cooled M&A in the first half of 2022 compared to the prior six months across all major regions.

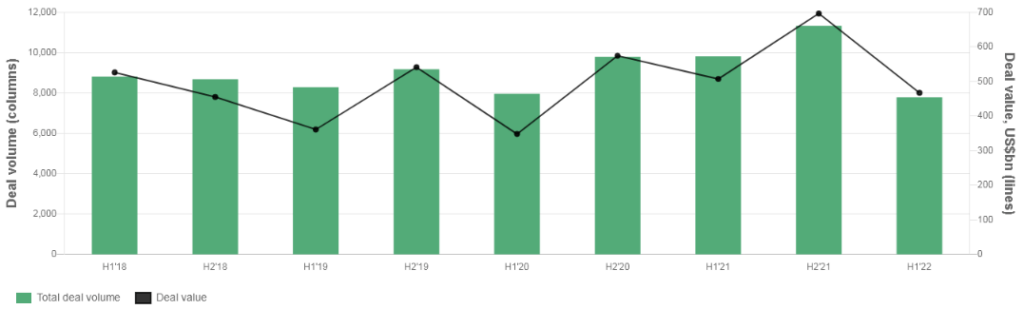

Deal global volumes and values, 2018–2022

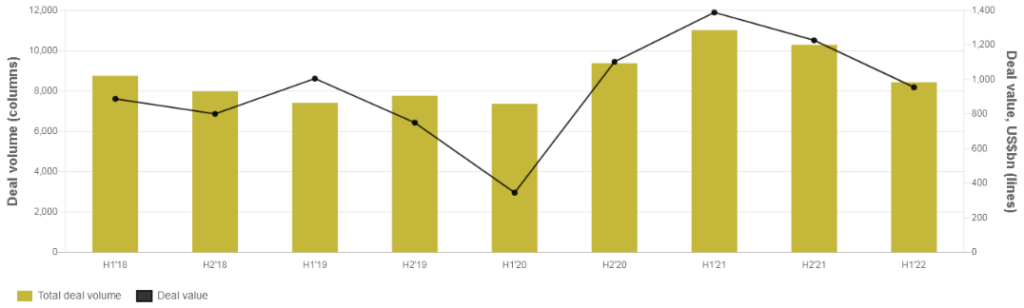

Asia Pacific: Deal volumes and values have both declined by more than 30%, due mainly to macroeconomic headwinds and recent pandemic-related restrictions imposed across several major cities in China.

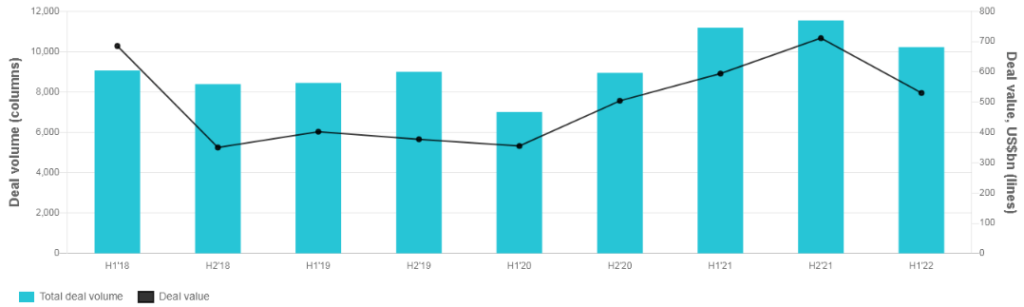

Deal Asia Pacific volumes and values, 2018–2022

EMEA: Deal volumes and values are down 12% and 33%, respectively, as countries face higher energy costs and lower investor confidence.

Deal EMEA volumes and values, 2018–2022

Americas: Deal volumes and values have declined by 18% and 22%, respectively, mainly due to concerns around inflation and rising interest rates.

Deal Americas volumes and values, 2018–2022

Overall, however, the number of megadeals greater than US$5bn declined by a third, partly due to increased regulatory scrutiny, which has deterred some larger deal activity, and the precipitous decline in deals by special purpose acquisition companies (SPACs)—only one US SPAC has closed in 2022, as opposed to more than 40 in 2021.

Deal values were boosted by four transactions announced during the first half of 2022 with values of over US$50bn each, compared to just one deal greater than US$50bn during all of 2021.

For those SPACs that raised capital in late 2020 and early 2021 who have yet to announce a merger, time is rapidly running out to do so. And with investor enthusiasm for SPACs having waned, their buying power and influence has consequently faded.

Spotlight on private equity

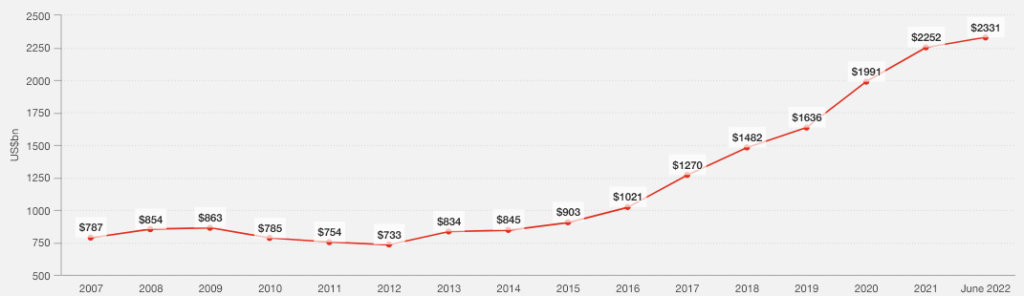

In a relatively short period of time, the evolution of the private equity (PE) model has effectively created an engine for M&A, and is now considered by many in the industry as a perpetual source of deal-making capital that can be counted on to fuel deal volumes, irrespective of market challenges. As our analysis shows, just prior to the COVID-19 pandemic, PE had doubled from levels at the beginning of the global financial crisis of 2007–08. As of June 2022, global PE dry powder stood at US$2.3tn—three times more than the amount in 2007.

Global private equity dry powder, 2007–2022

Credit funds’ growing share of the leveraged buyout market

PE has fuelled the growth in the private credit market over the past few years, and private capital for financing deals is now outstripping traditional lending sources. This development is accelerating the disintermediation of banks as the primary financing source for secondary buyouts.

As the IPO and high yield markets remain practically shut—global IPO proceeds dropped from $212bn in Q1 2021 to $56bn in Q1 2022—lending by credit funds will be key to providing much-needed liquidity to the leveraged loan market and will likely put a floor under the M&A market.

As traditional lending sources seek to limit their exposure to some riskier sectors, we expect this will only increase the role of credit funds, owing to their greater appetite for risk and their ability to offer more flexibility around financing structures.

However, that capital will not come cheaply, and we expect greater protections for lenders, such as more covenants, going forward.

Mid-year global M&A outlook

Dealmakers are adapting to a new business climate—one where short-term volatility in financial markets, inflationary pressures, rapidly rising interest rates, supply chain disruptions and geopolitical tensions all appear to be developing into longer-term trends. As a result, charting a strategic reset of M&A priorities and approaches will be essential in order to unlock future growth.

Now is not the time to sit things out. To the contrary, we believe that is the time for true leaders and best-in-class dealmakers to make bold moves and set the stage for the next five years, winning the targets that matter most to their business or portfolio and using M&A to pursue opportunities that can deliver value in a challenging economy.

There’s no doubt that dealmakers now face a higher bar for success. Gone are the days when returns were generated simply through the passage of time. We remain optimistic that the need for both speed and agility to navigate the current challenges will ensure M&A remains a strategic priority, helping companies to transform, grow and build a new foundation for their future success.

…………………………….

AUTHORS: Brian Levy – Global Deals Industries Leader, Partner, PwC United States, Malcolm Lloyd – Global, EMEA and Spain Deals Leader, Partner, PwC Spain, David Brown – Asia Pacific Deals Leader, Global Corporate Finance Leader, Partner, PwC Hong Kong